*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer https://www.apmiindia.org/

Consistent Compounders Portfolio (CCP)

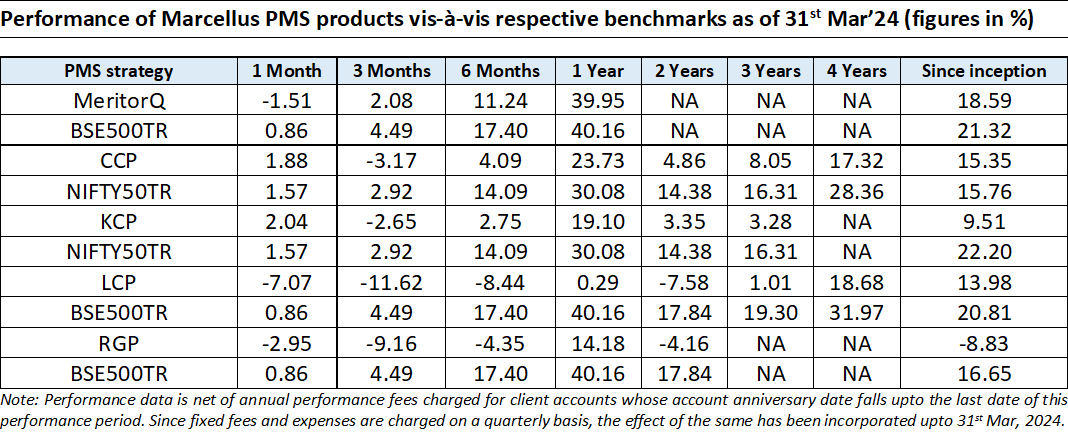

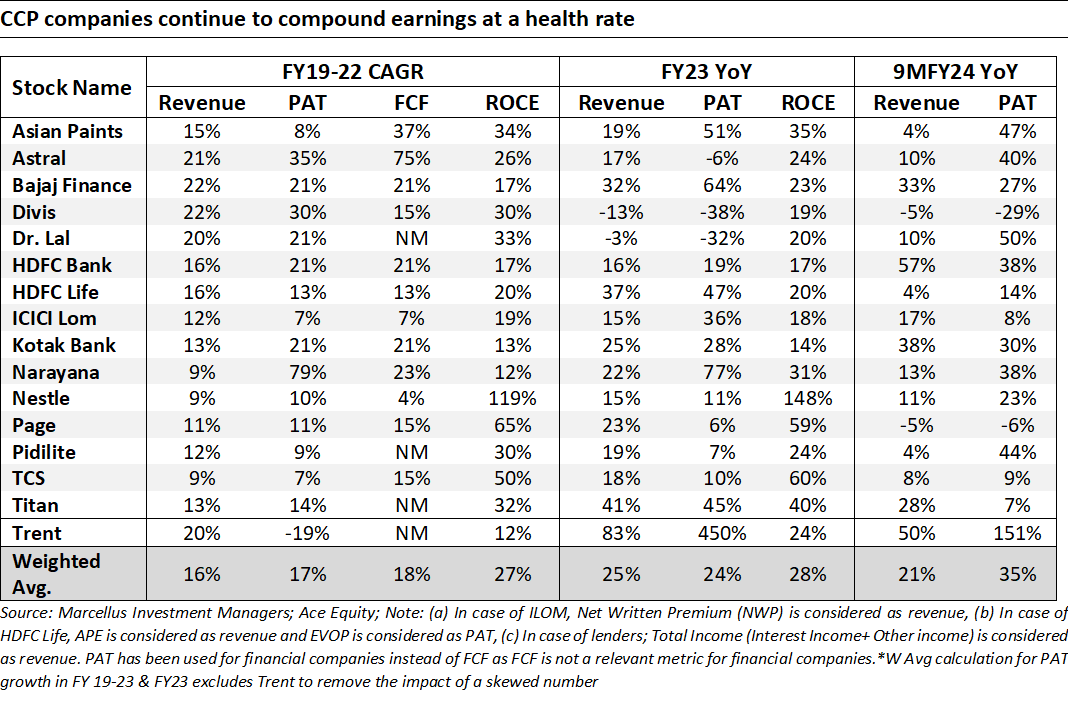

During FY24 (12 months ending 31st March 2024), Marcellus’ CCP Portfolio delivered 24% performance (net of fees and expenses). As shown in the exhibit below, this was a year of recovery after weak performance of the fund during the 15 months ending 31st March 2023. The drivers of this recovery in FY24 included: a) over 30% YoY growth in earnings of the portfolio (weighted average EPS for 9MFY24 – see fundamental performance table below), continuing the healthy and consistent earnings compounding that we have witnessed from this portfolio over the last 5 years; b) normalization of fund flows in the broader markets; and c) excess returns generated by position sizing (measured by the difference between equal-weighted portfolio of stocks vs the actual portfolio performance). Over the next few years, we expect to see these three drivers at play in the CCP portfolio’s performance.

