*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.

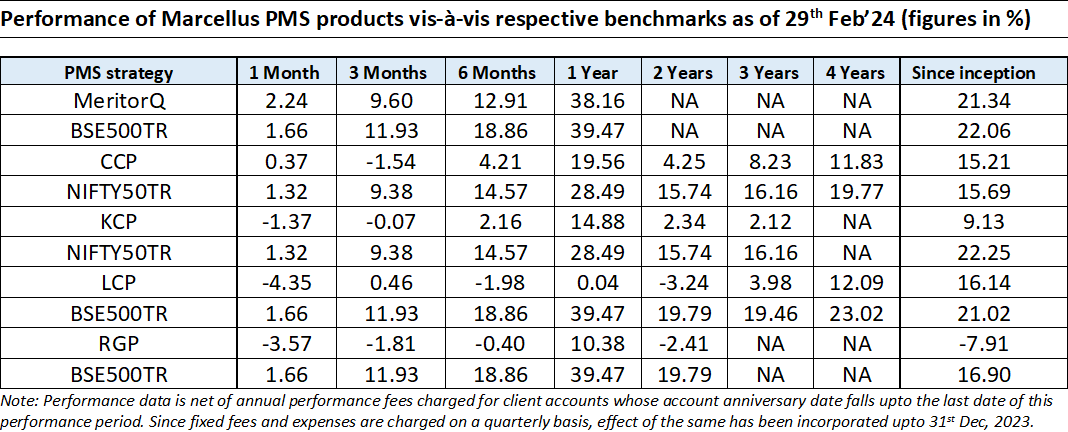

Consistent Compounders Portfolio (CCP)

In our recent CCP newsletter (click here ) we highlighted that long periods of outperformance by quality firms are often characterized by intermittent periods of severe underperformance – something that has been unavoidable by even the likes of Warren Buffet. Such underperformance was especially prominent during three instances (first half of 1970s, Mar’99-Aug’00 & Nov’04-Apr’06) wherein Berkshire Hathaway’s underperformance was in high double digits even as over a 10-year period encompassing the aforementioned instances, Berkshire’s shares beat S&P500 quite handsomely. As seen in the case of Berkshire Hathway, most such short-term pain periods are driven by market ‘narratives’ and during such periods, the tried and tested model of investing in high quality franchises takes a back seat. People often become enamoured with the sharp increase in share prices of erstwhile beaten down stocks which are then taken to dizzying heights – often to massive detriment of people entering late into the buying cycle.

In India, we appear to be in the midst of a narrative driven market rally as a recent article from Bloomberg highlighted:

“In 2023, Indian investors traded 85 billion options contracts, more than anywhere else in the world. The country has topped the charts since 2019, when it first overtook the US in the volume of annual trades. (The US still buys and sells the most by dollar value.)”

- Bloomberg piece ‘Retail traders are losing billions in India’s booming options market’, Feb, 2024

