History shows that competing only on the basis of price either as a lender or as an insurer has inevitably led to heavy losses and in some cases to bankruptcy. In this newsletter, we discuss how PSU general insurers in their quest to gain market share, cut pricing in group health insurance for 5+ years which eventually resulted in massive losses and negative net worth for three of the four PSU general insurers. This coupled with low compliance and fraud detection capabilities was a recipe for disaster waiting to unfold which eventually came to light after the CAG’s audit report in 2022. Similarly, select housing finance companies and a private sector bank in the past have grown their balance sheets recklessly in benign conditions without adequately pricing risks thereby leaving no room for error when things turned south. The euphoria around new credit cycle has led to several mediocre lenders catching the fancy of investors. Consequently, KCP lenders like HDFC Bank and KMB are now undervalued compared to PSBs when adjusted for their core profitability (ROA).

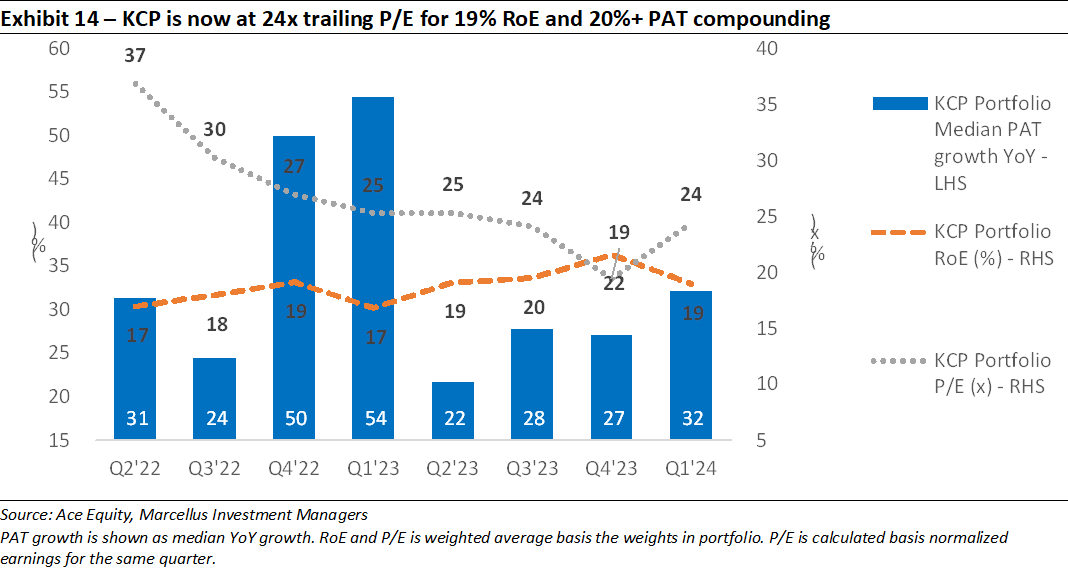

Performance update of the live fund

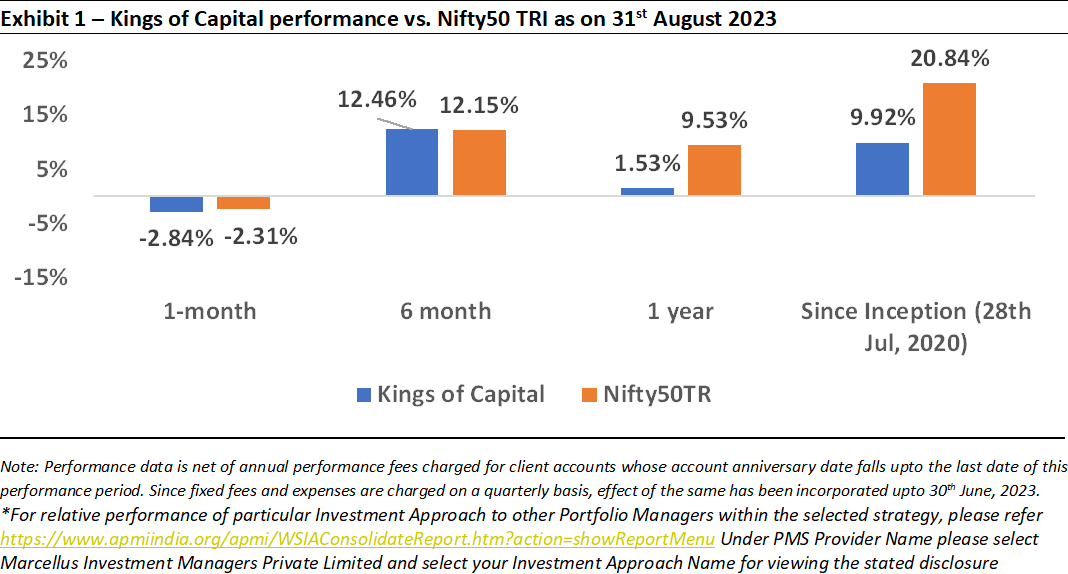

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

“If you are willing to do dumb things in Insurance; the world will find you, you can be in a boat in the middle of The Atlantic and just whisper out – ‘I’m willing to write this at a dumb price’, you will have brokers swimming to you” – Warren Buffet in Berkshire’s 2003 Annual Meeting

People, culture and quality of underwriting: The biggest source of value creation in financial services

Financial services and specifically, lending and insurance businesses, involve selling an undifferentiated product. The customer’s call on whether or not to take a loan/insurance policy is largely a function of loan/premium rates being offered.

This implies that to be able to make a decent Return on Assets (RoA) while offering competitive rates, the lender/insurer should be able to keep its costs low. This can be achieved in two ways:

- For lenders: Through low cost of funds (high CASA ratio, low deposit rates) and high-quality underwriting (in order to price assets’ risk correctly).

- For insurers: Through high quality underwriting (in order to price claim risk correctly) and keep cost of operations and acquisition lower (thought intelligent use of technology and building a captive direct distribution channel)

It is worth spending some time on quality of underwriting as a source of advantage for lenders/insurers. Lenders and insurers are both leveraged business models which run the risk of a large loss arising from a loan default/ large insurance claim which can push their P&L into the red and, more importantly, cause irreparable damage to the balance sheet. Firms that are able to correctly assess their customer’s risk and price their loans/policies accordingly, are able to build a cushion against such losses. On the other hand, firms which lack strong risk management processes, every so often become a victim of underpriced loans/policies – incurring heavy losses and risking even the firm’s solvency.

However, these critical aspects come to light only during periods of crisis; during more benign periods, investors tend to overlook such risks and instead attribute higher importance to growth metrics (irrespective of the quality of business being considered). In every cycle we see newcomers (and old sinners) making the same mistakes again and again.

Underpricing of risk is a recipe for disaster in the insurance business

To understand why quality of underwriting remains the most critical element in financial services like lending and insurance – let’s take a look at the 2022 Comptroller & Auditor General’s (CAG) audit report on Public Sector Insurance Companies (link). Before that let’s understand some basic terminology used for insurance companies.

- Claims to premium ratio: Incurred claims as % of premiums earned.

- Combined ratio: Claims ratio (as above) + Operating expenses (incl the cost of acquisition) as a % of premiums earned.