However, despite a healthy absolute performance in FY24, Marcellus’ CCP Portfolio underperformed relative to Nifty50 benchmark index. This was primarily due to our lack of exposure to certain segments of the stock market which, due to low cash generation and ROCEs in the long term, do not form part of the coverage universe for CCP. We see this outcome reversing in future. Nifty50 TRI delivered 30% returns in FY24, which is significantly higher than the long term sustainable expected annualized return from the benchmark.

During FY24, we made three stock additions to our portfolio – Trent in Aug 2023, Astral in Oct/Nov 2023 and Narayana Hrudayalaya in Feb/Mar 2024. We expect to see Trent deliver a strong growth through continued scale up of Westside, successful and rapid expansion of Zudio and a successful turnaround and expansion of StarBazaar. Additionally, Trent is incubating several other retail formats and is working on delivering greater operational efficiencies in future. For Astral, we expect significant market share gains from some of its largest competitors in the pipes segment whilst the management continues to explore new category addition through incremental capital deployment. We see Narayana Hrudayalaya running a network of hospitals with a business model that is stronger and more sustainable than most other hospital chains.

Kings of Capital Portfolio (KCP)

During FY24 (12 months ending 31st March, 2024) the Kings of Capital portfolio delivered 19% returns post fees and expenses. The 19% return was lower than the Nifty50 return of 30% as the financial services sector underperformed the broader indices – this was evidenced by the fact that Nifty Financial Services Index delivered 16% returns during FY24.

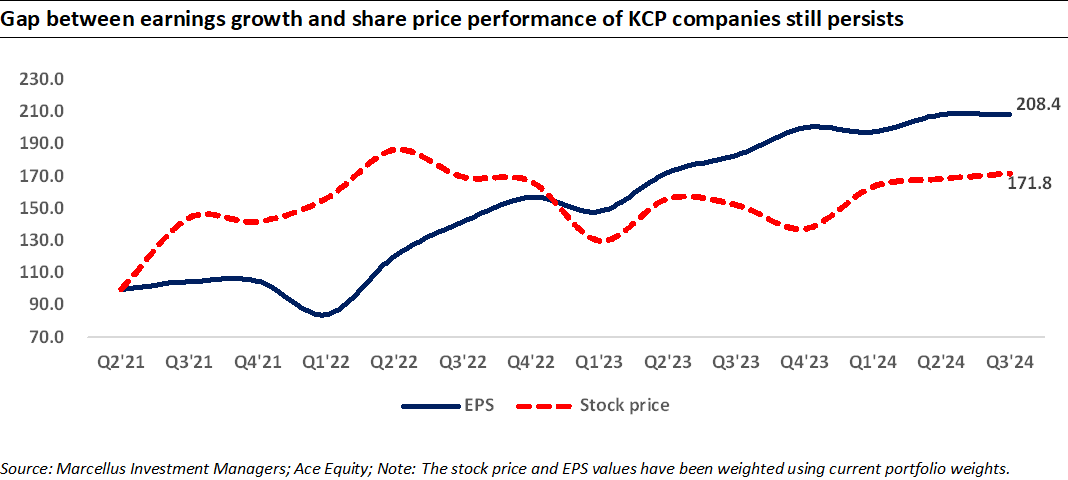

The portfolio delivered healthy earnings growth of 26% during 9MFY24, as a result of this consistent earnings delivery there continues to be a wide gap between the earnings growth and share price performance as shown in the exhibit below. The top contributors to performance during FY24 were ICICI Lombard, Info Edge, Prudent and Chola while the detractors were HDFC Bank, Aavas and Kotak Bank.

