Marcellus’ Global Compounders Portfolio (GCP) strategically invests in 25-30 deeply moated global companies listed in developed countries, leveraging their products and services aligned with global economic megatrends, fortified by exceptionally solid moats. These elements contribute to the consistent compounding of free cash flow/earnings in the mid-to-high teens. Here, we spotlight the investment philosophy known as “owner-operators,” where CEOs/founders with significant ownership drive success. We allocate significantly to these pioneers, forging lasting partnerships for generational wealth creation.

The GCP Introductory newsletter delves into the conceptualization and construction of Marcellus’ GCP. This newsletter’s primary emphasis lies in the investment philosophy centered around companies where the founders or owners maintain active involvement in both operational and strategic decision-making processes. Within the GCP portfolio, we maintain a substantial exposure to such enterprises, often referred to as “owner-operators”.

Notable examples of GCP stocks include companies such as Berkshire Hathaway, Constellation Software, Heico, Copart, Amazon, and Hermes. These businesses share a common characteristic – owners and executives with significant ownership stakes who make long-term strategic decisions and generate wealth through prudent capital allocation.

GCP’s allocation to “owner-operators” typically ranges between 40% to 50%. This approach underlines our commitment to partnering with visionary leaders, aligning with their dedication to long-term success and wealth creation.

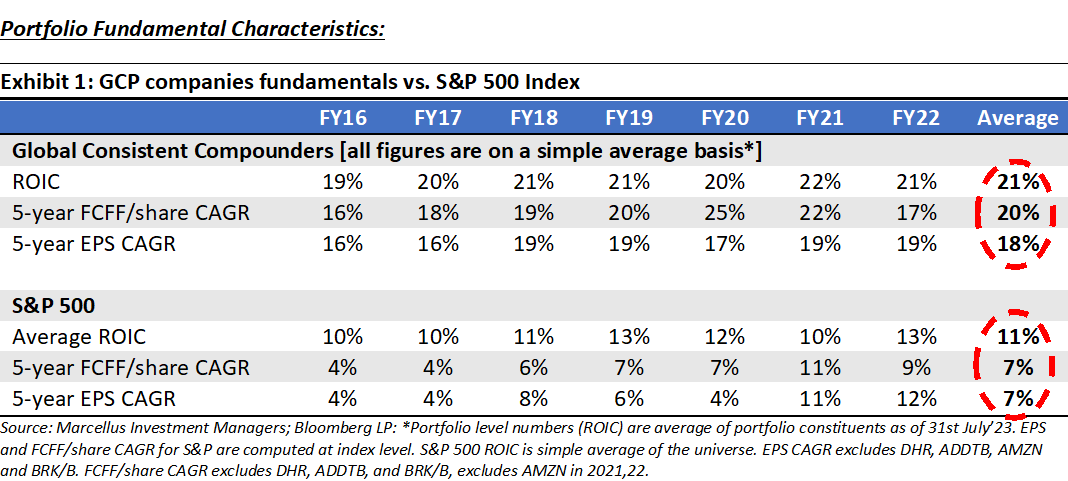

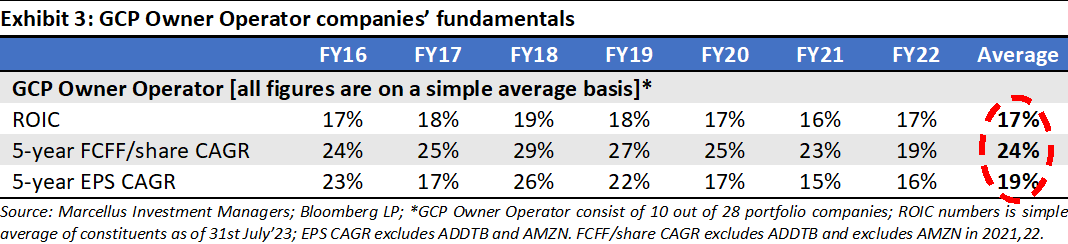

The average 5-year FCFF/EPS CAGR for the GCP Owner Operator cohort demonstrates a slightly favorable comparison with the broader GCP portfolio 5-year FCFF/EPS compounding of 20% and 18% respectively (Exhibit 1).