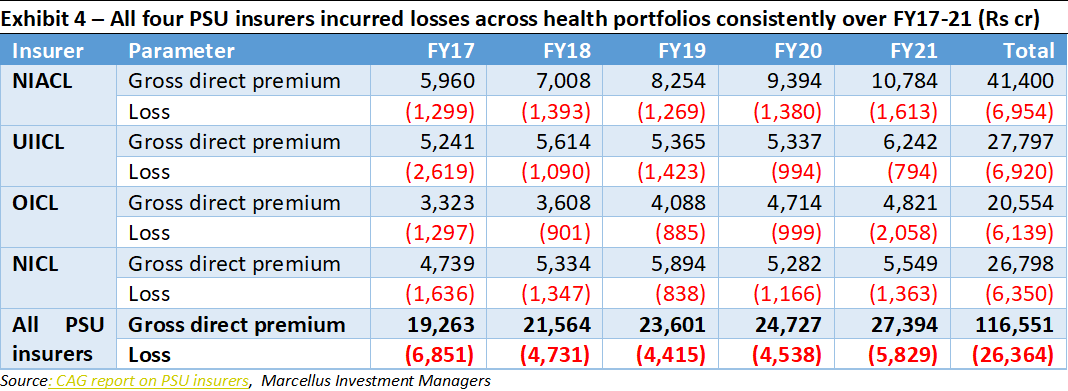

The focus of aforementioned CAG report was understanding the cause of the perennial losses in the health insurance portfolios of four PSU insurance companies viz., The New India Assurance Company Limited (NIACL), United India Insurance Company Limited (UIICL), The Oriental Insurance Company Limited (OICL) and National Insurance Company Limited (NICL) over 2016-17 to 2020-21 (see table below)

According to the report, the key reason for the consistent losses was the highly unfavourable claims to premium ratio in the group insurance portfolios for the four PSU insurers. As stated in the report:

“The audit noticed that retail and group health insurance business in the four PSU insurers has shown a growth of 36.41 per cent and 34.29 per cent respectively, in terms of gross premium collected during the five-year period from 2016-17 to 2020-21. However, the average percentage of claims paid to premium collected was 107 per cent in group health insurance business whereas it was 86 per cent in retail health insurance during the five-year period.” (Emphasis added by us)

The report went on to state that given the highly skewed nature of claims/premium ratio there was an element of incorrect pricing/discounting being done by PSU insurers for their group health customers.

“it is evident that on the one hand, less premium per life was charged by the insurance companies from Group policy holders as compared to retail policy holders and on the other hand more payout towards claims had to be incurred on group policies, resulting in overall losses in the health insurance portfolio.” (Emphasis added by us)

“Had the PSU insurers charged premium as per their underwriting policies/ guidelines, their ICR (Incurred Claims Ratio) would have been under control and health insurance segment would not have resulted in cumulative revenue loss of Rs.26,364 crore in five financial years from 2016-17 to 2020-21.”

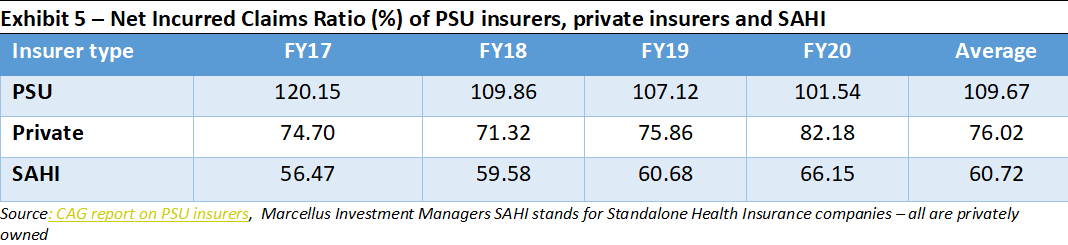

To put things in perspective, let’s see how private insurers and standalone health Insurers (SAHI) performed on similar metrics.

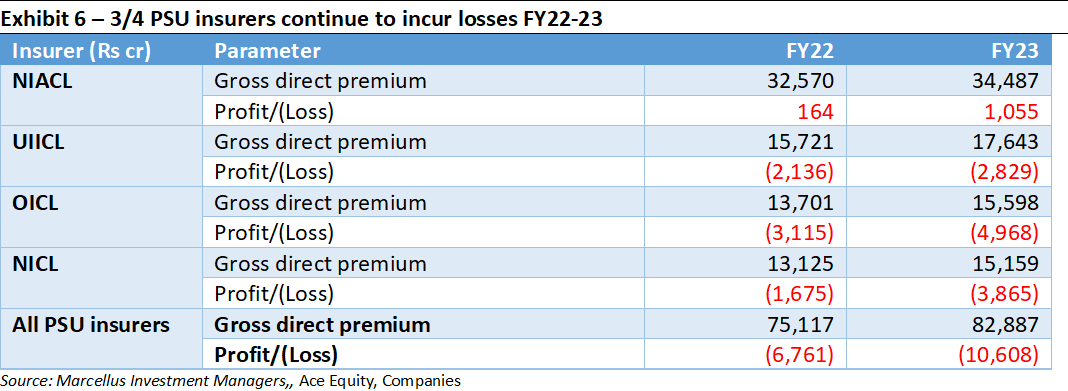

The corresponding metrics for PSU insurers have not changed in the period following the CAG’s report:

Coming to the reasons behind such a vast differential in the performance between the PSU vs. Private insurers and SAHI, the report discussed multiple reasons out of which two stand out:

- Lack of checks and balances w.r.t Third Party Administrators (TPA): In health insurance business, TPAs are engaged by insurance companies to have better expertise, specialization in provider interface, medical adjudication of claims and technologically driven customer services. The CAG audit found that the four PSU insurers have allocated major share of TPA business to just one TPA viz. Medi Assist India TPA Pvt. Ltd. This was done even though the ICR of claims serviced by the aforementioned TPA was above 100 per cent in some year(s) with the PSU insurers either increasing the volume of business or maintaining it at the same level as in earlier periods.

Secondly, in Jan’19, IRDAI cancelled the certificate of registration of M/s. E-Meditek Health Insurance TPA Limited for various irregularities including empanelment of fake hospitals and settlement of claims for treatments taken in such hospitals. M/s. E-Meditek Health Insurance TPA Limited processed claims amounting to Rs. 1,432 crore for the four PSU insurers over FY17-FY20. On the back of this development, IRDAI asked the four insurers to present an investigative report into the TPA by Aug’19. However, till Jul’21 the matter was still under investigation by the insurers. The CAG report concluded that:

“…it is evident that PSU insurers failed to carry out proper and timely investigation into the claims settled by M/s. E-Meditek Health Insurance TPA Limited. Safeguards such as ensuring validity of bank guarantees and collection of claim records on regular basis from TPAs were lacking…even after fraud was detected, the PSU insurers could not take affirmative action against the TPA.” (Emphasis added by us)

Interestingly, all this was being done despite Health Insurance TPA of India Ltd (HITPA) – a joint venture of the four PSU insurers – being underutilized by the PSU insurers. The puzzling aspect is that this was done even though average Turn Around Time (TAT) for cashless approvals in case of HITPA was 60 minutes vs. 65-197 minutes for other top ranking TPAs and ICR of claims serviced by HITPA ranged from 34 to 113 while ICR of other top ranking TPAs ranged from 95 to 114!

