In this month’s Little Champs newsletter, we delve deeper into Rainbow Children’s Medicare (Rainbow), one of the new additions to the portfolio. Rainbow, founded in Hyderabad in 1999 by Dr Ramesh Kancharla, focusses only on pediatric and maternity care. The Company stands head & shoulders above its like-to-like peers on profitability and growth metrics and ranks ahead of most multispecialty hospital businesses on key operating and financial metrics thanks to: (i) A strong business model created around high-quality pediatricians (specialising in complex pediatrics), 24*7 doctor availability; and (ii) A hub and spoke model enabling low capex but high revenue per bed. The Company has witnessed success beyond its core Hyderabad market in recent years and also built maternity care as an important growth driver. Key person dependence, execution issues in Delhi-NCR and potential over-capacity in the sector are key risks.

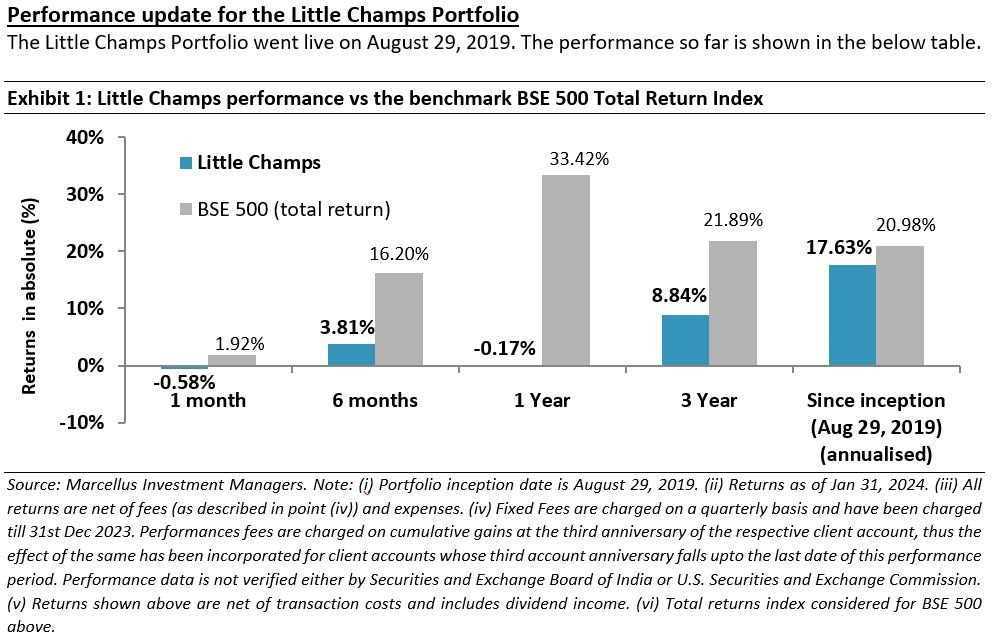

*For relative performance of particular Investment Approach to other Portfolio Managers within the selected strategy, please refer this link. Under PMS Provider Name please select Marcellus Investment Managers Private Limited & select your Investment Approach Name for viewing the stated disclosure.

Significant new additions to the Little Champs portfolio in the last few months

Since July 2023, we have added 10 new stocks to the Little Champs portfolio: (i) Rainbow Children’s Medicare; (ii) RHI Magnesita India; (iii) PDS; (iv) Cera Sanitaryware; (v) Tega Industries; (vi) Control Print; (vii) Everest industries; (viii) Ami Organics; (ix) Shanthi Gears; and (x) City Union Bank. On the other hand, we have exited from V-Mart Retail, Paushak and Home First Finance. The brief rationales for all the above additions and deletions have been shared with you in the monthly portfolio updates.

In this LCP newsletter, we delve deeper into reasons for adding Rainbow Children’s Medicare in the portfolio.

Why we invested in Rainbow Children’s Medicare?