An ‘Unusual Billionaire’ from the east and his striking resemblance to a Billionaire from the west who transformed ‘Junk to Gold’

In the bestseller “The Unusual Billionaires” (2016), each narrative detailing the inception of some of India’s most iconic companies stands out as a unique story in its own right. Notably, one such narrative showcases the journey of Mr. Sandeep Engineer, who, in 2002/03, steered Astral away from the precipice of financial ruin. He risked everything, leveraging his personal assets to resurrect Astral from a company barely generating INR 10 million in profit in FY03 to a powerhouse projected to generate over INR 6 billion in profit by FY24, with a market capitalization nearing INR 500 billion.

This tale of resilience and audacity is similar to another story from a different part of the world – that of Mr. Willis Johnson, the founder of Copart. Faced with the stark choice between a house and a salvage yard, he and his family embraced a modest life in a trailer amidst the junkyard. Their nights echoed with the sounds of mice, and their days were colored with school bus embarrassment for their children (we highly recommend reading Willis Johnson’s Autobiography – “Junk to Gold: From Salvage to the World’s Largest Online Auto Auction”). Yet, within this unconventional existence, a dream blossomed, giving birth to Copart, now the world’s leading salvage auction operator. From a modest half-a-million-dollar profit in 1994, Copart is poised to generate a profit of USD 1.4 billion dollars in FY24.

What unites these two luminaries, despite their disparate geographies, is their shared identity as exceptional “owner-operators.” Both Mr. Engineer and Mr. Johnson defied conventions, transforming seemingly ordinary businesses (CPVC pipes for Mr. Engineer, scrap parts for Mr. Johnson) into unparalleled engines of wealth. These visionaries, marked by their resilience, ingenuity, frugality, and strategic capital allocation, transcended boundaries, redefining the very essence of success in the world of business.

Owner-Operators tend to transcend established norms, leading to outperformance: it is a Global Phenomenon

The prevalence of “owner-operators” among prominent examples in “The Unusual Billionaires” – such as Asian Paints, Berger Paints, Astral, Marico, and Page Industries – comes as no surprise. In India, substantial wealth creation has historically been attributed to large promoter families.

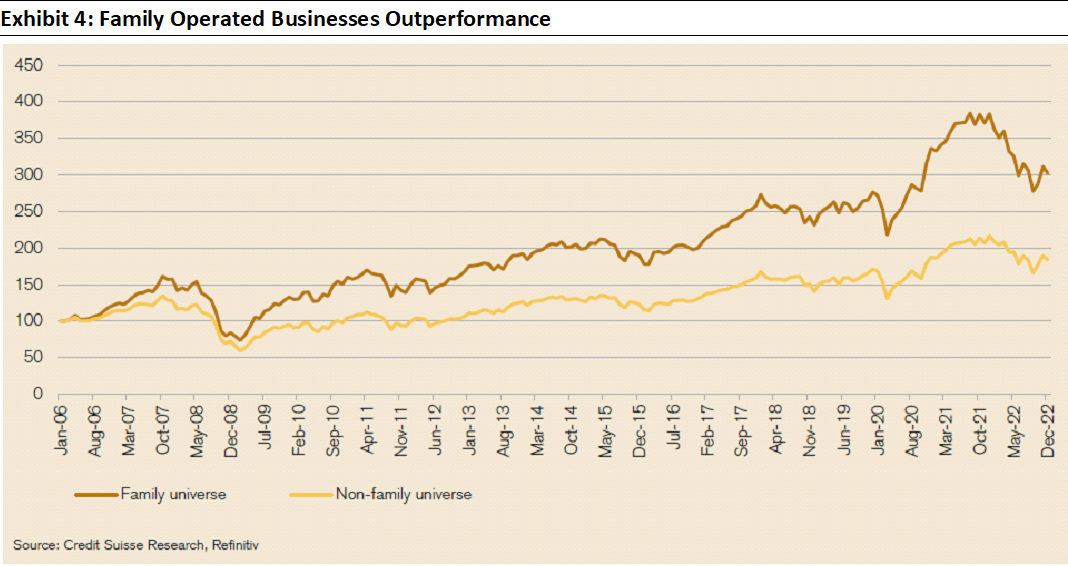

However, it’s essential to recognize that the phenomenon of “owner-operator” businesses outperforming the market is not confined to a specific region. Extensive research conducted by the Credit Suisse Research Institute since 2006 has scrutinized the business model of listed family-owned enterprises. They have curated the exclusive “Family 1000” dataset, encompassing 1,000 major family-owned businesses spanning the Americas, Europe, and Asia Pacific, with a significant concentration in the latter.

