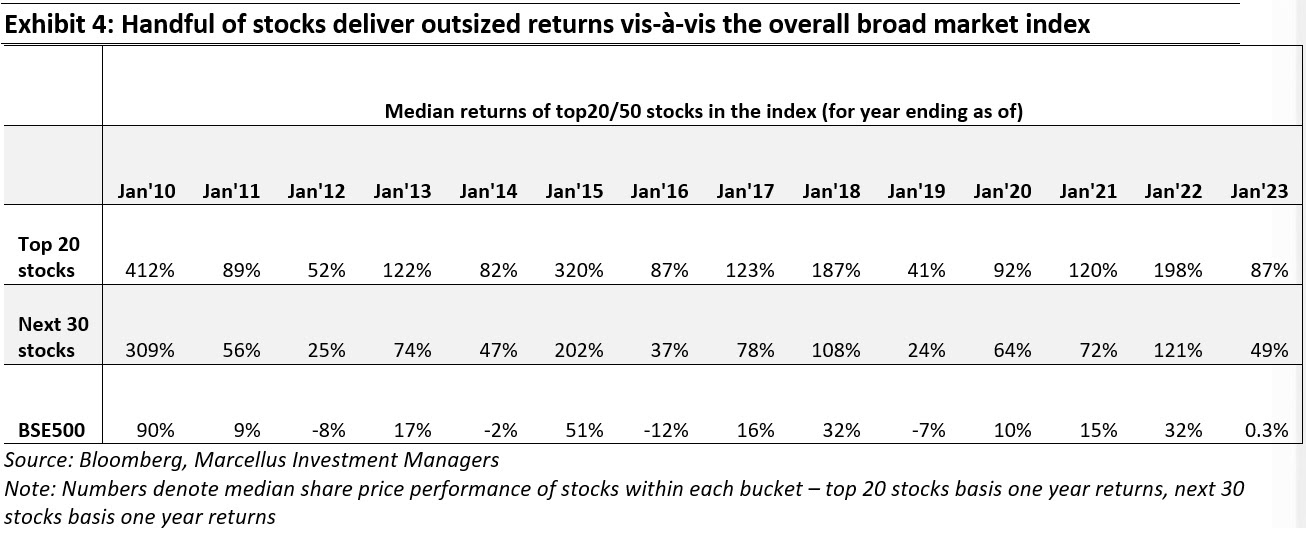

Every year there will be a couple of sectors and a handful of stocks that give outsized returns helped by short term earnings momentum and narratives around the same. However, such sectors and stocks are generally unable to replicate their short-term success over the medium to long-term. While chasing momentum can provide short term enrichment, unless one possesses the gift of timing entry into & exit from stocks, this investment strategy usually doesn’t create wealth over the long term. In contrast, we believe, a strategy based on investing in high quality companies with superior fundamentals such as Rising Giants (RG) has a much better chance of generating long term wealth creation.

