Periodic rebalancing or re-alignment of the MeritorQ portfolio is as necessary as watering a plant periodically to help it grow – do it too often and the plant may rot; on the other hand, never do it and the plant dies. In MeritorQ we identify quality yet relatively undervalued companies (our newsletters Forensic Accounting Using Quant Methods Boosts Returns and The Value of Free Cash Flows explain at length about this). Rebalancing MeritorQ allows investors to benefit from: (1) Mean reversion in Price to Free Cash Flow multiples, (2) Invest in the next set of undervalued stocks; and (3) Reduce concentration risk. Thus, periodic rebalancing, as we like to call this refresh, not only helps in improving performance but also functions as a risk-mitigation tool.

What is rebalancing and why do we need it?

Rebalancing can be understood as a realignment of the portfolio to restore balance. For instance, as per the seasons and weather conditions, you need to alter the kinds of food that you would consume; during summer you would probably go heavy on roughage and water and maybe cut down on fats and carbohydrates, whereas during winters, you may wish to consume more fats and carbohydrates.

Likewise, rebalancing can be thought of as a periodic portfolio refresh to keep an investment strategy aligned with overall investment objectives. This alignment could take different forms, for example, investors might choose to rebalance to reflect new information on prices or fundamentals of portfolio companies, among others. In MeritorQ, rebalancing involves refreshing the portfolio as of the first trading date of April and October basis the investment checklist, as discussed in our January newsletter, “MeritorQ: The Power of Checklists”. Because rebalancing necessarily involves portfolio trades, the cost of rebalancing needs to be compared with the intended benefits.

How does rebalancing help investors?

Rebalancing of portfolios is more common than one would presume – intuitively investors do load up on securities which may have witnessed a sharp fall (for example the Covid induced crash in March 2020). Yet higher turnover is perceived as a one-way street with higher churn equaling higher costs for the investor. Not rebalancing during the investment horizon creates the risk of the investment strategy drifting too far from its investment objectives and not reflecting new information.

Rebalancing in this context is therefore like that pungent spice in food – put too much of it and it can ruin the taste (like the costs from higher portfolio turnover), and if not added at all, the food may taste bland (akin to the disappointment from lower returns).

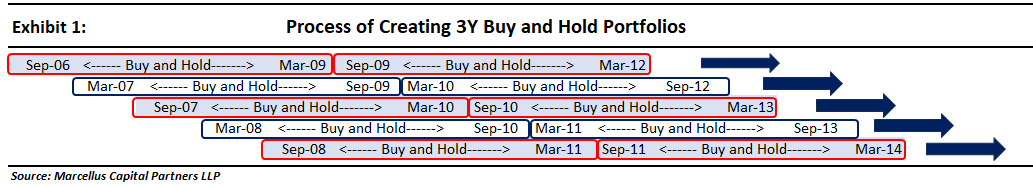

Regularly investing in quality undervalued companies’ basis their free cashflows

To understand why frequently rebalancing the portfolio is beneficial, let’s look at the counter case – what if one buys and holds a portfolio (created based on MeritorQ’s construction rules) for a certain period of time without touching the portfolio at all in between. Let’s say, you invest in a 3-year duration portfolio, hold it for the entire duration and then liquidate to invest in the next 3-year portfolio. We created all possible combinations of these 3-year buy and hold portfolios, with different starting dates, between September-2006 to September-2022. This is represented visually in the following exhibit.

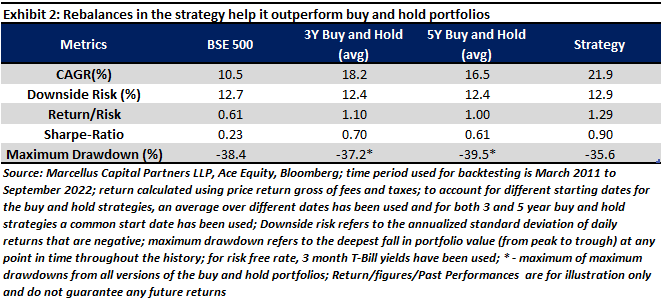

Now, let’s say, you also do this for a 5-year holding period – i.e., you buy and hold a portfolio for 5 years using the same process as above. Assuming a common starting point for these strategies and taking an average of the different time periods when the unique portfolios begin and run, we can clearly see (in the exhibit2) that a strategy like MeritorQ (which is rebalanced semi-annually) outperforms the 3-year and 5-year ‘buy and hold’ portfolios, not only on absolute returns basis but also on risk adjusted returns basis.