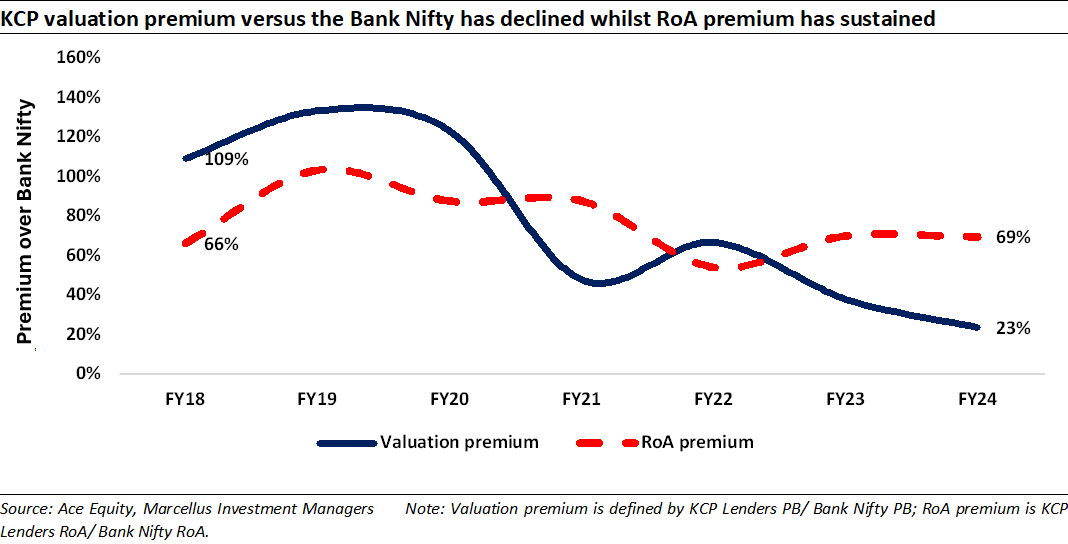

During FY24, share price performance within the financial services universe was quite dispersed with capital market players and PSU banks delivering strong returns and frontline private banks being significant laggards despite strong earnings growth and market share gains. Given the strong rally in PSU banks, the valuation premium of KCP lenders is at an all time low despite the superior RoAs as shown in the exhibit below. We believe that this superiority in business model and return profile of KCP companies deserve a higher premium than what is currently reflected in the stock prices and therefore re-rating along with healthy earnings growth will be drivers of KCP performance.

Little Champs portfolio (LCP) and Rising Giants portfolio (RGP)

In our last months’ newsletter, we had discussed that “the management for most portfolio companies indicated a bottoming out of destocking cycle that has been impacting the earnings in the recent quarters. We are indeed seeing some corroboration of the same in the exports data (deceleration in volumes/realisation seems to be bottoming out in the last 2-3 months’ exports data).” The exports data for the month of March 2024 further strengthened our belief regarding the recovery in Little Champs and Rising Giants portfolio companies especially those in the exports and chemicals space.

We continue to reteirate that as we head into FY25, the portfolio earnings should recover. Any positive development (cut) on interest rates can be an icing on the cake in terms of significant improving the consumer sentiments for the stocks with global market exposure. However, a risk factor is any major escalation in the geopolitical issues such as the current tensions in the Middle East region.

We continue to make the necessary changes in the portfolio bringing in more diversity in the portfolio and companies which are likely to witness healthy earnings trajectory over the coming years. To that end, we actioned the following changes the portfolio in the month of March 2024.

Changes to the Little Champs PMS model portfolio (as at March 31, 2024)

Additions to the portfolio:

- Eureka Forbes

Eureka Forbes (or EFL) began operations in 1982 as a JV between Forbes and Campbell (a Tata Group company) and Electrolux (Sweden) by introducing a range of vacuum cleaners (EuroClean). However, it’s now famous and most significant introduction came in the space of water purifiers (WP) in 1984 in the name of Aquaguard, making them the first ever WP producer in the country. EFL was part of the Shapoorji Pallonji Group until February 2022 when EFL was carved out from its parent, listed on the stock exchange, and whose majority stock (72.56%) was bought by Advent International, a private equity firm (out of this, Advent recently offloaded 10% stake in the open market). The intent was to turnaround the company given its strong positioning in the WP space by bringing in professionals and streamlining operations. Its current CEO, Mr. Pratik Pota was part of Jubilant FoodWorks previously and since his appointment in August 2022 has built a team of professionals over the last 1-1.5 years.

We see several levers for earnings growth for EFL over the next 5 years:

- Increase in WP category penetration in households (currently ~5%) backed by improved tap water supply/electricity, increased product awareness and initiatives undertaken by WP companies to make the product affordable (rental model, financing etc).

- Competitive advantages around brand, an established sales distribution channel and shaking off the complacency/lethargy of the past by focussing on product innovations should hence forth enable EFL to maintain its market leadership in WPs.

- Greater focus on higher margin service AMC and spares through lowering the entry points for AMC, taking initiatives to plug grey market proliferation and increasing share of modern trade.

- Scope for margin expansion through improving AMC mix, better vendor pricing from higher volumes and focus on reducing overheads.

Thanks to the above, we expect a healthy earnings growth trajectory for the Company in the next few years. The Company also enjoys a strong negative working capital cycle thanks to AMC payments received in advance. Any attrition in senior level management represents key risks to the above investment thesis.

- Godrej Agrovet

Godrej Agrovet is a diversified agriculture company, that is involved in manufacture and marketing in the following segments:

– Animal Feed – cattle, aqua (fish, shrimp) and poultry;

– Vegetable Oil (Crude Palm oil);

– Crop Protection and Science (Herbicide, Pesticide and through 64.8% owned subsidiary – Astec LifeScience);

– Dairy through 51.9% owned subsidiary Creamline Dairy Pvt. Ltd.; milk and milk products); and

– Poultry and Processed Food (live chicken, Real Good Chicken, Yummiez) carried through 51% JV.