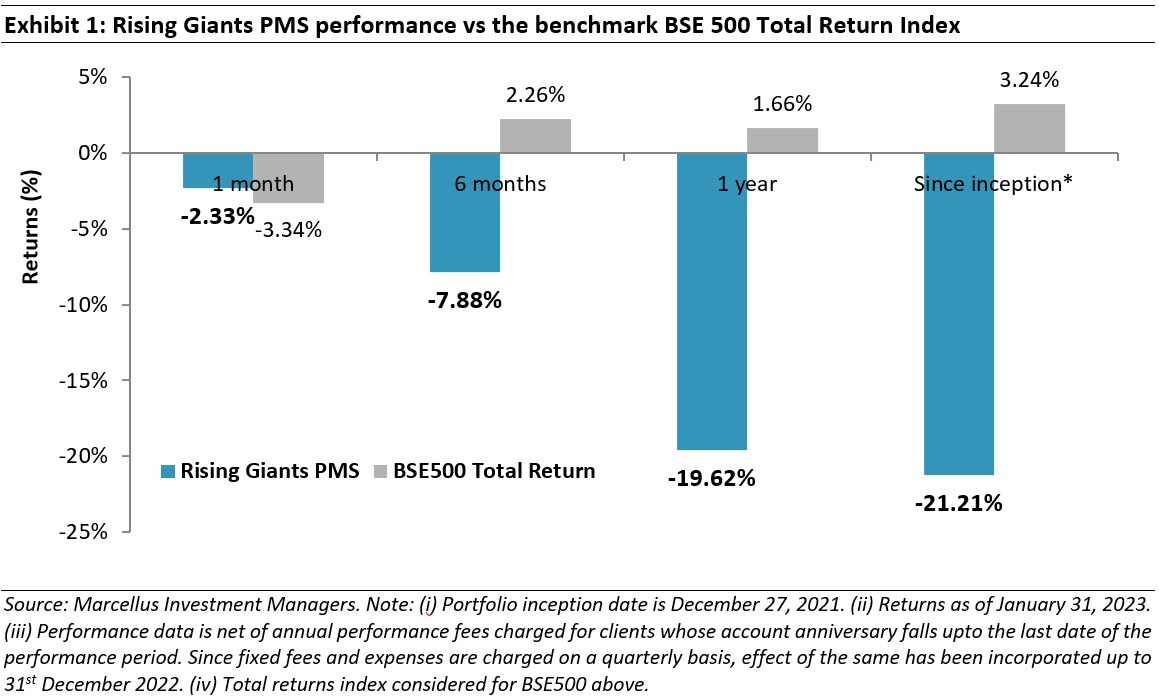

Performance update for the Rising Giants PMS

Every year brings with it a new set of winners

The Rising Giants PMS portfolio intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with:

1) Strongly moated dominant franchises in niche segments;

2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and

3) Clean accounts and corporate governance.

From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

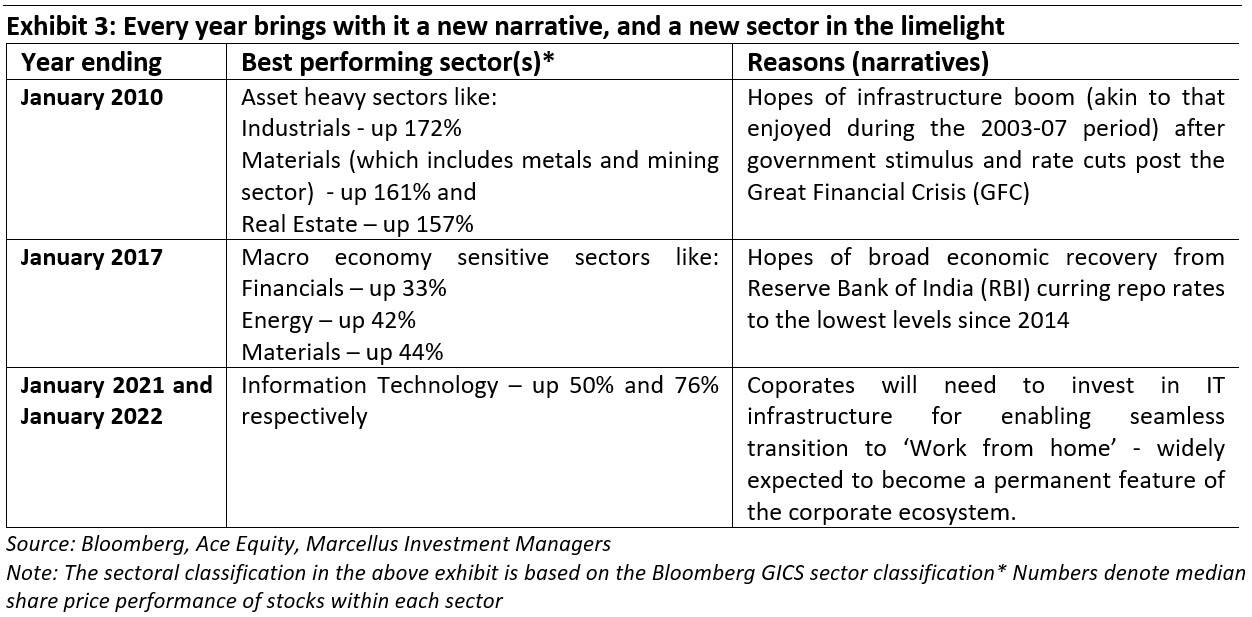

Every year there are a set of sectors and stocks that give outsized returns compared to the rest of the stock universe. However, more often than not, such strong share price performance is a result of some or the other narrative that has taken hold and created a buzz amongst the institutional and retail investors alike for such sectors or stocks. For instance, the exhibit below illustrates some of the narratives that had taken hold of investor psyche at different points of time resulting in strong returns for the concerned sectors.

|

However, such winners are unable to sustain their performance over the next 3/5 years

