Consistent Compounders Portfolio (CCP)

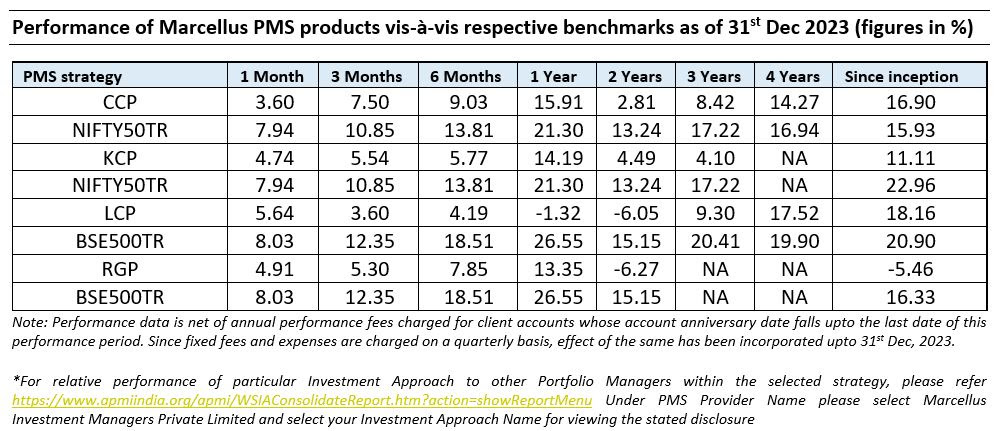

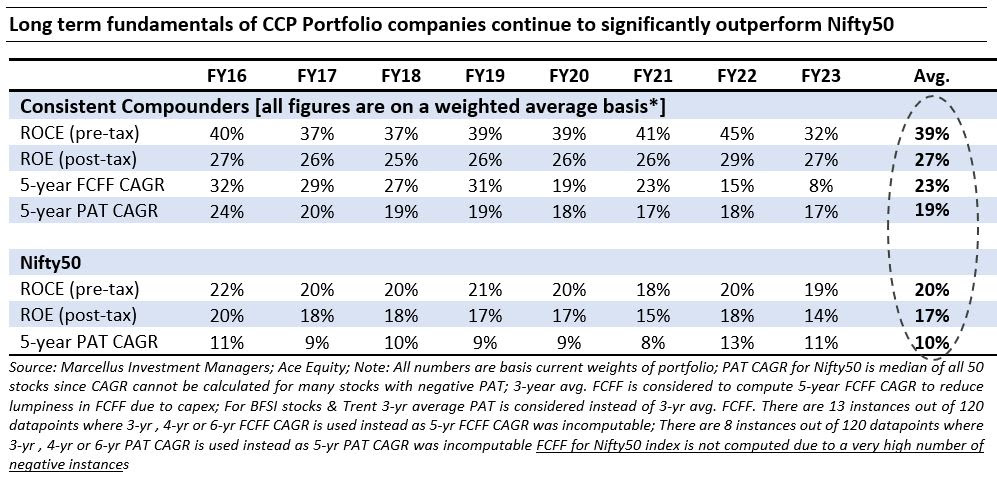

Calendar year 2023 ended with Marcellus’ CCP portfolio generating 16% returns with 6% underperformance against Nifty50 TRI, supported by a recovery in performance from April 2023 onwards (1st Apr 2023 to 31st Dec 2023 performance was 28%, marginally better than Nifty50 TRI). The top-5 stocks in Nifty were Tata Motors, Bajaj Auto, NTPC, L&T and Coal India, all generating 67%-101% share price performance during the year. From a quality, consistency and longevity perspective, we believe our CCP portfolio companies are likely to generate stronger fundamentals and share price performance over the long term compared to the top performers of Nifty50, and hence we see the underperformance of 2024 as being temporary with a strong likelihood of reversal in future.

