Marcellus’ Global Compounders Portfolio (GCP) strategically invests in 25-30 deeply moated global companies aligned with megatrends, fostering a consistent mid to high teens compounding of free cash flow/earnings. Amidst an increasingly uncertain global macro landscape, our proprietary Torque based positioning favors defensive stocks that deliver higher than GDP growth with low earnings volatility – as evidenced through resilient performance during major upheavals over last 20 years. Whilst how & when key risks play out is anybody’s guess, our portfolio’s objective is to balance the troika of fundamental business strength, risk to growth from short term disruptions and prevailing valuations.

Permissible Accredited Investors* can now invests in GCP Strategy with minimum ticket size USD 25,000.

*Accredited Investors shall qualify eligible criteria as defined under IFSCA-IF-10PR/1/2023-Capital Markets dated January 25, 2023.

For non-accredited investors, Investment in Marcellus’ GCP is through Separately Managed Accounts (i.e., SMAs, just like a PMS) via GIFT City (regulated by IFSCA) with a minimum investment amount of USD 150,000.

Marcellus’ GCP outperformance led by strong underlying fundamentals + proactive position sizing

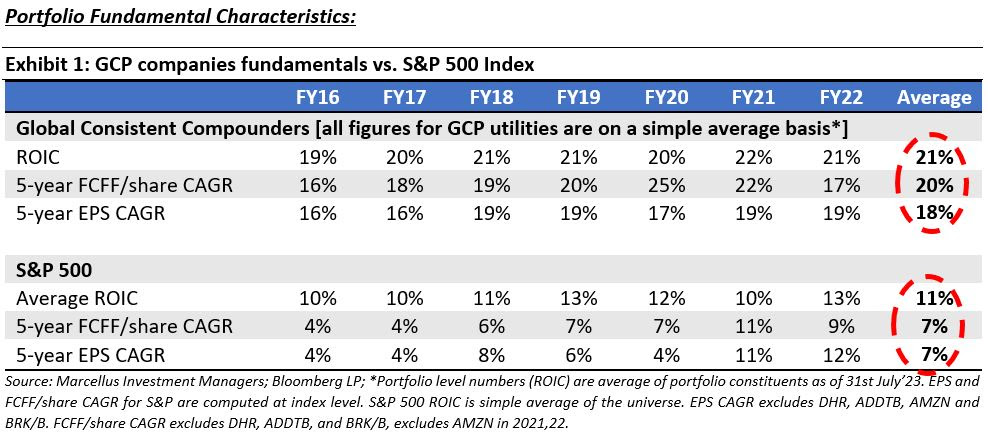

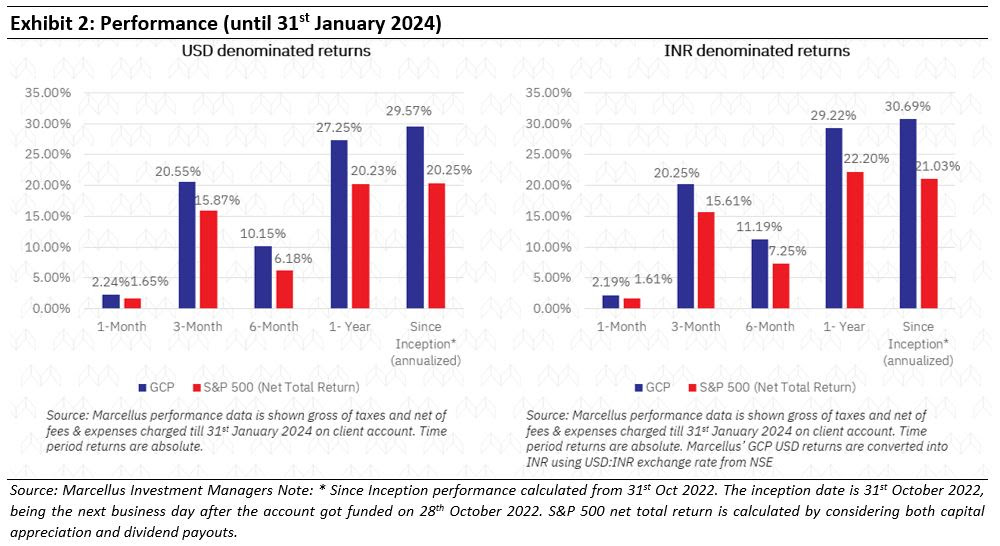

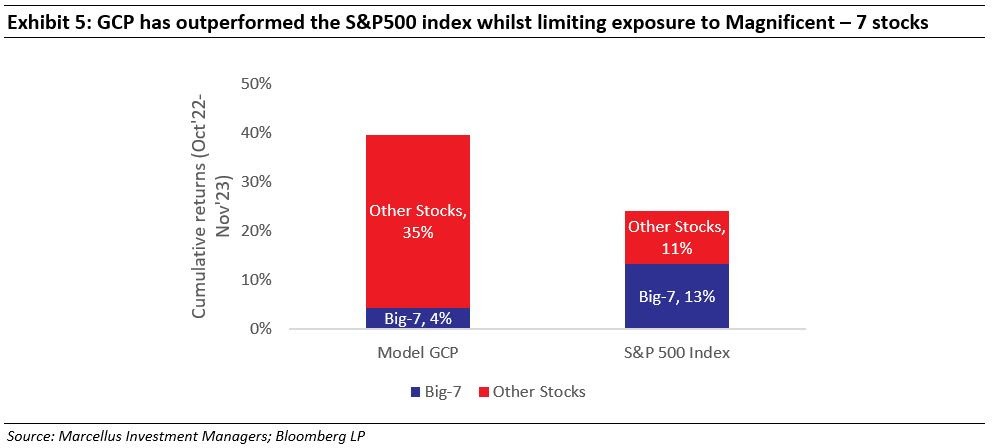

Marcellus’ Global Compounders Portfolio (GCP) went live on 31st Oct’22 and in our first anniversary review newsletter, we highlighted that the portfolio outperformance vs. the benchmark S&P500 index (by 8.55% until 30th Nov’23 and 9.32% until 31st Jan’24 in USD terms) was mainly a combination of two factors:

- Stock selection as measured by growth in Intrinsic value: This parameter captures the underlying fundamental performance (Earnings/cashflow growth) of our portfolio companies and the GCP Companies average Intrinsic Value Growth of 11.9% since Oct’2022 exceeded that of S&P’s 4.8% (excluding dividends).

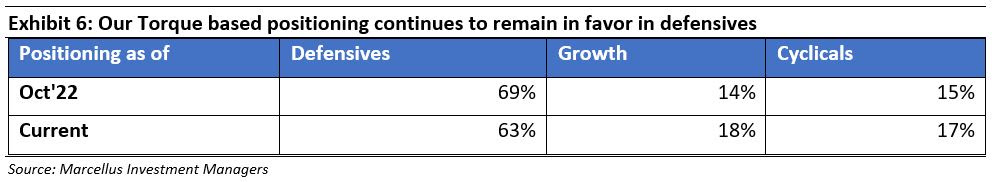

- Position sizing using our proprietary Torque methodology: The Torque signalling (defensive/growth) which is a combined output of multiple macro parameters is used to determine the relative weightage of stocks within portfolio. This parameter has consistently signalled a defensive positioning since Autumn of 2021, and has added ~2.6% additional outperformance relative to the S&P500.

Road ahead: The macro landscape is likely to remain uncertain in 2024

“The picture that market prices are now painting is for inflation to fall to central banks’ targets, for real growth to be moderate, and for central banks to lower interest rates fairly quickly—so the markets are now reflecting a Goldilocks economy” – Ray Dalio in his article 2024: A pivotal year on the brink (link)

CY 2023 was a remarkable year for not just US equities but global equities in general. Amidst a challenging backdrop presented by steep interest rate hikes and supply chain issues forced by geopolitical conflicts, the US economy continued to outperform market expectations. The US markets were mainly bolstered by the narrative around Artificial Intelligence, with the “Magnificent Seven” stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla), commanding a significant portion of the S&P 500’s gains and exerting outsized influence on the index.