While the sectors and stocks highlighted in the two preceding exhibits did enrich their investors in the short term, what about the medium the long term? Our analysis suggests that a very different fate awaits these hot stocks and sectors over the longer term:

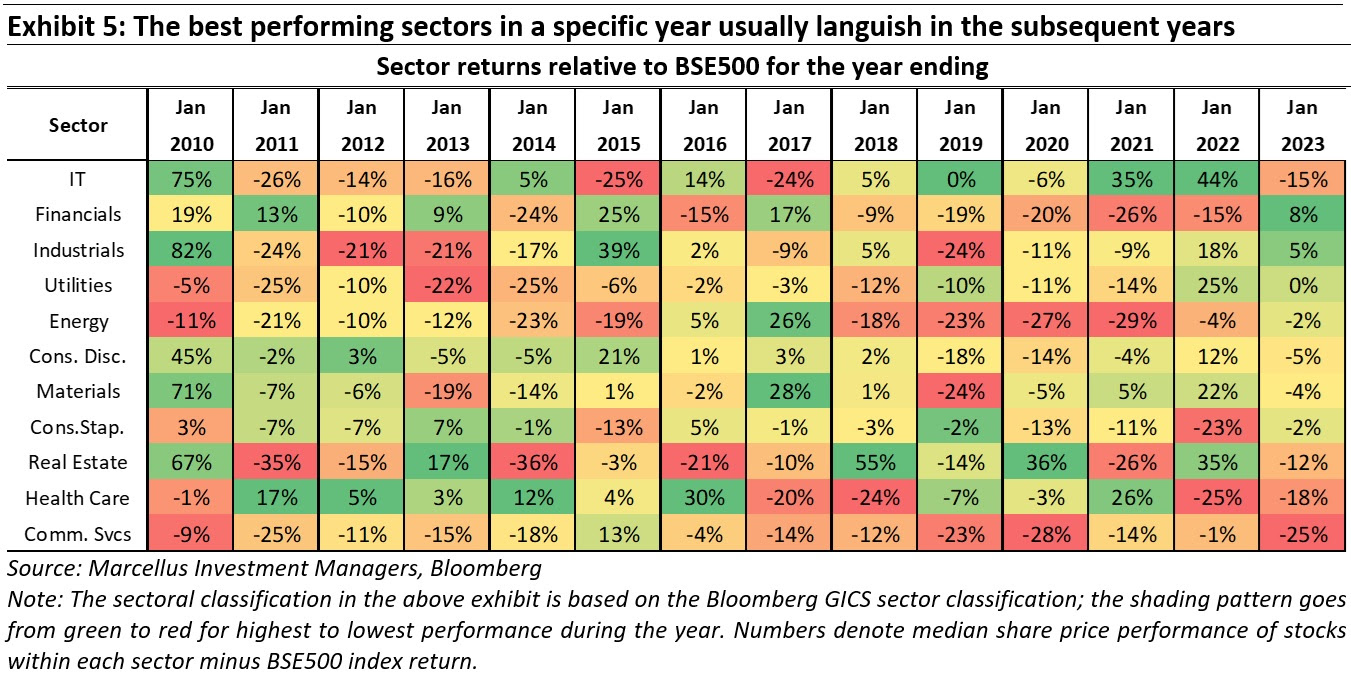

- If we were to take a look at the yearly performance of the various sectors within the BSE500 index, the list of the best performing sectors keeps changing frequently. For instance, as shown in exhibit 5 below, the sectors which deliver the best returns in a specific year are unable to replicate the success in the subsequent years. In fact, often, the best performing sector in a specific year languishes in the performance tables in the subsequent years.

