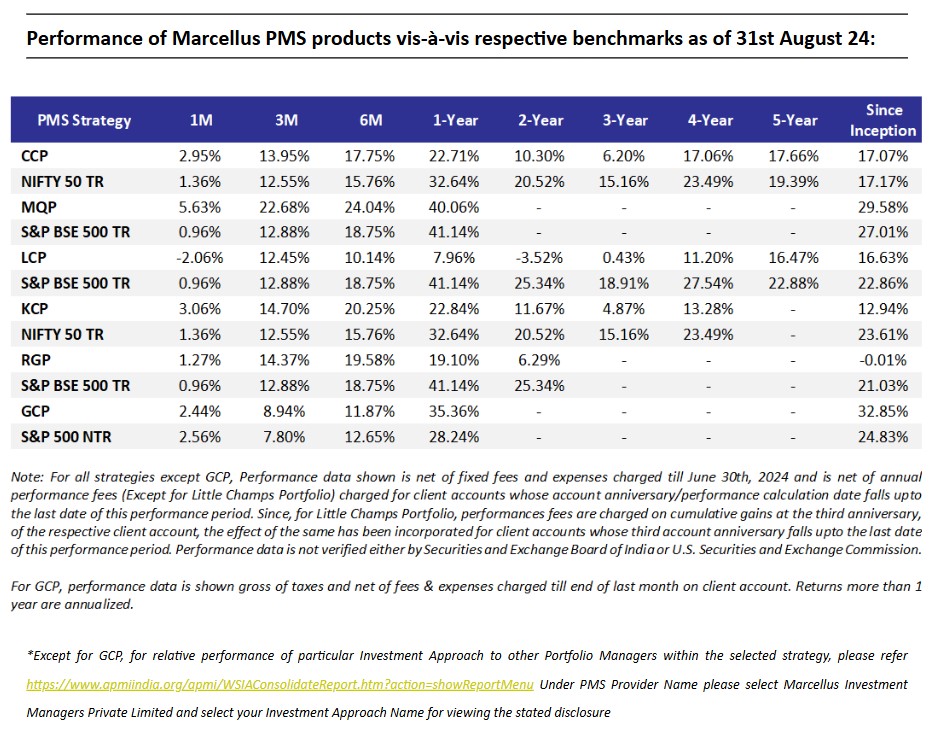

Consistent Compounders Portfolio (CCP)

Performance of Marcellus’ CCP portfolio has turned a corner in absolute returns over the last 18 months and in relative returns (relative to Nifty50 TRI) over the last six months. This is attributed to both the upgrades made to our portfolio construction approach as well as to the strong performance of the ‘quality’ universe in the broader stock market. Upgrades made to our portfolio approach include: a) a wider coverage universe to include ‘enterprising compounders’ where outcome of capital allocation decisions is yet to get appreciated in their stock price; and b) active use of position sizing to benefit from opportunities presented by the interplay of risks and valuations of our portfolio companies. Attributes that haven’t changed include: a) portfolio concentration (>70% allocated to top 10 stocks); b) investments in only deeply moated businesses that can drive healthy earnings growth over long periods of time; c) low churn of less than 20% on average (last 12 months was a one-off period of high churn) and d) depth of bottom-up research being our biggest strength in stock selection.

