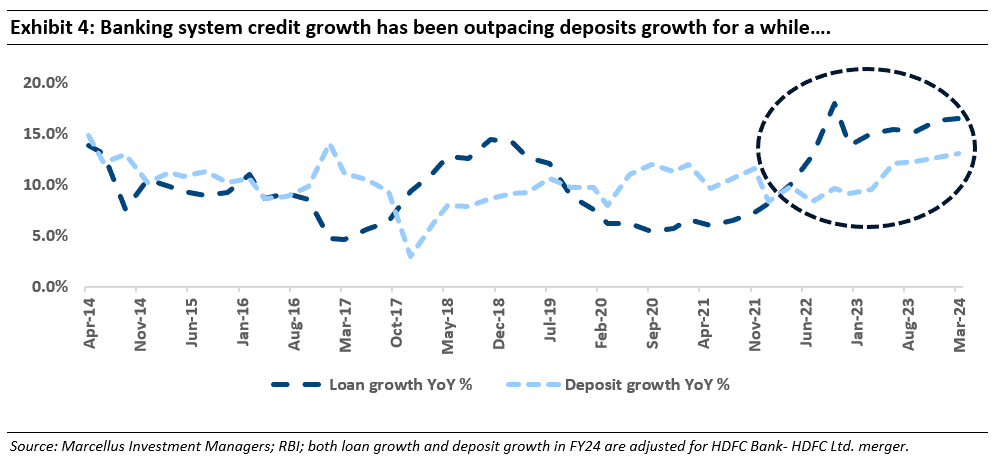

Given consistently strong credit demand and weak deposit growth, we are now staring at a tough funding environment with banking sector credit to deposit ratio at an all-time high of ~80%. This funding environment along with consistent regulatory action will separate the men from the boys in the upcoming quarters leading to divergent growth outcomes even within our portfolio. History also suggests that when liquidity is easily available, asset quality risks are masked only to emerge later when liquidity tightens. Whilst KCP banks should benefit due to their stronger deposit franchise, KCP NBFCs have strong parentage which should ensure access to funding. Meanwhile, the insurers in KCP can benefit by deploying their excess liquidity at attractive yields.

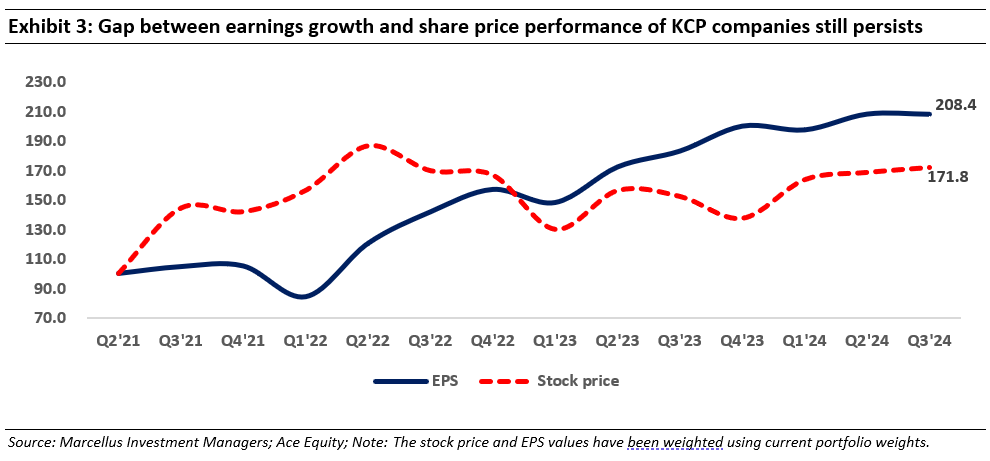

Divergence in share price growth vs. earnings growth has created a strong foundation for returns catch up