Rainbow Hospital – focussing on niche pediatric and maternity care: Rainbow Children’s Medicare Limited (Rainbow) was founded in Hyderabad in 1999 by Dr. Ramesh Kancharla (pediatrician) & Dr. Dinesh Kumar Chirla (neonatal surgeon) as a pediatric multi-specialty hospital (~70% of revenue today comes from pediatrics). In 2009, the company forayed into maternity care (gynae/obstetrics) which now accounts for ~30% of Revenue. As of today, Rainbow operates 17 hospitals with a capacity of 1,715 beds and 3 outpatient clinics in six cities viz. Hyderabad, Bangalore, Chennai, Vijayawada, Vizag, and Delhi.

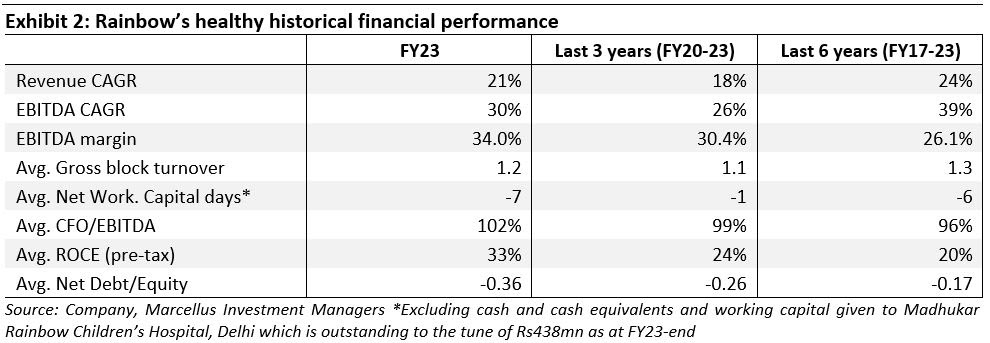

Healthy historical financial performance: Over the last 1/3/6 years (ending FY23), the Company has delivered consistently healthy financial performance with strong double-digit growth in Revenue and EBITDA. Helped by a healthy operating margin as well as negative working capital days, RoCE and cash generation have been strong resulting in a net cash surplus as at FY23-end.

