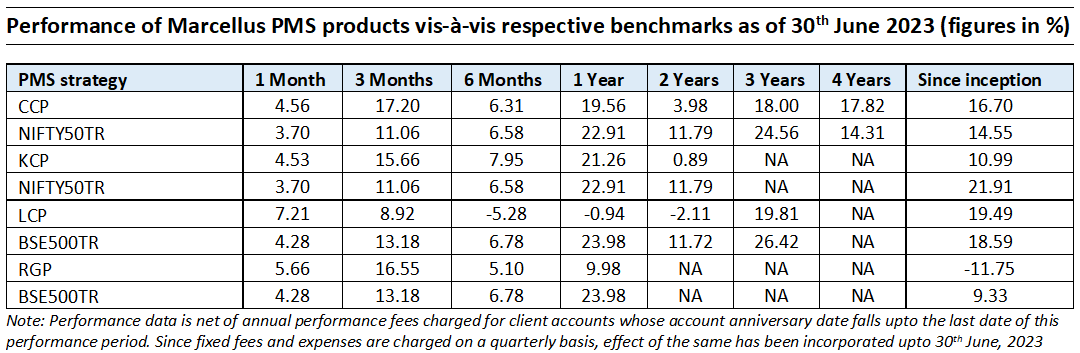

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/

Consistent Compounders Portfolio (CCP)