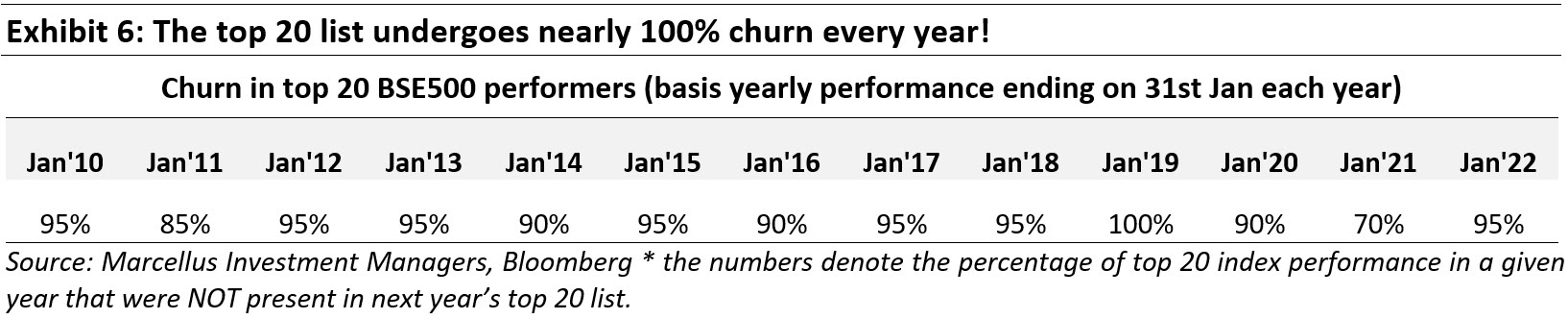

- Similarly, if one was to create a list of top 20 performers within the BSE500 index (based on annual performance), there’s close to 90-95% churn in the constituent stocks, year after year i.e. 9 out of 10 stocks fall from grace from one year to next as the prevailing narratives die down and there’s a new kid on the block!

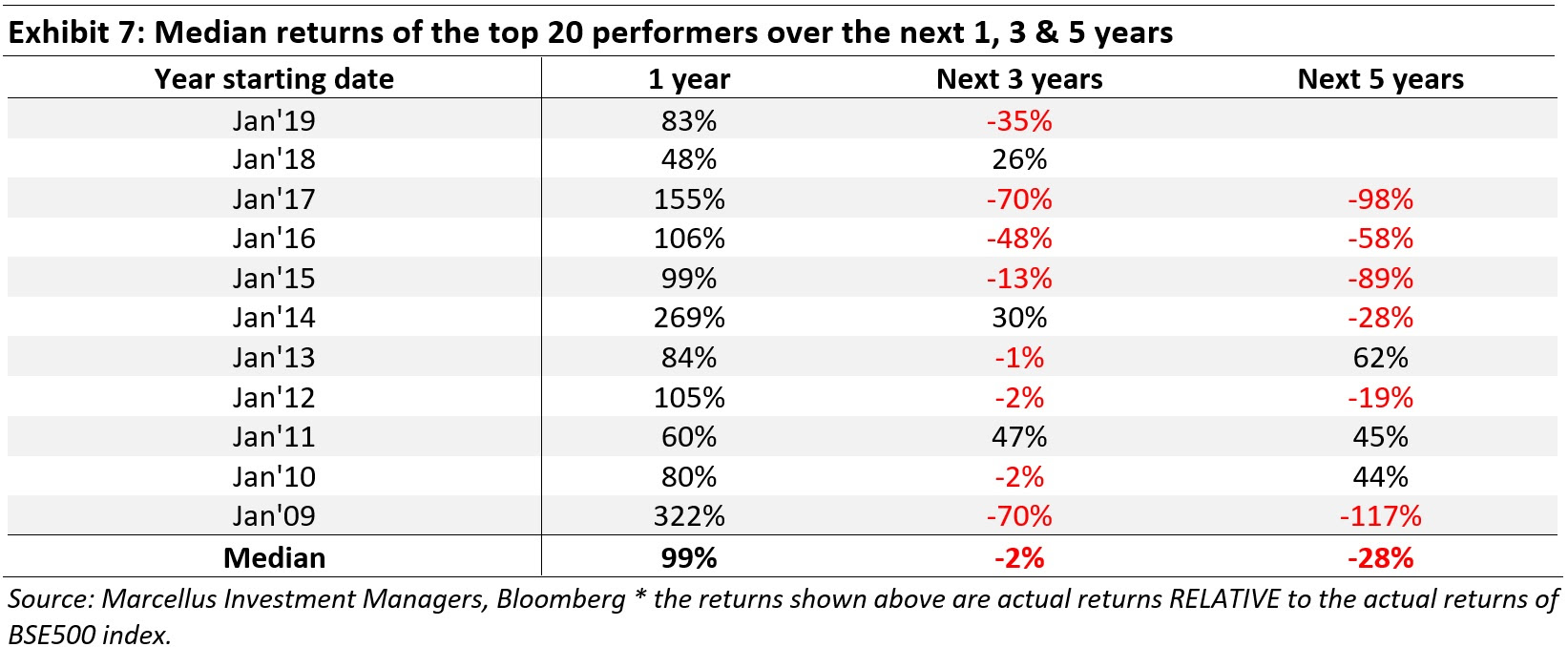

One may raise a reasonable question that while a top performing stock may not feature in the top 20 list in the succeeding year, it might still produce very good share price performance over a longer horizon of 3-5 years. To understand this aspect we drilled down further to see how such top 20 ‘annual’ performers perform on the succeeding 3 and 5 year horizons. For instance, if stock A has given a relative return of 50% (vs BSE500 index) from Jan’15 to Jan’16, how has the performance been from Jan’16-Jan’19 and Jan’16 – Jan’21?

