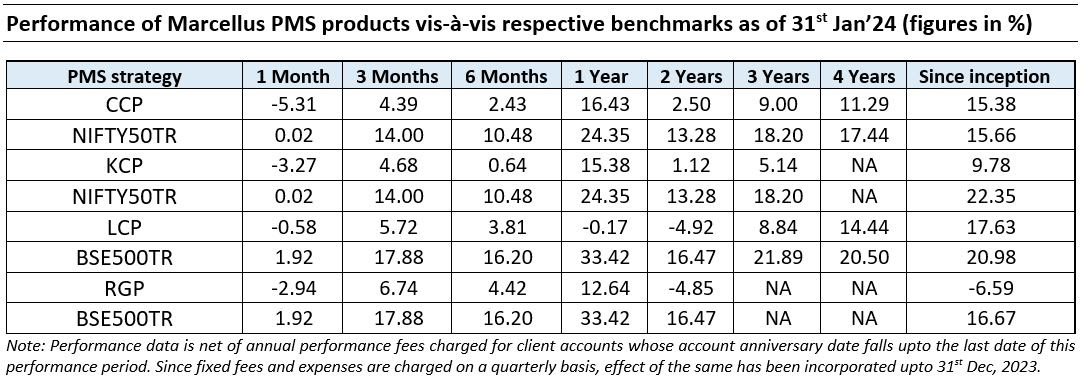

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/

Consistent Compounders Portfolio (CCP)

For the quarter ended December 2023 (i.e. 3QFY24), earnings growth of CCP portfolio companies continued to accelerate further. Weighted average EPS growth was 36% YoY during the quarter for the portfolio. On the one hand, this growth was higher than the long term expected run-rate of earnings growth due to normalization of margins in 3QFY24 for companies like Page Industries, Dr. Lal Pathlabs, Asian Paints, Pidilite etc – margins in 3QFY23 for these companies were suppressed by either the reversal of Covid tailwinds during FY23 or by higher input costs last year. On the other hand, EPS growth in 3QFY24 for most of our portfolio companies also reflected market share gains, accelerate business development and hence robust revenue growth compared to competitors in the industry – e.g. Trent, Titan, Bajaj Fiannce, Astral, Dr. Lal etc.