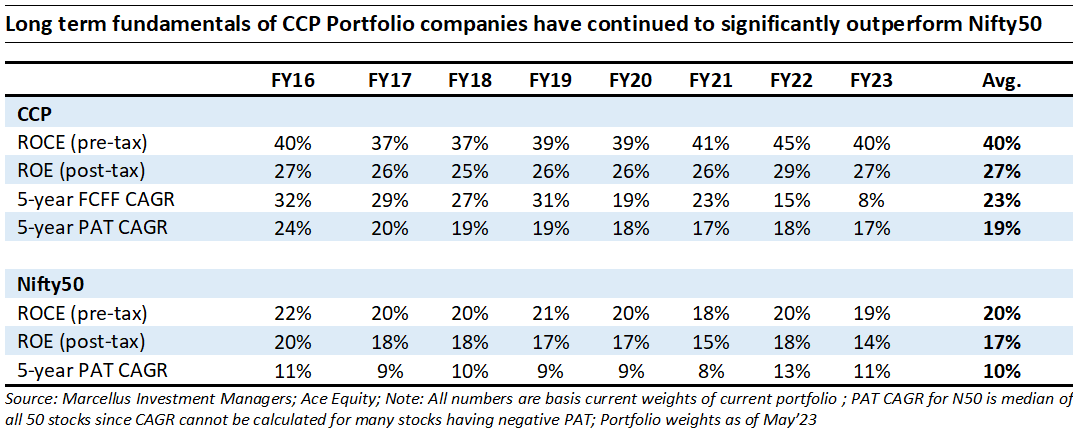

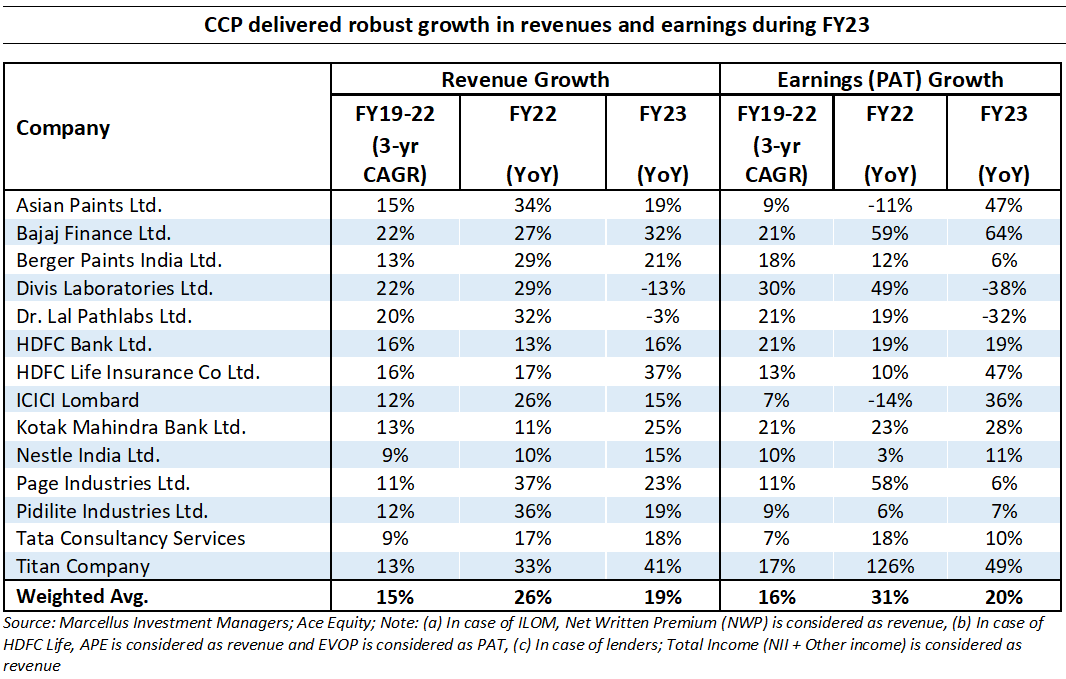

Fundamentals of CCP companies continue to deliver healthy progress, as reflected in the portfolio’s weighted average PAT (profits after tax) growth of 20% YoY in FY23, backed by a revenue growth of 19% YoY in FY23. First few results / quarterly updates for 1QFY24 received have been exceptionally strong across the portfolio – e.g. Titan has reported 20% YoY revenue growth for 1QFY24, Bajaj Finance has reported 32% YoY growth in its loan book, HDFC Bank has reported 16% YoY loan growth (albeit deposit growth was weak in 1QFY24) and TCS has reported 17% YoY growth in PAT and 24% YoY growth in deal wins. Such strong fundamental performance of our portfolio companies is representative of market share gains from competitors and successful execution of new business growth initiatives / tech investments / opportunistic capital allocation decisions implemented over the last three years of volatility in the external environment.

Share price performance of most stocks in the CCP portfolio was sluggish during FY23 due to a variety of temporary factors. As a result, the gap between fundamentals of our portfolio companies and their share prices widened to over 35% (refer to our Mar’23 newsletter). Over the last 3 months, we have started witnessing a reversal of this gap as share prices catchup with the underlying fundamentals of our portfolio companies.