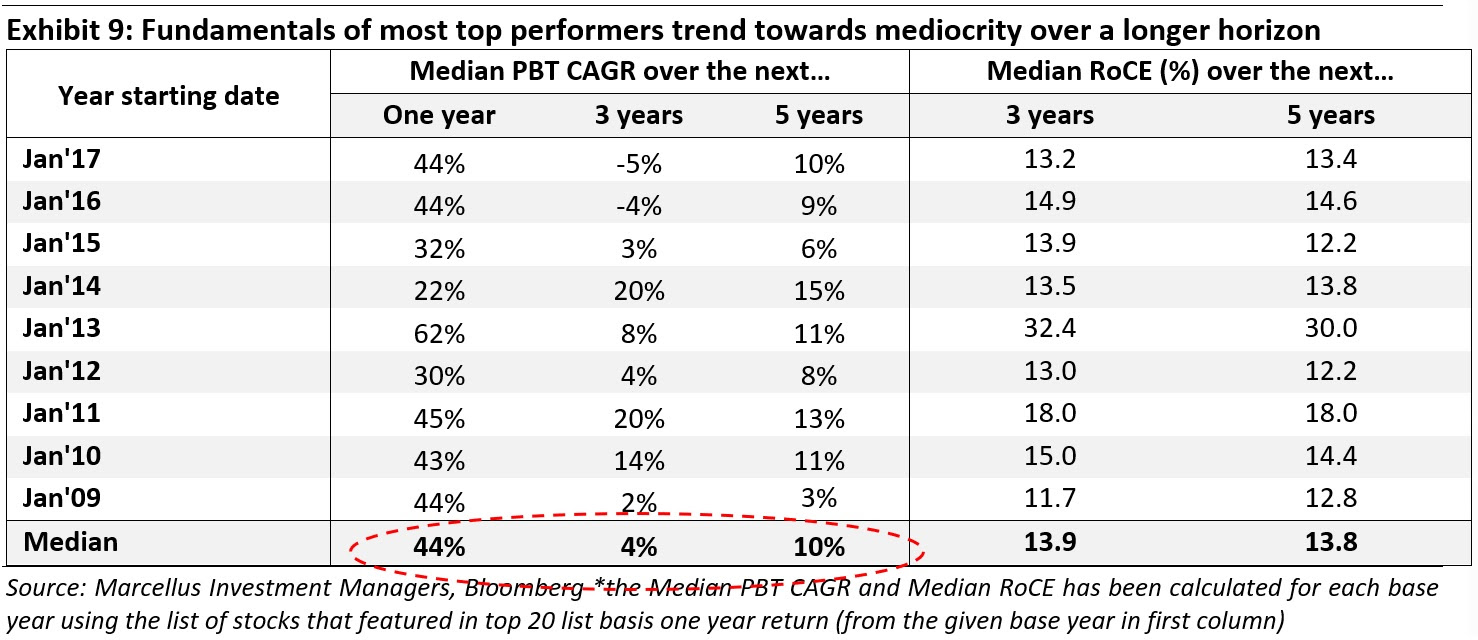

As can be seen in the exhibit below, if one was to look at the median returns of top 20 performers on 1, 3 and 5 years (as explained above), most stocks fail to live up to their short-term stardom over a longer horizon.