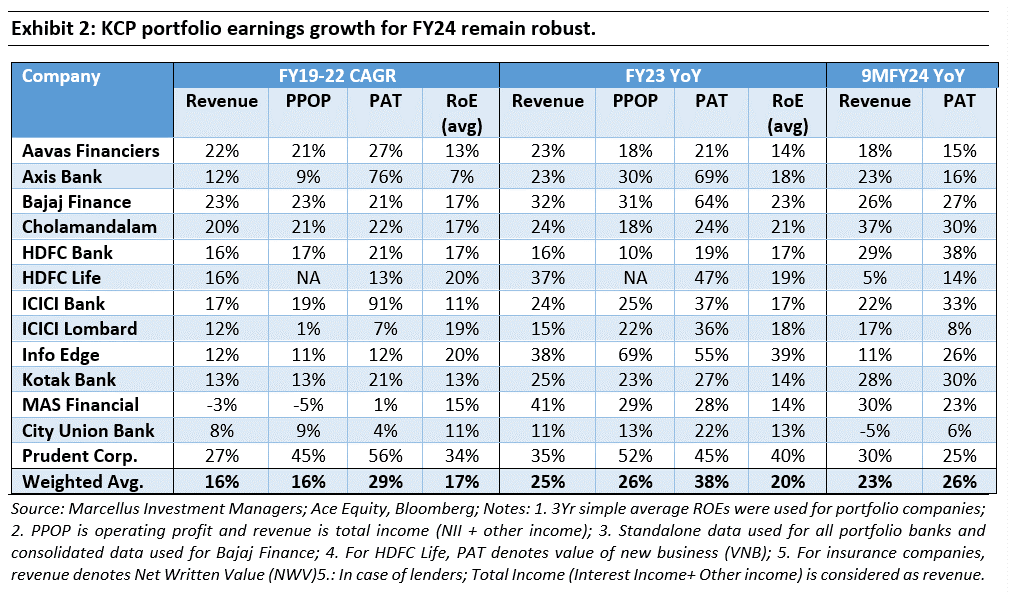

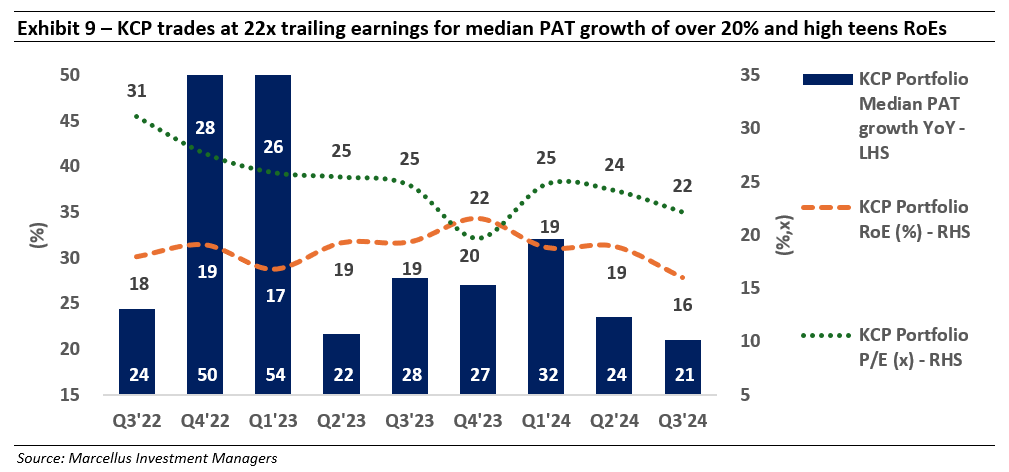

The Kings of Capital (KCP) portfolio earnings have continued to grow at a robust rate over 9MFY24 period (as seen in the table below) highlighting the strong fundamentals of our portfolio companies.

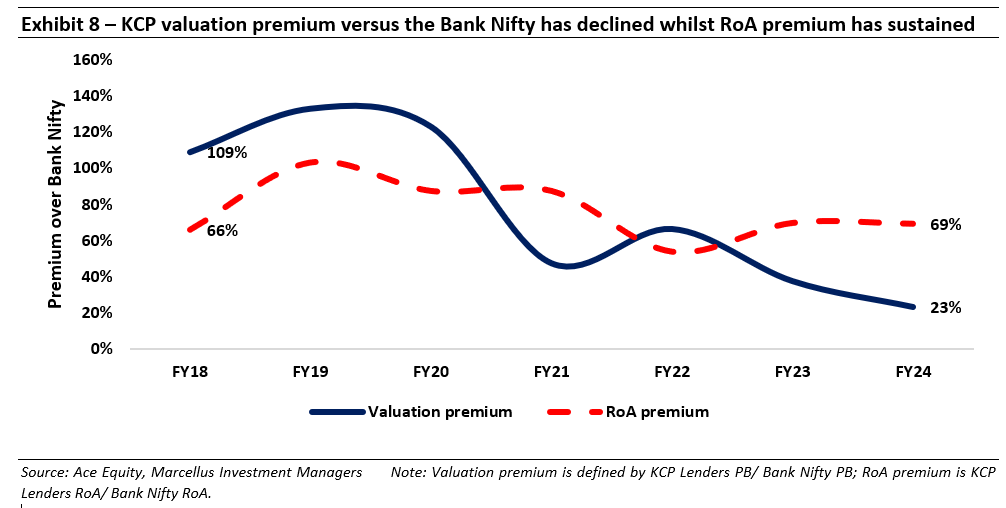

That being said, the post-Covid euphoria around listed Public Sector Undertakings in general and Public Sector Banks in particular, has led to high-quality lending franchises taking a back seat in the investors’ mind. As can be seen in the chart below, while the KCP’s (weighted average) portfolio earnings have compounded at a healthy pace over the last three years, the corresponding stock price performance has remained a laggard.