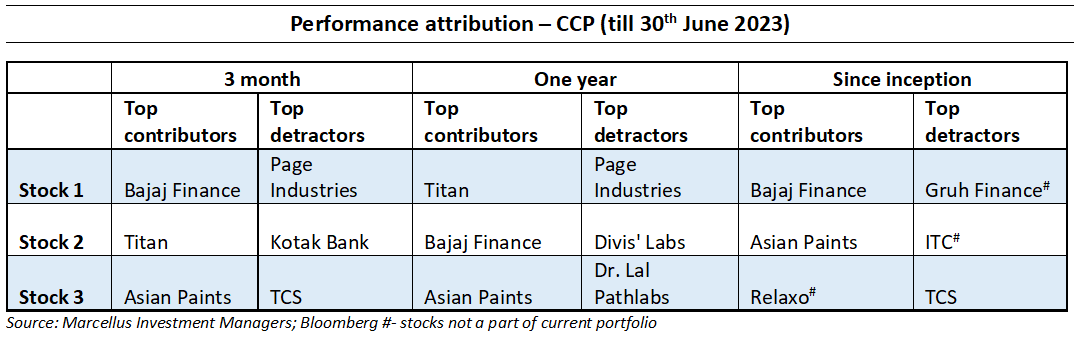

The top three contributors to the 19.56% performance of CCP over the last 12 months (1st July 2022 to 30th June 2023) were Titan, Bajaj Finance and Asian Paints. The biggest detractors over the last 12 months in the portfolio were Page Industries, Divis Labs and Dr. Lal Pathlabs. Reported growth in revenues and profits of these three companies over the last couple of quarters has been weaker than our expected long term rate of growth, due to short term headwinds: a) For Page Industries, high base of athleisure and inventory de-stocking due to auto-replenishment system’s implementation; b) For Divis Labs and Dr. Lal – high base of Covid19 related sales from Molnupiravir and Covid related diagnostic testing. Over the last 12-15 months, after having conducting our research diligence, we have tried to benefit from the dislocation in share prices of some of these firms through rebalancing activity in the portfolio.

Since inception of the portfolio on 1st December 2018, the top three contributors to CCP’s 16.7% CAGR in performance have been Asian Paints (current holding), Bajaj Finance (current holding) and Relaxo Footwears (exited from the portfolio in Sept 2021) – see attribution charts below.

Kings of Capital Portfolio (KCP)