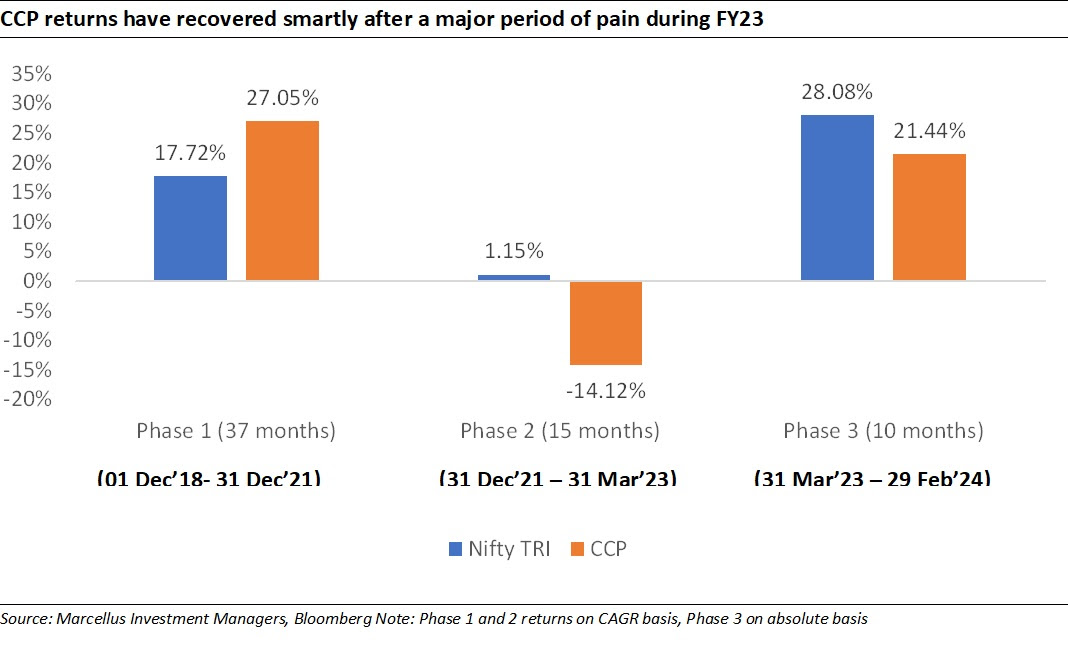

CCP’s major period of underperformance (mostly FY23) was a combination of both retail inflows backed strength of Nifty50 index as well as correction in our own investee companies (we discussed reasons for the same in our Feb’24 webinar). Since reaching the trough in the end of FY23 (14 Mar’23 to be precise), CCP NAV has recovered quite impressively to provide returns of 23.7% until January 2024 end.