In last month’s Consistent Compounders newsletter, we’d highlighted how stock markets are prone to ‘narrative’ driven rallies every so often. During such phases, the tried and tested model of investing in high quality franchises takes a back seat as investors become enamoured with the sharp increase in share prices of erstwhile beaten down stocks which are then taken to dizzying heights – often to massive detriment of people entering late into the buying cycle.

However, it’s exactly such phases when quality investing is undergoing its toughest phase that form the foundation for outsized returns in the years ahead. For the Kings of Capital Portfolio, we are in the middle of such a phase (as the chart above clearly exhibits) and remain confident of a significant catch up of share prices with underlying earnings growth in the months to come.

Scant deposit growth and banking system liquidity deficit have been a key overhang for banking stocks

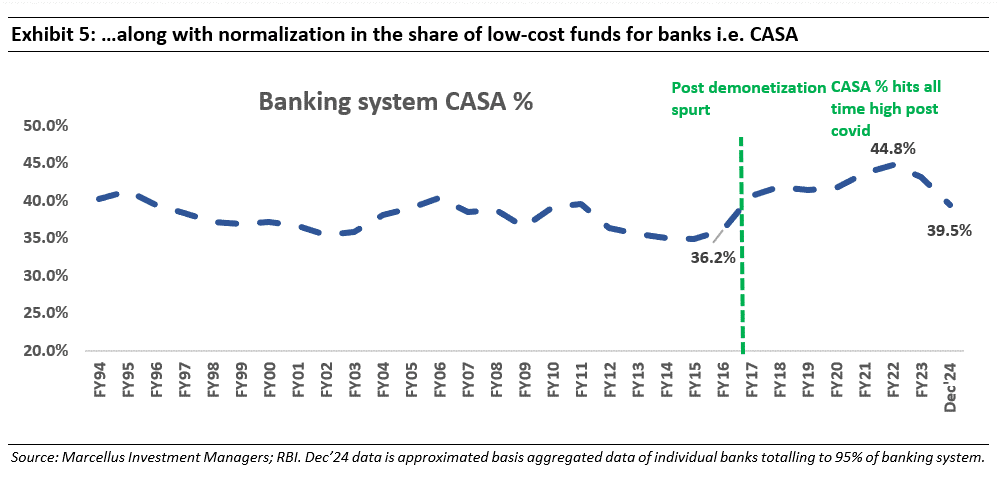

A key overhang for the banking stocks over the last few months has been the lack of deposit growth which can sustain mid to high teens growth in credit. The low-cost deposit (CASA) growth for the banking sector for 9MFY24 is zero – something that has been led by consumers and businesses moving their money to higher yielding avenues including fixed deposits. The lack of deposit growth has accentuated a 5-year high liquidity deficit in the banking system which has ranged between Rs. 1.5 trillion and Rs. 4 trillion since mid CY23.

What’s liquidity and why is it important for the banking system?

At its most basic level, a bank borrows money from depositors (which can be retail customer and/or corporates) and lends to debtors. It makes money by earning a spread i.e. difference in interest charged on debt given vs. interest owed to depositors on the loans it creates. Liquidity refers to the readily available cash that banks can use for their business needs -like creating loans. Under a surplus liquidity scenario, the banking system has enough money which can be used to make new loans allowing credit growth to continue uninterrupted. However, when the liquidity goes into a deficit, it can hamper the ability of banks to make new loans – thus posing a potential threat to credit growth in the system.

- High credit demand across almost all customer segments – housing finance, unsecured credit, vehicle finance, SME loans, parts of corporate lending are seeing a consistent surge in credit demand in India.

- Growth pressures on lending ecosystem – after a long time PSUs, NBFCs and all private banks have clean balance sheets and adequate tier-1 capital to accelerate loan growth. In such an environment every lender is under extreme growth pressure from all stakeholders to ramp loan growth leading to high incremental liquidity requirement.

- Regulatory inclination toward tempering growth in unsecured loans: As we had said in our Dec’23 newsletter, the RBI has grown increasingly wary of systemic risk posed by growth in unsecured consumer loans and to that end has likely ensured that there is no surplus liquidity in the banking system to make sure credit gets dearer with more checks in place to reduce the money flow towards unsecured credit.