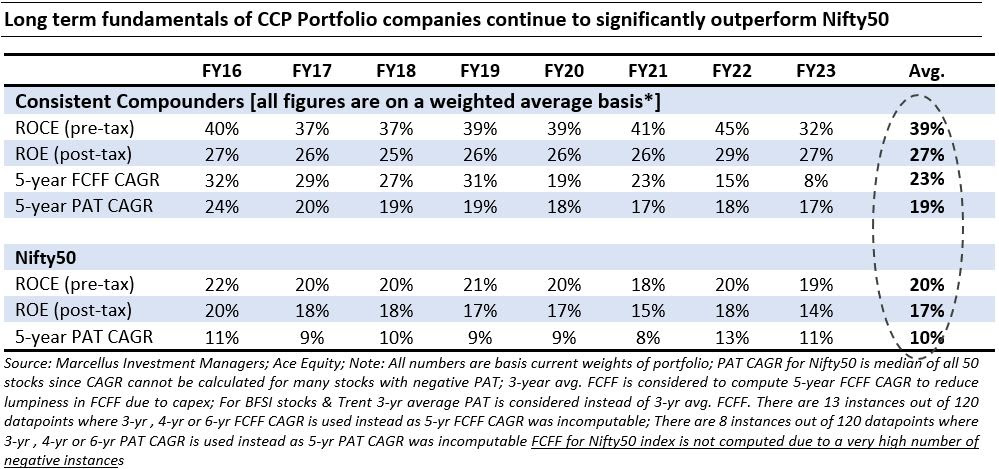

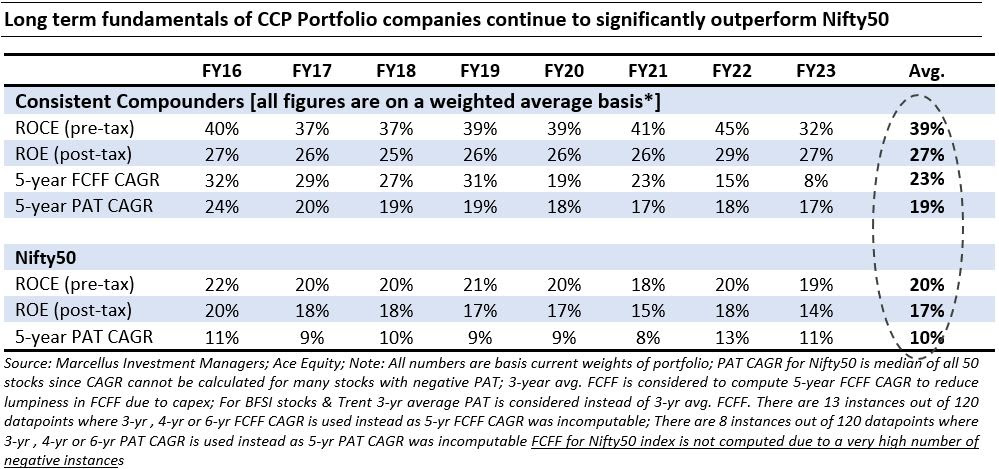

As highlighted in our recent (3rd Feb) webinar, the ROE premium (measure of cash generation) and EPS growth premium of our portfolio companies compared to Nifty50 has been maintained across the last decade, including the last couple of years. However, the P/E premium of our portfolio companies has crunched down to a decadal low. Over the past five years, we have seen earnings compounding (measured by 1 year forward EPS expectation) being significantly ahead of share price compounding for all the three CCP lenders and the two CCP insurance companies. This presents a significant opportunity for catch-up of share prices with their fundamentals in the months and year to come. Amongst the non-financial sector companies, several companies (e.g. Titan, Trent and Astral) have significantly strengthened their business growth prospects over the last 5 years by transitioning from say a single product or retail format players (Tanishq for Titan, Westside for Trent, and Pipes for Astral) to a wider platform of products (Watches and Caratlane for Titan, Zudio and StarBazaar for Trent and Adhesives for Astral). Whilst the market had appreciated some of this transition in the first three out of the last five years, the share prices of these companies have also lagged significantly behind their fundamentals over the last two years – creating opportunities for outsized gains in the years to come. Finally, for companies such as Divis Labs, Dr. Lal Pathlabs and Page Industries, the wake effect of the Covid (i.e. reversal of some of the tailwinds that these companies witnessed during Covid) is behind us. From 3QFY24 onwards, for all these three companies, we can see more normal like to like growth rates and hence recovery in fundamentals is likely to get reflected in their share prices.

Last but not the least, we have increased our agility of portfolio construction tools over the last two years, the benefits of which are already visible in the strong positive contribution of position sizing changes to the performance of our portfolio over this period. We strive to keep learning from our mistakes and grab greater opportunities to enhance the performance of CCP in future. We expect the recovery in our portfolio performance since 1st April 2023 to continue over the next 12-24 months.

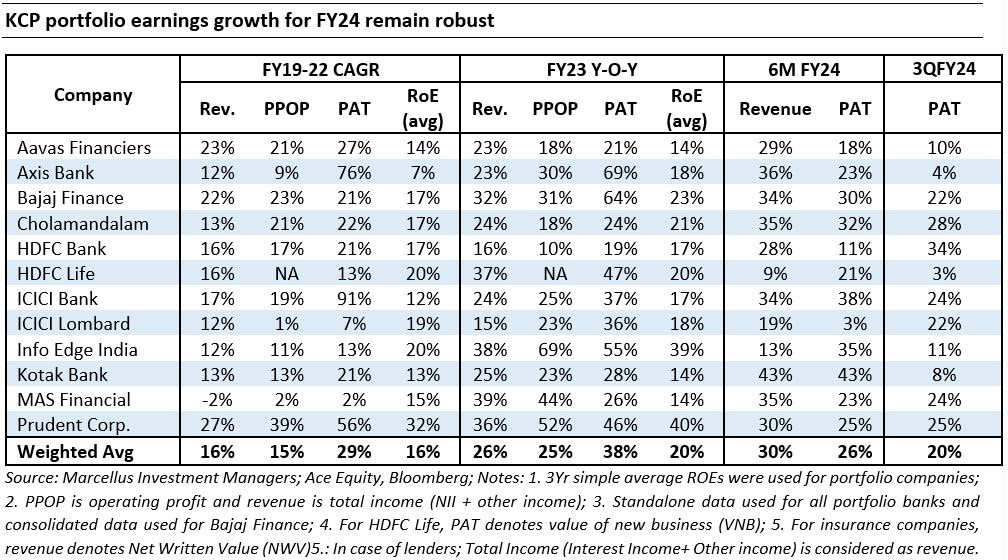

Kings of Capital Portfolio (KCP)