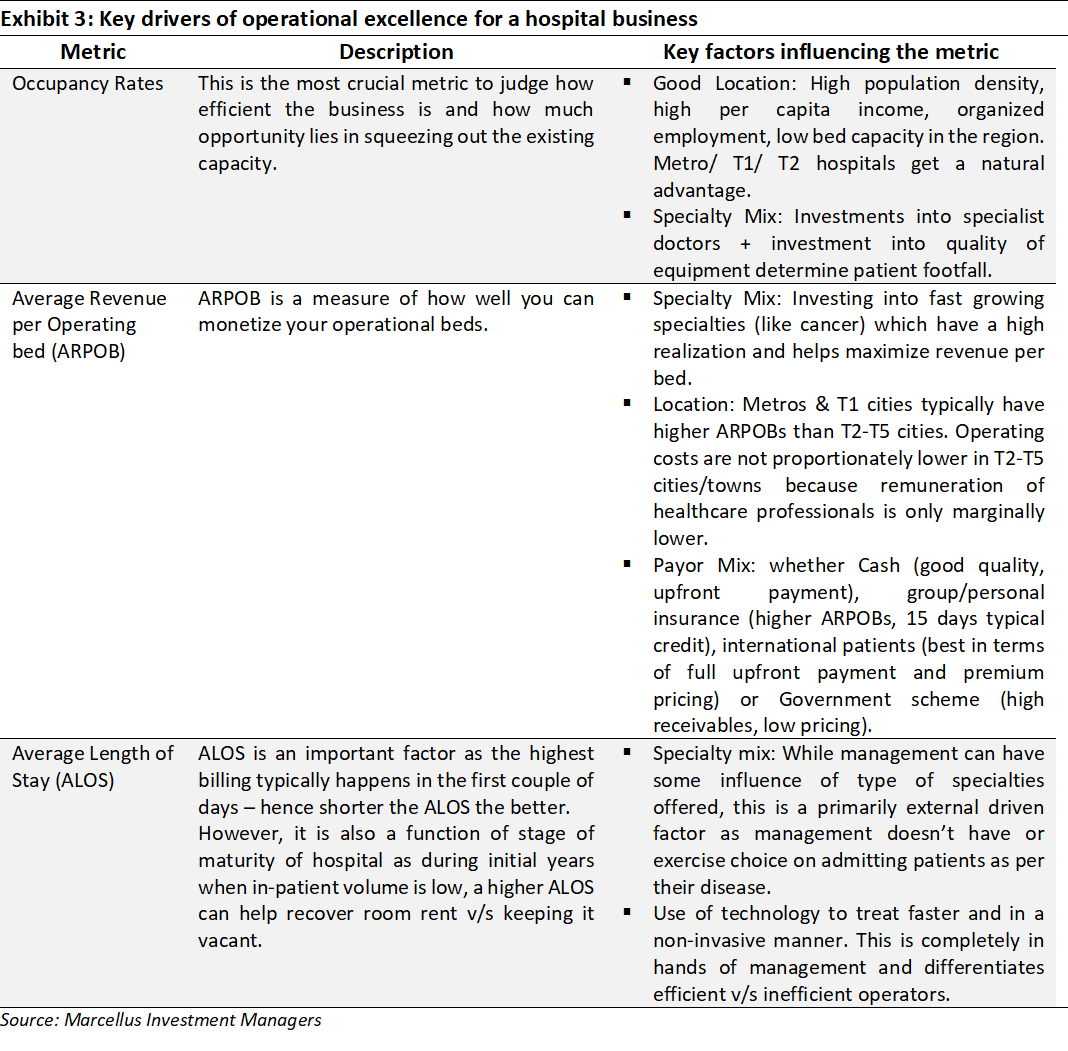

What defines the success for a hospital/hospital chain?

The exhibit below lays out our understanding of the critical drivers of operational excellence in a well organised hospital business in India.

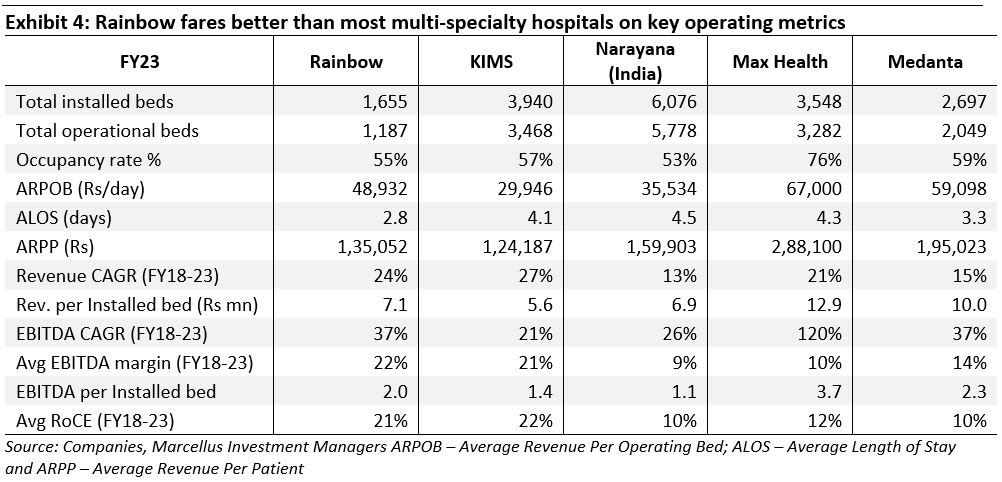

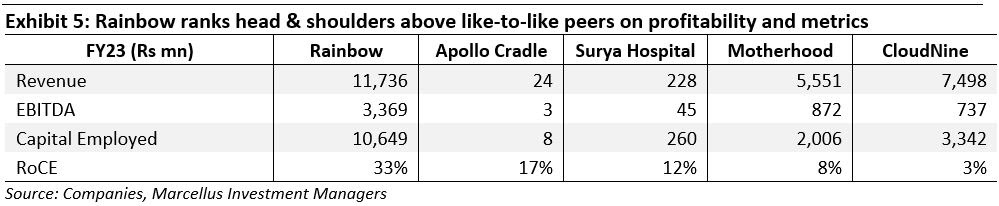

Rainbow has superior profitability metrics

Mother & child-care hospitals tend to have lower occupancy rates than adult hospitals due to: (a) the seasonality of business; (b) the length of stay for birthing is lower relative to other procedures, (c) lower contribution from government schemes; and (d) the presence of NICU beds which is reserved for babies with age up to 30-40 days and cannot be used for other pediatric procedures. However, higher ARPOB and lower capex per bed makes up for Rainbow’s lower occupancy rates. As a result, Rainbow generates superior ROCEs relative to peers.