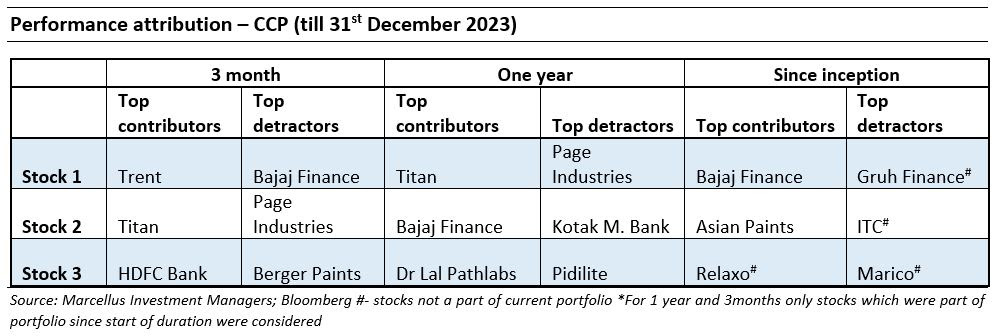

The top contributors to the performance of CCP for CY 2023 were Titan, Trent, Bajaj Finance, Dr. Lal Pathlabs, TCS and Nestle. There is a broader slowdown in consumption across the country, particularly for middle-class and lower households and hence smaller ticket items. Amidst such macro head-winds, Titan, Trent and Nestle in our portfolio have avoided a moderation in the rate of growth of their revenues and profits by gaining significant market share backed by several company specific initiatives. Dr. Lal Pathlabs, in FY24 has witnessed benefits of moderation in competitive intensity from several of the ‘new-age-competitors’ backed by private equity and venture capital. Bajaj Finance continues to demonstrate success in aggressive new customer addition, loan growth and fee income growth when several unsecured lenders are likely to witness headwinds from increased regulatory scrutiny and high competitive intensity. TCS continues to lead the pack in IT services through vendor consolidation and moderation in fears of an adverse economic environment in the US.

The key detractors in CY2023 were Page Industries, Kotak Mahindra Bank and Pidilite. Page Industries saw demand growth moderation amidst a weak macro environment for small ticket consumption and temporary adverse impact of: a) auto-replenishment system related de-stock in their channel during the March 2023 and June 2023 quarters, and b) high-base-effect of athleisure sales as work-from-home significantly reduced during the year. Kotak saw a change in the management team during the year as Uday Kotak stepped down from the role of MD and CEO.

Over the past five years, we have seen earnings compounding (measured by 1 year forward EPS expectation) being significantly ahead of share price compounding for all the three CCP lenders and the two CCP insurance companies. This presents a significant opportunity for catch-up of share prices with their fundamentals in the months and year to come. Amongst the non-financial sector companies, several companies (e.g. Titan, Trent and Astral) have significantly strengthened their business growth prospects over the last 5 years by transitioning from say a single product or retail format players (Tanishq for Titan, Westside for Trent, and Pipes for Astral) to a wider platform of products (Watches and Caratlane for Titan, Zudio and StarBazaar for Trent and Adhesives for Astral). Whilst the market had appreciated some of this transition in the first three out of the last five years, the share prices of these companies have also lagged significantly behind their fundamentals over the last two years – creating opportunities for outsized gains in the years to come. Finally, for companies such as Divis Labs, Dr. Lal Pathlabs and Page Industries, the wake effect of the Covid (i.e. reversal of some of the tailwinds that these companies witnessed during Covid) is in all likelihood, behind us. From 3QFY24 onwards, for all these three companies, we see more normal like to like growth rates and hence recovery in fundamentals to be visible and likely to get reflected in their share prices. Just a recap on recent fundamental performance – companies in our Consistent Compounders Portfolio generated median PAT growth of 24% YoY in 2QFY24 and 27% YoY in 1HFY24.

Last but not the least, we have increased our agility of portfolio construction tools over the last two years, the benefits of which are already visible in the strong positive contribution of position sizing changes to the performance of our portfolio over this period. We strive to keep learning from our mistakes and grab greater opportunities to enhance the performance of CCP in future. We expect the recovery in our portfolio performance of the last nine months to continue in 2024, and we wish all our clients a very happy new year.

