In any vibrant, free market economy, firms that enjoy high RoCE will attract continuous waves of competition. Amidst high competitive intensity, while most firms will fall by the wayside, the Consistent Compounders are able to maintain their dominance due to their strong moats – built through prudent capital allocation and strategic decision making. Marcellus’ research process continuously assesses competition threats via a two layered framework focusing on: (a) the structure and strength of the current moat; and (b) the strategic decision making of the incumbent in response to competition. Firms that display any signs of ‘lethargy’ – whether in terms of strengthening their moats or in terms of responding to competition lose their place in our portfolio e.g. Abbott India in early 2022. However, for CCP stocks that are proactively strengthening their moats and defending their territory, we consider any temporary dislocation in market price vs. intrinsic value as an opportunity to increase our exposure in such businesses.

The superior economics of CCP companies attracts competition

“Every day, in countless ways, the competitive position of each of our businesses grows either weaker or stronger. If we are delighting customers, eliminating unnecessary costs and improving our products and services, we gain strength. But if we treat customers with indifference or tolerate bloat, our businesses will wither.

On a daily basis, the effects of our actions are imperceptible; cumulatively, though, their consequences are enormous. When our long-term competitive position improves as a result of these almost unnoticeable actions, we describe the phenomenon as “widening the moat.” And doing that is essential if we are to have the kind of business we want a decade or two from now.”- Warren Buffet in 2005 Berkshire Hathaway’s annual letter to shareholders [underlining is ours]

Competition amongst companies is a key aspect of any vibrant, free market economy. Over the life cycle of any company, it will see waves of competition, from peers looking to de-throne the incumbent market leader.

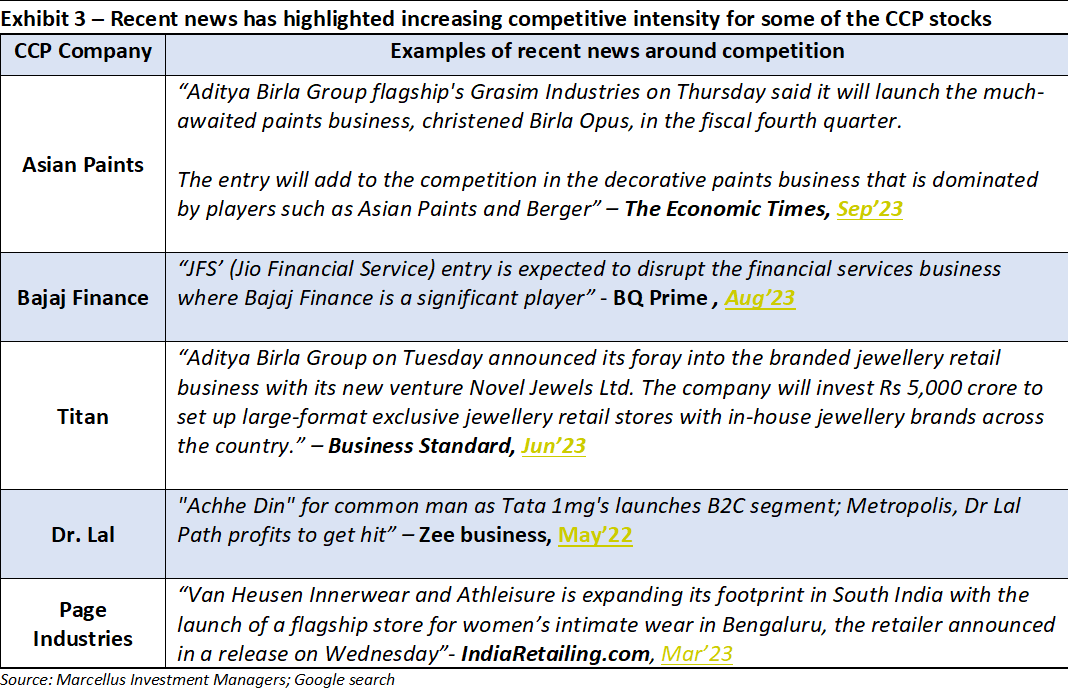

Over the last few months, we have seen this dynamic play out (again) for many of the CCP firms (see exhibit 3 below).

