Globalisation has been an important growth driver for Little Champs. However, several headwinds (geopolitical issues, rising energy costs and rising interest rates) in some export markets like Europe have raised concerns around Little Champs with significant global exposure. The fact that historically the impact of crises in the West has had limited impact on Indian exporters and the resilient end-user demand for most portfolio companies give us comfort that the Little Champs can deal with the prevalent headwinds. In fact, we expect locational advantages in manufacturing alongside strong balance sheets, a thriving domestic business and ramp-up in investments in recent years to facilitate market share gains for the Little Champs.

Performance update for the Little Champs Portfolio

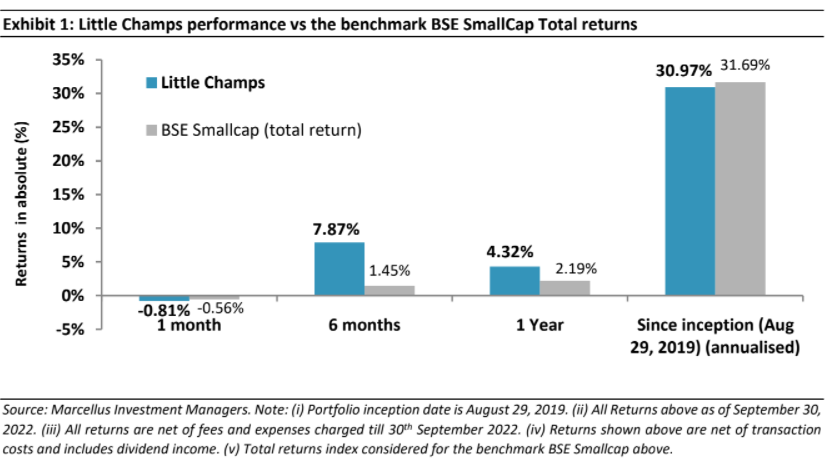

At Marcellus, the key objective of our Little Champs PMS is to own a portfolio of about 15-20 sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. While we intend to fill our portfolio with companies having the above attributes, we want to stay away from names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not getshared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Little Champs well positioned in the current global turmoil

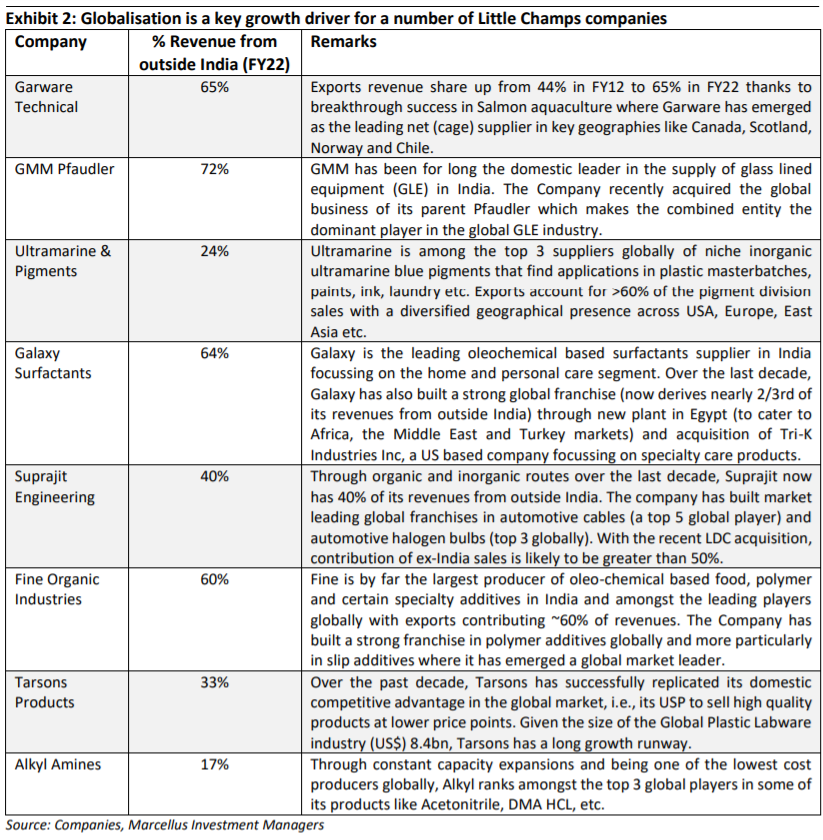

Globalisation – an important growth strategy for Little Champs: In our previous Little Champs newsletter, we have described how Little Champs have used globalisation as a growth strategy by replicating their domestic success factors (across products, process and people) on a global canvass. Out of the total 16 companies currently in the Little Champs portfolio, half of them have sizeable exposure to the global/exports business as can be seen in the exhibit below.

