Marcellus’ Little Champs portfolio (LCP) aims to discover companies with a high probability of entry into benchmark BSE500 index over the next 3-5 years thus capturing the outsized returns that accrue to such potential entrants. Over the past year, some of the LCP stocks have faced temporary headwinds mainly on account of Covid-19 demand normalization, inventory de-stocking and adverse demand-supply dynamics (impacting revenues and margins). We remain sanguine about the long-term prospects of our portfolio firms on account of: (a) healthy reinvestment undertaken in FY22 & FY23 to further strengthen their franchises; (b) current valuations signalling market’s underappreciation of LCP’s longevity of compounding; and (c) historical evidence of strong share price returns post periods of weakness.

Performance update for the Little Champs Portfolio

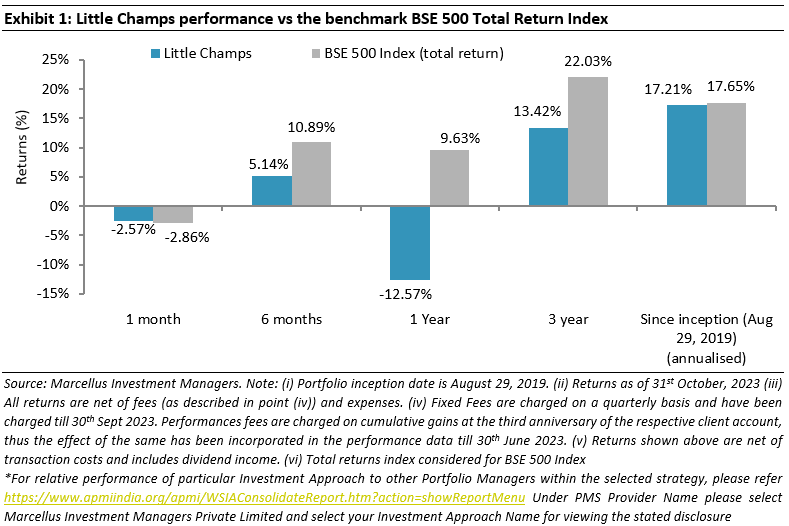

The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table

A key objective of the Little Champs portfolio is to discover the potential entrants in BSE500

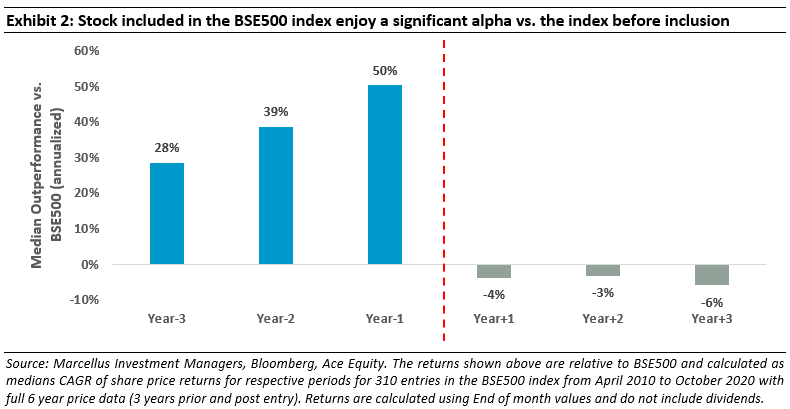

Indian small cap companies prior to entering the BSE500 are one of the most lucrative niches of the Indian stock market in terms of long-term returns. As shown in Exhibit 2 below, in the three-year run-up to entering the BSE500, these potential entrants outperform the index by 28% CAGR with the margin of outperformance increasing as they get closer to entering the benchmark index.