Why are CCP companies witnessing entry of new players in their industries?

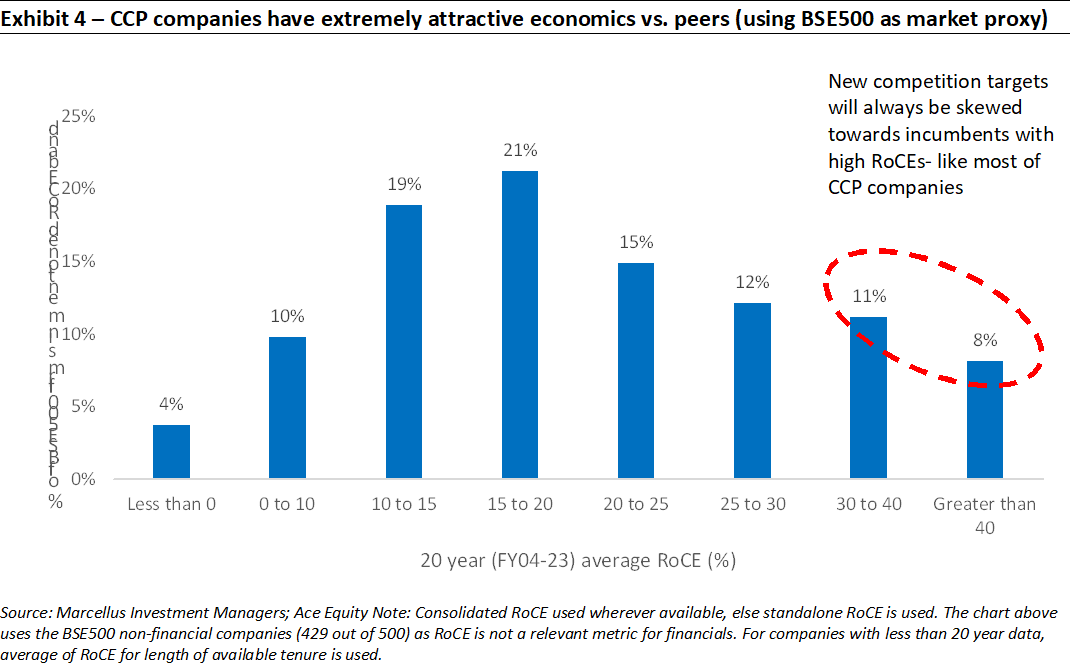

CCP companies are not only dominant in their respective industries, they also have extremely attractive economics (using Return on Capital Employed or RoCE as a proxy). As can be seen in the chart below, most of the CCP companies feature at the far-right tail of the broader market’s RoCE distribution (the chart below shows the number of non-financial companies in BSE500 index whose 20 year (FY04-23) average RoCE falls in the band mentioned on the x-axis).