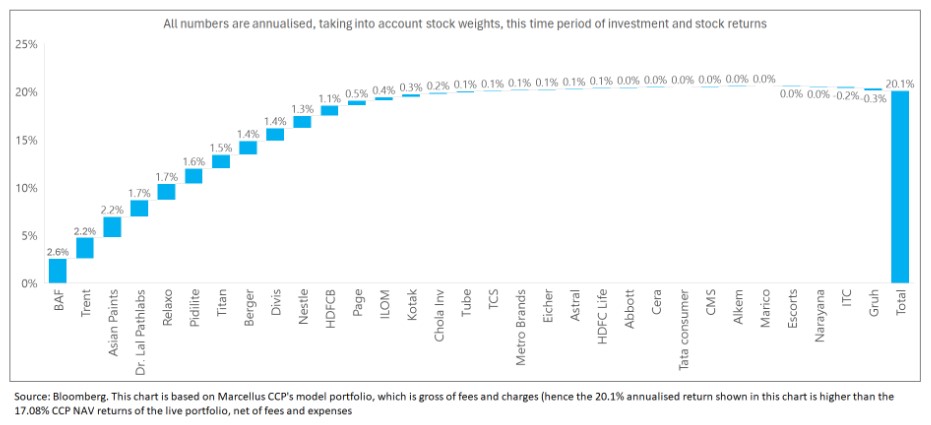

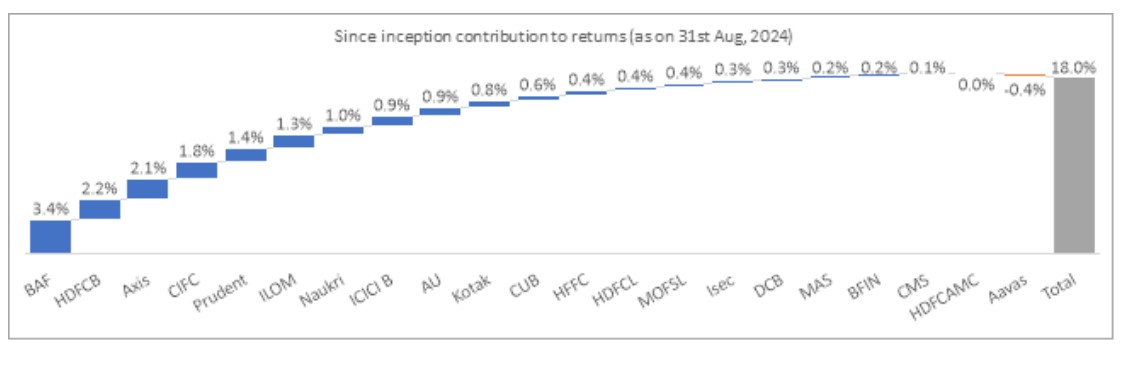

The attribution of our performance since inception across stocks is highlighted in the chart below. There are few key observations worth drawing from this chart:

- Observation #1: Very few stocks have contributed to negative returns for CCP – none of them meaningful in quantum.

- Observation #2: More than 10 stocks have contributed with healthy and positive annualised contribution. It is encouraging to note that in a concentrated portfolio with hardly held 14-15 stocks held at a point in time on average, there are 11 stocks that have contributed to more than 1% annualized returns since inception.

Going forward, we expect the portfolio to continue to deliver healthy and consistent performance largely backed by fundamentals of the portfolio constituents. Upgrades made to the portfolio construction approach over the last 12 months should provide greater resilience to absolute and relative returns if the external scenario akin to that of FY23 were to repeat itself in future.