In 2024, we’re faced with an interesting proposition with benchmark indices like S&P500 and Nasdaq100 at their all-time highs alongside multiple risks rearing their head. Some of the more prominent ones are highlighted below:

- Delayed impact of Fed’s rate hikes: One of the more prominent views amongst market participants last year was that the record pace of interest rate hikes by the US Fed would lead to a recession as businesses struggle to refinance their debt and consumers opt against borrowing at high rates. While the scenario panned out contrary to expectations, it’s worthwhile noting that many companies refinanced their debt during the period of ultralow rates during 2020-21 and would feel the pinch of high rates when the need to refinance arises again. Similarly, customer savings built up during the Covid-era have started dwindling and credit card borrowing is setting records. It takes time for the effects of higher interest rates to flow through the economy and any weakness in labour market may affect the bellwether of GDP growth – consumer spending, in 2024.

- The return of inflation: One of the biggest reasons for expectations of a ‘soft landing’ for the US economy has been the rapid cooling of inflation last year as low inflation allows for greater manoeuvrability by central bankers – like cutting rates when unemployment rises. However, inflation is a notoriously difficult parameter to forecast and inflation cooled in 2023 partly due to significant improvement in supply chains post-Covid led disruptions. With geopolitical risks remaining elevated (and even increasing with the terrorist attacks on ships in the Red Sea), an encore of 2022 continues to be a real risk!

- The unravelling of China: This potentially remains the biggest elephant in the room! Chinese economy has remained an overhang on the global growth with the implosion of its housing sector and resultant impact on consumer confidence and spending. The Chinese leadership meanwhile has thus far steered clear of a massive stimulus package to revive the economy (even as it announced some steps to stem sharp fall in stock markets in Jan’24). As one of the most prominent producer and consumer nation, a major economic crisis in China would have significant impact on the international supply chains (especially in manufacturing).

GCP companies have been resilient during times of distress

“In the realm of equity investing, uncertainties are inevitable. At Marcellus, rather than attempting to evade uncertainty, we believe in the art of selecting the right stocks and constructing a portfolio capable of withstanding the various challenges presented by the market” – Marcellus GCP’s first anniversary review (Dec’23)

In addition to the inherently global nature of GCP companies, where risks specific to individual countries are diversified (with over 40% of revenue for our top 10 investee companies originating from outside the US), it is crucial to acknowledge the adage, “when America sneezes, the world catches a cold“. Notably, the United States not only avoided the anticipated recession last year but also demonstrated robust growth, surpassing that of many other nations (4.9% real GDP growth in Q3CY23). While our expertise does not lie in macroeconomics, from a data-driven perspective, it is evident that Central Banks have been operating at an unprecedented pace. The swift response of the Federal Reserve to the Covid crisis, within less than a month, and that of Silicon Valley Bank within 72 hours, underscores this trend. Given the significant financialization worldwide, where the ratio of Market Cap to GDP is substantial, fiscal challenges are likely to be ignored by common people and hence by political parties – more so considering that the fiscal situations of most countries are relatively similar. It is probable that economic cycles prompted by Central Banks will persist, likely characterized by shorter and more intense fluctuations. Consequently, the outcome is straightforward: either we engage in rapid trading or adopt a longer-term investment perspective, focusing on companies resilient through economic downturns while not overpaying for those. We chose to do the later.