Since its Initial Public Offer in October 2017, the Company witnessed muted trends in profitability (FY18- 23 EPS CAGR of 6%) impacted by Covid-19 and volatility in commodity prices (finished products as well as inputs). However, we expect a much better outlook for the Company’s earnings going forward driven by favourable government policies such as National Mission on Edibile Oils – Oil Palms (NMEO-OP) and Pradhan Mantri Matsya Sampada Yojana (PMMSY) which are likely to favourable impact the growth/earnings of the Vegetable Oils and Fish feed businesses respectively. The Company’s focus on driving value added product sales in the diary business and strong partnerships with Nissan Chemical Corporation, Japan in the crop protection business are also likely to aid the consolidated net earnings growth.

- Carysil

Carysil started as a manufacturer of quartz sinks (FY23 – 52% revenue mix) & over time diversified into adjacencies like stainless steel sinks (13%), kitchen appliances/bath products (11%) & solid surface tops (25%). Carysil started with Quartz sink exports to Europe and US. Carysil’s customers are building material companies/retailers like IKEA, Grohe, B&Q, Menards, Lowe’s, Home Depot.

Quartz has been taking share from Stainless Steel sinks due to better aesthetics. We expect Quartz sink market to grow in double digits as market share shifts continue from Steel. Carysil makes quartz sinks through “Schock” technology- globally only a handful of companies have this technology such as Schock in Germany, Blanco in US, Franke in Switzerland, and Carysil in Asia. Schock technology and know-how serves as a strong moat for the company and acts as an entry barrier. Furthermore, out of the above players who have Schock technology, all except Carysil have plants in US or Europe and hence are at a cost disadvantage compared to Carysil. Currently Europe is the biggest market for kitchen sinks followed by North America. It is aiming to further penetrate into GCC (six Arab countries Bahrain, Kuwait, Oman, Qatar, Saudi Arabia & UAE) and India.

Overtime the firm has expanded into adjacencies like premium stainless-steel sinks, quartz surface tops, kitchen appliances (hobs, wine chillers), sanitaryware & bath fittings. Carysil has a history of doing M&A to enter new geographies or new categories in UK & USA at attractive valuations. Revenue & PAT has grown at 25% CAGR and 33% CAGR over FY18-23.

Exits from the portfolio

- Galaxy Surfactants

We have been trimming the position in Galaxy Surfactants Limited due to the downgrade in the earnings growth expectations owing to persistent challenges around its Africa, Middle East and Turkey (AMET) business and generally weak volume growth across key regions. Given the resultant relatively low IRR expectations, it was further decided to fully exit from the stock.

- Metropolis Healthcare

The investment team have downgraded their earnings projections for Metropolis on the back of lower revenue per centre from the Tier 2/3 expansions. This results in 1% decline in blended revenue per centre vs our earlier expectation of positive growth in this crucial parameter. Metropolis’ track record on the execution front has been patchy due to management changes/bandwidth issues which doesn’t give us confidence to assign a higher than 30x exit multiple for the stock – further impacting the expected IRR from P/E de-rating. Hence, on a relative basis, it was decided to exit from the stock.

Changes to the Rising Giants PMS model portfolio (as on March 31, 2024)

Additions to the portfolio:

- Motilal Oswal Financial Services

Motilal Oswal Financial Services (MOFS) is a financial services group which runs various businesses like asset management (both private and public), retail and institutional broking, wealth management and affordable housing finance. The group has been in existence for over 3 decades run by 2 promoters (~70% shareholding) who have been able to compound BVPS at 22% CAGR over the last decade after paying out 20-25% of operating PAT as dividends/buy back. MOFS capital markets business has a differentiated client franchisee and will gain from financialization of savings.The company’s asset management business is seeing a turnaround in fund performance with majority of funds delivering alpha resulting in resurgence of flows and increase in market share. MOFS has significantly invested in its wealth management business which is now bearing fruits with AUM growth upwards of 35% YoY, its HFC has also seen a turnaround with RoE expected to be above CoE in FY25. Valuations for the group are attractive, adjusted for treasury investments (at 1x book value), core business is available at ~16x FY25E PAT.Risks – any sharp downturn in capital markets could impact profitability as most businesses within the group are linked to capital markets. - Eureka Forbes: Please refer to the write up under the Little Champs section

Exits from the portfolio

- Galaxy Surfactants: Please refer to the write under the Little Champs section

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Copyright © 2024 Marcellus Investment Managers Pvt Ltd, All rights reserved