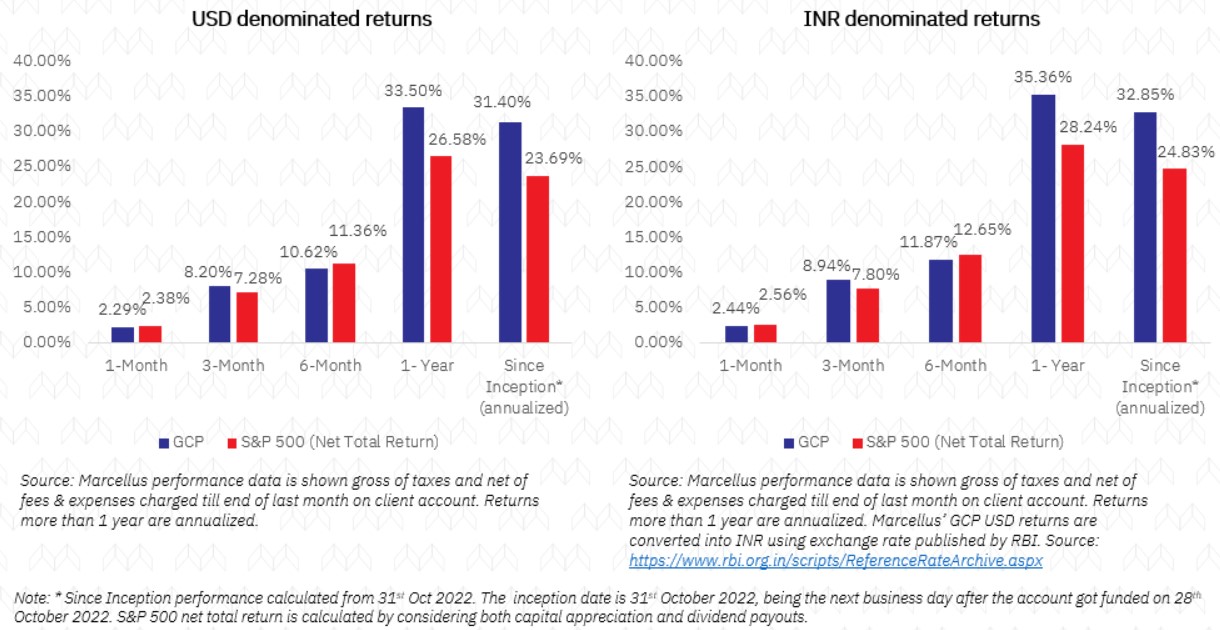

Global Compounders (GCP)

This month was largely uneventful for our portfolio companies, and our portfolio performed inline with our benchmark S&P 500. But this month included one of the most closely watched earnings releases in the world—Nvidia. While we don’t own the stock, we follow it closely. The reported figures were generally in line with expectations, though the forward outlook was somewhat lighter in terms of gross margins, causing the stock to react poorly. The Blackwell delay had been well flagged, but expectations were still high.

As we’ve mentioned in previous updates, we regret missing the Nvidia opportunity early last year or even coming into this year. However, from this point forward—while it’s impossible to predict stock prices and momentum-driven rallies that can drive prices to unbelievable levels—the path ahead for Nvidia seems more challenging than the last 12-18 months, as much of the potential is already priced in. We recognize Nvidia’s superior engineering, but we also acknowledge that these are inherently cyclical businesses. Peak growth and peak margins likely require a greater margin of safety from a valuation perspective.

Additionally, the growing case for custom silicon is worth noting. It’s becoming increasingly logical for hyperscalers like Microsoft to develop their own GPU chips, as GPUs are becoming one of their largest cost items. Microsoft, for example, pays tens of billions of dollars to Nvidia for these chips, on which Nvidia likely earns supernormal profits (possibly 50-60%+ operating margins). At some point, it may make financial sense for companies like Microsoft to produce their own chips to save costs. Companies like Google and Amazon are already exploring this path, and it’s a development that could have long-term implications. Still, Nvidia’s engineering moat is enormous, and it will be interesting to see how this story unfolds—but for now, we are not chasing the stock or the sector.

Shifting away from tech, while Nvidia captured the spotlight, one of our portfolio companies—run by a 90+ year-old investor from Omaha—quietly crossed the $1 trillion market cap threshold, making it the first “non-tech” company to achieve this. Yes, it’s Berkshire Hathaway. It’s an astounding achievement, compounding shareholder wealth at 20%+ CAGR not just for 10, 20, or 30 years—but for more than 60 years! Coincidentally, just a few days before Berkshire reached the trillion-dollar mark, we recorded a podcast on the company’s remarkable journey, which turned out to be timely. Here’s the Spotify link for those interested.

The “non-tech” designation fits perfectly. When revisiting the Berkshire Hathaway website after it hit $1 trillion, we found that it hadn’t changed at all—still the same minimal design!

Berkshire Website:

Yes – that’s it for a $1Tn company website!