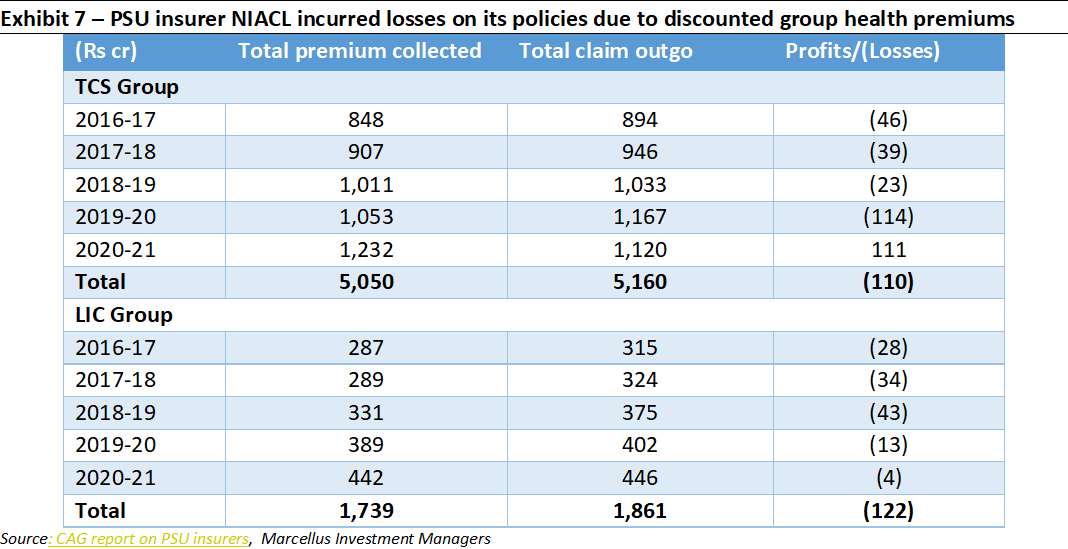

- Under-pricing of policies for some customers: The CAG report also highlighted that the PSU insurers faced the issue of undercharging of premium for group health customers. For NIACL, the audit revealed that three group clients were given a ‘Special discount’ in premium amount – even though there was no such provision in the underwriting policy. In case of one client – Maratha Vidya Prasarak Samaj – the report highlighted: “ICR was 384 per cent during the year 2015-16 and instead of loading the premium amount for high claim outgo in previous year, heavy discount of 75 per cent was allowed in violation of policy indicating undue favour to the client. (Emphasis added by us)

The report also noted that Group clients of health insurance policies tend to bargain for reduction of premium on the ground that they also bring in business in other portfolios such as fire, marine etc. Such ‘discounting’ is allowed by the Ministry of Finance guidelines as long as the Combined Ratio is less than 100 per cent. However, whilst issuing group policies NIACL did not consider this aspect – resultantly the insurer had claims which were HIGHER than the premiums collected for two large clients as shown in table below.

In other words, the reduced premium of health insurance was not offset by profits earned from other portfolios of the aforementioned clients. As per the report, net loss due to undercharging of premium works out to Rs 1,120 crore in respect of TCS (Tata Consultancy Services) and Rs 470 crore in respect of LIC once you include the overheads (20% of premiums).

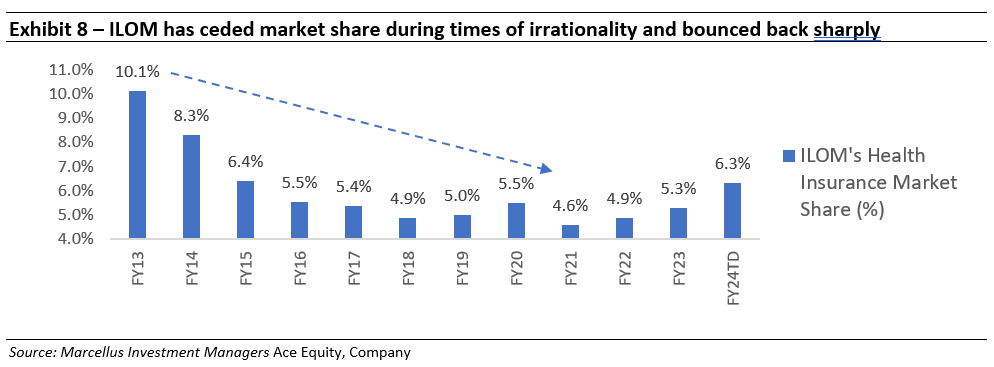

During the same period, profitability focused players (like ICICI Lombard) ceded market share to PSU insurers as pricing was inadequate in the market. As soon as pricing became adequate (PSU players corrected pricing), ILOM started gaining market share.