These returns performance above can be broken down into two main components – change in business fundamentals (FCF or profit growth) and change in valuations:

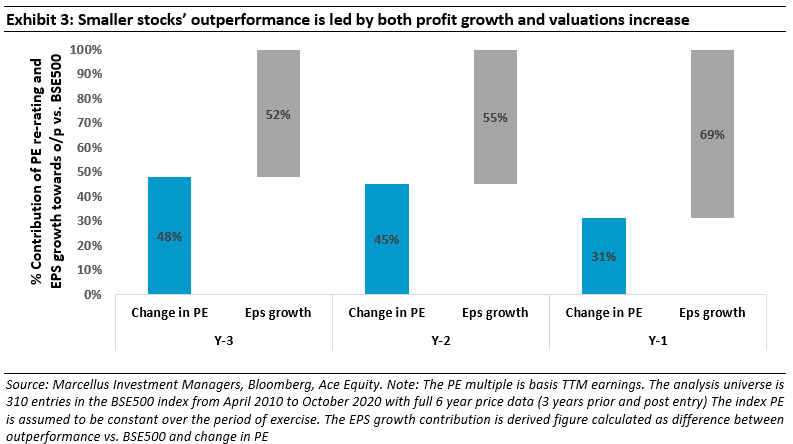

As can be seen in the chart below, profit growth is responsible for the majority of relative outperformance of aforementioned BSE500 entrants vs. the index. These entrants are able to scale up their business by successfully gaining market shares and expanding their businesses into newer geographies/product adjacencies. As the Company reaches decent size and scale, economies of scale help the company improve its profit margins and thus achieve rapid growth in profits (see the gray bars showing EPS growth in Exhibit 3).

Besides profit growth, these smaller companies typically undergo a valuation re-rating on their way into the BSE500. When these companies are small and still inventing the wheels of their business, they are largely unnoticed by the institutional investor and research analyst communities. However, once they reach a particular size, they come into the radar of investors and analysts and tend to undergo a re-rating of their P/E and P/B multiples.

Identifying relatively unknown companies with high profit growth potential and thus consequent high potential for entry into the BSE500 over the next 3-5 years is one of the key objectives of our Little Champs strategy.

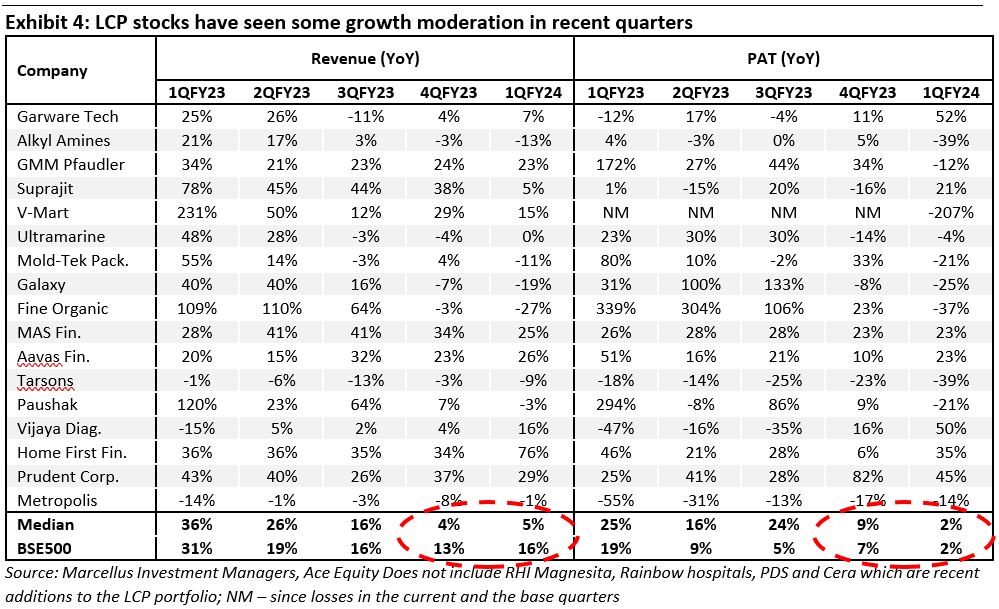

Little Champs’ earnings growth have moderated in recent quarters due to temporary headwinds

That being said, even a fast growing, high-quality company would inevitably face temporary headwinds on its path towards gaining bigger scale. Over the last few quarters, LCP stocks have seen pressure on their growth and profitability mostly on account of unfavorable macro conditions – something we remain confident will correct itself in due course.