Looking ahead – Emerging Opportunities in a likely volatile set up:

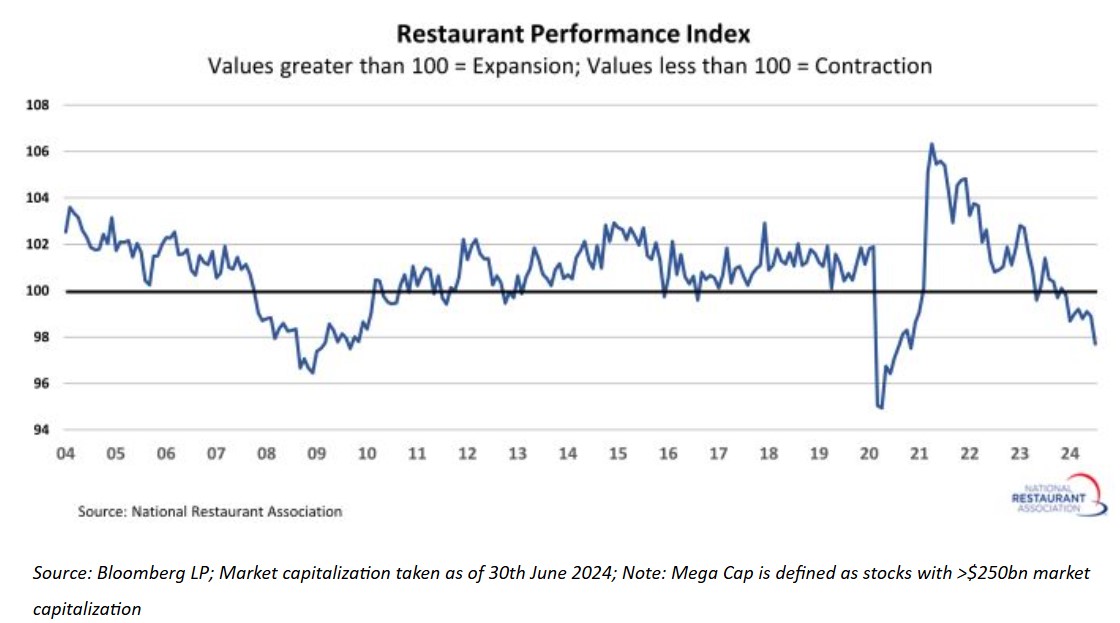

Looking ahead, U.S. consumers continue to show signs of weakness in discretionary spending, leading investors to seek safety in consumer staples names like Costco and Walmart, which provide daily necessities. However, many of the discretionary spending indicators we track are now approaching levels last seen during the Global Financial Crisis. For example: the Restaurant Performance Index – even though we have not invested in any Restaurant stocks – we use this as one of our many leading indicators to assess discretionary spending.

Restaurant Performance Index:

To us, this signals opportunity, particularly for long-term investors with a 3-5 year horizon. For example, the largest luxury brand, with a multi-decade history of compounding in the teens, is now trading at a forward P/E in the high teens. As we continue to explore these opportunities, we remain disciplined in our portfolio allocation, especially as we approach November—a typically volatile period due to the upcoming elections. We aim to navigate this period carefully.

Happy Investing!