We believe the key reasons why Rainbow is able to rank high in the above operational metrics boils down to:

Success factor #1: The Flywheel effect: Quality & Breadth of Doctors <> High Patient Footfall

A. Rainbow’s unique 24*7 doctor availability model: Pediatrics is based on emergency cases procedures and frequent night-time cases. Simply put, children don’t stop crying in the night if they are unwell and hence must be rushed to the doctor. Hence, almost 50% of hospital admissions happen in the night. Thus, the presence of a consultant doctor in the night shift becomes crucial. The doctor roster is typically of 3 types: (i) Resident – fresher MBBS; (ii) Jr. Doctor – 5+yrs experience post MBBS & (iii) Senior Doctor/Consultant. The trust element is highest with the Junior & Senior Doctors, but in most hospitals the senior doctors normally don’t stay for the night shift. Rainbow overcame this by creating a culture of night shifts for every level of doctor. The promoters – Ramesh Kancharla & Dinesh Chirla – would themselves work night shifts, leaving no excuse for any other doctor to not work the night shift. This allowed Rainbow to offer an added differentiation which led to its popularity first in the Hyderabad medical fraternity and overtime with consumers.

B. Rainbow’s ability to attract high-quality pediatricians: Hospital is a people business and hence the ability to attract high-quality pediatricians is critical for success. In our interactions with multiple doctors across India, Rainbow comes across as preferred employer or is seen in high regard by pediatricians because of following reasons:

- In Rainbow, the pediatrician is the the star of the hospital unlike in a multi-specialty hospital, where Oncologists, Cardiologists and Orthopaedics are the stars. Moreover, multi-speciality adult hospitals prioritise investments in equipments for Cardiac, Onco, Renal etc over pediatrics due to lower realizations. This factor helps Rainbow attract good quality pediatricians from mutli-speciality hospitals.

- Rainbow runs one of the biggest Diplomate of National Board (DNB) programmes for pediatrics in India and this creates a funnel for talent acquisition. High case volumes allow Rainbow to have DNB (fellowship) courses in-house. These are allotted by Ministry of Health basis the case volume and seniority of doctors. Every pediatric student anywhere in India will be aware of Rainbow – which creates an internal funnel of specialised talent. Multi-specialty hospitals struggle to convert DNB residents into full time doctors because there are several options for the resident to join after graduation. However, in case of pediatrics, there are very few multi-speciality hospitals out there.

- Dr. Ramesh Kancharla is a key man in the attraction & retention of doctors. He has created personal rapport with all his top doctors which has led to a non-monetary bond/culture. In monetary terms Rainbow pays the doctors at par or better than the industry. As of FY23, ~100 doctors own close to 16% of the company.

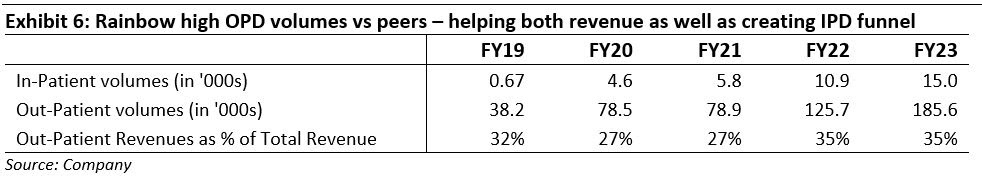

Both the above factors result in high Outpatient Department (OPD) – Rainbow’s OPD revenue as % of total sales is at 35% v/s 20% for rest of the industry. Besides generating significant revenues, this creates a strong funnel for In-Patient Department (IPD) patients.

