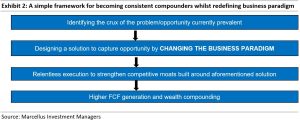

Several CCP Portfolio companies have announced business initiatives which seek to change the paradigm of certain industries – such as Titan (Caratlane), Asian Paints (Home Décor and backward integration) and Bajaj Finance (Fintech related initiatives). All of these initiatives are already profitable with a potential to leverage the existing core strengths of these companies to build strong moats and scalable revenues in these new business segments. This is exactly how many consistent compounders have disrupted their industries historically to build longevity of cashflow compounding – a) identify a challenge that presently exists in an industry; b) design a solution that changes the paradigm; c) relentless execution to strengthen the moats; and d) scale up free cashflow generation and hence wealth compounding for investors.

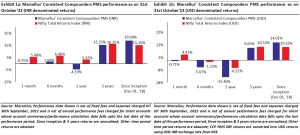

Performance update – as on 31st October 2022

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS portfolio is shown in the charts below.

“The best phones of 2005 used WAP browsers that showed only a short text summary of what a full-fledged desktop Web browser displayed. Steve Jobs’s diagnosis of the situation was that the technology was close to being capable of providing a phone that could also be a real portable Web-surfing device (and an iPod too). No market research. He simply “knew” that this was something people would want and pay for. The crux of the challenge was to create one now, while it was still hard, before technological progress made it easy.” -Excerpt from ‘The Crux: How Leaders Become Strategists’ by Richard P. Rumelt

Over the last few years, several companies in our CCP portfolio have focused on expansion of new disruptive business initiatives, such as:

Caratlane by Titan

redefines how Jewellery is used for gifting and daily wear rather than being only an occasional ‘event based’ purchase. Through wide designs of 14-18 carat gold products offered in a ‘phygital’ retail format, Titan has upended the age-old use case of an entire product category.

Bajaj Finance

is redefining how fintech companies operate by leveraging its existing customer base (rather than paying ‘customer acquisition costs (CAC)’ and hoping to monetize it some day in future). By leveraging its huge proprietary customer credit data, it plans to mine higher wallet share of its 27 million best customers (who have Rs 6-7 trillion of outstanding credit in India’s lending sector in addition to the amount outstanding with BAF) as well as offering products to a further 90 million prospects with an almost 80-90% approval rate.

Asian Paints

is redefining how renovation projects are executed by households by implementing a platform for end consumers to avail ‘Painting Services’ which will be delivered through its vast network of dealers & empaneled painters. Under its Home Décor umbrella, the ‘Beautiful Homes’ stores offer a ‘digital’ element to customers through its state-of-the-art 3D visualization platform along with touch & feel aspect for all home décor products under one roof. Additionally, the firm has announced capex towards backward integration in manufacturing of paints, putty, white cement and adhesives.

Execution of such initiatives is exactly the way Consistent Compounders have upended and dominated their industries over the past several decades. The framework followed is highlighted in the exhibit below.

In this newsletter, we discuss four examples of the paradigm shown in the above exhibit – Diagnostics, Adhesives, Innerwear and Paints.

Identifying the crux of the challenge/opportunity that existed in the ecosystem

Here are some of the challenges that existed in these industries under the old regime:

A. Innerwear: contract labour manufacturing delivered poor quality product + wholesale distribution through multi-brand outlets without trial rooms + advertising through expensive Bollywood celebrities

In a country with tropical climate and high wear and tear of innerwear, products offered by most players until two decades ago were of sub-standard quality (partly because the products were manufactured by contract labour). Marketing of men’s innerwear involved hiring expensive Bollywood celebrities. The opportunity lay in making innerwear an aspirational product alongside redefining the way the manufacturing and distribution of the product is done.