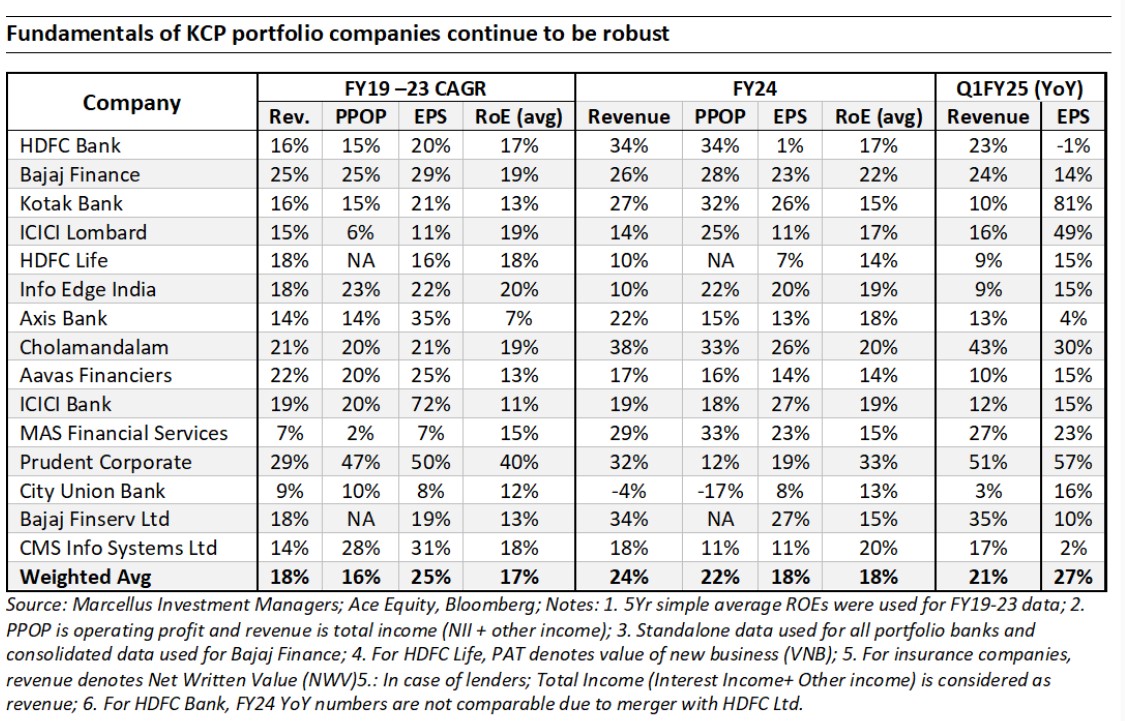

Kings of Capital Portfolio (KCP)

Over the past 6, 12 and 18 months, the portfolio has outperformed the Bank Nifty and Nifty Fin Services Index as the euphoria and investor interest in public sector banks has gradually subsided over the past couple of quarters. Also, our exposure to capital markets and insurance sector has outperformed these indices.

While the portfolio performance has rebounded over the past 12-18 months, we have not made significant changes to the portfolio. Our name churn at the portfolio level since inception has been ~10% per annum which implies a genuinely long-term approach to investing and this approach hasn’t changed over the past 18 months. The performance rebound has largely been a result of stocks prices catching up with earnings growth rather than a change in approach.

However, this low churn, long term oriented approach implies a shortcoming which KCP investors should be aware of: there is a significant possibility of KCP missing out on stocks which we believe do not have enough margin of safety in their business models and/or valuations. The most vivid example of this would be us missing out on the PSU bank and microfinance rally of 2022-23 which has now started to reverse. We strive to invest in (i) business models with trustworthy management teams which we believe can survive downturns – this is quite important for financial services businesses (ii) linked to the first criteria – we will invest in businesses which we understand and will have the fortitude to hold on to when the business goes through an eventual downcycle and (iii) businesses available at a valuation which offer a margin of safety as the future is unlikely to be a linearly forecastable estimate which we will get right.

As seen in the chart below, the result of this approach has been us not losing significant capital on any of our investments so far. Aavas, in hindsight was a mistake of us massively over paying for a housing finance business in an era of low interest rates back in 2021. While the data in the chart below is flattered by the stock market rally of the past four years, there is a risk of more Aavas like outcomes whenever we get carried away and invest in businesses which do not fulfil all three criteria mentioned above.

We believe the portfolio is well positioned to deliver healthy earnings growth albeit at a pace lower than what we saw during FY23 and FY24 as credit costs for lenders normalise and banking sector loan growth reverts to 12-13%.

Changes to the portfolio:

Addition of CMS Info Systems Limited: CMS is a business services company with leadership in cash management market, a growing presence in ATM managed services market, and now expanding into tech solutions (remote monitoring and software). On back of its scale and a strong balance sheet (net cash company with healthy return ratios), it is well placed to benefit from healthy ATM rollouts (capex heavy), increased outsourcing activity of support functions by banks and tightening regulatory compliance. Stronger growth in RMS segment and diversification into bullion-logistics and loan collections will drive revenue growth & diversification of revenues. The biggest risk is acceleration in replacement of cash by digital payment modes and hence material reduction in cash in circulation.