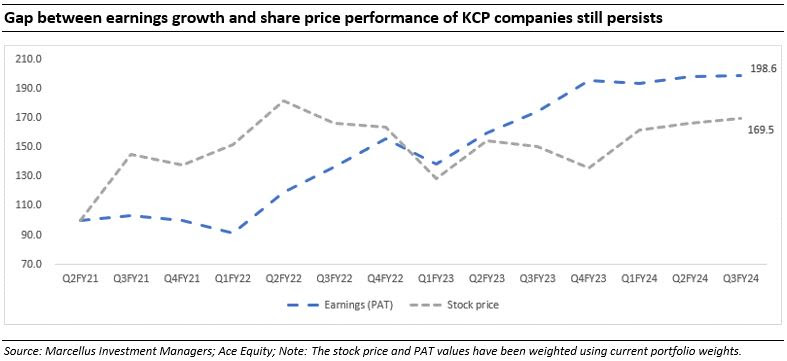

All KCP portfolio companies have reported results for the quarter ended Dec, 2024. As we have always stated, quarterly results provide a good checkpoint to analyse how our investee companies are doing versus competition and rest of the industry. Companies in our portfolio reported healthy fundamentals but HDFC Bank was a notable exception to this positive trend. Some key takeaways from this quarter’s results are as below:

- Deposit growth for the banking sector continues to be a challenge: The banking sector continues to struggle to raise low-cost deposits, CASA growth for the banking sector for 9MFY24 is zero. This has been led by consumers and businesses moving their money to higher yielding avenues including fixed deposits. The current deposit growth is not enough for the banking sector to keep growing at the mid-teens growth rate. The lack of deposit growth has been further accentuated by a 5-year high liquidity deficit in the banking system which has ranged between Rs. 1.5 trillion and Rs. 4 trillion over the past six months.

- Asset quality for the system continues to be robust: Banking sector asset quality continues to be pristine with low level of slippages barring some small segments of unsecured lending. Most of the improvement in asset quality however might now be behind us and the next two years will likely see credit costs gradually rising from the current levels.

- Early signs suggest profitability of the general insurance industry is improving: After a difficult 2-3 years for the general insurance industry there are visible green shoots in industry profitability. The nature of the industry has meant that industry profitability has been perpetually under pressure. The previous 2-3 years have been tougher than the industry’s own history given high covid claims (health claims), supply side challenges for motor OEMs, no hikes on motor third party pricing and excessive competition plus capital on the motor own damage business. If the recent discipline and focus on profitability from industry participants sustains, ICICI Lombard will be a beneficiary being the largest private general insurer.

- Lack of system liquidity and deposit growth hurt HDFC Bank the most: While HDFC Bank continues to gain market share on both sides of the balance sheet, the lack of system level deposit growth has hurt it the most given it has the highest liquidity requirement because of the recent merger with HDFC Ltd. Unlike the past decade where NBFCs bore most of the brunt of a liquidity squeeze, this time around the negative liquidity in the banking system is impacting lenders with a great CASA franchise the most while NBFCs are almost insulated as of now!

- HDFC Bank now finds its balance sheet in a tight spot: HDFC Bank’s liquidity coverage ratio of 110%, loan to deposit ratio of 110% and 21% of balance sheet funded by borrowings suggest it has limited headroom to navigate the next 2-3 quarters of a low/ negative liquidity environment. It might have to stop growing its balance sheet or sell down a part of its loan book to generate liquidity and repay the upcoming repayments of HDFC Ltd. high-cost borrowings. This will also impact net interest margins which has been under scrutiny since the past few quarters. The lack of any asset quality issues, continuous market share gains, large investments in branches and people and all-time low valuations provide us comfort to see through the difficult next 2-3 quarters.

- MAS Financial likely to raise equity capital: MAS Financial has not raised equity capital since its IPO in 2017 which is rare for a lender growing at healthy rates of 20%-25%. In the recent quarter it crossed Rs. 10,000Cr of AUM and has passed an enabling resolution to raise equity capital for its next leg of growth. We believe the equity raise will further insulate the company’s balance sheet will also enable it to continue growing at a healthy rate.

- Business as usual for all other companies in the portfolio: We have nothing much to report for any of our other investee companies – a quarter with ‘nothing much to report’ is the ideal state we would want for the Kings of Capital portfolio because boring, conservative financial companies are usually the most sustainable businesses and virtually all surprises in financial services are unpleasant ones.

No new stocks have been added/ exited from the KCP portfolio in the past month.