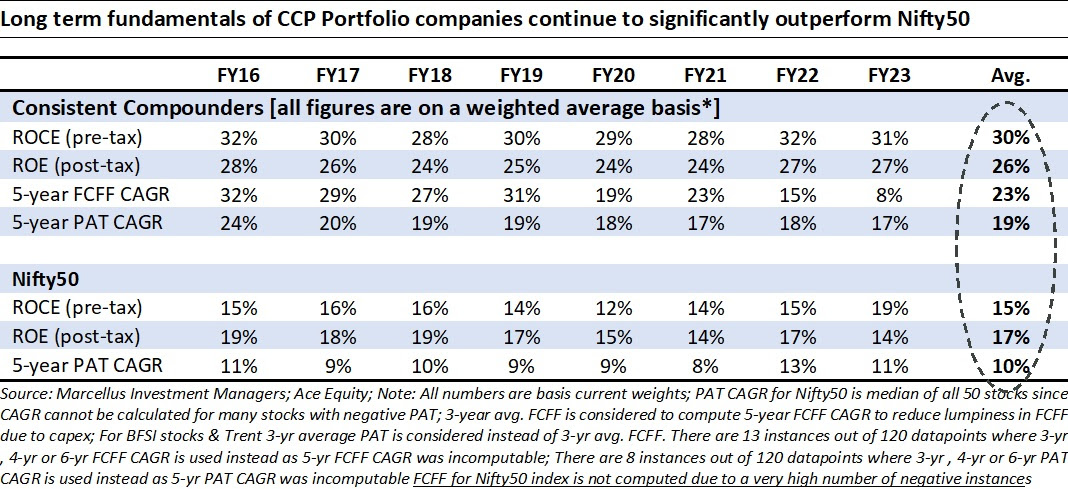

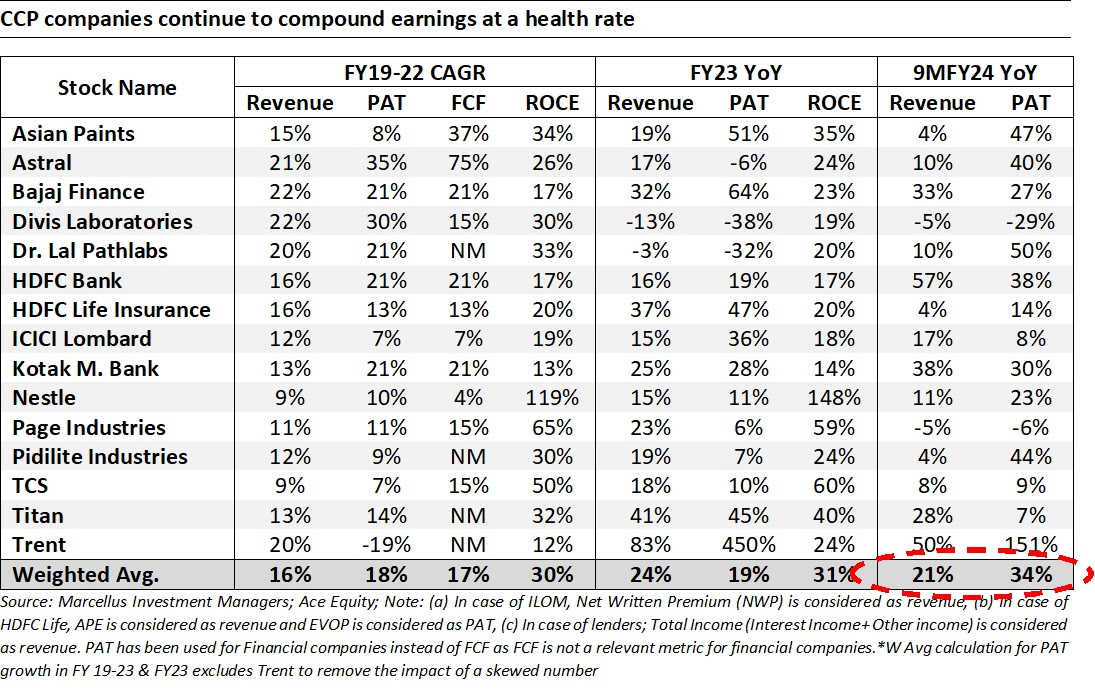

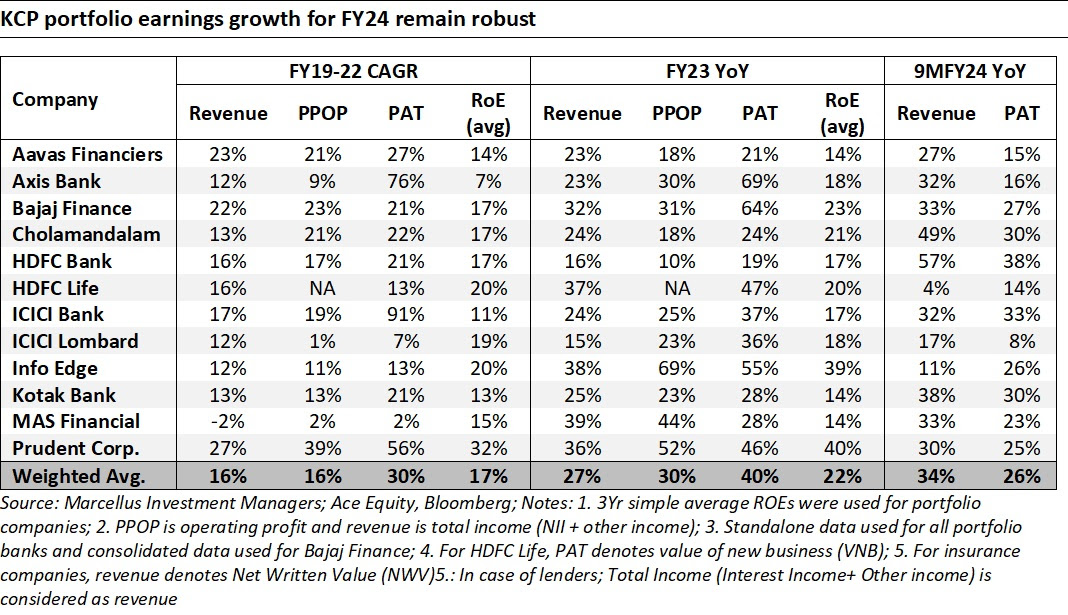

As can be seen in the tables below, these returns have come on the back of healthy earnings that our investee companies have churned out over the 9MFY24 period. In light of these healthy fundamentals of our portfolio companies and the prevailing market conditions, we’d urge our investors to remember the lessons from Berkshire Hathaway and how investing during the toughest phase was a much better strategy than believing the prevailing narratives around death of conservative, high quality fundamentals backed investing. Such phases are few and far between in a quality investor’s journey and more often than not form the foundation for outsized returns in the years to come.

We have added Narayana Hrudalaya (NH) to the portfolio. A summary of NH’s business model can be found in the RGP section of this note.