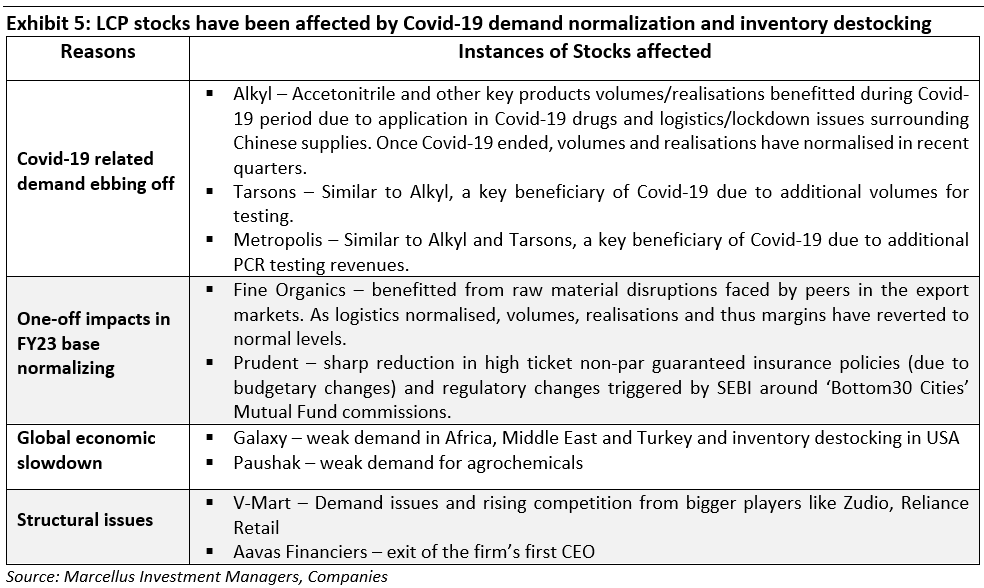

There are broadly four factors which are responsible for the above earnings moderation:

We remain sanguine of Little Champs’ medium to long term prospects

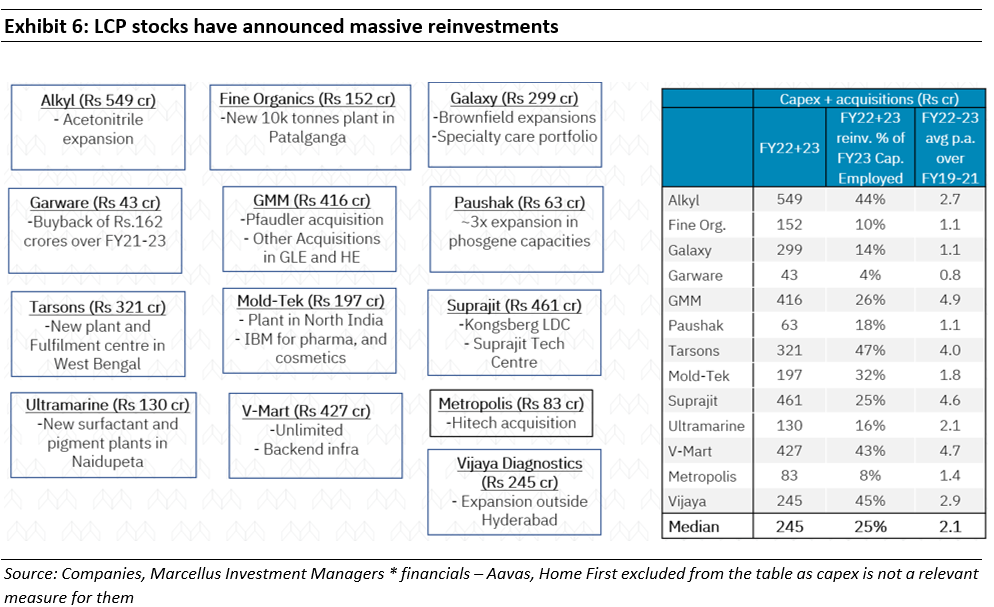

1. Little Champs continue to augment their capabilities in the face of tough macro environment

Despite the macro headwinds, Little Champs portfolio companies continued to reinvest in the business with FY22-23 reinvestment levels at more than double the level seen in the previous three years (FY19-21). This step-up in reinvestments is a result of:

- The increasing size and scale of the companies resulting in significant internal accruals (operating cash);

- Rising opportunities for consolidation due to challenges faced by many of the competitors of the portfolio companies brought upon by Covid-19, rising cost structure particularly for those having manufacturing facilities in the western geographies.