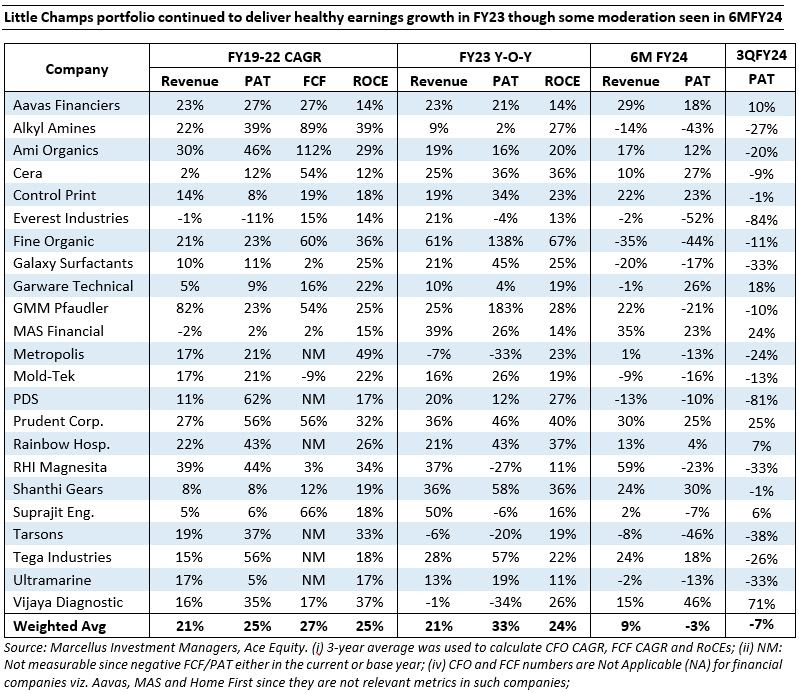

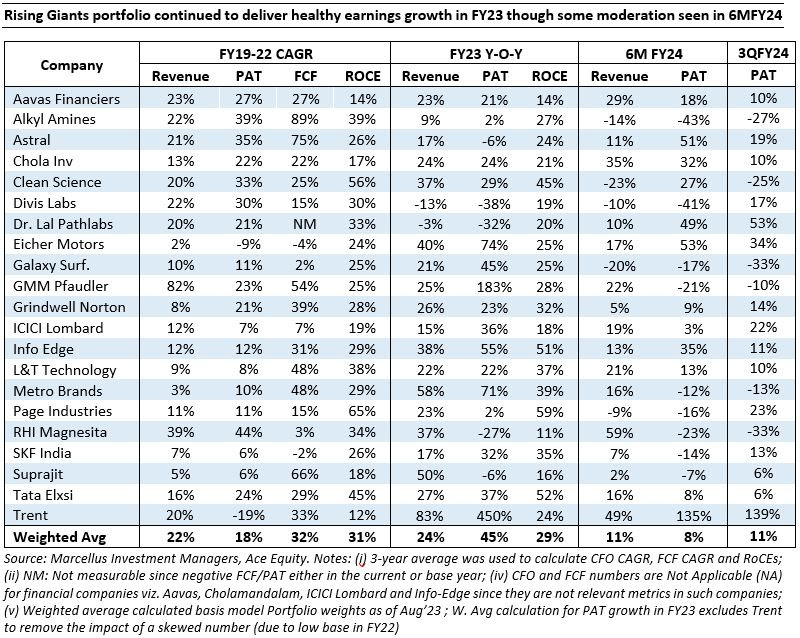

Little Champs portfolio (LCP) & Rising Giants Portfolio (RGP)

Th 3QFY24 results season panned out as expected for the portfolio companies. Little Champs portfolio with relatively higher exposure to the export oriented companies continued to witness muted earnings in 3QFY24 due to unfavourable demand-supply dynamics impacting the volumes as well as the realisation and profits. On the other hand, Rising Giants portfolio’s earnings was a mixed bag with growth in the domestic oriented companies more than offsetting the weak earnings of exports/chemical oriented portfolio companies. On the positive front, the management for most portfolio companies indicated a bottoming out of destocking cycle that has been impacting the earnings in the recent quarters. We are indeed seeing some corroboration of the same in the exports data (deceleration in volumes/realisation seems to be bottoming out in the last 2-3 months’ exports data). As we head into FY25, more particularly for the Little Champs portfolio, the earnings would also benefit from a favourably base of FY24. Lastly, any positive development (cut) on interest rates can be an icing on the cake in terms of significant improving the consumer sentiments for the stocks with global market exposure.

We continue to reteirate that: (i) the above factors are transient in nature and we remain sanguine about the medium-long term prospects of our portfolio companies – we can seen several cycles in the past when portfolio earnings have come back sharply after temporary period of weakness; and (ii) given the current valuation levels, any uptick in earnings can result in disproportionate gains in the share prices for the portfolio companies.

Changes to the Little Champs portfolio

Exit from Home First Finance Company:

Home First Finance’s business continues to do well with the company achieving 15%+ RoEs (vs. 11-12% when it entered our portfolio) and healthy growth, however we believe that its valuation (~4.5x FY24 P/B at our exit share price) offers little margin of safety at current levels.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/