Addition of Bajaj Finserv: We started adding Bajaj Finserv to the portfolio in July. Bajaj Finserv owns 51.3% stake in Bajaj Finance – one of the most profitable and best-managed NBFCs and 74% stake in 2 insurance businesses – BAGIC and BALIC. BAGIC is one of the most well run and reputed general insurers in the country, whilst BALIC has turned around in the last 3 years under the new management team. Bajaj Finserv’s new initiatives like Bajaj Finserv Health, FinServ Market Place & Bajaj Finserv AMC offer additional optionality. With all cylinders firing, it is a good proxy to take exposure to the Indian financial sector. When we started adding Bajaj Finserv, its derived holding company discount (on Bajaj Finance) was marginally lower than previous 5-year average, however this has significantly narrowed over the past month post our purchase. This position was built by selling off some of our holding in Bajaj Finance. Given majority of the SoTP value of Bajaj Finserv continues to be contributed by its stake in Bajaj Finance, this addition does not result in any significant change in portfolio composition.

Source: Annual filings of the respective companies

Little Champs portfolio (LCP) and Rising Giants portfolio (RGP)

As discussed in the last month’s newsletter, the Little Champs portfolio stocks delivered a mixed set of earnings for 1QFY25 (median portfolio earnings growth of 7% YoY). However, on the positive note, the portfolio median earnings growth has been improving significantly from -13%/-10%/-6% in 2QFY24/3QFY24/4QFY24 to now +7% in 1QFY25.

On the other hand, Rising Giants portfolio fared better recording 15% YoY median portfolio earnings growth

As we head into FY25, we expect both Little Champs’ and Rising Giants’ portfolio earnings to benefit from a favourable base of FY24; A bottoming out of destocking cycle which impacted the earnings particularly for the export-oriented companies in the recent quarters; Portfolio changes through additions of stocks where the earnings outlook appear sanguine and getting out of the stocks where the earnings outlooks is not encouraging.

We continue to make suitable changes in the portfolio (particularly the Little Champs portfolio) to create more diversity (increasing the mix of domestic vs the historical heavy leaning towards the export-oriented franchises; reducing the historical high concentration of chemical oriented companies in the portfolio) and bring the healthy earnings growth trajectory back in the portfolios

Changes to the Rising Giants PMS portfolio (as of August 31, 2024)

Addition of Safari Industries (India) Ltd: Safari Industries, the third largest luggage company in India, has performed commendably over the last decade, clearly outperforming its much larger peers (VIP and to some extent Samsonite) and delivering 44% operating profit CAGR over FY14-24. A large part of this success is owed to its promoter Sudhir Jatia’s near-perfect ability to bet on market trends (focus on hard luggage portfolio and in-house capacities, foray into back-packs, thrust on ecommerce), tight control of costs/operations, and effective marketing (proactively introducing new product features, innovative replacement scheme etc). This has been complemented by a stable and well incentivized senior management team, and a clear focus on the mass segment. Going forward, with the new Jaipur plant enhancing Safari’s cost advantage and scope for still expanding the distribution network (particularly on the EBO front), we don’t foresee significant threats to Safari’s status as the king of the mass segment. We expect Safari to be the clear winner of the ongoing shift in the market from unorganized to organized segment.

The Company enjoys industry leading margins, working capital days and RoCE helped by competitive advantages around:

a. Milk procurement: The Company has been able to build relationships with and procure milk directly from farmers, which takes away the price inflation that is caused typically by middlemen in this industry (increased from 7% of the total milk procured in FY14 to ~93% in FY24) and also reduce the volatility in procurement cycles as far as the source is concerned.

b. Density of operations: through setting up of village level collection centres to chilling centres to processing units in proximity to each. This helps reduce the distance as well as number of times the trucks have to transport milk, and also maintain freshness in milk which enables premium pricing.

The Company also runs successful operations in Africa (particularly Uganda) where it makes healthy operating margins (around 18.0% in FY24) and likely to grow at healthy clip.

Source: Respective company’s annual filings

Changes to the Little Champs PMS portfolio (as of August 31, 2024)

Addition of Safari Industries (India) Ltd.: Please refer the rationale discussed under the RG section.

Source: Annual filings of respective companies.

Please refer to the following link for our Responsible Investing Policy, our ESG Integration Framework and Results of ESG scoring: https://marcellus.in/responsible-investing

Team Marcellus