- A conscious effort to add new growth drivers by the portfolio through geographical expansion/and or new product adjacencies.

The high level of reinvestments in FY23 and recent years has provided enhanced visibility on the earnings performance for the portfolio over the next 3-5 years.

2. We don’t see structural issues for the portfolio stocks adding to our conviction of earnings recovery

Barring a couple of the names in the portfolio, we don’t see any structural issues plaguing the Little Champs portfolio stocks. Here is why we remain confident about the demand-situation for LCP firms’ products:

- Most export oriented Little Champs companies (Garware, GMM, Tarsons, Galaxy and Fine Organics cater to resilient end-user industries (Food, FMCG, Pharma) with sustainable and resilient demand which doesn’t remain under stress over extended periods of time.

- We don’t see market share loss for the Little Champs companies. As discussed in point 1, the LCP firms have doubled down on their investment in the business. This will serve them well when demand normalises. In fact, most of the LCP firms’ competitors have throttled off on investments due to severe challenges to their businesses eg. compare Alkyl Amines to Balaji Amines or compare GMM Pfaudler to HLE Glasscoat.

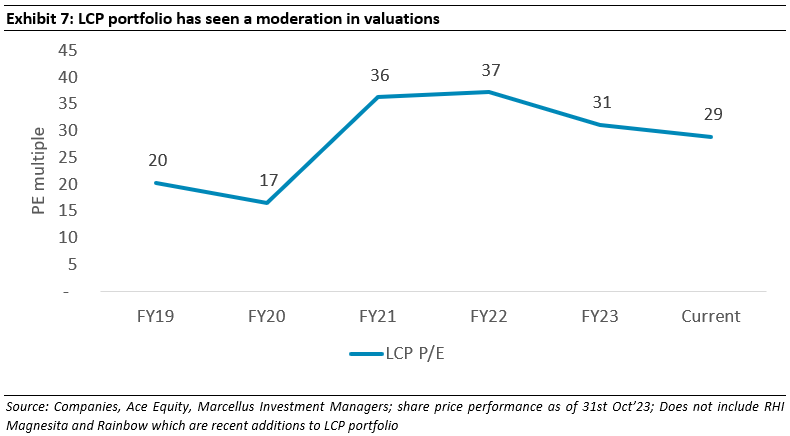

3. Current market valuation significantly undermines the franchise strengths

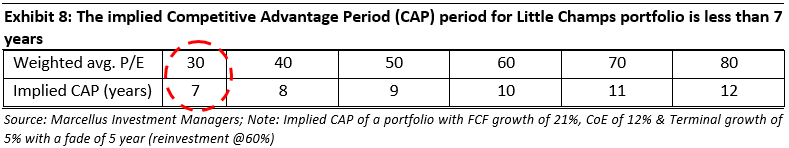

The recent correction in the LCP stocks has brought down the PE multiple of Little Champs portfolio to ~29x.

A PE ratio less than 30x implies that the market believes the firms in LCP portfolio would continue their dominance (i.e. longevity) for less than 7 years in the future – something we feel highly underappreciates the level of moats and capital allocation skills these firms enjoy. (Note: the implied CAP or Competitive Advantage Period calculated using Free Cash Flow growth of 21%, cost of equity of 12%, terminal growth of 5% with a fade of 5 years.

Let’s consider the case of GMM Pfaudler – one of the largest allocations in our LCP portfolios. The Company enjoys strong moat in its core Glass-Line Equipment (GLE) business through access to best-in-class technology from Pfaudler, long-standing relationships with customers, smart capital allocation skills and massive scale benefits – the nearest competitor is 2/3rd its size (basis standalone numbers).

Furthermore, the Company has strengthened its business in recent years through: (i) Continuous reinvestments in enhancing the glass lined capacities. It also acquired De Dietrich Process Systems’ (DDPS) Indian unit. (ii) Bought its parent Pfaudler’s International business thus gaining access to global markets, creating opportunities to bring Pfaudler’s global products to India and increasing sourcing from India for the global business; and (iii) Carried out other acquisitions to strengthen the non-GLE businesses such as mixing systems, heavy engineering, etc. All of the above has been done without impacting the balance sheet with consolidated debt-equity standing at 1x at FY23-end.