Kings of Capital Portfolio (KCP)

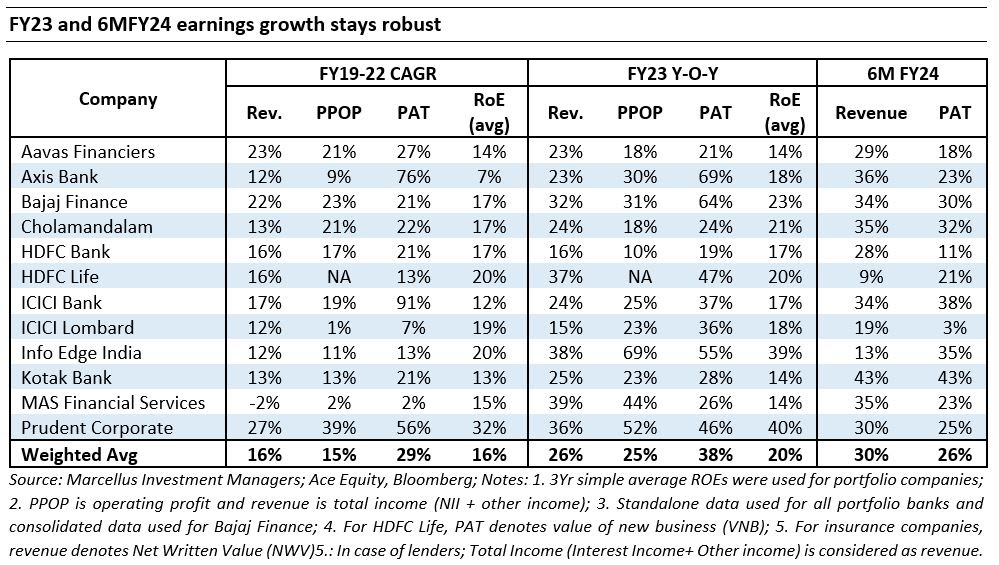

Large private banks have continued to underperform the broader indices during YTDFY24 and is now the worst performing sub sector in the broader market during this financial year. This is despite healthy growth and no concerns on asset quality. As a result, well run large private banks such as HDFC Bank and Kotak Bank continue to trade at valuations which are near 10-year lows while the broader markets in general and small and mid caps in specific have continued to re-rate upwards. We believe the market has the following broad concerns:

- Lack of differentiation on credit underwriting: The previous credit cycle was long (it lasted ~15 years from 2007-21) and by the end of the cycle HDFC Bank and Kotak Bank stood out from the rest of the banking sector in terms of governance and balance sheet strength. Post this long and painful 15 year period, most banks have cleaned up their books, are well capitalised and are now growing their balance sheets after a long period of time. Given the lack of any visible balance sheet stress and market’s belief that ‘the mistakes of the previous cycle won’t be repeated’ because of various structural changes that India has seen (introduction of IBC, changed behaviour of PSUs, better availability of data, a more proactive RBI etc.) there is no clear reason why investors should pay a premium valuation for HDFC/ Kotak who have been winners of the past cycle but don’t seem to enjoy any visible differentiation currently.

- Reversion of large valuation gap: What the previous cycle resulted in was a large valuation gap between HDFC/ Kotak and the rest of the banks. For instance, even after 3 years of massive outperformance by PSU banks over private banks, PSU banks still trade at a 50%+ discount to large private banks. What we are seeing is mean reversion of the previous cycle as share prices of PSU banks (ex-SBI) have now reached back to the pre asset quality review (AQR) era of 2014-15.

- Concerns on deposit growth and margins amidst the changing landscape: Deposit growth for the banking sector has lagged loan growth over the past 18 months. As loan growth is expected to remain strong, there are concerns on what happens to NIMs and how will large banks be able to fund their balance sheet in an environment of low deposit growth.

We believe the fundamentals of HDFC Bank and Kotak Bank have only improved vs. their own history as RoAs, growth and market share gains have continued/ improved but the gap versus the rest of their banking peers has reduced on most metrics primarily because of improvement in asset quality for the sector. As seen in the factors listed above, none of them pertain to issues specific to these banks but are more macro in nature. We therefore believe this is a good time to buy these high quality banks as opportunities to buy great companies at great valuations are far and few in between. Buying into such opportunities have historically rewarded investors handsomely in the long term (for eg. IT services in 2017, FMCG in 2007).