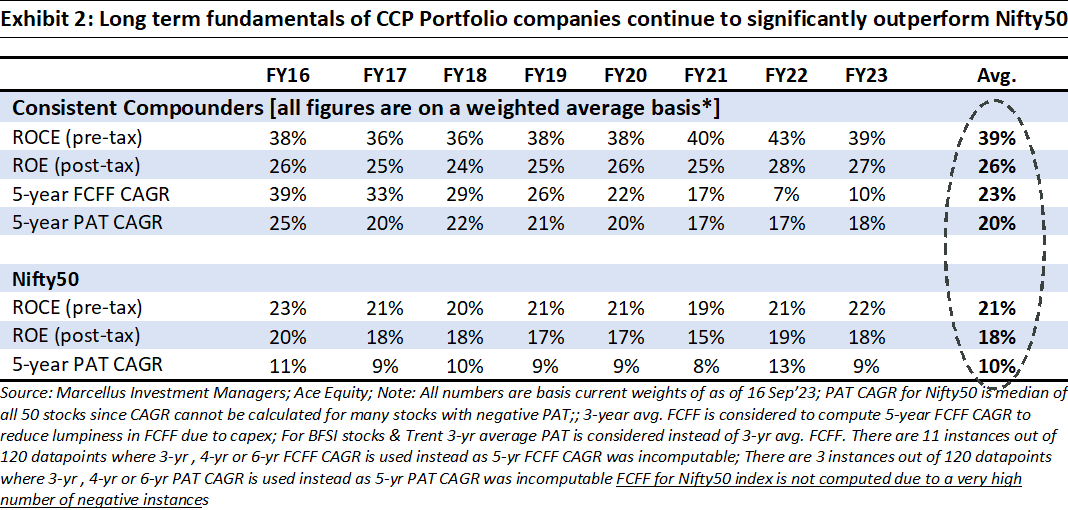

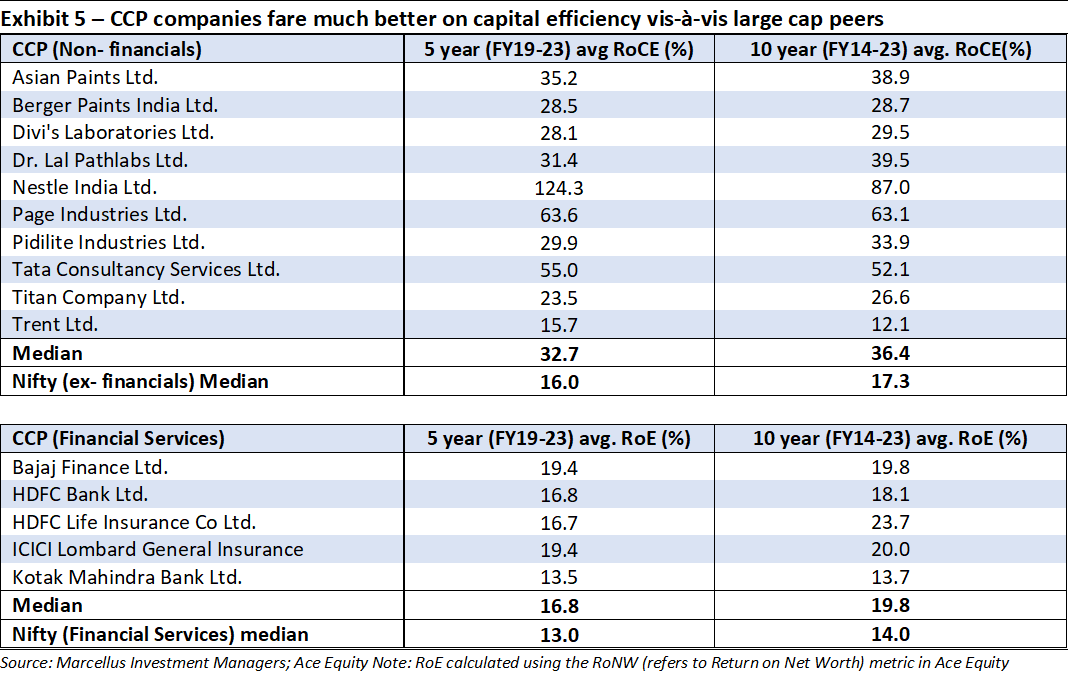

Over the last decade, the CCP companies have fared much better vis-à-vis their large cap peers in terms of RoCE (or ROE (Return on Equity) for financials) – see exhibit below. These elevated levels of profitability and cash generation attracts new entrants who aspire to take a slice of the profit pie controlled by the CCP companies in their industries.

