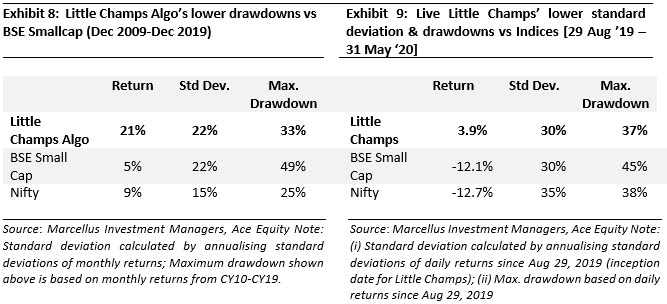

An analysis of BSE Smallcap’s performance over CY10-19 indicates that sharper falls (drawdowns) during market downturns and higher frequency of such falls are key reasons for its relative underperformance vs Nifty and BSE500. Therefore, the need to protect capital in a downturn is equally, if not more, important than chasing returns. Put simply, compounding from a larger base consistently generates significantly better returns than compounding at a faster pace but on a much smaller base. Given that our Little Champs portfolio not only generates higher returns than BSE Smallcaps, it also has much lower drawdowns, our portfolio appears to be on the right path.

Performance update of the live Little Champs Portfolio

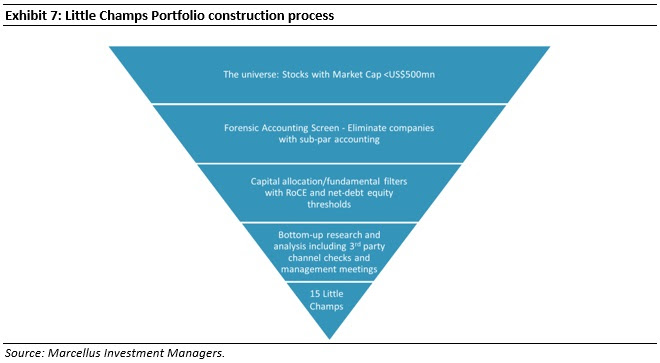

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs.

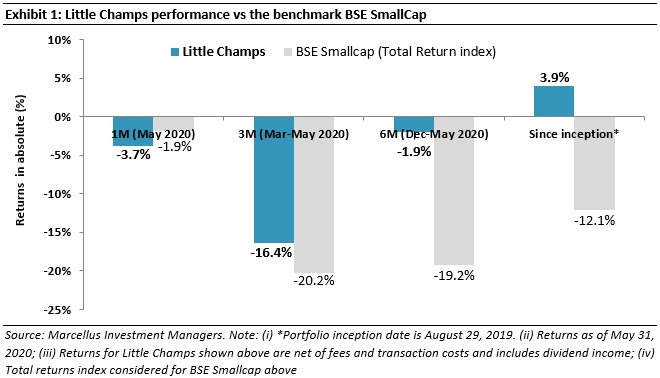

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Minimising risks is central to making returns in small caps

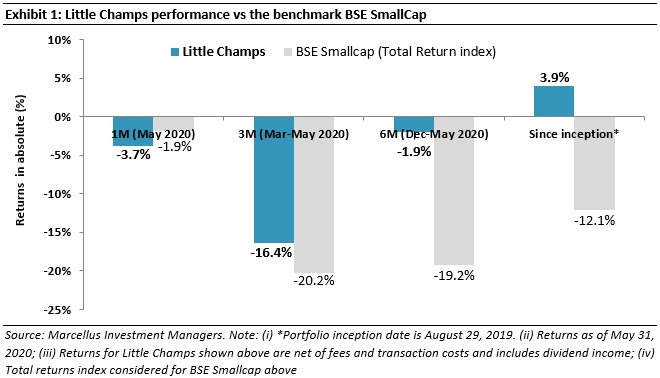

From December 2009 to December 2019, the BSE Smallcap index has delivered a total return CAGR of 6.3% compared to the Nifty’s 10.4% and BSE500’s 10.2% over the same period (these returns include dividends & buybacks). While the BSE Smallcap has had periods of relative outperformance against these larger cap indices over this ten-year period, such outperformance has not bridged the deficit created by:

- Much sharper falls for BSE Smallcap during market downturns– the maximum drawdown for BSE Smallcap has been much sharper at 49% between December 2009-December 2019 compared to 25% for BSE500 and 22% for Nifty. Furthermore, as highlighted in exhibit 2 below BSE Smallcap fall has been much sharper than Nifty during periods of market downturns; and

- Relatively higher frequency of ups and downs– BSE small cap index fell by more than 5% MoM for 22 months between December 2009 to December 2020 compared to 10 months for Nifty and 12 months for BSE 500.

In other words, we believe the key reasons for BSE Smallcap’s underperformance relative to Nifty and BSE500 have been its much sharper drawdowns and much higher volatility.

Understanding how drawdown and volatility impact portfolio returns

Why minimising drawdowns is important?

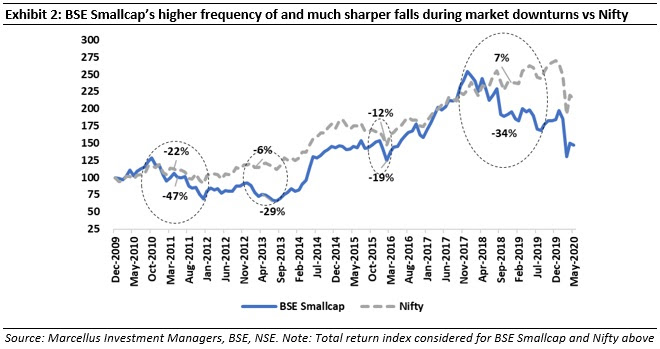

In the investment world, drawdown is a measure of decline in the value of portfolio (or any individual stock) from its peak value to its trough value over a given period of time. Simply put, drawdown means an erosion in the portfolio value. Hence higher drawdown leaves us with lower capital to generate future returns. In other words, one need to generate significantly higher returns to regain the original investment value (or make positive returns) which becomes more and more punitive with declining capital base. This is explained in a simple way in the below exhibit 3.

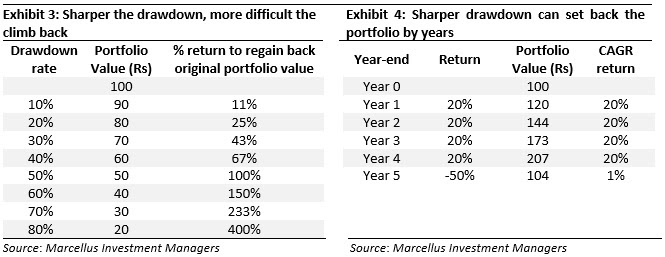

Furthermore, sharper drawdowns also negate all the returns investors may have generated previously. For instance, if a portfolio which is compounding at 20% p.a. for 4 years experiences a drawdown of 50% in the 5th year, the portfolio value will drop to a level at the start of the first year. Please refer to exhibit 4 below.

Why reducing volatility is important?

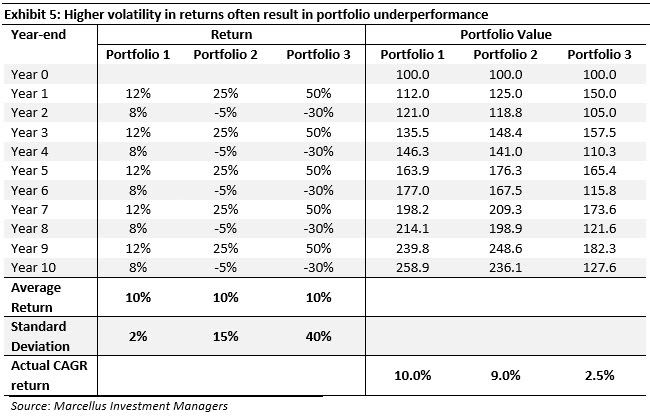

Volatility by definition means the rate of divergence around the mean return. Hence, theoretically it is possible that higher volatility does not necessarily mean ‘negative returns’. However practically in the investment world, more often than not, higher volatilities imply frequent periods of negative returns and hence negative impact on portfolio value as explained under the drawdown section above. This is also illustrated in a simple example below. All the three portfolios have similar average return over the 10-year period. But Portfolio 1 with the lowest volatility ends up generating the maximum value at the end of the 10th year – though it has lower rise during good periods it is able to maintain resilience (protect capital) during market downturns and hence generate better overall portfolio returns.