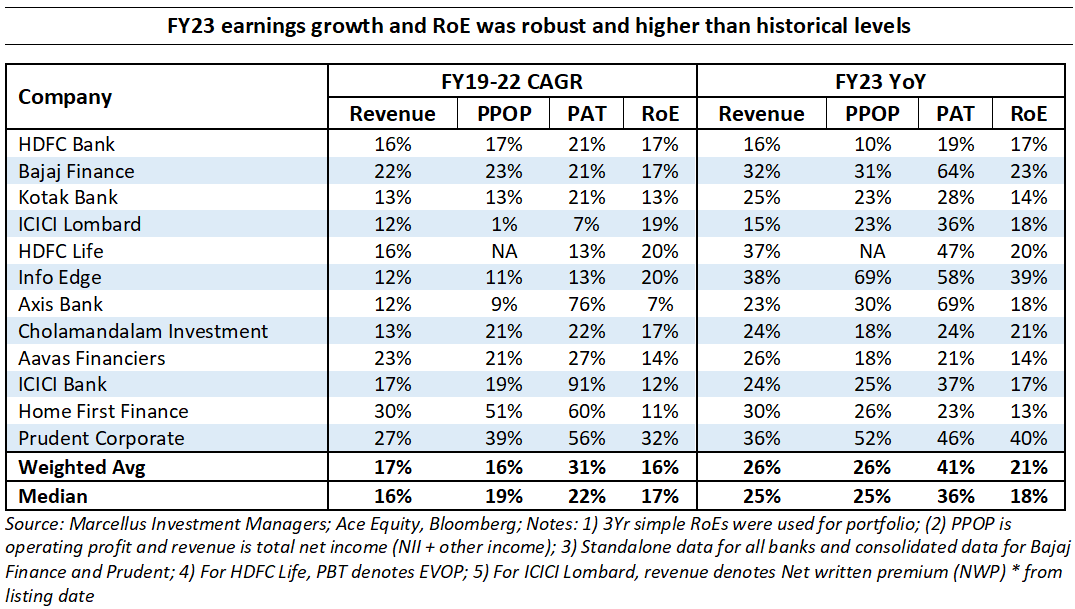

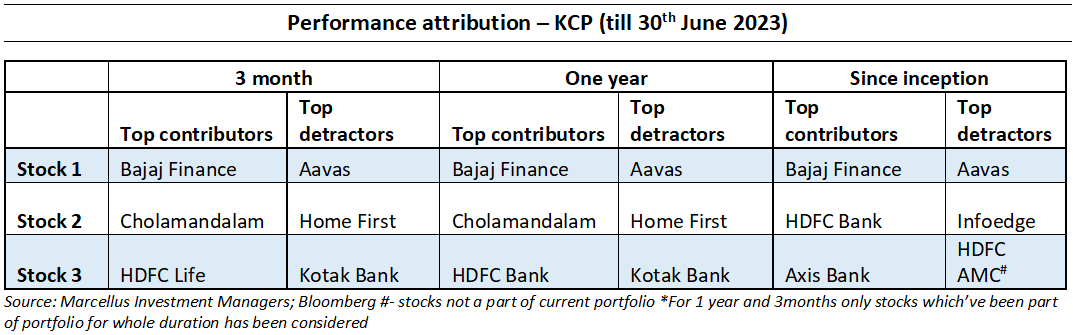

For the Kings of Capital portfolio, FY23 was marked by robust loan growth, record high net interest margins and low NPAs. All companies in our portfolio gained market share during the year and reported solid RoAs and RoEs. We believe FY24 will be characterised by headwinds on margins and deposit growth for the banking sector and that is when high quality lenders in our portfolio will differentiate themselves further vs the rest of the industry. Reported monthly numbers of our insurance companies – ICICI Lombard and HDFC Life point towards healthy growth and market share gains during Q1FY24. There have been no additions/ deletions to the portfolio in YTDFY24.

Further, the largest drags on portfolio performance during the past year have been Aavas Financiers, Home First Finance and Kotak Bank. The FY23PAT growth of these laggards has been 21%, 23% and 28% respectively – this exactly shows the disconnect between fundamentals and share prices and how stock prices of high growth, quality stocks have suffered in a rapidly rising rate environment. Despite the ~15% run up in KCP over the past three months, given the solid fundamentals and the wide disconnect between stock prices and earnings growth, we believe stock prices of Kings of Capital stocks still have significant upside potential.

Little Champs portfolio (LCP)