While we believe GMM has significantly strengthened in the recent years, the market seems to think otherwise: compared to GMM’s consolidated PAT CAGR of 44% over FY20-23, the share price CAGR has been a mere 10%, resulting in 1-year forward P/E derating from 52x at FY20-end to 29x currently. We believe the current P/E of GMM significantly underestimates the longevity and growth in GMM’s free cash flows.

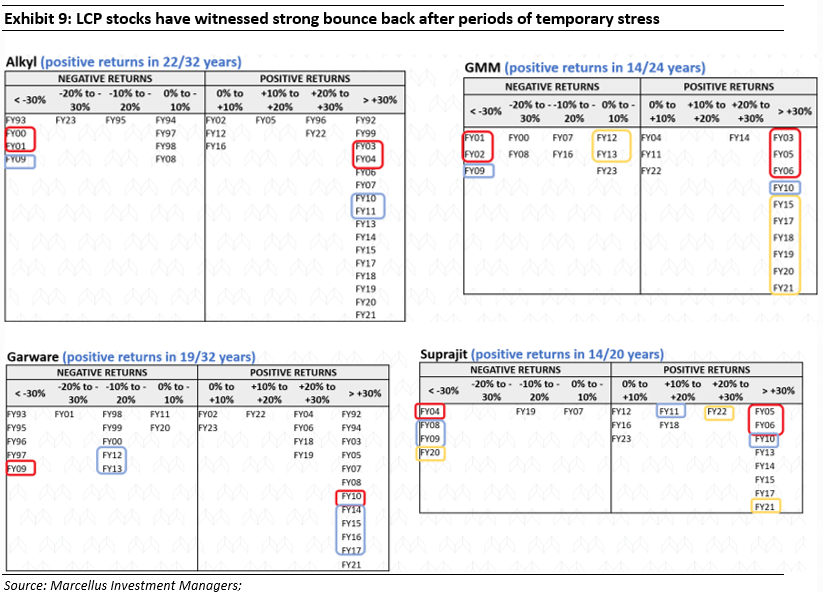

4. Portfolio stocks have seen strong bounce back in returns after periods of slowdown

Unlike many small cap stocks that tend to wither away after a brief period in the sunshine, LCP stocks have a rich history of being wealth compounders over an extended period of time. During such period however there have been phases which have seen the stocks see sharp corrections (much like the correction being witnessed currently) only to be followed by years of sharp positive returns.

The table below which highlights such instances using different colours. For e.g. Red box on left encircling FY00, FY01 for Alkyl denotes financial years with more than 30% drawdown while red box on right denotes the following years (FY03,04) which saw 30%+ returns. Blue colour denotes the next instance in FY09 when similar dynamic played out.

Changes made to the Little Champs portfolio

In the recent months we have made the following changes to the portfolio.

Additions to the portfolio:

RHI Magnesita

- Highly critical nature of refractories: Even though it accounts for ~2-3% of overall cost, without refractories the customer’s plants cannot commence production. Additionally, they go through general wear and tear and requires replacement at regular intervals, a tedious and time-consuming process entailing plant shutdowns. Given low-cost but critical impact of refractories, a customer prefers products with highest quality and longest lives, thereby reducing downtime risks.

- RHI’s Quality and R&D focus: RHIM India’ leadership in the Indian refractory market is underpinned by its superior product quality. This superior product quality is a result of RHIM Global’s high focus on R&D (1700+ active patents) and ability to continuously come out with better quality products that have longer lives. Our channel checks suggest that RHIM India is a dominant player with 40%+ market share in the Basic Oxygen furnace + Laddle segments.

- Significant reinvestments by RHIM India in the recent years: In the last 5 years, RHIM India has added various flywheels and gained new capabilities. For instance, by merging all the subsidiaries of RHIM Global into RHIM India (listed entity), RHIM Global has aligned its interest with that of the minority shareholders. Similarly, the Dalmia acquisition has further fortified RHIM India’s moat through access to an extensive manufacturing base as well as facilitating entry into the Cement/Industrial and Blast Furnace refractory segments.