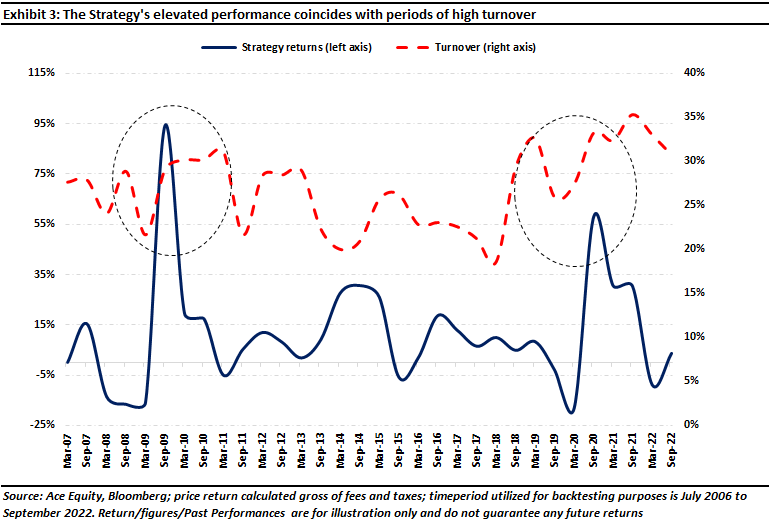

Since we select and allocate more to relatively undervalued companies in MeritorQ, the returns of the strategy are partly driven by investing from the reversion to mean of out of favor or undervalued stocks (measured on a relative basis using Price to Free Cash Flows). As explained in our November 2022 newsletter, “MeritorQ: The Moneyball of Quality Investing”, the selection and position sizing steps add roughly 3.6% points to overall back tested performance. Our screening steps – where we look for companies with clean accounts, consistent profitability, and low leverage – ensure that undervaluation is more due to transitory factors like a recent loss of market share, negative sentiment around the stock or sector etc. than due to deteriorating fundamentals. For MeritorQ, therefore, the extent and speed of mean reversion in price to free cash flow across leading up to each rebalance, partly drives both the strategy returns as well as the turnover.

Turnover in MeritorQ comes from both:

- Overvalued stocks being replaced by more undervalued ones, and

- From having their allocation reduced depending on the extent and speed of mean reversion.

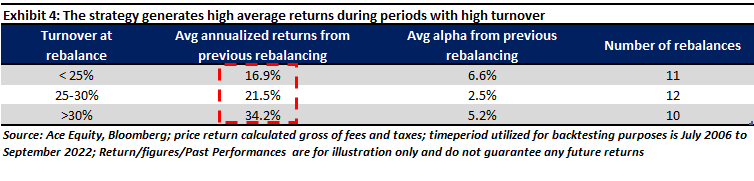

Exhibits 3 and 4 show this in more detail by comparing the returns between the semi-annual rebalancing dates and the one-way turnover on these dates in MeritorQ. Exhibit 3 shows that higher turnover around major turning points like the Global financial crisis or Covid crisis, are generally followed by higher alpha. Exhibit 4 emphasizes that historically in MeritorQ increased turnover has generally been accompanied by better returns. Key takeaways for investors are that while we have observed historical one-way turnover for the strategy is around 55%, turnover could be higher than this number during certain years. This higher turnover is, however, justified because, as exhibit 4 shows, higher portfolio turnover implies a higher probability of strong strategy returns.

|