This is not a new phenomenon – it has happened before and will happen again

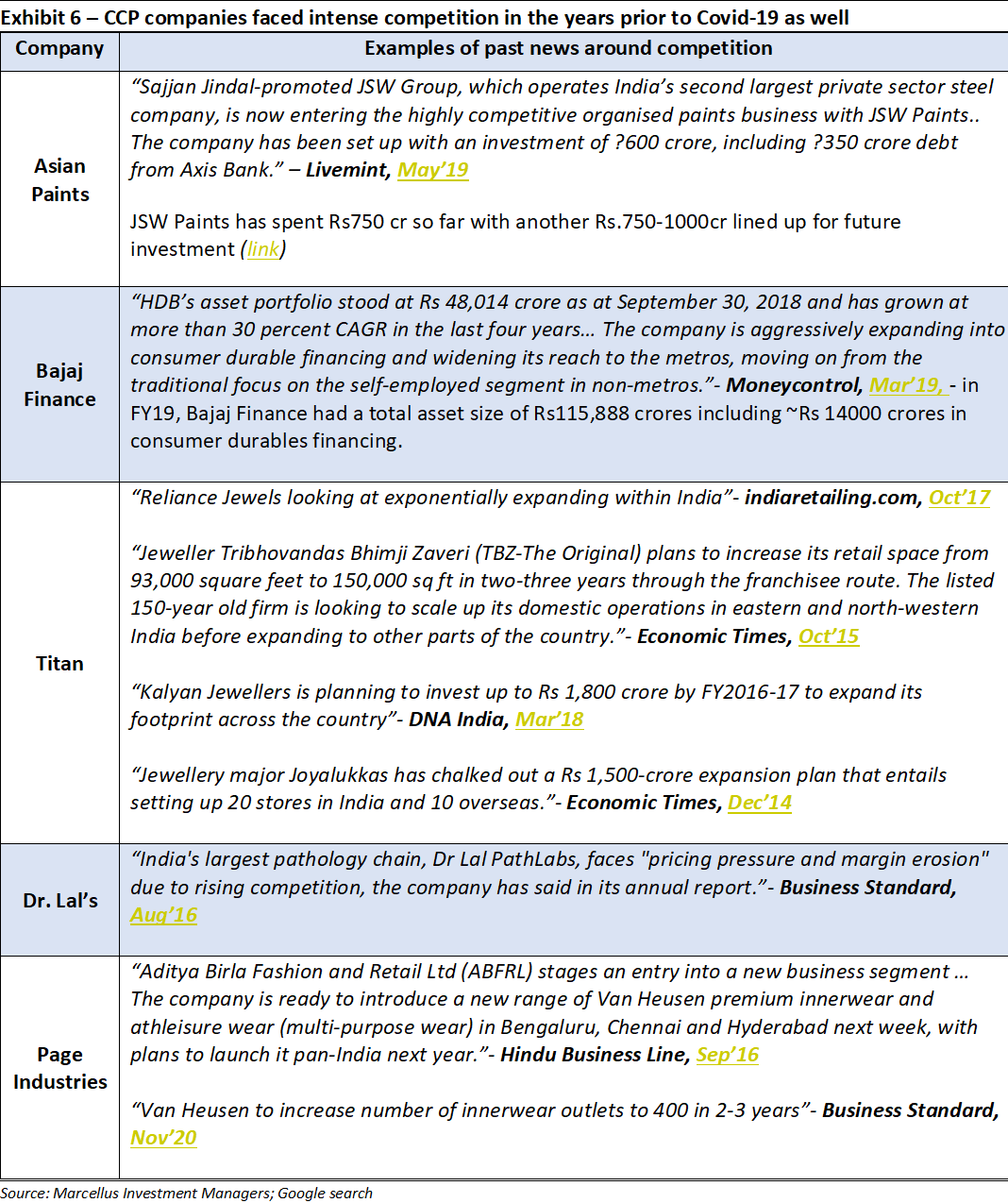

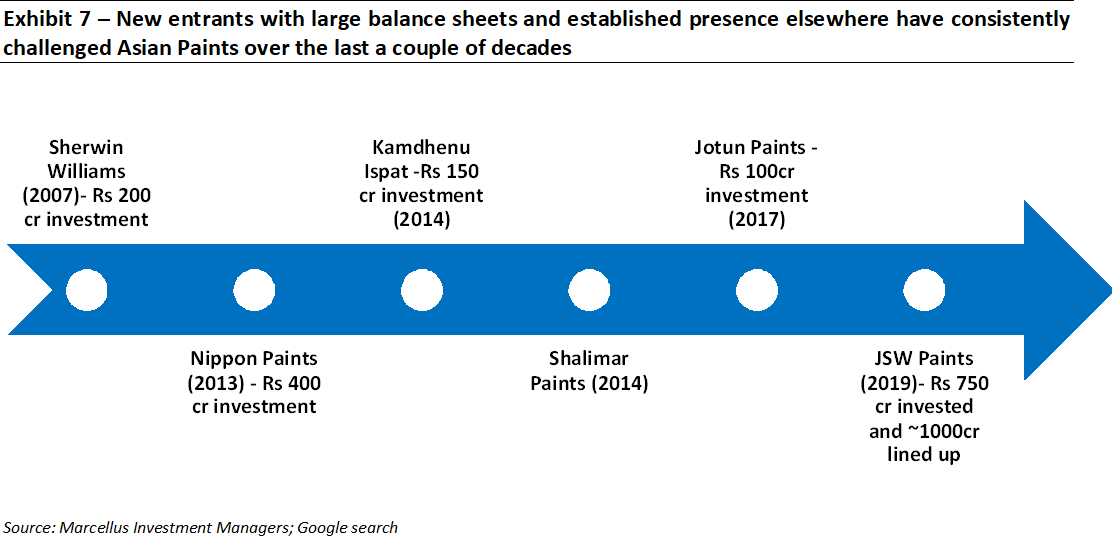

‘Competition from new entrants to companies with high ROCEs’ – is neither a new phenomenon, nor a rare phenomenon. Time and again, new competitors attempt to disrupt / challenge cash generative incumbent leaders in various industries to garner some share of the cash generation. See table below for instances of CCP companies undergoing a similar rise in competition from new entrants in the past.

Should we be worried about our investments amidst rising competitive intensity?

Is it always a given that new competition will be successful at dislodging incumbent cash generators? That’s a question Warren Buffet answered succinctly and beautifully in the quote cited at the beginning of this newsletter.

A firm’s ability to maintain its leadership position whilst providing superior returns to its shareholders is referred to as its competitive “moat”. Companies that are able to demonstrate this ability over decades are the ones that have built (and continuously strengthened) their competitive positioning vis-à-vis peers through innumerable steps – small and large. While on the surface it may appear that a new competitor poses a credible threat to the incumbent leader- reaching any conclusion without diving deep into structure of the incumbent’s moat is fraught with risk.

It’s almost akin to saying that a new cricket team in the IPL, possibly backed by a wealthy owner, would pose a challenge to the champions who have dominated the league consistently over several years. While an upset is not entirely unwarranted, to dislodge champions in the big league, needs more than a few instances of individual brilliance and more than just a large balance sheet.

With that thought let’s dive into how we at Marcellus assess the threat of competition for our investee companies. There are two layers to our thinking:

Structure of the moat of Marcellus’ investee company: the reasons for a strong moat can be classified into two broad categories:

Impregnable moats: These moats are a result of regulations or patents prevalent in an industry which might determine the number of competitors as well as the kind of products/services they can offer.