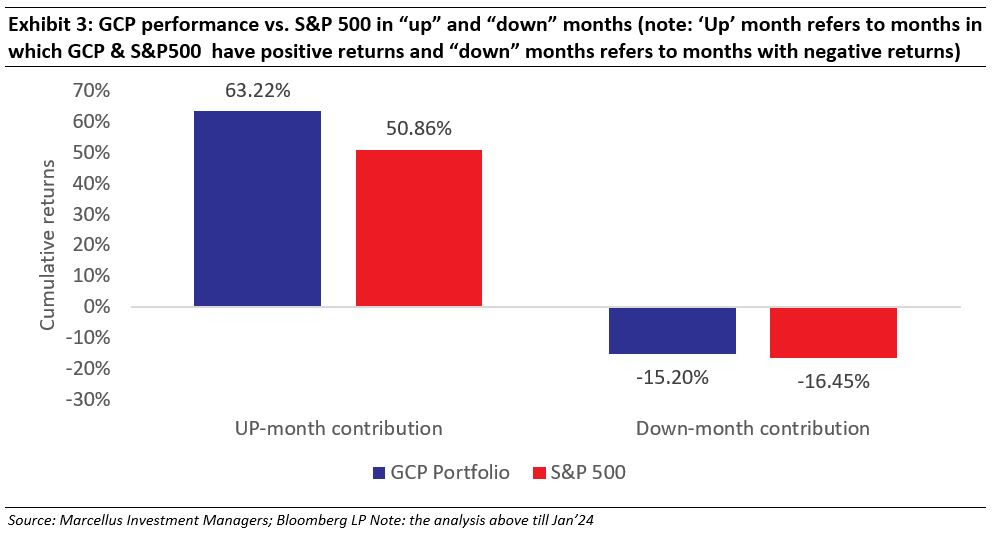

While this approach does not imply immunity to stock corrections, it is anticipated that, at the portfolio level, any relative correction compared to benchmarks would be manageable and comparable. Furthermore, during recovery periods – which are likely to be faster and sharper, such companies are likely to significantly outperform broader benchmarks. This performance aligns with the behaviour of our portfolio since its inception, providing an early indication of its construction and potential.

Navigating the complexities of market timing presents formidable challenges. Therefore, we have opted for a longer-term investment strategy, focusing on reasonably priced dominant franchises, echoing the sage advice of the Oracle of Omaha: “Don’t bet against America.”

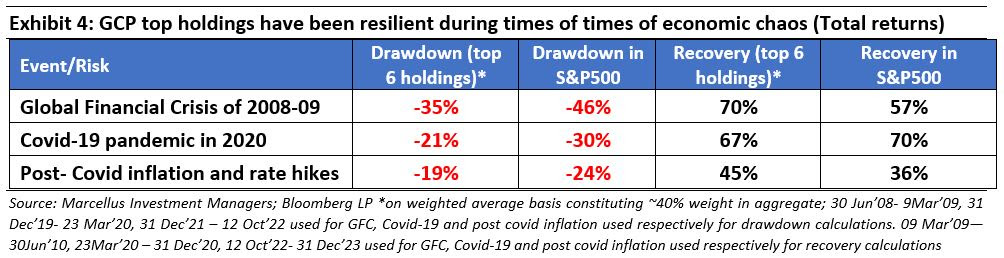

Delving deeper into this approach, let us examine the performance of our portfolio companies during periods of adversity:

1. Full-blown recession: The Global Financial Crisis of 2008-09.

2. Unprecedented crisis: The Covid-19 pandemic in 2020.

3. Supply-side challenges stemming from geopolitical conflicts, such as the aftermath of the post-Covid scenario.

As is quite evident from the chart above, a prevalent theme among our chosen companies is their ability to weather downturns effectively. This is enabled by core business strength built around:

- A. Counter-cyclical cash generation: Many of our selections exhibit a pattern of generating cash in a counter-cyclical manner, enabling them to deploy substantial resources when markets falter.

B. Exposure to maintenance, aftermarket, or consumables: The recurrent revenue streams derived from the staple or utility nature of these businesses ensure their resilience in downturns.

C. Monopoly, quasi-monopoly, or established oligopoly in their respective markets: This positioning affords them pricing power even during challenging economic climates.

D. Unparalleled value proposition: These companies offer compelling cost savings for their customers, a factor of heightened significance during periods of stress.Our primary exposure is to companies that meet at least three of the aforementioned criteria.

Our primary exposure is to companies that meet at least three of the aforementioned criteria.