B. Diagnostics: previously executed as a B2B business with doctor incentivisation to drive patient footfalls

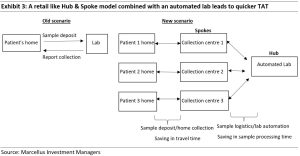

Until two decades ago, diagnostics industry in India was highly fragmented with single-lab players who incentivised local doctors to drive footfalls of patients. Laboratories that started to expand their local networks did so through a combination of both pathology as well as radiology diagnostics, which is capex heavy and hence difficult to expand significantly across geographies. The opportunity lay in reimagining pathology diagnostics as an asset light retail offering centred around rapid turnaround times through the execution of hub-and-spoke supply chain infrastructure.

C. Adhesives: previously sold as an unbranded B2B chemical

Adhesives was an underserved market before Pidilite launched chemical-based adhesives. Until then, carpenters used animal fat-based glue which lacked quality, smelled bad and had to be heated before use which was a time-consuming process. The downside of a poor-quality glue was the inability of carpenters to deliver a high quality furniture to the customer. The opportunity lay in product innovation, redefining ‘carpenters’ as the primary customers, resolving their challenges, building relationships with them and subsequently using innovative branding to also reach out to households as the end customers.

D. Paints: voluminous product, limited product differentiation, sold in a B2C manner through several layers of channel partners

Paint is a highly voluminous product with low realisations per unit volume which is sold directly to households from space constrained paint shops. Prior to Asian Paints’ dominance of the industry, paint companies in India executed the supply chain through wholesalers and distributors, offering them high channel margins. The opportunity was to create a supply chain oriented competitive advantage.

Designing the solution by redefining the business paradigm that previously existed

There are generally two ways of finding a solution to a business problem.

The commonly followed (but often unsuccessful) way is to look at examples of how other successful businesses have gone on to solve similar challenges elsewhere in the world – e.g. developed nations in North America and Europe. However, even in the same industry a copy-paste of foreign models is potentially fraught with risks because each country has its unique idiosyncrasies. Our 25 Jan’22 blog discussed this aspect using the case study of Sherwin Williams vs. Asian Paints – the path taken by each firm differed even as the end goal was the same.

The other way to go about finding a solution is to think first-principles and then find a novel solution – all the while building your own competitive advantages around the said solution.

Jockey was able to make innerwear, an aspirational product

Before Page Industries launched Jockey in India in 1995, innerwear was a category which was sold as a mass focussed generic product. The industry structure was such that it used outsourced/contract manufacturing, wholesale-oriented distribution and marketing involving expensive Indian celebrities. Jockey changed the existing paradigm in three ways:

(a) Product differentiation around comfort & durability through indigenized product development, in-house manufacturing, backward integration for elastic and procuring high quality RM;

(b) Unique approach to brand building through use of Caucasian models for product advertisement – creating an international brand image; and

(c) Building a distributor-based channel and EBO (exclusive brand outlet) network to showcase the product rather than a wholesale-based channel which is primarily driven by margins. This helped Jockey establish a direct connect with the retailers/ end consumers, sell a wider range of SKUs as well as bring efficiencies in the distribution supply chains.

Dr Lal Pathlabs changed the paradigm by becoming a retail company.

The business models that exists for diagnostics chains in countries like the USA cannot be applied in India. In the US, diagnostics is more of a B2B industry, where reimbursements from Health Plans or Insurance companies accounts for more than 90% of business. Thus, the Health Plans or Insurance companies negotiate prices with diagnostic chains and influence the patient’s decision-making. In India, diagnostic charges are borne by the patient; so, the industry has evolved into a service industry competing on consumer convenience (rather than being focussed on the clinical or medical side).

Diagnostic chains like Dr. Lal Pathlabs moved away from doctor incentivisation, towards a hub-and-spoke supply chain led retail business model by: (a) Going closer to the customer through gradual expansion of Collection Centres & Labs, and (b) Optimization of sample logistics and lab automation to reduce report generation time.