Banking is a sector which benefits from a regulatory moat given that the RBI issues licenses for establishment of a bank which can enjoy lower cost of deposits vis-à-vis non-banking financial services firms. Niche sectors like Phosgene manufacturing also enjoy regulatory moat given the limited number of licenses issues by the Government on account of the critical but extremely hazardous nature of the product under consideration (phosgene was the gas at the centre of the 1984 Bhopal gas tragedy). In India just four firms – Paushak, Atul, GNFC and UPL – hold a license for this product and just one new license (to UPL) has been issued in the last two decades.

Similarly, in sectors like technology and pharmaceuticals (including APIs) product offerings by competitors can be limited by patent protections which can last for more than decades.

While these kinds of regulatory moats can act as a significant entry barrier for new competitors, without another company specific moat (e.g. product quality / R&D / distribution / cost structure/ etc.), such companies are at the mercy of regulators for the longevity of their moats.

A more sustainable source of moat is the one that is theoretically penetrable but practically extremely difficult to penetrate – as we discuss below

Penetrable but structurally impregnable moats: These moats are created and strengthened by champion franchises by developing solutions that allow a win-win ecosystem to arise for various stakeholders in an industry, like customers, vendors, etc. Most CCP stocks belong to this category, having disrupted the status quo and redefined the operating characteristics of the industry they operate in.

For instance, Asian Paints’ moat lies in its inter-dependent relationship with paint dealers – wherein the latter’s economics (RoI) are linked to rapid inventory turns facilitated by the high quality logistics infrastructure developed by Asian Paints. The core engine of this infrastructure is fueled by accurate demand forecasts at SKU level – which in turn are a result of decades long investments in technologies like ERP and supply chain management (see more such examples in our Nov’22 newsletter). While it may appear that a new entrant can easily persuade a paint dealer to push its products through higher margins, such a strategy is unlikely to work without adversely impacting the said entrant’s financial position. The win-win solutions adopted by the likes of Asian Paints takes decades to establish and unless the incumbent grows lethargic, such an incumbent is incredibly difficult to dislodge.