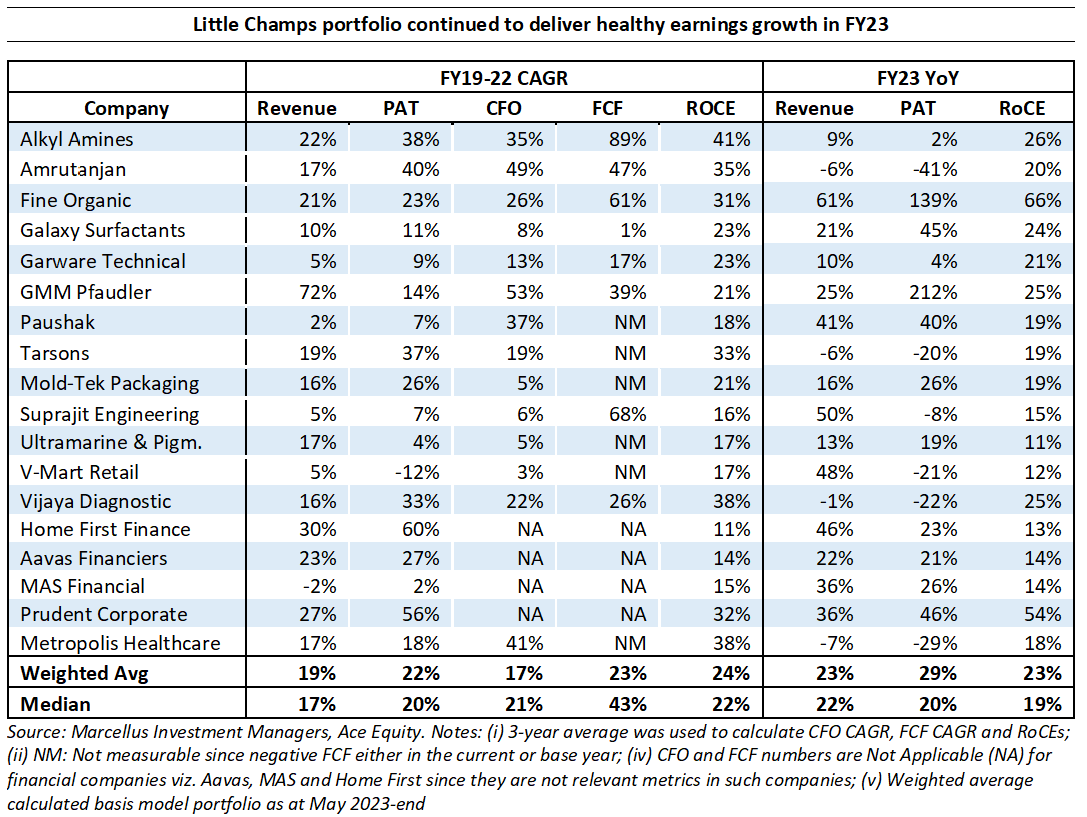

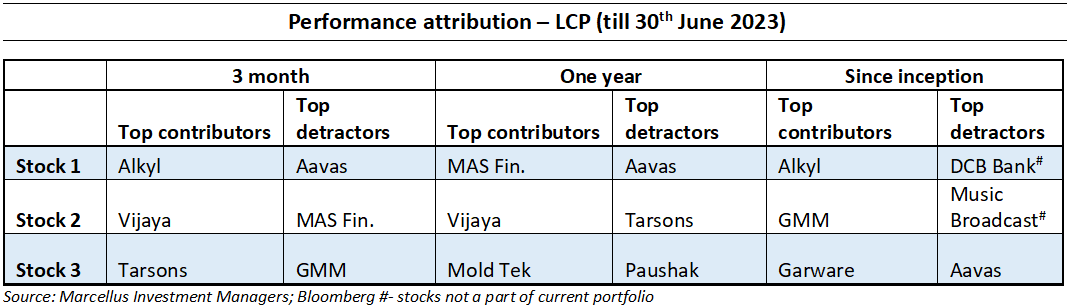

Similar to its historical track record of generating healthy earnings growth combined with 20%+ return ratios, the Little Champs portfolio delivered YoY allocation weighted average PAT growth of 29% (median 20%) alongwith weighted average RoCE of 23% (median 19%) for FY23.

Heading into FY24, relatively clean base (devoid of Covid-19 related revenues), stabilization in input prices and more importantly capital allocation initiatives of the portfolio companies (annual average reinvestments for the portfolio companies in FY22 and FY23 at 2.4x the annual rate of reinvestments over FY19-21) are likely to provide earnings support. Some sectors like chemicals continue to witness challenging times driven by global demand weakness and clearance of excess inventory built during Covid-19 years – however beyond the near- term headwinds we don’t see any structural concerns in the industry or the portfolio companies.

The largest drags on portfolio performance during the past year have been (i) Aavas; (ii) Tarsons; (iii) Paushak (iv) V-Mart; and (v) Amrutanjan. Of these Aavas and Paushak have witnessed strong growth in earnings in FY23 whereas Tarsons’ and Amrutanjan’s FY23 earnings were impacted due to high YoY base (which included Covid-19 related revenues). V-Mart faced challenging times in FY23 due to weak demand as its core customers’ spending power were curtailed by rising inflation, while high fixed costs structure in retail business and investments in Lime Road business further impacted the Company’s bottom-line. We expect better times for V-Mart in FY24.

Rising Giants portfolio (RGP)