Lenders : Outcomes are no different

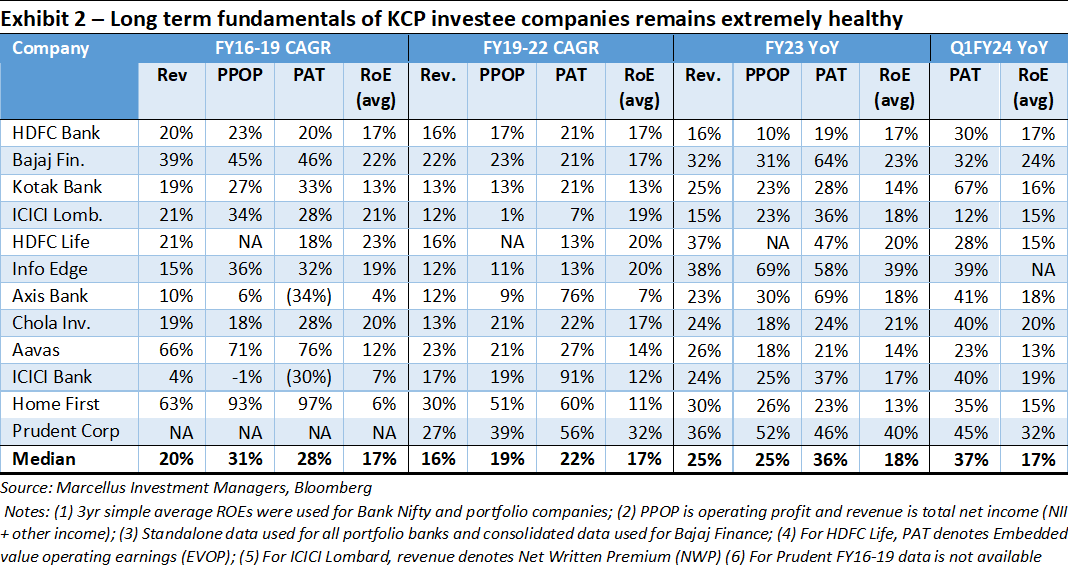

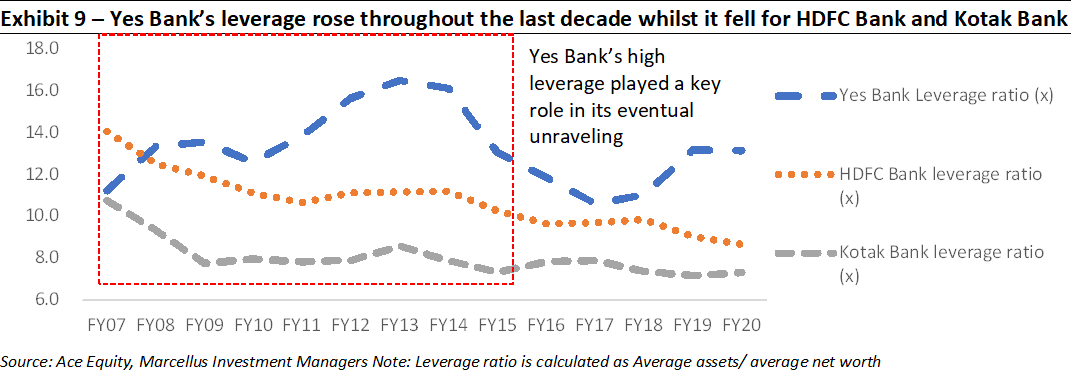

The importance of underwriting quality gets amplified in the case of lenders due to the additional element of leverage employed by both banks and NBFCs to fuel for their growth. We have discussed the importance of core profitability as measured by Return on Assets or RoA and risk management for lenders in our previous newsletters (see our Feb’23 and Dec’23 newsletters); hence we won’t delve into that aspect here. That said, it needs to be reiterated that there are broadly two sources of growth for any company (whether financial or non-financial):

- Internal accruals (RoE) which are reinvested into the business to grow their earnings – this is dependent on underwriting quality, correct loan pricing and astute risk management for lenders; and

- External capital which can be both in the form of debt and/or equity issuance. While such capital can provide a strong impetus to growth in the short run as long as things stay benign, excessive debt in particular can threaten the very survival of the company in question when things turn south

More details on the above aspect can be found in our Jun’22 dated newsletter.

With his background, it’s important for investors to understand that any growth (and share price returns) needs to be looked in context of the strategy being employed by the lender in question. If the lender resorts to a lackadaisical approach to risk management by underpricing its loans (vis-à-vis risk being undertaken) alongside utilizing leverage to keep gaining market share, it’s a classic sign of prioritizing short-term gains over long term sustainability. Such an approach may work very well for management, employees and even the shareholders for a while but as has been witnessed multiple times in the past, the end return is inevitably the same- wealth destruction.

Now that the initial euphoria around ‘cheap’ lenders is over, what next?