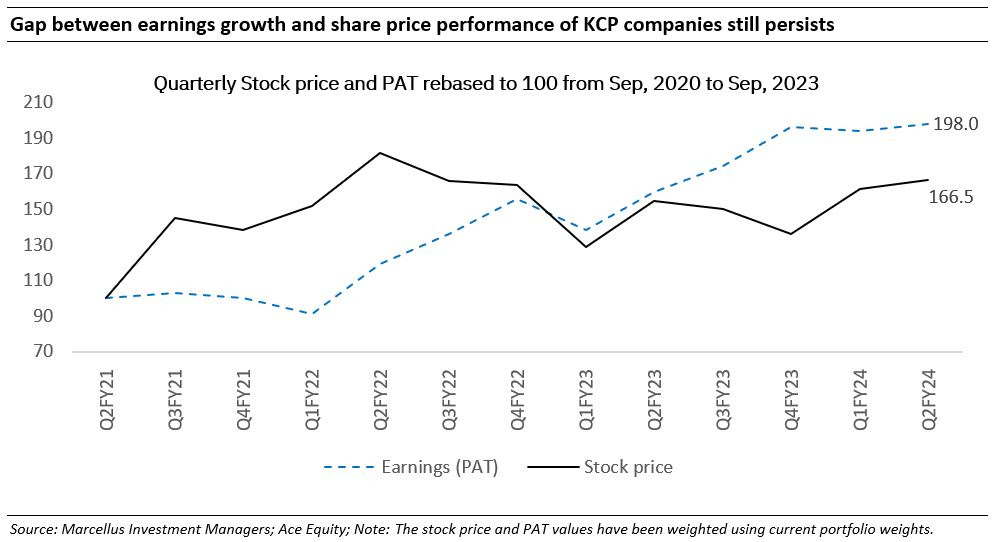

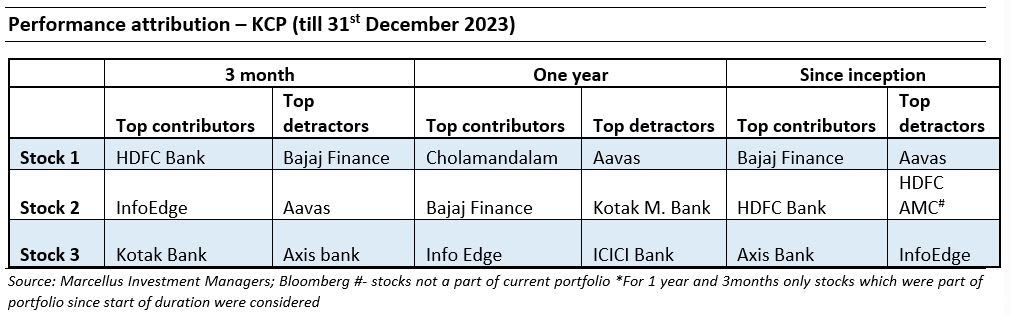

While FY23 was a year of significant share price dislocation as multiple stocks which reported 20%+ earnings growth saw a 10%-30% correction in their stock price, YTDFY24 is seeing a reversal of this trend as stock prices are catching up with the strong fundamentals. However, we believe KCP stocks have still quite a bit of catching up to do especially for the large private banks as discussed above.

We have made the following change to the Kings of Capital portfolio:

Replaced Home First Finance with MAS Financial Services:

MAS Financial is a Gujarat headquartered NBFC largely present in Gujarat and Maharashtra. 40-50% of the loan book consists of loans to NBFCs. MAS lends to retail NBFCs and understands the needs of such NBFCs better than most other lenders. It is able to offer tailor made solutions and a quicker turnaround time to such NBFCs whose only other source of funding is PSU banks. Along with this, company offers retail products like CV finance, 2Ws and salaried personal loans. The promoters have managed to retain a stake of ~74% which is remarkable in a listed NBFC which has scaled to an AUM of Rs. 10,000 cr and has paid out 18-20% of its profits as dividends, this has been achieved because of the company’s ability to consistently generate high RoEs leading to a self-propelling business model. The company has a capital adequacy of 24%+ and has access to ample liquidity, thus having enough balance sheet strength to grow. Over the last 5 years, the company has grown its loan book and PAT at a CAGR of 19% with RoEs at ~18%.

Home First Finance’s business continues to do well with the company achieving 15%+ RoEs (vs. 11-12% when it entered our portfolio) and healthy growth, however we believe that its valuation (~4.5x FY24 P/B at our exit share price of ~Rs. 1,020) offers little margin of safety while MAS Financial Services offers similar RoEs as Home First along with healthy growth at almost half the valuations.