Kings of Capital Portfolio (KCP)

While the balance sheets of Indian banks are the cleanest they have been in a long time with decadal low NPAs and an all-time high Tier-1 ratio, most large banks are surprisingly growth constrained – this is due to the lack of deposit growth. With more than enough credit demand across most segments and high willingness to lend, banking sector loan growth at 15%+ has been outstripping the deposit growth of 12%-13%. In the past 6 months, the RBI has also ensured that there is no surplus liquidity in the banking system which has further constrained deposit growth. While there don’t seem to be any apparent asset quality risks given the healthy state of the economy and the asset quality cleanup of the previous decade, there are a few signs which usually precede an ‘unexpected’ credit event and point towards an accident waiting to happen:

- One of the lowest AAA credit spreads in a long time

- High amount of exuberance and willingness to lend even in relatively risky segments such as unsecured and microfinance lending

- Most conversations with lenders revolving around growth and margins rather than asset quality and balance sheet risks

- A raging bull market with high retail participation

- A host of IPOs, QIPs, promoter stake sales

However, we cannot predict the intensity or timing of an adverse event but rather keep stress testing our financial services investments for worst case outcomes and stay invested in relatively stronger balance sheets.

We have added City Union Bank to the portfolio in the past month. City Union Bank Ltd (CUB) is a South India based mid-sized bank with a legacy of over 100 years. A professionally managed bank with no identifiable promoters, City Union Bank caters to SMEs/MSMEs in the state of Tamil Nadu. The bank has a long history of careful underwriting and a never too aggressive loan growth strategy. The bank’s strength lies in having a loyal customer base which has been built over generations leading to a stable liability franchise as well as the ability to underwrite better. The bank has grown its loan book at a CAGR of 15% over FY11-21; though the growth has slowed down in the last 2 years (9% CAGR) owing to specific industry wide and company specific issues. Considering the banks’ stability and strong track record in the bank’s management team and its conservatism through multiple cycles in the past, we believe that this trend of consistent growth can continue in the future as well. Valuations are attractive at 1.1x FY25E P/B.

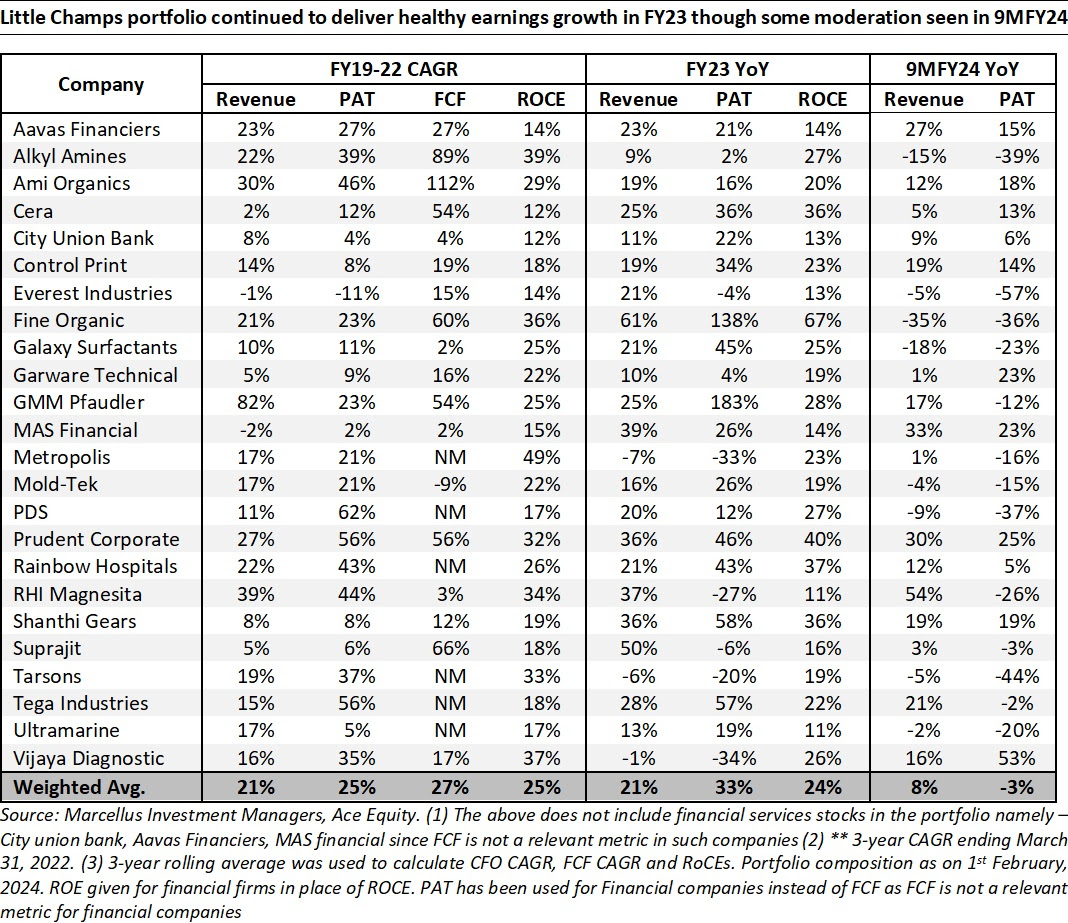

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP)