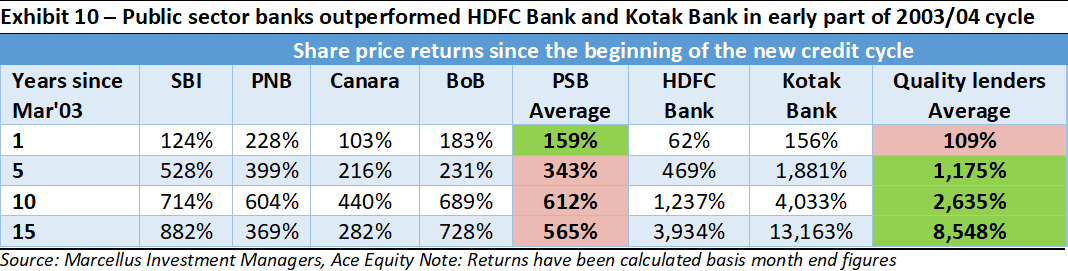

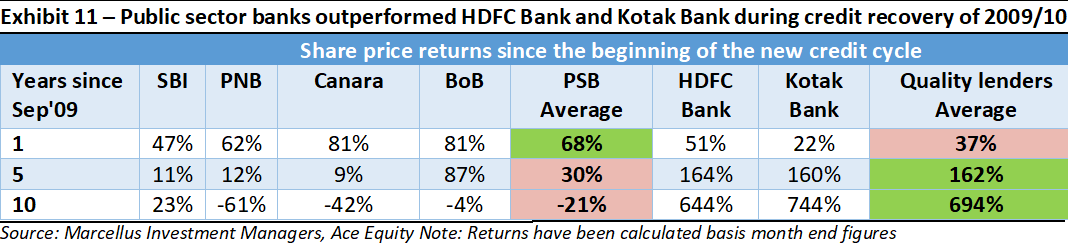

In our Dec’23 newsletter, we’d highlighted how risks in lending ecosystem tend to be non-linear and how at the start of every credit cycle, relatively lower quality (and ‘cheaper’) banks tend to provide substantially higher returns vis-à-vis their higher quality peers in the initial years. After that though, it’s the quality lenders that break away from rest of the pack – and by a substantial margin! We reproduce the tables discussed in that newsletter below:

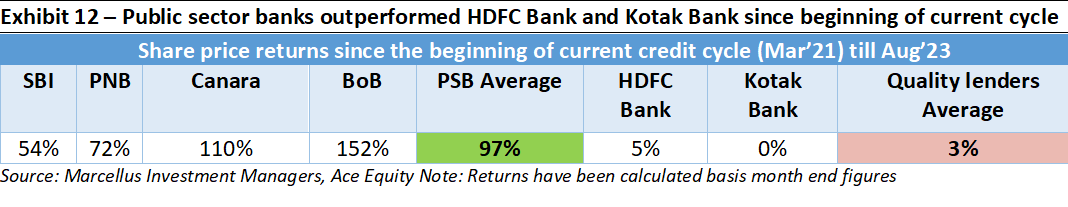

We have seen similar dynamic play out since the start of current credit cycle as well which began around Mar’21.