Let’s take another example of a moat which is practically very difficult to disrupt – Divis’ Laboratories. The core of Divis’ competitive moat is three-fold: 100% IP compliant outsourced manufacturing; being a non-competing service provider to its clients which are the world’s largest Big Pharma companies; and having a high-quality manufacturing process which also scores highly on regulatory compliance. These attributes in and of themselves are extremely difficult to achieve together and Divi’s further augments its moats through laser-like focus on disciplined capital allocation towards few chemistries in which it can become a global leader. It is difficult for a new competitor to be able to combine all these attributes (which’ve taken decades to build) in a short span of time particularly if the incumbent is not lethargic in deepening its competitive advantages further (see our Jan’23 newsletter for more details on Divis’).

Response by Marcellus’ investee company to new competitive activity: We rigorously assess our portfolio companies for lethargy as they deal with competitive pressures. Sustainability of greatness is not possible without having a clear playbook of warding off potential competitive threats on the horizon. Let’s go through some examples:

In 2019, JSW Paints entered the paints industry with ‘One colour One price’ offering. There were several questions raised in the investor community about Asian Paints’ ability to defend its market share in the face of JSW’s entry. Asian Paints continued to improve upon what it does the best i.e., improve its service levels to the dealer which matters most to any paint dealer interested in gaining market share. At the same time, the firm worked on dealers’ incentive structures and entered adjacencies like putty & waterproofing to generate additional growth drivers, thereby ensuring that home building material dealers keep deploying incremental capital with Asian Paints rather than with any other paint company. Since FY19, the firm’s revenues and volumes have grown faster than industry growth at 16% CAGR & 17% CAGR respectively.

In the three years from Oct’16 to Jul’19 Dr Lal Pathlabs’ share price delivered an absolute return of negative 8%. One of the key reasons was investor concern around Dr Lal Pathlabs facing a major price war during 2016-2017 from Thyrocare in the form of bundled packages. Dr Lal responded with its own packages called “SwasthFit” which were designed keeping in mind value add to both the patients and the doctors rather than just selling the cheapest packages. Since FY17, the share of SwasthFit for Dr. Lal has increased from zero to Rs ~400crs annual business, contributing ~20% to the firm’s overall revenue.

Bajaj Finance (BAF) has faced recurring competition from different set of players – banks, NBFCs, fintechs, etc. over last decade. However, as is the case with decadal compounders, BAF has continued to innovate, allocate capital smartly, digitally equipped itself and hired & retained the best talent to remain well ahead of the competition. In 2018, when fintechs (Financial Technology oriented firms) were gathering pace in India, there were concerns raised in the investor community on BAF’s ability to compete with digital loans. However, BAF proactively responded through a massive digital transformation which not only made it agile but also expanded its presence across all mediums (omnichannel approach). Today BAF disburses Rs ~100 bn/year of personal loans over its app within 12 months of the app roll out. Similarly, in FY22-23, BAF faced competition from banks and select NBFCs which were getting aggressive in CD (Consumer Durables) financing. Consequently, BAF increased its physical footprint (added ~15,000 new CD stores over the last 12 months), and has increased staffing across these stores – resulting in BAF’s market share in subvention pool remaining in a narrow band of 65-70%. Moreover, BAF’s timely investments in Bajaj Mall (which redirects customer to relevant store) has made BAF’s relationships with the dealers far deeper vs. other financiers, strengthening its moats further.