Rainbow Children’s Medicare

- Rainbow Children’s Medicare, founded in Hyderabad in 1999 by Dr. Ramesh Kancharla (paediatrician) & Dr. Dinesh Kumar Chirla (neonatal surgeon) as a paediatric multi-specialty hospital (today paediatrics forms 70% of its revenue). As of today, Rainbow operates 16 hospitals with a capacity of 1,655 beds and 3 outpatient clinics in six cities viz. Hyderabad, Bangalore, Chennai, Vijayawada, Vizag, and Delhi NCR.

- Rainbow’s multi-specialty children’s hospital along with maternity is one of its kind models in India and ticks all the boxes from customer convenience and experience perspectives. Rainbow’s 24*7 doctor availability and its ability to attract & retain high quality paediatricians across specialties underpins its stellar brand creation in Hyderabad. It’s scale allows retaining existing talent (high volumes mean more money for doctors) as well as run one of India’s largest govt. approved fellowship programmes for DNB paediatrics to create a continuous talent pipeline for fresher paediatric specialists. This flywheel is difficult to replicate for any new entrant in Rainbow’s core markets.

- In the last 5 years it has entered 4 new clusters and shown signs of initial success viz. Andhra Pradesh (Vijayawada, Vizag), Tamil Nadu, and Delhi NCR. Hyderabad revenue % has reduced from 70% to ~55-60%. Rainbow is also widening its focus from doing only high-risk pregnancies in-house to regular deliveries as it has built entire spectrum of gynae, obstetrics, vaccinations in-house to widen its revenue base and create a funnel for NICU and beyond.

PDS Limited

- PDS is a sourcing platform for retailers & brands in the Western world. In its core business of ‘Design-led Sourcing’ (90% of FY23 revenues), PDS acts as a link between retailers & brands in the West and small garment manufacturers in the Far East. PDS has 250+ designers and 600+ factories associated with its platform which enables it to provide entire design to delivery of apparels to its customers.

- PDS’s key competitive advantage is its entrepreneur-driven partnership model which enables it to scale up efficiently without diluting management bandwidth and remain agile in a dynamic industry. Overtime, PDS has ventured into ‘Sourcing as a Service’ business model where it takes over the sourcing office of a brand in the Far East countries. This helps generate a steady stream of annual income and open opportunity to up-sell its design & compliance services. In FY23, PDS expanded its expertise into ‘Brand Management’ services by going up the value to take over the entire design team of brands in addition to managing their sourcing.

- In the last 5 years, PDS has grown its revenues at 17% and PAT at 73% CAGR and ended up with a ROCE (pretax) of 27% in FY23. Key value drivers for the firm going forward are increasing share of value-added business, increasing wallet share and synergies between various group companies.

Cera Sanitaryware

- Cera is the no. 2 player in the mass-affluent segment of the sanitaryware and faucets market in India. It’s a pan-India brand, with maximum revenues from the south (40% of total revenues) – a geography that is likely to continue growing faster relative to other regions. The company has grown revenues at 11% CAGR over the last 5 years, while earnings over the same period have grown at a CAGR of 16%, while maintaining an average RoCE of 20%.

- The company’s moats are built on strong distribution, continuous product innovation and introduction and an established brand image. The company has also been focusing on deepening these moats, with regular capacity expansions, steady new product introductions, and investments in manufacturing capabilities that go towards improvement in product quality and finish. Working capital cycle has come down an average 111 days during F18-20 to an average of 77 days during F21-23.

- Over the next few years, we expect to see strong a demand environment for Cera’s products. Cera is a mid-to-late cycle play on residential real estate. In the March 2023 quarter, new project launches in the top 7 property markets in India were at a decadal high. Large players such as DLF and Godrej Properties have reported record new sales bookings in F23 (up 107% and 56% respectively). These new launches would be ready for bathroom fitouts in the next 18-24 months and will translate to a surge in demand for bathware.

Exit from Amrutanjan: One of our key investment thesis for Amrutanjan revolved around its success in the Sanitary Napkin segment. However, our recent channel checks suggest that Sanitary Napkins has become a crowded space with many regional players as well as a few national players competing for market share. This has made it difficult for Amrutanjan to gain market share thus delaying the path to profitability in the Comfy segment. When the reduced estimates for Amrutanjan are fed into our position sizing framework, the result is an exit from LCP.

Regards,

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/