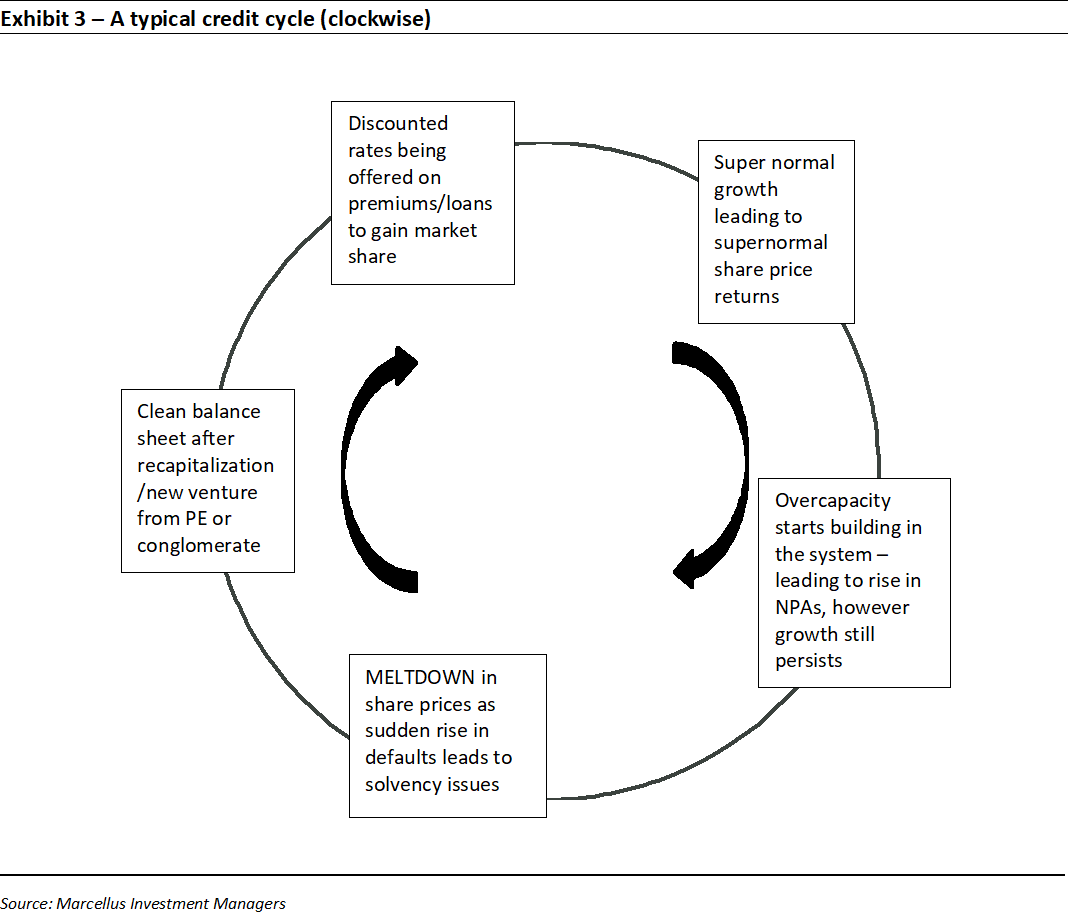

As a result of share prices not moving in tandem with the 20%+ earnings growth witnessed during this timeframe for high quality lenders like HDFC Bank and Kotak Mahindra Bank, their P/E multiples have seen a significant compression – while those of public sector banks have seen an expansion.

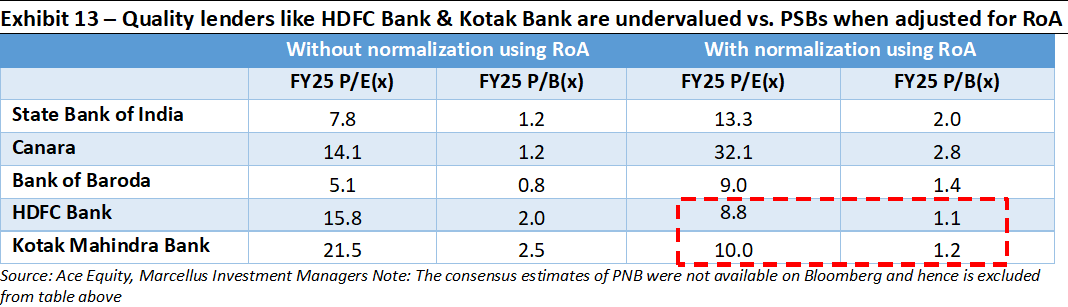

In our Oct’22 CCP newsletter we’d explained why structurally higher capital efficiency businesses deserve a higher P/E multiple vis-à-vis lower efficiency businesses. Further, in our Feb’23 KCP newsletter, we’d shown a strong correlation between RoA and long term shareholder returns. In that spirit, if one was to normalize valuations for underlying core profitability (by dividing stock P/BV by RoA) the consensus FY25 P/E and P/B of PSU Banks, HDFC Bank and KMB using last 15-year average RoA, once can see that quality lenders actually have lower valuations that their public sector peers.

We believe that much like in the past, ‘boring’ lenders which keep compounding their earnings at 20%+ will see a clear divergence in share price performance vis-à-vis rest of the pack over the next few years- something our KCP portfolio is well designed to benefit from.