Remarkably, the global “Family 1000” universe has consistently generated an annual sector-adjusted excess return of 300 basis points since 2006, a trend that holds true across all regions. Furthermore, smaller-capitalized companies within this universe have occasionally delivered outsized returns. This underscores the enduring significance and profitability of the “owner-operator” model in the global business landscape.

Source:https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/family-1000-insight-into-family-owned-business-universe-202303.html

Source:https://www.credit-suisse.com/about-us-news/en/articles/news-and-expertise/family-1000-insight-into-family-owned-business-universe-202303.html

It is a ‘Market Inefficiency’ that can be exploited!

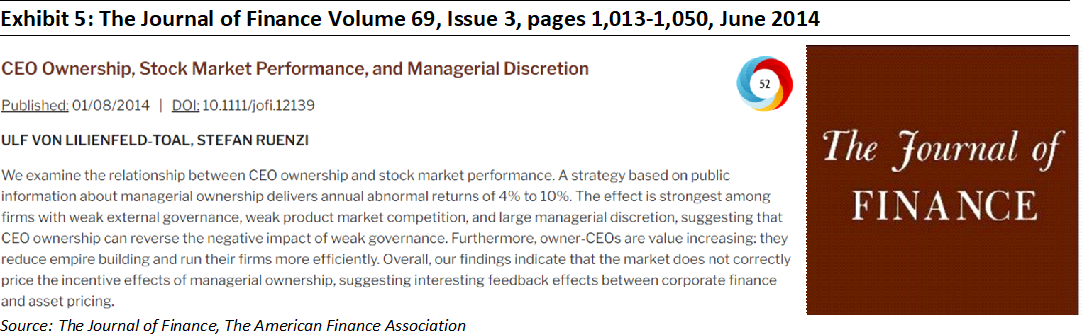

In May 2014, a noteworthy paper was published in the Journal of Finance, aiming to dissect the impact of CEO stock ownership on long-term stock returns. The authors embarked on a quest to unravel whether higher ownership translates to superior company management and, if so, how the market reacts to this critical information. They meticulously controlled for various factors acknowledged to influence returns, including company size, sector, momentum, index inclusion, and book-to-market valuation. Rigorous stability tests were conducted to ensure the robustness of their findings.

The crux of their discovery was unequivocal: “We scrutinized the relationship between CEO ownership and stock market performance. A strategy grounded in publicly available information about managerial ownership yielded annual abnormal returns ranging from 4% to 10%.” In their paper, the authors delineated several benefits associated with high-ownership firms, such as enhanced cost efficiency, a diminished Principal-Agent problem, and reduced tendencies for empire building.

What piqued the authors’ interest was the incomplete recognition of these advantages by the market. While academics are often hesitant to concede that markets exhibit less than perfect efficiency, the authors acknowledged in their summary that the “market is not fully efficient in understanding incentive effects.” This revelation challenges conventional notions and underscores the complexities that persist within the intricate realm of stock market dynamics.

What Factors Contribute to the Enhanced Fundamentals and Superior Investment Returns

of Owner-Operator Businesses?

“The man who does not work for the love of work, but only for money, is likely to neither make money nor find much fun in life.” – Charles Schwab, Chairman, Charles Schwab Corporation