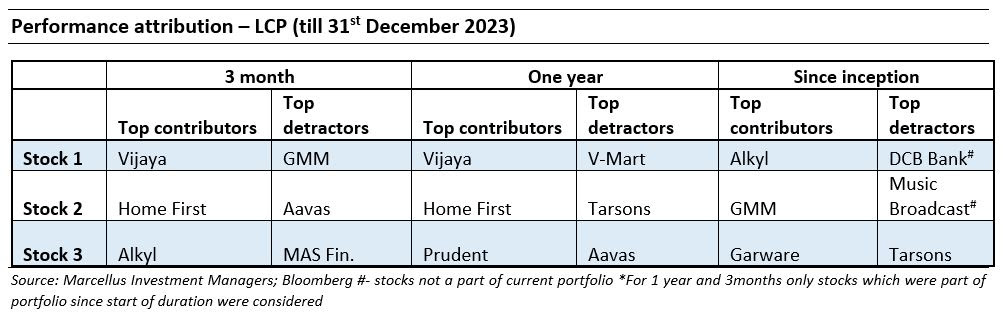

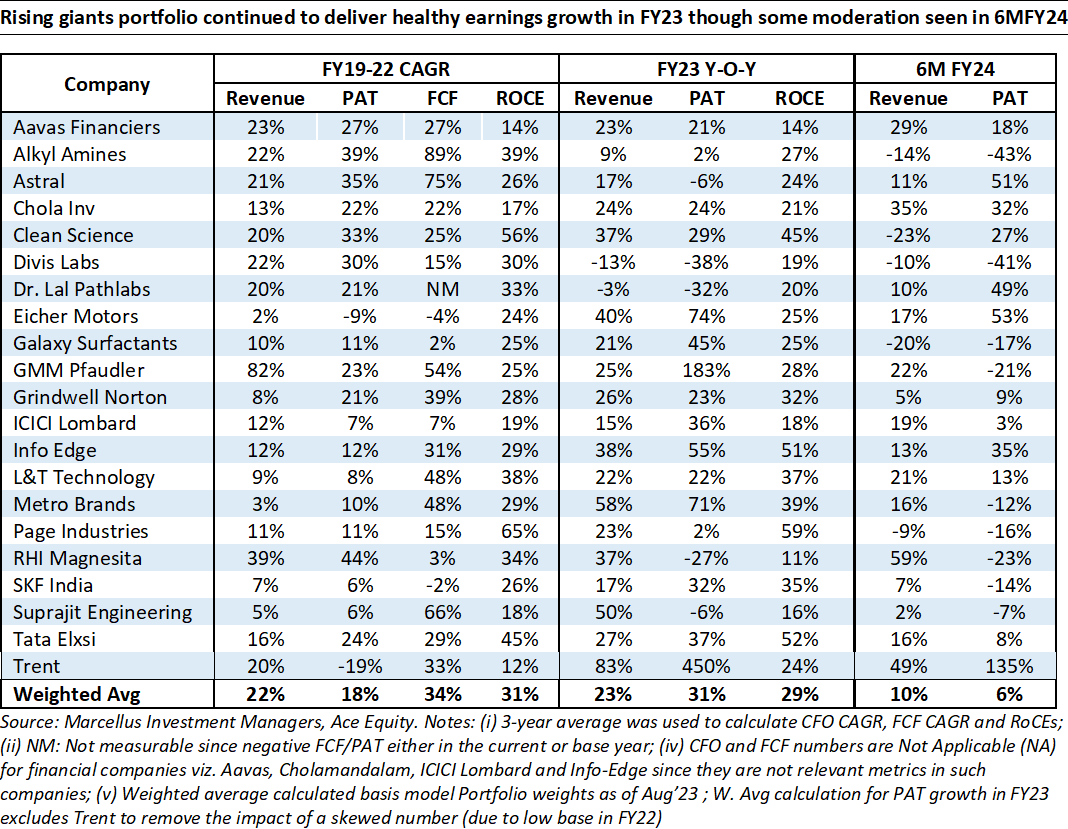

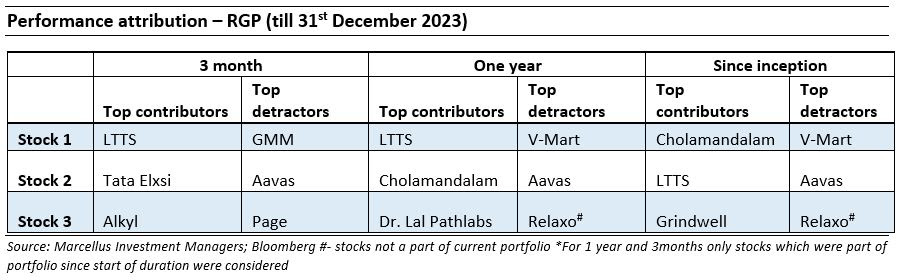

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP)