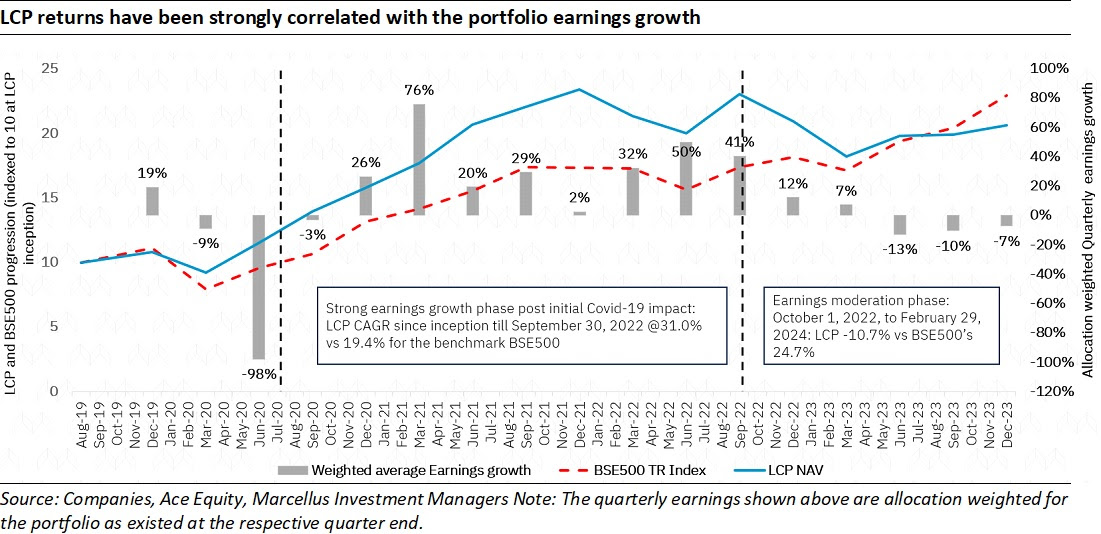

In our 14th Mar’24 webinar, we discussed how LCP returns have tracked the deceleration in portfolio earnings growth (see chart below). As we’ve discussed in our earlier communications, reason for aforementioned deceleration is related to higher exposure to the export oriented companies that’ve witnessed muted earnings due to unfavorable demand-supply dynamics impacting the volumes as well as the realization and profits.

That said, the management for most portfolio companies indicated a bottoming out of destocking cycle that has been impacting the earnings in the recent quarters. We are indeed seeing some corroboration of the same in the exports data (deceleration in volumes/realisation seems to be bottoming out in the last 2-3 months’ exports data). As we head into FY25, the portfolio earnings would also benefit from a favorable base of FY24. Lastly, any positive development (cut) on interest rates can be an icing on the cake in terms of significant improving the consumer sentiments for the stocks with global market exposure.

Further, we have also strengthened our portfolio through new stock additions. Since July 2023, we have added 10 new stocks to the Little Champs portfolio: (i) Rainbow Children’s Medicare; (ii) RHI Magnesita India; (iii) PDS; (iv) Cera Sanitaryware; (v) Tega Industries; (vi) Control Print; (vii) Everest industries; (viii) Ami Organics; (ix) Shanthi Gears; and (x) City Union Bank.