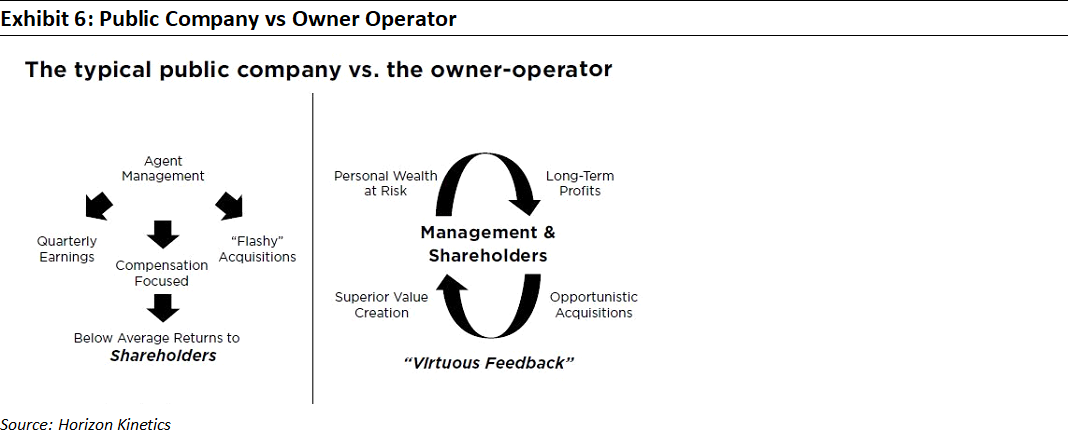

1. Effective Principal-Agent Alignment: In economic theory, the Principal-Agent problem refers to the challenges that Principals (i.e. the shareholders) face in incentivizing the Agents (i.e. the CEO) to take actions which are in the interests of the Principals. This problem of aligning incentives between shareholders of public companies and the CEOs of the same companies has vexed economists for several decades. Significant personal investments provide a solution to the principal-agent problem, as owner-operators opt for modest self-compensation, thereby building wealth through the sustained appreciation of their company’s stock. This resolutely aligns management’s interests with those of shareholders.

2. Innate Survival Instinct: Owner-operators possess an inherent survival instinct, characterized by relentless innovation to enhance their products or services. They intuitively understand the importance of building a formidable moat around their business and prioritize long-term profitable growth over short-term quarterly results. A prime example is Amazon’s (a GCP Company) strategic decision to develop its logistics network, fortifying its delivery moat for relentless growth.

3. Empowered Workforce: Recognizing the limitations of a single individual, owner-operators advocate for decentralized structures that empower frontline employees. They focus on shaping incentives rather than micromanaging minor operational decisions. An exemplar is TransDigm (a GCP Company), guided by founder Nick Howley’s wisdom: “Treat people like owners, and they’ll act accordingly.”

4. Rigorous Cost Control: Exemplary owner-operators exhibit an innate commitment to cost control and frugality. They view every expenditure as a personal investment and align with Warren Buffett’s perspective that true cost management transcends sporadic cost-cutting initiatives. Evidenced by CEOs like Jay Adair (USD 1 base salary) of Copart and Warren Buffett (USD 100,000 base salary) of Berkshire Hathaway, this ethos of prudence permeates the entire organization, nurturing sustained wealth creation.

5. Strategic Capital Allocation: Owner-operators demonstrate exceptional prowess in capital allocation, seizing opportunities during market turbulence. Notable instances include Berkshire Hathaway’s historic investments, such as rescuing GEICO from the brink of bankruptcy and deploying significant capital during the Global Financial Crisis. Crises serve as moments for most GCP owner-operator companies to enhance intrinsic shareholder value, embodying their capacity to capitalize on fear and greed.

6. Undervaluation by Mr. Market: Owner-operators’ unwavering drive for growth remains a boon to shareholder value, all while maintaining substantial personal investments. Yet, paradoxically, Mr. Market persistently undervalues these titans of industry. This paradox is a testament to the mysterious allure of their enduring success.

- Notably, Marcellus’ GCP Universe of Owner Operators is currently trading at a slight premium to the broader market’s (S&P 500) multiple, suggesting an implied <5 years

of earnings outgrowth. This, in our view, presents an exceptionally attractive opportunity.

GCP Case Study: Copart (CPRT, USD 44 Billion market cap):

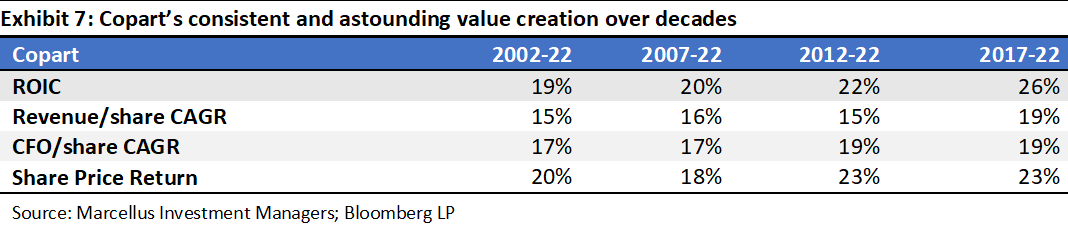

Willis Johnson, in a classic rags-to-riches tale, forged a relatively obscure but remarkably successful business empire with Copart, the world’s premier salvage vehicle auctioneer, boasting over 50% market share in the US, and global share likely around 20%. Copart operates an expansive network of salvage yards, encompassing more than 10,000 acres, which serve as the storage grounds for vehicles awaiting auction on its online platform. Each day, Copart offers more than 265,000 vehicles for auction, housing them at its 250+ salvage yards and selling over 3 million vehicles annually to buyers from 190+ countries. In essence, Copart serves as the eBay equivalent for salvage vehicles, with a significant portion of its supply (typically around 80%) originating from insurance companies declaring policyholders’ vehicles total losses following accidents.