Our positioning favours a defensive stance amidst global uncertainties

Our proprietary framework, Torque, has consistently signalled a defensive positioning since Autumn of 2021 – a stance that remains unchanged. Consequently, we limited our exposure to the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla) which’ve commanded a significant portion of the S&P 500’s gains. [On average Apple, Amazon, Microsoft, Alphabet have together constituted ~11% of our portfolio since inception]. The impact of our stock selection and position sizing vis-à-vis S&P500 index is visible in the chart below.

As can be seen in the charts below, our Torque based position sizing continues to remain in favour of “defensives”. Here is how we define the three categories of stocks in our portfolio: Defensive: delivers GDP+ growth with little sales/earnings volatility; Growth: delivers GDP ++ growth albeit with higher variability in earnings growth; Cyclicals: delivers GDP + growth through the economic cycle but with much higher variability in earnings]

Consequently, our top three positions feature steadfast and resilient cash compounders—Berkshire Hathaway, Costco, and Heico. As we’d highlighted in the previous section, most of our current top holdings have fared well during times of distress and we expect such resilience to continue over the course of this year (and even further) as well.

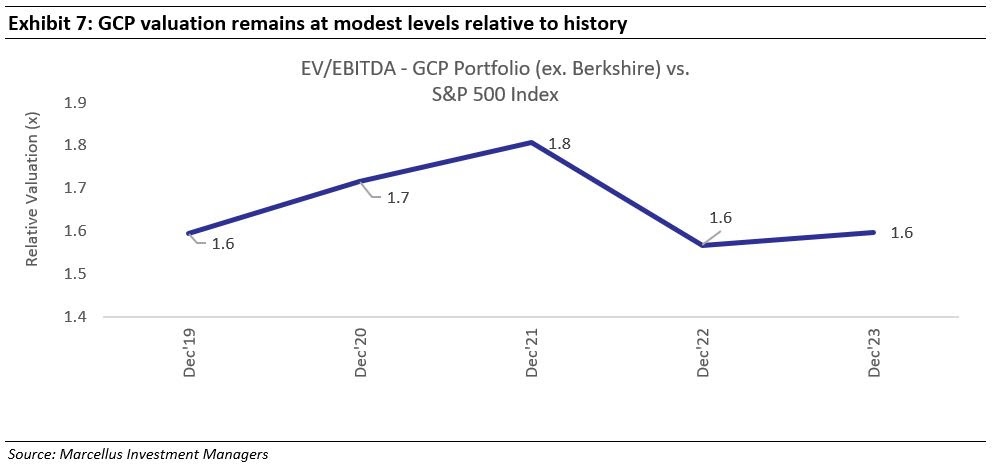

GCP valuations remain modest relative to history

As highlighted at the start of this newsletter, the bulk of our outperformance vs. S&P500 index has come from a combination of stock selection and position sizing. In other words, the contribution of any valuation ‘re-rating’ vis-à-vis the benchmark index has been minimal. As can be seen in the chart below, the valuation of GCP portfolio remains at the same level as it was four years ago (before Covid era euphoria) and even that a year back.

As far as the premium of 60% vs. S&P 500 index is concerned – it’s a function of the higher quality of businesses we own vs. an average company in the S&P500 index. As we’ve shown in the first exhibit at the start of the newsletter, an average GCP company has ~2x the Return on Invested Capital (21% vs. 11%) and ~3x the growth rate (20% vs. 7% FCF growth rate) of an average S&P500 company. We find the current quantum of premium multiple for a premium performance an acceptable proposition!

Cutting a long story short…

On balance, in light of the last couple of years of equity market euphoria (briefly disrupted by inflation spike and central bank rate hikes) and extreme polarization of returns (in favour of tech mega cap stocks), our portfolio is positioned towards franchises that remain resilient in the face of risks we’d highlighted above AND trade at moderate valuations.

While it’s near impossible to accurately predict is which risks will actually come to the fore and when, prudent money management warrants constructing a portfolio that balances the troika of fundamental business strength, risk to growth from short term disruptions and prevailing valuations. We’ve been committed to achieve this objective since the fund’s inception in 2022 and will continue to do so in the years ahead as well.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/