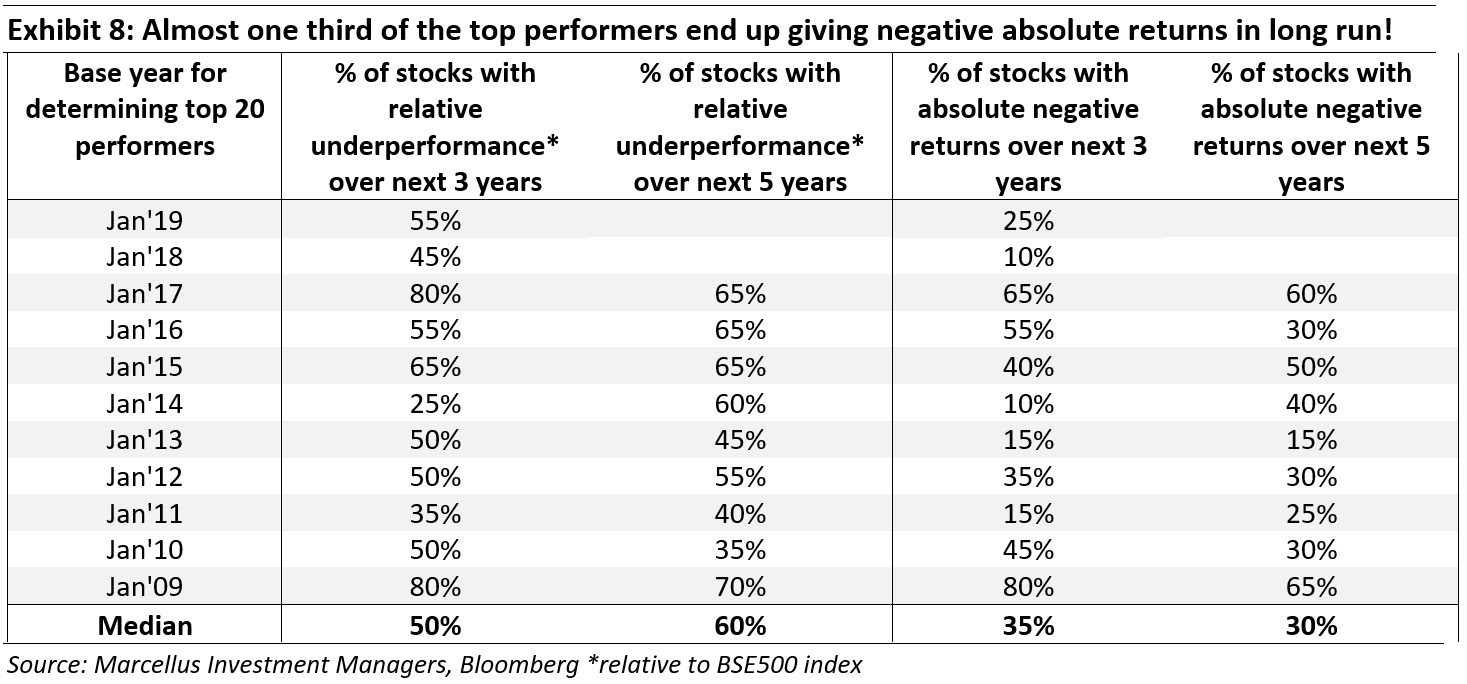

Further, such (under)performance is not a result of few wayward stocks. As highlighted in the table below, close to 60% of the stocks, on a median basis, from such ‘top 20’ lists end up underperforming the benchmark BSE500 index. In fact, almost one third of the stocks actually give negative returns over the subsequent 3-5 year periods.

Fundamentals and management quality matters for long term performance

So why are most companies unable to replicate their short term performance over longer periods of time? Closer analysis points towards the following reasons:

Fundamental performance ebbing off: For the stocks which form part the ‘top 20’ list of index performers, if one was to look at the basic business performance parameters – i.e. PBT growth and median RoCE (Return on capital employed) over the next 3 and 5 year periods, the reason for underperformance shines through. The stocks run up mostly on the back of strong operating performance over a one year period. However, such fundamental performance deteriorates materially over the subsequent 3 and 5-years due to a variety of reason such as macro tailwinds dissipating, high financial leverage (coinciding with a macro slowdown), capital misallocation and issues around succession planning. Usually, such a deterioration in the fundamentals is also accompanied by a valuation de-rating.