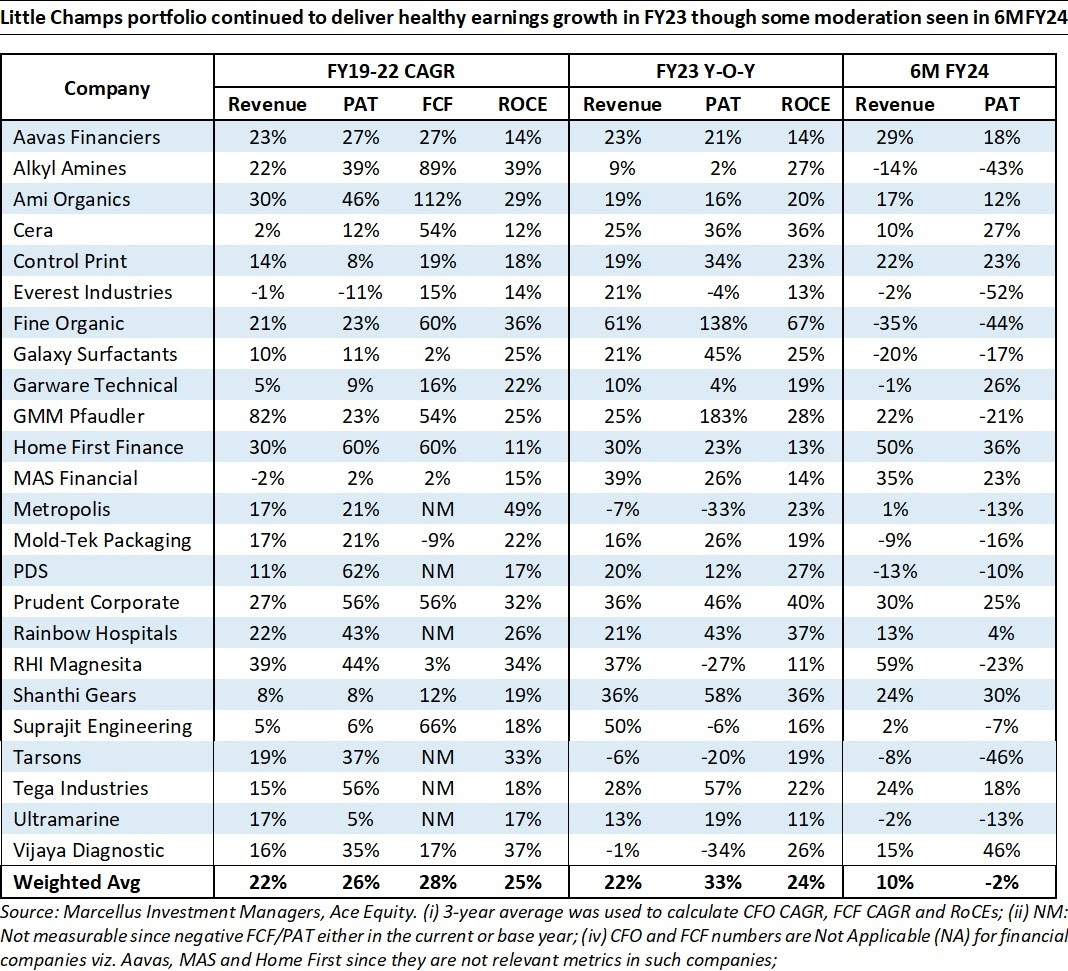

As highlighted in our December 2023 month newsletters, some of export oriented Little Champs and Rising Giants portfolio companies are facing headwinds owing to the demand-supply mismatch and weak sentiments. While things continued to be muted for the chemical stocks, we are seeing an uptrend in the export volumes for the pharma-oriented companies which is a positive sign. Furthermore, while there is uncertainty surrounding the interest rate cuts by the Fed, any positive development on this front can result in significant improvement in consumer sentiments and augur well for the stocks with global market exposure.