However, there are near term headwinds in key export markets like Europe: Currently, some of the key export destinations particularly Europe are marred by headwinds around geopolitical issues, high energy prices, volatile currencies and rising interest rates. Consequently, for the LCP companies having global exposure (those highlighted in exhibit 2 above) there are concerns around the likely impact of these issues on the LCP’s growth and profitability prospects.

Why are we sanguine about Little Champs’ prospects amidst the global turmoil?

While we admit the near-term scenario for export/global markets is uncertain, we derive confidence about the medium to longer term prospects for the global businesses of Little Champs from the following points:

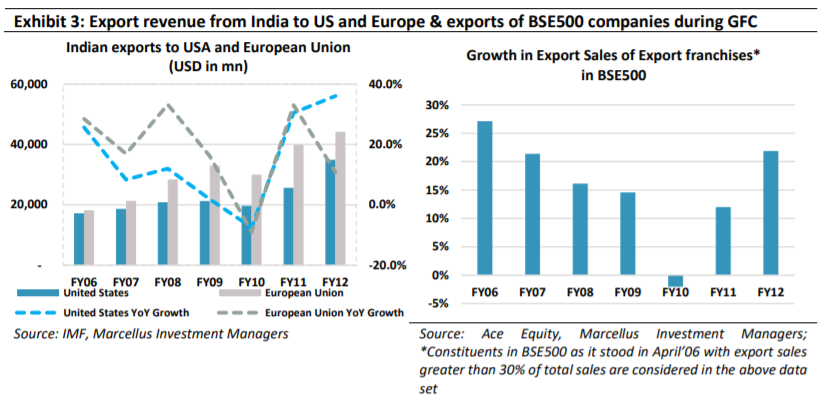

1) Historically, recession in the west has had only short-term impact on Indian exporters While the 2008 financial crisis resulted in a dip in the revenues of the Indian exporters (based on data from IMF) in FY10, export demand bounced back sharply in FY11 indicating the temporary impact of the financial crisis. Similarly, if we restrict the analysis to BSE500 companies, export revenues for BSE500 companies having export exposure >30% of the revenues declined in FY10 but growth returned at a healthy pace over

the next two years.

2) The resilient end-user demand for most export oriented Little Champs

Products sold by the majority of export oriented Little Champs cater to essential end-user Industries like pharma, food, etc which tend to have resilient demand even at times of recession. Here are some examples of such industries catered by Little Champs:

▪ Garware generates 70% of its total revenue from food related industries like Salmon Aquaculture, Agriculture, Fishing, etc. Similarly, Fine Organics also derives a significant portion of its revenue from Food related industries.

▪ Alkyl Amines and GMM Pfaudler generate a lion’s share of their revenue from pharmaceuticals and chemicals industry.

▪ Likewise, Tarsons generates 60% of its revenue from Diagnostic Labs and Pharmaceuticals industry. ▪ Galaxy Surfactants largely caters only to the Home & Personal Care industry.

3) Opportunity for Little Champs to gain market share globally amidst the crisis

While a crisis results in near term impacts, some of the greatest market shifts has been catalysed by periods of great uncertainty. For example, the proliferation of fuel-efficient Japanese cars across the world and more particularly in USA in 1970s was thanks to the fuel crisis (triggered by the Arab-Israeli war). Similarly, the Y2K crisis in way acted as a catalyst for the Indian IT services exports boom. We believe the current crisisin Ukraine, Russian and China surrounding geopolitical issues and consequent rebuilding of the supply chains (Western countries diversifying away from China) opens significant opportunities for Indian companies in general. Amidst this broad theme, we see Little Champs benefiting in particular due to the following reasons:

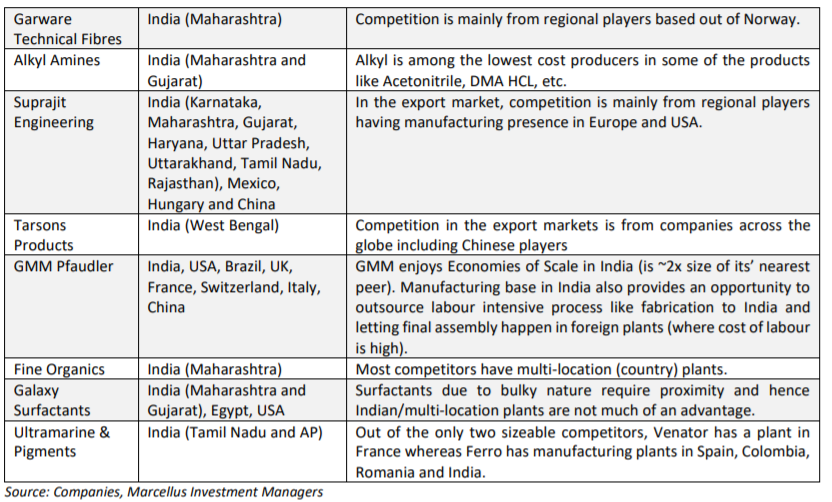

▪ Locational advantage vs regional peers: A key issue currently in the developed markets and particularly Europe is the soaring energy bills due to geopolitical issues raising the spectre of partial or full shutdown of the production facilities. Another challenge is around manpower availability which is felt across the globe but much more pronounced in the western world. In this regard, the Little Champs are relatively better placed since most of them have manufacturing facilities in India or have plants across multi countries/continents which lends them significant advantages over peers.

Strong balance sheets and a diversified revenue base

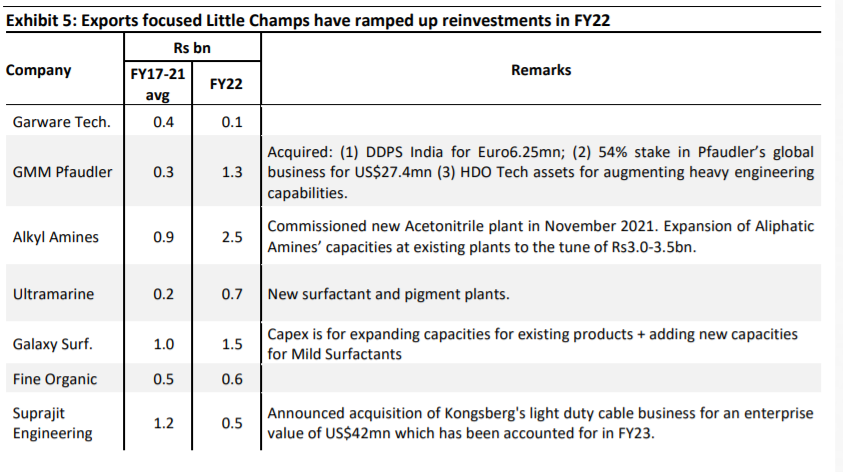

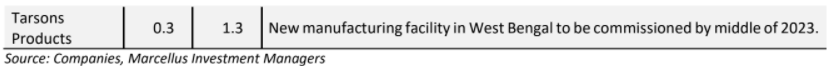

While the non-India revenues of the Little Champs may be impacted in the short term due to the challenges mentioned above, these firms have thriving domestic business which can provide support (profits and cash flows) to the overall business. Furthermore, most Little Champs have surplus cash sitting on the balance sheet. Both these factors place the Little Champs in an advantageous position – at a time when their competitors are having a tricky time, the Little Champs can continue investing in products, processes, and people. In fact, as discussed in the previous newsletters, Little Champs have accelerated investments in the last 12-24 months – see the exhibit below.

4) Lastly, we don’t expect recent currency movements to have significant adverse bearing Over the past twelve months, there have been major currency movements such as the depreciation of the Euro relative to INR which obviously reduces the competitiveness of Indian exporters. However, we see limited impact of the same on the Little Champs portfolio due to the following reasons: ▪ Most export oriented Little Champs’ revenues are diversified across the geographies. ▪ The INR has depreciated by 10% against USD. This depreciation will most likely counterbalance the impact of the Euro depreciation in the Little Champs’ earnings.