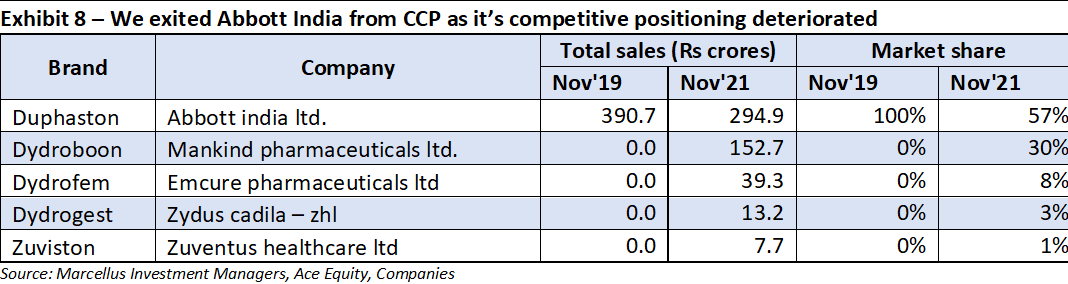

Example of an exit from Marcellus’ CCP on the back rising competition from new entrants

We exited our position in Abbott India in early 2022 on the back of concerns around the company’s ability to defend its market share in key molecules. Specifically, the company had lost significant market share in products like Duphaston, a product used by pregnant women and an erstwhile monopoly product of Abbott. Abbott lost share in this molecule after the launch of a competing product by Mankind, a new entrant, which had been priced at a significant discount to Abbott’s product.

Investment implications- maintaining focus on few simple fundamentals

“Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential”- Warren Buffet in 2017 Berkshire Hathaway annual letter to shareholders

Analysis of competitive intensity within an industry and the consequent impact on our portfolio holdings is an ongoing part of Marcellus’ research process. As part of our longevity framework, we continuously assess and score our companies on ‘lethargy’ or the steps being taken to widen their existing moat. To that end, as long as we see limited threat from competition we stay put, else we exit our position. This is exactly the work our research team has been doing on all the companies mentioned in Exhibit 3.

For example, when it comes to Grasim’s entry in paints with an investment of ~Rs 10,000crs, its important to note that capex is not equivalent to sales or market share in paints industry. If it was the case, MNC paint players in India – who were never short of money to invest in creating capacities – would also be market leaders. Nor is there any scope for price disruption as there are many players in the market who offer 2-3x margins to dealers and yet can’t gain market share from Asian Paints. Moreover, Asian Paints itself has increased its painter base and dealer base in rural areas by 2x over the last couple of years, targeting cement dealers as well as other hardware / home building material shops.

Asian Paints is also investing ~Rs 2,100crs in backward integration for paints by investing in plants for VAE (Vinyl Acetate-Ethylene) and VAM (Vinyl Acetate Monomer) which is a key raw material in decorative paints and is expected to reduce their paint cost by ~10% and make the product more competitive. It is investing another Rs 550crs in buying licenses for limestone mines in the UAE and setting up clinker units in India which will be used to produce White cement which is a key raw material not only for White Putty but also for powder paints, gypsum and more. There are also multiple new businesses which Asian Paints has started or planning to start like construction chemicals, putty, gypsum, home décor stores, home décor services to offset any temporary blip. Hence, at this stage we are convinced about Asian Paints’ ability to defend its turf. However, we will continue to keep our ears close to the ground as Grasim will enter and attempt to expand its presence in the paints industry over the next few months and years.

Similarly, the biggest constraint factor for Indian banks in recent times has been the mobilization of deposits (as system loan growth is 300 bps higher than deposit growth) whilst keeping cost of funds under control. Amidst the intense competition for deposits, HDFC Bank had led in branch additions – with 1,479 branches added in FY23 (23% of opening branch count vs. 9%/1% for ICICI and SBI respectively). This is not the first time HDFC Bank is going for aggressive branch additions – during FY09-FY13 HDFC Bank grew its branch network at a scorching pace of 21% CAGR. Moreover, HDFC Bank is not only expanding its branch network but is also doing so at a 10-30% higher branch productivity (mobilization of deposit per branch) vis-à-vis peers.

A zip code level analysis of new branches of HDFC Bank (according to broker reports) in fact reveals that they have added branches in areas with limited competition from private banks. Almost 45-50% of new branches are in markets where other leading private banks like ICICI and Axis are not present. In fact, these markets mostly have presence of PSU banks, gaining market share from whom may not be a tall ask for HDFC Bank.

We believe such aggressive branch additions along with best-in-class productivity metrics will keep HDFC Bank ahead of the competition in the coming years as well.