We reiterate that: (i) the above factors are transient in nature and we remain sanguine about the medium-long term prospects of our portfolio companies; and (ii) given the current valuation levels, any uptick in earnings can result in disproportionate gains in the share prices for the portfolio companies.

New stocks added to the Little Champs portfolio:

Everest Industries

Everest was founded in 1934 as an asbestos roofing company. Over the years, the firm has diversified into non-asbestos roofing needs (Steel/Clay/ Plastic Roofing), fibre cement boards (FCB) in 1994 and prefabricated steel buildings in 2008. Everest was listed as a subsidiary of ACC in 2006. In 2013, the firm was acquired by its current owners – Sekhsaria family. In 2017, leadership underwent a change with appointment of Anant Talaulicar (former Cummins India MD) as the Non-executive chairman and Rajesh Joshi (Former CEO of ICA Pidilite and Head of Strategy at Pidilite) as the MD & CEO. Entire leadership team has undergone a complete change with new CXOs joining from professionally run companies like Asian Paints, Cummins etc. Today 50% revenue comes from roofing, 20% from cement fibre boards and 30% from prefabricated steel buildings.

We expect roofing business to improve profitability on back of launch of innovative products and operating efficiency initiatives around manufacturing processes & logistics. Indian cement fibre boards industry is growing at 15%+ due to rising awareness of the product and need for solutions to shorten the construction time. Everest is a reputed player in this market and with renewed focus on architects and contractors, new product launches and operating efficiencies, we expect healthy revenue growth in this business along with improvement in profitability. Steel business is an operationally challenging and WC intensive, but with management’s focus on profitability over revenue, we expect this business to grow at decent topline growth but with improved profitability than earlier levels.

Control Print

Control Print (CP) is the 3rd largest player in the Indian coding & marking industry. Coding & marking industry provides printers for variable information for packaging and branding & identification for industrial products like pipes, cables, wires etc. CP dominates the industrial segment of coding & marking industry with significant market share in pipes & steel industries mainly through sales of Continuous Ink Jet printers and Large Character printers.

CP has garnered close to 20% market share since 2008 (basis aggregate revenues of top 4 industry players) on back of their lower consumable prices, superior service capabilities and technology tie-ups with global firms like KBA, Germany and MACSA, Italy. Moreover, CP comes out as more agile compared to MNC peers for whom strategic decision making happens outside India. In the last 5-7 years, CP has successfully forayed into packaging space (2/3rd of the overall Indian coding and marking industry size) on back of new technologies like Thermal Inkjet, Laser printers and Hi-Res printers. Sales of new types of printers which typically cater to the packaging space has increased from ~5% of sales to ~17- 18% of sales. Recent acquisition of Markprint BV (Netherlands) and JV with V-Shapes of Italy should help accelerate foray into Packaging space. CP has grown revenues & PAT @15% over the last 10 years. Operating and Free cash flow have grown at 18% & 23% respectively over same period. We expect CP’s growth to accelerate led by an uptick in Industrial activity and market share gains in Industrial and Packaging space helped by consistent R&D spends, improvement in management bandwidth and lower consumable prices v/s MNC peers.

Ami Organics

Ami Organics Ltd (Ami) is a Surat based pharma intermediates and specialty chemicals manufacturing company. The key investment thesis surrounding the stock are:

- Wide chemistry skillset and large pharma intermediate portfolio – Over the years, the Company has created skill and competency in handling multiple chemistries allowing it to offer multiple routes of synthesis for any given intermediate. This enables the Company in partnering with a higher number of clients who have used varied routes of synthesis for their dossier filings. In addition to its wide chemistry capabilities, the Company has a big basket of products (~350-400) which provides visibility on growth as more and more of the products get commercially scaled up.

- Diversification – Ami Organics has made 3 key decisions to diversify and reduce their dependence on pharma sector – (i) entered larger volumes specialty chemicals through acquisition of Gujarat Organics Ltd; (ii) entered semiconductor chemicals segment through acquisition of majority stake in Baba Fine Chemicals; and (iii) developed and introduced EV battery electrolyte additives. As a result, company has now around 25% of its revenues coming from non-pharma industries. Furthermore, with scale up in semiconductor and electrolyte segments, the blended margins are expected to improve.