C. Higher share of complex pediatrics: Over the years Rainbow has improved the depth & width of the specialities it offers by investing in areas like cardiology, neurology, nephrology, oncology which have higher pricing power. These specialities require investments in high-quality talent and equipment and are not easy to replicate. Rainbow would have the highest number of pediatric specialties covered under one-roof than any adult multi-specialty hospital. Over ~33% of beds are reserved for critical care in Rainbow. With the exception of Rainbow and Surya, no other mother & child hospital has this sort of capacity set aside for critical care. The journey from pediatrics to maternity is much easier than the other way round due to various challenges around talent acquisition & creating infrastructure for pediatrics.

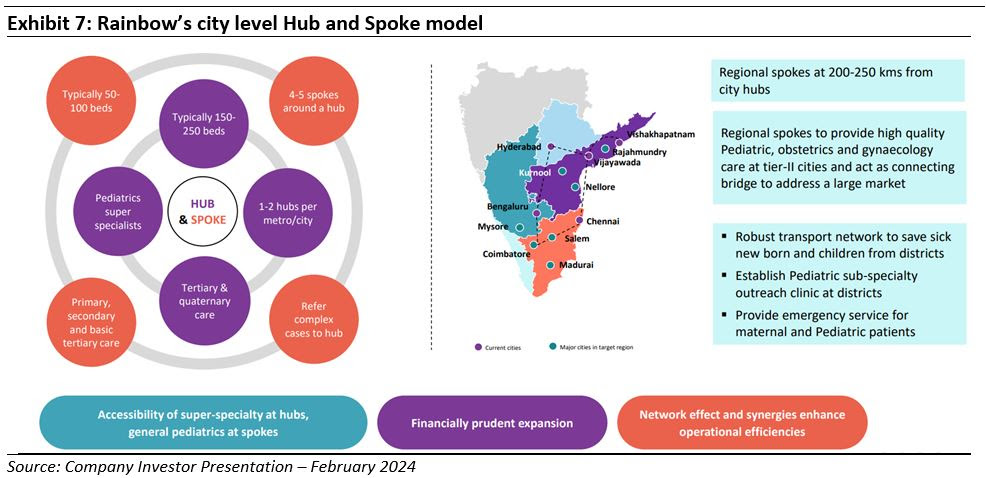

Success factor #2: Unique business model – low capex but comparable revenue per bed vs peers: Rainbow follows a Hub & Spoke business model. The strategy is to build a Hub Hospital (140-250 beds) in every major city it chooses to enter. The Hub Hospital takes care of mainly complex surgeries (tertiary & quaternary care). Then the company opens Spoke Hospitals (<100 beds) in other parts of cities for the routine stuff like health checkups, pediatricians, obstetrics & gynaecology. These spokes also help earn some ancillary revenue, but the major purpose is to acquire customers and then feed to the Hub Hospital for any complex surgeries. This model is more capital efficient way of running the business as capex requirements are lower for spokes and hubs become pure profit centres (despite higher capex) as the surgery/critical care load is high.

Rainbow incurs capex of Rs. 5-6 mn per bed for a spoke versus Rs. 6-7 mn for a hub. All hospitals are leased for a period of more than 20 years. Another factor behind Rainbow’s lower capex intensity (capex per bed is 30-40% lower than a comparable quality adult multi-speciality hospital) because equipments required for pediatrics and obstetrics are lower compared to adult hospitals.

On the other hand, the value proposition to the parents (of child patients) is superior compared to an adult multi-speciality, hence ARPOB is comparable to an adult hospital. This is driven by:

I. Intangible aspects: Firstly, most people visit a hospital because of some problems/sickness and the objective is to get out of the hospital as soon as possible, hoping to never visit again. This makes the entire experience very transactional in nature. In contrast, childbirth is a once in a lifetime event and a milestone to be cherished. This has led to emergence of mother & child hospitals which can provide superior birthing experience compared to adult hospitals. There is also a preference to take unwell children to a children hospital to avoid the chaos and negativity associated with an adult multi-specialty.

II. Higher ARPOBs: As discussed above, Rainbow offers every niche specialty in pediatrics. Rainbow would have the highest number of pediatric specialties covered under one-roof than any adult hospital. As a result, ARPOBs are comparable to peers whereas EBITDA per bed is highest despite lower capex per bed.