Early Days and Inspiration: Commencing with a solitary junkyard in Vallejo, California in 1982, Johnson reinvested every earned cent into the business. At that time, the salvage auto industry was highly fragmented, and Johnson swiftly expanded through strategic acquisitions. Inspired by the notion of a self-contained business entity found within Disneyland, complete with gate fees, restaurants, and gift shops, Johnson propelled Copart into a juggernaut by introducing an array of services to his locations.

During this remarkable journey, Willis Johnson, and later his son-in-law Jay Adair, embodied most of the quintessential characteristics of “owner-operators” that paved the way for astounding returns. We highlight a few here:

- Effective Principal-Agent Alignment: Willis Johnson, owning 6.66% of Copart, and CEO Jay Adair, his son-in-law, owning 3.75%, exemplify this alignment. Jay’s annual cash salary of USD 1 (not a typo) underscores his dedication. These shareholdings worth USD 4.4 billion form the vast majority of their personal networth. Jay’s unique journey within Copart, which began in 1989 when he joined as a 19-year-old manager, was marked by pioneering Copart’s shift to online auctions in 1998. By 2003, the company had transitioned to 100% online auctions, eliminating in-person bidding.

- Innate Survival Instinct: Willis Johnson’s audacity to challenge industry norms and disdain for conventional practices set Copart apart. He transformed scrapyards into clean, organized stores more akin to retail establishments than typical car wreck lots. Despite lacking an engineering or technocratic background and formal degrees, Willis was a trailblazer in various industry-firsts, such as dismantling parts, computerizing inventory, introducing an industry catalog, and adopting a fully online auto auction model. The introduction of a Percentage Incentive Program, charging a percentage of the auction sales price instead of fixed fees, aligned customer interests with Copart’s objectives, creating an unparalleled marketplace with over 800,000 members – a hard to displace moat.

- Strategic Capital Allocation:

- Deepening of Moat: In its nascent stage, Willis Johnson’s decision to acquire lands for scrapyards, as opposed to its most notable rival IAA’s leasing strategy, proved visionary. While IAA’s approach seemed practical in the short term, it overlooked the long-term implications of the NIMBY (Not In My Backyard) phenomenon. Existing scrapyards gained substantial value, benefiting landowners like Copart, while lease prices for IAA increased upon renewal. This forward-thinking approach, spanning 20, 30, and 50 years, is a testament to the business acumen Johnson possessed but eluded most professional managers. Today, recreating a similar land parcel network with comparable density to Copart’s is virtually impossible – another hard to displace moat.

- Opportunistic: Copart initiated aggressive share buybacks during 2008, 2011-2012, and 2015-2016 when the stock price experienced significant declines. In just a few years, particularly during the Global Financial Crisis and its aftermath, the company reduced its outstanding shares from 370 million to 250 million, representing a 32% reduction. Buybacks ceased when the valuation increased.

Copart’s Future Opportunities and Valuation

The global auto salvage market’s volume surpasses 15 million, with Copart commanding a formidable ~20% of Global share. Its peerless moat, anchored in its robust buyer and seller network, makes it an unrivalled force. This positions Copart for sustained growth, with the potential to increase its Cash Flow Per Share at very healthy rate for next decade. Although its Forward PE currently stands at 30x, 1.5x that of S&P 500, it hints at an outgrowth period of 5-7 years factored into the valuation. However, we think that this outgrowth phase is poised to extend to a minimum of 10 years, offering further value unlocking potential over the long term.

The opportunities such companies present:

The significance of effective management and appropriate incentive alignment cannot be overstated for long-term investors, a fact that often goes underappreciated in the investment world. While research reports by sell-side providers may offer an abundance of information, they frequently relegate insights into the management team to a mere page or two at the back.

Management quality deserves more prominent consideration in the realm of investment decisions. We firmly hold the belief that the finest management teams are those with a vested ownership interest. Their inherent perspective fosters a commitment to long-term success. Moreover, this isn’t just theory; empirical evidence backs the notion of superior long-term investment outcomes.

At Marcellus, our dedication revolves around a meticulous examination of management teams, assessing their ability to operate with the mindset of owners. We recognize that there are no shortcuts to this process, and we consider it our core strength. Through our methodical approach, we have achieved rewarding results, and we remain confident that it will continue to generate value for both us and our investors.

Happy Investing!

Regards,

Team Marcellus