- Resilient financial track record – In last five years (till FY23), company has grown its revenues at 27% CAGR (Rs. 617 crores, including acquisitions), EBIDTA at 32% CAGR and PAT at 35% CAGR. The Company has maintained average EBIDTA margin of ~ 20% in last five years and average pre-tax ROCE of ~ 26%.

Shanthi Gears

Shanthi Gears Ltd. (SGL) is an Industrial Gearing Solutions company supplying gears and gearboxes to different industries. Tube Investments of India Ltd (TII) brought 70% stake in the company for around Rs.465 crores in 2011-12. SGL manufactures all types of gears and mainly caters to customers in Steel industry (30% of revenues), material handling (10% of revenues), Power sector (10%), Mining & off-highway industries (10%), Plastic and Tools (10%), Exports (7%) and other industries (23%).

SGL due to the insistence of erstwhile promoter, had focused on the customized-gears demand. Due to this, the company has developed complex gearboxes over the decades and has a long experience of the required engineering know-how. As a testimony of its engineering advantage, SGL has a major market share for the Industrial Gears used by Vande Bharat trains. In the last three years, various initiatives were taken by the management. SGL started providing channel financing facility for its channel partners (though Cholamandalam Finance) there by reducing its outstanding debtor days to 45 days credit period, Revamping of the sales team according to products i.e., different salespeople for Project Sales, worm gears (catalogue product) and services, introduced the IOT concept in their factories with which the CEO now tracks the exact movement of goods being manufactured as well as dispatched. The company had 4 plants (A,B,C &D) and one foundry unit which has now been consolidated from four plant to two plants. This led to savings in certain fixed costs and increase in efficiency of manufacturing operations. It started increasing the standardised gears portfolio and participating in projects with catalogue product requirements. This single decision was a game-changer for the company, as it started using its capacities more and revenues started growing. The through-put increased and the company’s asset-turns more than doubled. The thinking was very simple, company needs to change its DNA and be open to businesses where the real market lies. The revenue, profit and asset-turn growth were achieved without incurring any meaningful capex.

Additional growth drivers for the company would be increase in share of exports, further increase in share of catalogue/standardised gearboxes and developing presence in Northern/Western India. The strategy execution is decentralized and follows the template of TI. CEO Karunakaran is a Mechanical Engineer and has been a part of Murugappa Leadership program (MLP) from IIM, Ahmedabad. He has been associated with Tube investments of India Limited (TII) for 18 years (1996-2014), and then started working at Shanthi as Operations Head.

Addition to the Rising Giants portfolio

SKF India

SKF AB (literally Swedish Ball-bearing Company) is a Swedish manufacturer of bearings and seals and is the largest bearings company in the world. Bulk of SKF’s revenues stem from the sale of bearings. Unlike many other companies trying to make India a low-cost manufacturing base, SKF India has continued to import bearings as needed from other SKF entities. Its’ Traded/Manufacturing goods revenue split has remained constant at ~57% / 43% over the past decade. SKF India’s exports as a share of revenues has also varied in narrow band of 7-10%.

SKF’s sources of competitive advantage include: (i) Access to technology of Parent, (ii) stickiness of customers (SKF was the company that supplied bearings to the first 2W from Bajaj and the relationship continues till this day); (iii) its asset light strategy generating better ROCEs in India; and finally (iv) its Rotating Equipment Performance (REP) offering. REP is a one-stop solution for the maintenance of roller bearings & other rotating machinery. SKF basically helps the client with condition monitoring, replacement of parts, and other services. It is a fee-based model, that they have been actively promoting since 2015 (and recently crossed 1 bn in annual sales globally).

SKF AB has recently announced a ‘localization’ initiative. This consists of identifying several regions around the world – each of which will be self-contained w.r.t. sourcing, manufacturing, and selling. South-east Asia has been classified as one such region, and management has stated that incremental manufacturing capacity will be set up in India. The new capacities will be largely for Industrial. Additionally, the REP program which caters only to Industrial segments is also poised to grow & increasingly contribute to revenues. Hence, we expect overall revenue mix to shift towards Industrial segment – we forecast a 55% / 45% split between Industrial / Automotive by F28. Management has indicated that they will shift to the SKF AB split of 70% Industrial / 30% Auto over time.

Regards,

Team Marcellus