For context, LabCorp, and Quest Diagnostics – the two largest diagnostic chains in the US, do a business of around USD 7,000mn-7,500mn each (i.e., Rs 50,000 crores to 55,000 crores) and have only ~2,000 collection centres each across the entire nation. In contrast Dr. Lal’s has revenues of ~USD 200mn (i.e., Rs 1,400crs) through ~3,700+ Collection Centres.

Pidilite created a brand in a B2B commodity product

Pidilite’s promoters redefined an erstwhile unbranded, commodity B2B product category by combining their chemistry skillsets along with influencer marketing and advertising. Fevicol was launched as a synthetic resin-based adhesive to replace the traditionally used animal fat glue (which as discussed earlier required pre-heating and hence made the entire process time-consuming). At the time of launch however carpenters were not aware of benefits of chemical-based adhesives. Pidilite started marketing directly to the influencer (i.e., the carpenter) about benefits of chemical-based adhesives and this approach which went on to become one of the biggest strengths of Pidilite.

Pidilite focussed on R&D led innovation alongside influencer marketing to create a highly influential brand in an erstwhile underserved commodity market. Pidilite has built a virtuous loop wherein, feedback from the ground is gathered using its strong connect with the carpenters. This feedback is then used by the R&D team to launch innovative products made to address a specific need (e.g., Fast drying adhesive, Spray based adhesive). Over the years Pidilite has launched products like HeatX, Hi-Per, Marine, etc which we estimate contribute to more than half of Pidilite’s B2C adhesive segment sales. Moreover, Pidilite has had one of the most innovative marketing campaigns around its products over the last three decades.

Asian Paints redefined the paradigm by becoming a logistics company

Before solving the problem of supply chain in paint distribution, Asian Paints first made the construct incrementally difficult to operate in – all layers of wholesalers and distributors were removed, and then the margins for the paint dealers was compressed down to low-single digits (vs at least 15%-30% margins earned by dealers on the high street in various industries).

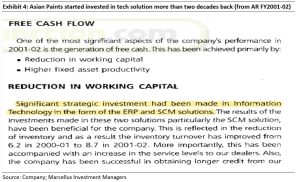

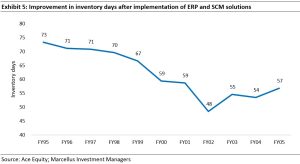

Low margins for the paints dealers meant that the only way for the dealer to generate a healthy ROI was through rapid inventory turns with 2000+ SKUs via 150+ depots currently across India. Asian Paints invested in its logistics infrastructure in order to develop the ability to maintain low inventory level at any point of time with order delivery from depots to dealer shops happening within 3-4 hours. This has been enabled by proactive investments in technology which enables the company to forecast demand with high accuracy at the SKU level. Such accuracy and intricate forecasting ability also feeds into its ability to optimize production at its plants.

Investments in technology to build a deep supply chain oriented moat didn’t start recently. The exhibit below is from Asian Paints’ annual report published 20 years ago and such incremental investments have continued ever since.

Investment Implications

Great businesses become successful, first by identifying key challenges that exist in a particular industry and then developing a solution around it. In doing so, they change the business paradigm itself. The four CCP case studies discussed above have, as a result, generated healthy and consistent compounding of fundamentals historically, as summarised in the exhibit below.

More importantly, the true test of a consistent compounder is to not rest on their laurels post such success. They should further deepen their moats through constant reinvestments (~30-60% of FCF for firms discussed above) to both garner scale as well as increase the quality and breadth of their products/services.

In that regard, it is encouraging to see the last two years’ capital allocation initiatives taken by CCP portfolio companies such as Page Industries (supply chain automation), Bajaj Finance (fintech), Titan (Caratlane, Eyewear turnaround, experimenting saree retail, etc), Asian Paints (Home Décor, backward integration), Pidilite (Araldite acquisition), HDFC Life (Exide life acquisition), ICICI Lombard (Bharti Axa acquisition), etc.