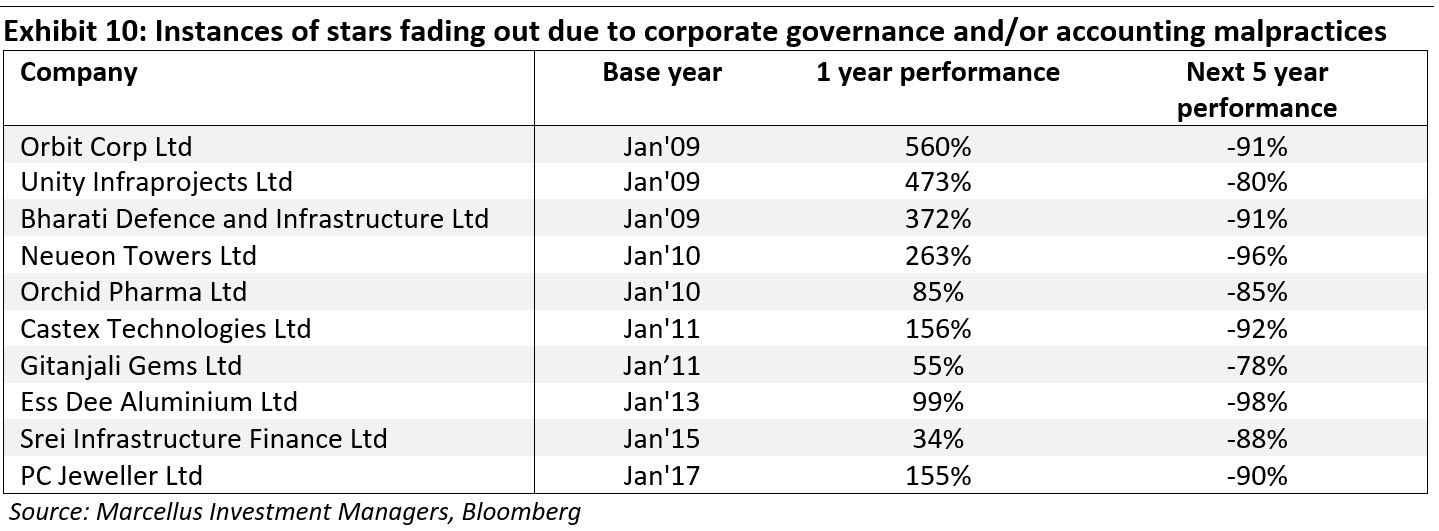

Governance issues: Another common reason for short term boomers fizzling out over the medium to long term is that many such names are often characterised by governance and accounting malpractices. Usually but unsurprisingly, such governance concerns come to the fore during periods of market weakness. For instance, amongst the top 20 index performers, there have been numerous instances of stocks which saw their share price value evaporate on the back of corporate frauds and/or accounting scams coming to light. Some examples are cited below.

| Conclusion: Superior fundamentals and governance – key to long term wealth creation