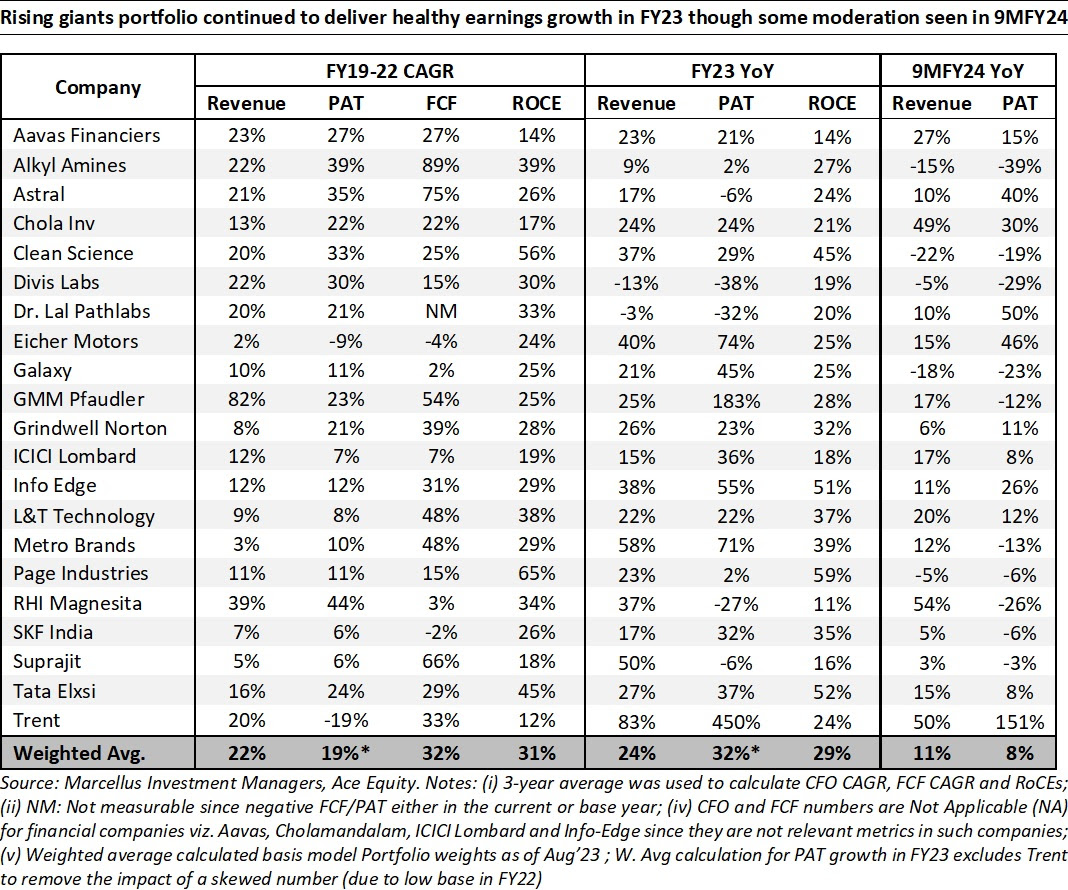

The above commentary also applies to RGP with chemicals and export names witnessing moderation in earnings. In this portfolio too, we see much better earnings growth trajectory in FY25.

We have recently added following new names to the portfolio:

- Tube Investments – Tube Investments (TI) has been making a transition from being largely an auto component maker to a multi-industry player, with investments in electric vehicles, medical equipment, pharma CDMO, industrial gears, industrial motors and power transformers and switchgears among others. The investment thesis rests on their capital allocation track record, as evidenced in the acquisition of CG Power, their execution strengths through manufacturing excellence, as evidenced in the profitability improvement in the core business and their risk mitigation abilities, as evident from the capital raised in the newer, relatively riskier EV segments.

- Narayana Hrudayala – Narayana (NH) runs a chain of hospitals across India and in Cayman Islands. The corporate hospital industry in India is undergoing structural tailwinds due to: a) increase in health insurance penetration; and b) increase in awareness and early detection of diseases related to oncology and cardiology. Amidst these tailwinds, NH has built a hospital network in Bangalore, Kolkata, Delhi, Mumbai and few other parts of the country. NH has also built a hospital in Cayman Islands, which has scaled up operations profitability over the last 5 years.

Moats of NH include:

- Multiple geographies delivering high ROCEs and growth – Bangalore, Kolkata and Cayman. Bulk of the future bedcount growth is likely to come from these three geographies.

- Relatively asset light and process efficiency orientation (medical device automation as well as opex automation through in-house software development). This helps maintain low ARPOBs compared to competition with healthy ROCEs.

- Capital allocation track record of NH: Over the last 8 years, NH has shown financial prudence when entering new locations. They have also shown discipline in shutting down units which were synergistically non-profitable.

NH has delivered a profit after tax CAGR of 64% over FY18-23 and 72% over FY20-23. Average ROCE over the last three years has been 29%.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/