Is this business model scalable?

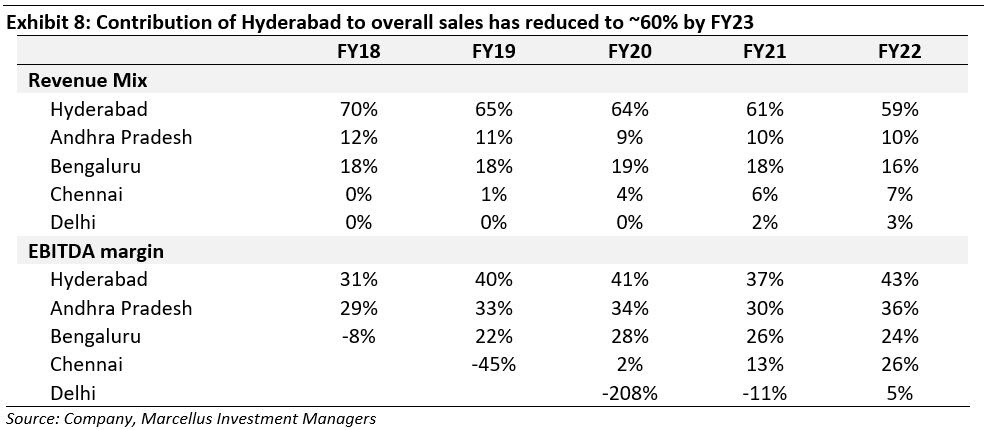

I. Success beyond the core Hyderabad market: In the last five years Rainbow has entered four new clusters where it has experienced initial success viz. Andhra Pradesh (Vijayawada, Vizag), Bengaluru, Tamil Nadu, and Delhi NCR. The share of revenue from Rainbow’s home base of Hyderabad has reduced from 70% to ~55-60% over the last five years. Multi-specialty pediatrics hospital is an under-penetrated concept in India and there is a clear need on the demand side as well as supply-side as explained above for this concept to penetrate further.

II. Extending into maternity services (fertility, pre-delivery, delivery, post-delivery care): In 2009, Rainbow started maternity services to make the birthing experience safe for both the mother and baby specially in case of high-risk pregnancies. It has now built the full spectrum of obstetrics, gynaecology, and fertility care services and would launch maternity services from all hospitals. There is synergy between pediatrics and maternity due to shared infrastructure and doctors which leads to higher sweating of assets. Since FY19, delivery count at Rainbow has increased at a CAGR of 10% from 10,000 to 15,000 in a year. This is a significant number when compared to Cloudnine which is the leader in birthing and does ~25k deliveries in a year. The birthing business today contributes close to 30% of Rainbow’s topline. Parents are increasingly opting for Rainbow type set-ups over traditional nursing homes for superior customer experience. Moreover, this acts as a funnel for NICU’s and post-birth care like vaccinations, etc.

Risks:

I. Key person dependence risk: Dr. Ramesh Kancharla is the key factor behind attraction & retention of high-quality doctor talent along with execution of day-to-day business, strategy & capital allocation. In the last 5 years, 4 COOs have left the organisation suggesting challenges to successfully delegate day-to-day execution to professionals which we think is required given hospitals is an execution heavy business. Rainbow has hired a new COO recently, but we would like to see more stability in this function.

II. Execution issues in Delhi NCR: Rainbow’s progress in Delhi NCR has been slow. ~45% of new bed additions that Rainbow has announced will come in Gurgaon. While the macro is supportive (high population of white-collar professionals), there is a difference of culture in North India v/s South India which meant that most South based hospitals have struggled to succeed in North.

III. Sector is prone to capital cycles: The hospital sector is prone to capital cycles impacting occupancies and economics of the business. Due to strong financial performance over the last 3-4 years, a lot of fresh capital is coming into the sector which could create pressure on occupancies and increase competition for doctor talent. Pediatrics, however, has not seen any large capex announcements from new players due to its niche market size i.e. the market is not yet large enough to evoke interest of large hospital groups.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/