- Relative to history, we are currently seeing very low AAA credit spreads i.e. the spread between yield on riskier bonds (such as BAA-rated bonds) and the yield on safer bonds (like AAA-rated bonds).

- We are seeing a great deal of exuberance and high willingness to lend even in relatively risky segments such as unsecured and microfinance lending.

- Most discussions that investors like us are having with lenders are revolving around growth and margins rather than asset quality and balance sheet risks.

- In the stockmarket, we are in the midst of a raging bull market with high retail participation.

- A host of IPOs, QIPs and promoter stake sales are taking place.

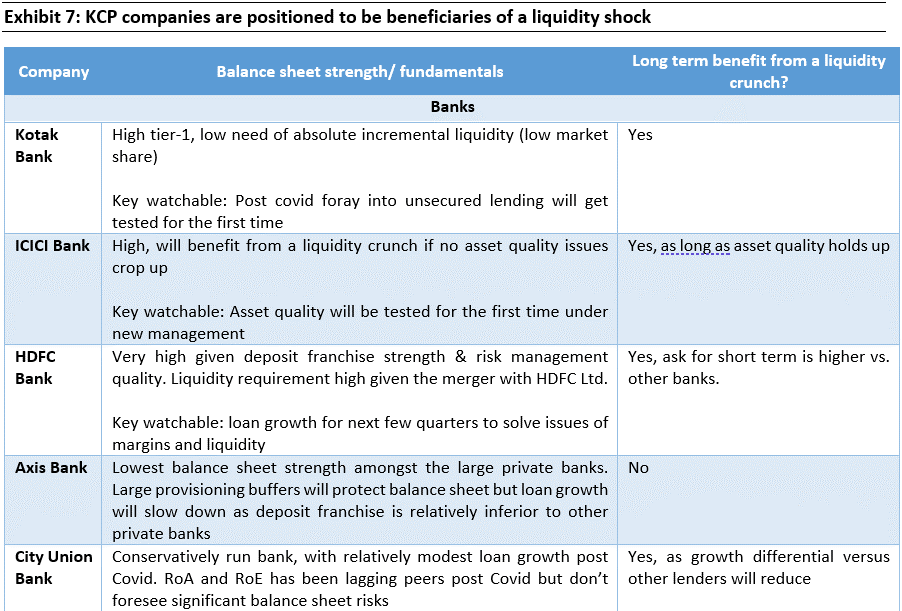

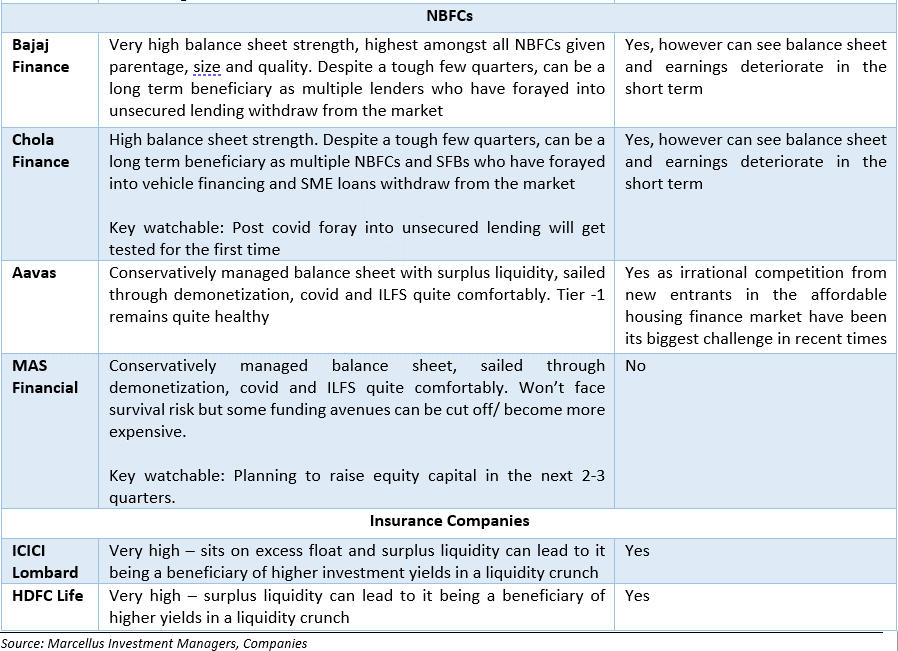

To that end, the table below provides our assessment of KCP portfolio companies’ vulnerability to a credit event or a liquidity crunch. For readers who don’t have the time to read the entire analysis, here is a quick summary:

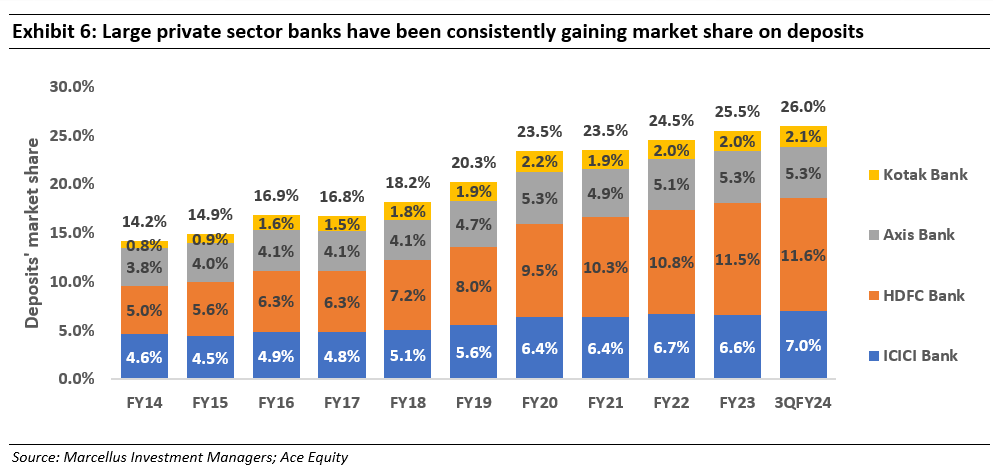

- Amongst banks, HDFC Bank is faced with a tough job with its high LDR ratio (loan to deposit ratio) and low LCR (liquidity coverage ratio), though its execution has been pretty solid in Q4. For other banks, key monitorables are continued ability to mobilize deposits at attractive rater in event of liquidity crunch.

- Amongst NBFCs, Bajaj Finance, Chola and Aavas have solid balance sheet strength and are likely to be long term beneficiaries as weaker lenders withdraw from the market if a liquidity/credit event were to play out.

- Both insurers in our portfolio – ICICI Lombard and HDFC Life – sit on surplus liquidity. Since their profitability is led by float income, they can be beneficiaries of attractive investment yields in a tight liquidity scenario.

Why HDFC Bank valuations factor in the pain from liquidity crunch?

HDFC Bank is amidst a transition as wholesale deposits of erstwhile HDFC Ltd. have been acquired and they have to over time be replaced by low-cost deposits, the quantum of replacement is not small to begin with. On top of that, the banking system has seen extremely tight liquidity which has resulted in lower than expected accretion in deposits for the system. In this scenario whilst HDFC Bank is still able to gain market share consistently on the deposits side, the absolute value of deposits it needs is higher. HDFC Bank’s execution prowess is well known, it showcased its muscle in Q4 by growing deposits at 7.5% QoQ.

Whilst earnings is likely to be soft in the short term, we believe: a) valuations (at 14x FY25 P/E or 2x P/B) already price in above risks; and b) management can take some counter actions to reduce earnings impact eg. taking price hikes in the loan portfolio, a sell down of existing low yielding portfolios, improving portfolio mix in favor of high yielding products and improving cross-sell capabilities.

Portfolio earnings growth, RoE and valuations have laid foundation for future outsized return

On the back of recent corrections seen in the relatively higher quality lenders, our top three holdings – Bajaj Finance, HDFC Bank and Kotak Mahindra Bank, that constitute almost 44% of the portfolio currently trade at the lowest valuations seen over the past decade. As we’d highlighted at the start of this newsletter, it’s quite rare to find such high quality franchises that have created immense wealth for shareholders at such discounted valuations.

Addition to the portfolio

We have added City Union Bank to the portfolio in the past couple of months. Brief investment rationale is below:

City Union Bank Ltd (CUB) is a South India based mid-sized bank with a track record of over 100 years. A professionally managed bank with no identifiable promoters, City Union Bank caters to SMEs/MSMEs in the state of Tamil Nadu. The bank has a long history of careful underwriting and a conservative loan growth strategy. The bank’s strength lies in having a loyal customer base which has been built over generations leading to a stable liability franchise as well as the ability to underwrite better. The bank has grown its loan book at a CAGR of 15% over FY11-21 although the growth has slowed down in the last 2 years (9% CAGR) owing to specific industry wide and company specific issues. Considering the banks’ stability and strong track record in the bank’s management team and its conservatism through multiple cycles in the past, we believe that this trend of consistent growth can continue in the future as well. Valuations are attractive at 1.1x FY25E P/B.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/blog/

Copyright © 2023 Marcellus Investment Managers Pvt Ltd, All rights reserved