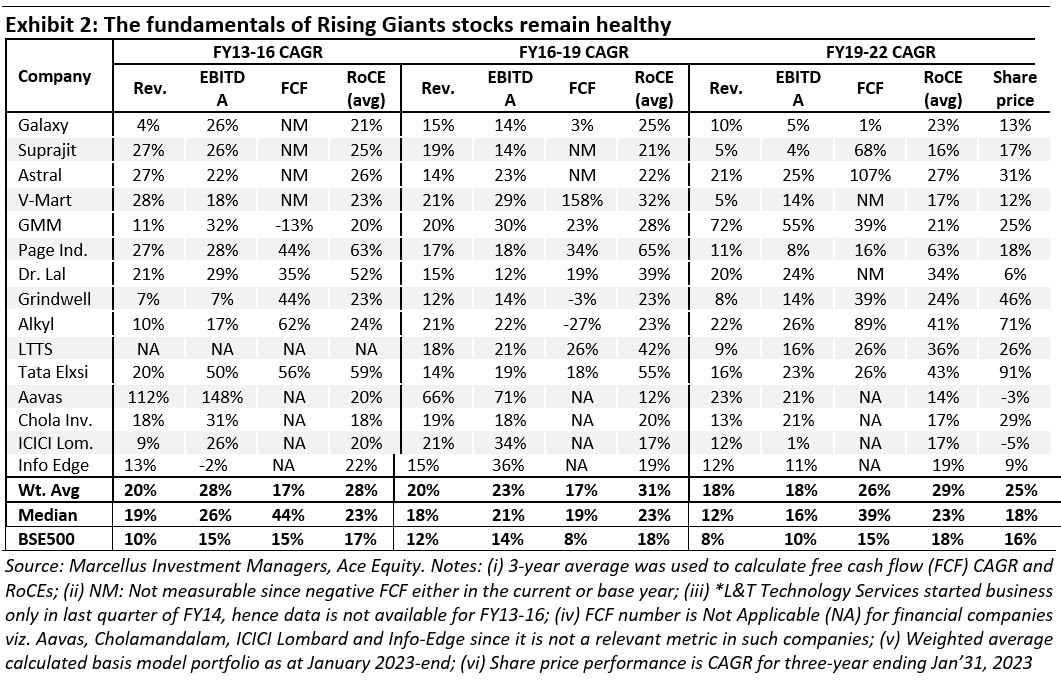

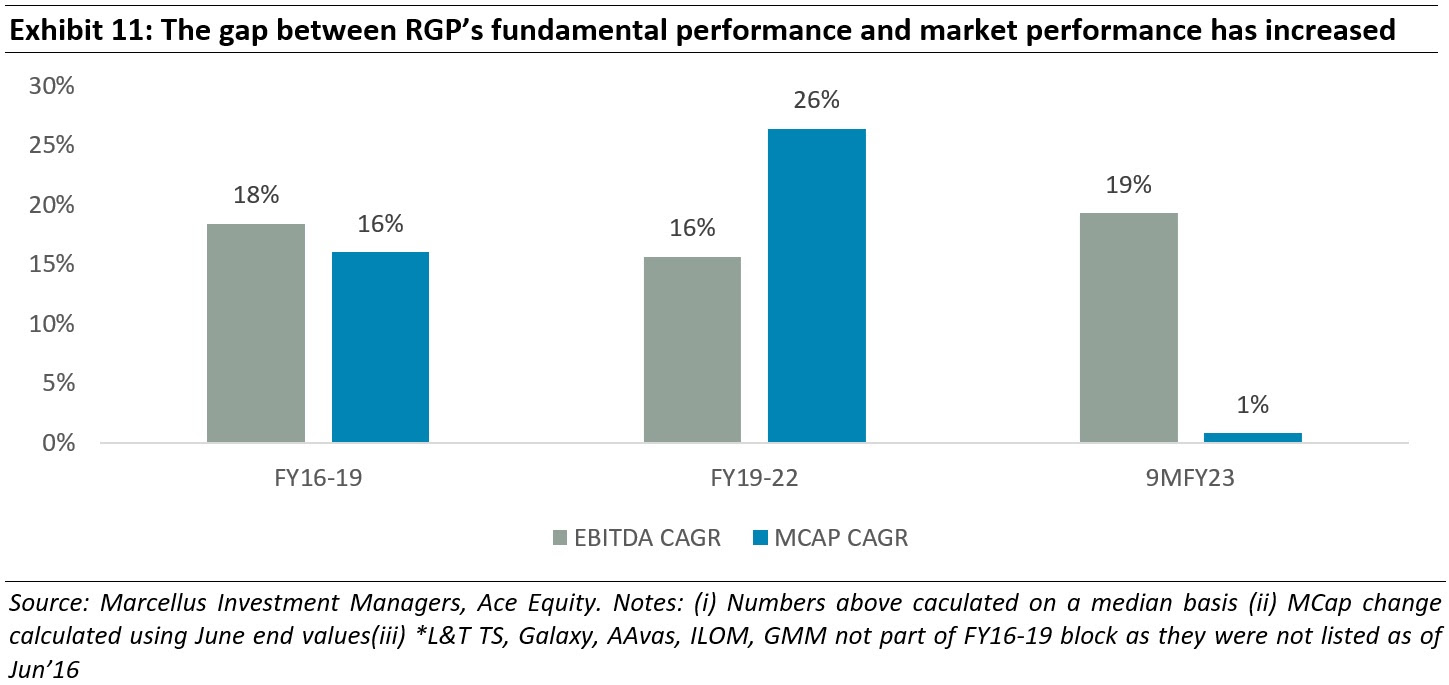

Chasing near term momentum – in fundamentals or in share prices – can provide short term enrichment. However, unless one is endowed with the gift of timing entry and exit into stocks, this strategy rarely creates wealth over the medium to long term. We believe superior fundamentals (driven by management quality) and governance to be the key drivers of long term free cash flow generation and share price returns. As can be seen in exhibit 2, the Rising Giants portfolio stocks, selected through a rigorous investment process (embedding both the above elements) and subjected to regular fitness checks through our longevity framework (around moat, lethargy and succession) have been able to sustain healthy fundamentals and thus wealth creation over the long term. More details about the longevity framework can be found in the Feb’22 newsletter. |

We continue to stay invested in companies which continue to demonstrate sustainably strong earnings growth on the basis of strong competitive advantages and robust corporate governance.