How we crush the drawdown and volatility risks in our Little Champs portfolio?

Key reasons for BSE Smallcap’s higher drawdowns and volatility vs NSE and BSE500

Basis our analysis of BSE Smallcap’s performance over the years, we believe following are the key factors driving the higher risks (volatility and drawdowns) and thereby the underperformance in small caps in general:

- Small firms’ revenues and profits tend to be more volatile than those of larger firms due to dependence on: (a) a single line of business; (b) a small group of people running the show; and (c) limited free float & trading volumes which accentuates the good or bad impacts of any macro/company specific developments.

- Most small caps are unable to survive the periods where the business cycle turns downwards. In fact, a cyclical economic downturn often structurally damages small cap companies (for example – as they enter a persistent cycle of indebtedness)

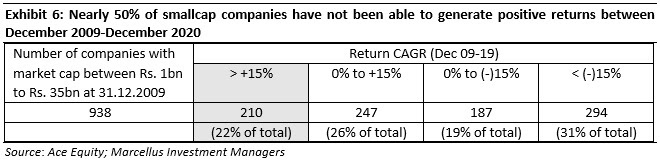

- Further, in our December 2019 Little Champs newsletter “The importance of accounting quality”, we highlighted the preponderance of fraudulent companies (shoddy corporate governance and poor capital allocation) in the small caps space. Such frauds typically come to the fore during bear markets. As can be seen in the exhibit 6 below, of the small caps (market cap between Rs1bn-35bn) at December 2009, only a small portion i.e. 22% have been able to generate healthy returns (>15% p.a.). On the other hand, a majority of the companies nearly i.e. 50% have not been able to generate positive returns between December 2009-December 2020 – mostly companies with issues around corporate governance and capital allocation.

Marcellus’ investment process to minimise Smallcap risks

Given the very nature of smallcaps, it is difficult to control the risk mentioned under point 1) above i.e. those associated with size and liquidity. However, it is possible to minimise the risks mentioned under points 2) (weak financials) and 3) (corporate governance) above through a rigorous investment process and philosophy.

Minimising risks associated with smallcap investing is central to our Little Champs investment process. As highlighted in some of our earlier newsletters, our Little Champs investment process is broadly divided into two parts:

- Use of quantitative frameworks to help shorten the large universe of more than 1,000 small caps companies into a researchable universe of 40 companies; and

- Conducting deep dive research & diligence on these 40 companies to build a final portfolio of around 15 stocks. For more details on our quantitative frameworks and bottom-up research, please refer our January 2020 and May 2020 newsletters.

The result of the above process is that we arrive at a shortlist of companies with clean accounts and which have demonstrated ability to grow efficiently (by maintaining pricing and balance sheet discipline), generate cash and redeploy that cash to grow further. In other words, these companies carry much lower risks around corporate governance and around financing than a typical small cap firm.

This is also reflected in lower standard deviation and drawdown for both the backtest of our Little Champs algorithm (i.e. just using the quantitative framework without any bottom-up research) and the performance of the active Little Champs portfolio as shown in the exhibits below.

Investment implications: Minimising risks is more important than chasing returns

Therefore, while chasing returns seems to be the most common route followed by investors, the need of protecting portfolio value in a downturn is equally, if not more, important. This is particularly true for long term wealth creation and given the higher volatility witnessed in equity markets in the recent years. Compounding from a larger base in most times generate higher returns than compounding at a faster pace from a much smaller base. Understanding and acknowledging the importance of downside protection has significant investment implications in terms of the choices of the stocks and sectors and thereby investment returns.

Regards

Team Marcellus