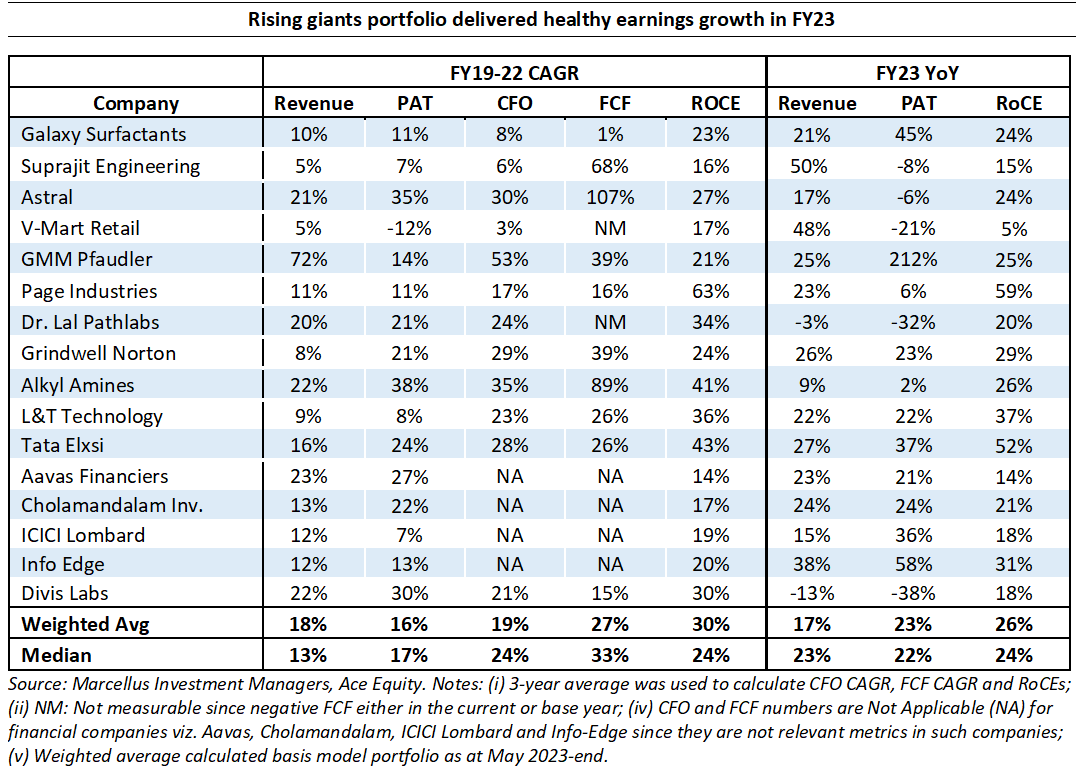

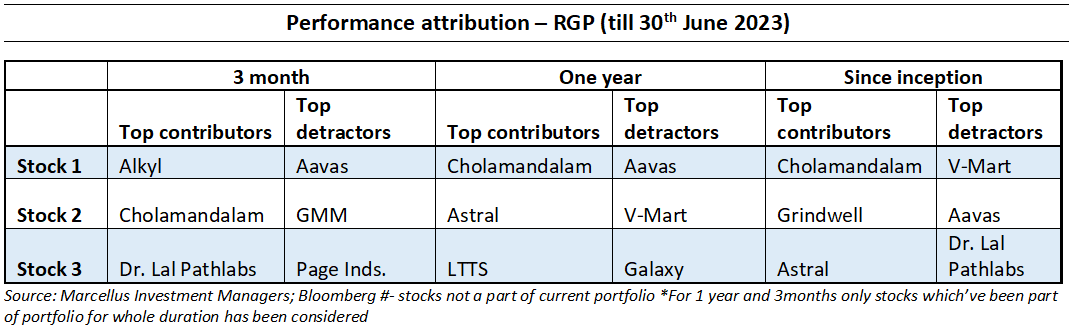

The Rising Giants portfolio, too, also witnessed a healthy earnings growth in FY23 with PAT up 23% and allocation weighted average RoCE of 26% (median 24%).

However, heading into FY24, relatively clean base (devoid of Covid-19 related revenues in base), stabilization in input prices and more importantly capital allocation initiatives of the portfolio companies (annual average reinvestments for the portfolio companies in FY22 and FY23 at 2.9x the annual rate of reinvestments over FY19-21) are likely to help earnings growth in FY24.

The biggest detractors since inception in the Rising Giants portfolio were (i) V-Mart; (ii) Aavas; and (iii) Dr Lal Pathlabs. V-Mart faced challenging times in FY23 due to weak demand as its core customers’ spending power were curtailed by rising inflation, while high fixed costs structure in retail business and investments in Lime Road business further impacted the Company’s bottom-line. We expect better times for V-Mart in FY24. Aavas posted healthy financial performance in FY23. On the other hand, Dr Lal Pathlabs’ FY23 performance was impacted due to high base of FY22 (which impacted Covid-19 related testing revenues).

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products/services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.