|

Portfolio updates

We have exited from a couple of stocks in the recent months viz. PPAP Automotive and Music Broadcast. The sale proceeds from these exits have been re-invested in the other portfolio stocks basis our position sizing frameworks.

PPAP Automotive

We decided to exit from PPAP Automotive due to the following reasons:

- PPAP’s second largest customer viz. Honda Cars India Limited has been going through a rough patch in India over the last two years with its market share in the domestic passenger vehicle market plummeting from 5.4% in FY19 to 3.0% in FY21. The absolute sales volumes have declined from ~183k units in FY19 to about ~82k in FY21 prompting Honda to stop car manufacturing at one of its plants (Greater Noida) in India. Obviously, this has had an impact on PPAP with its revenues from Honda declining sharply over these last two years.

- PPAP to its credit has somewhat made up for Honda’s revenue loss through rising revenues from Maruti (courtesy supplying injection parts from its new Gujarat plant), increasing penetration in the two-wheeler segment and certain other customers. However, it seems that the Company is not able to make the same level of margin in these new businesses/customers. For instance, the Company’s standalone gross margin stood at ~43% in 2HFY21 vs 48.4% in 2HFY19 while generating 15% higher revenues in 2HFY21 vs 2HFY19. Given these margin challenges, we see the climb-back to 20% pre-tax RoCE (the Company generated 19% in FY19) to be a tough ask for PPAP.

Music Broadcast

Our exit from Music Broadcast (MBL) centered around the following reasons:

- Even pre-Covid-19, the radio industry has been going through a challenging phase due to a sharp drop in radio advertising by the Government, traditionally a major advertiser on the medium. As per MBL’s investor presentations, Government’s radio advertising volumes witnessed a YoY drop of 70% in FY20. This further declined by 34% YoY in FY21. Given the post-Covid fiscal situation, we could not see when and how the Government would re-emerge as a big advertiser.

- Owing to the Covid-19 uncertainties during the first wave in 2020, radio players took aggressive price cuts to push volumes to both the existing clients as well as to attract new clients to the industry. However, a fall-out of this seems to be structural decline in radio ad-yields as evidenced by 3QFY21 and 4QFY21 when volumes recovered (YoY positive volume growth) but realization were still down sharply YoY.

- MBL also faced a setback in its pursuit of RBNL with approval from the Ministry of Information & Broadcasting not forthcoming and subsequent cancellation of the deal. RBNL’s acquisition would have made MBL an undisputed leader in the radio industry helping it command greater pricing power, bringing in a complimentary set of radio channels while not putting undue stress on MBL’s balance sheet given its strong net cash reserves & healthy free cash generating business model.

- Finally, while we were conscious of impact of digital and online music streaming mediums on the radio industry when we bought MBL in the portfolio, Covid-19 seems to have accelerated this shift significantly. Ever growing free access to music on various internet mediums seems to be weaning away listeners from radio much quicker than we thought.

Little Champs end FY21 on a high note

Healthy recovery in revenues and earnings…

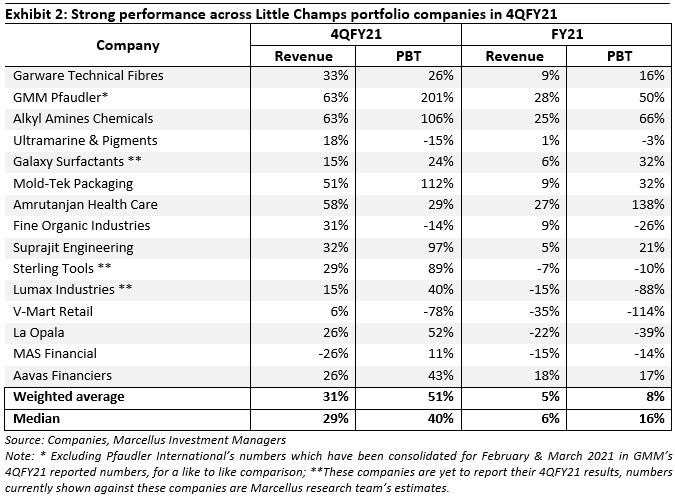

The recovery in the revenues and earnings for the Little Champs that began since 2QFY21 accelerated significantly in 4QFY21. At the weighted average level, the YoY revenue growth for 4QFY21 was 31% (vs 13% in 3QFY21) while the YoY growth in PBT was 51% (again much better than 36% seen in 3QFY21). The recovery in revenues and earnings have been helped by the fact that majority of the portfolio companies cater to resilient end-user industries like pharma, food, FMCG, etc. Secondly, most of our portfolio companies have witnessed market share gains against their weaker competitors (while FY21 numbers for some of the peers, particularly in the unlisted space is not yet available, management commentaries of the portfolio companies consistently point towards market share gains from peers). Thirdly, the YoY trend in revenues and PBT is also helped to some extent by a weak base of 4QFY20 (due to the imposition of the total lockdown in the country in the last few days of March 2020).

Helped by a robust 4QFY21, despite a washout in 1QFY21 (due to the first lockdown), the Little Champs portfolio has delivered weighted average revenue growth of 5% and PBT growth of 8% for FY21. In fact, the median PBT growth for the portfolio for FY21 is 16% indicating a broad-based earnings recovery across the portfolio stocks.

|

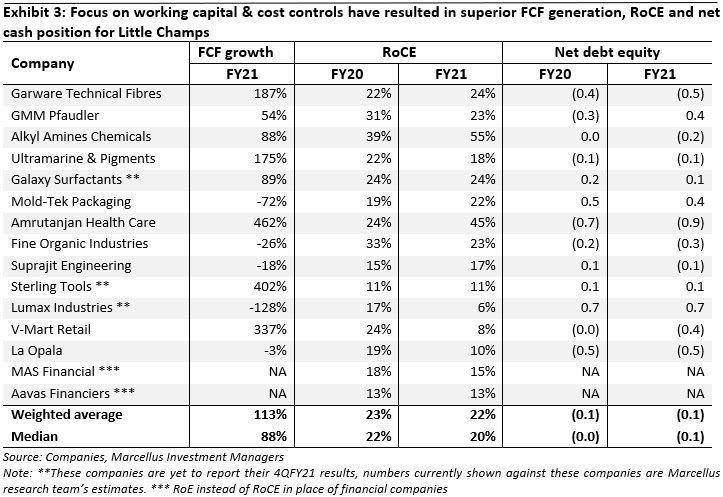

…complimented by a strong free cash generation

In addition to the recovery in the earnings highlighted above, the icing on the cake has been strong free-cash flow (FCF) growth recorded by the portfolio stocks in FY21. On a weighted average basis, the portfolio has delivered FCF growth of 113% for FY21 (median of 88% indicating again a broad-based FCF improvement across the portfolio stocks). This doubling in FCF comes despite our portfolio companies maintaining reinvestment rates at high levels. Besides focus on cost controls, working capital management has been a key focus of our investee companies to mitigate the Covid-19 impacts. This improved in working capital – contrasted with the stretched working capital at FY20-end as companies got stuck with high inventories and receivables due to the lockdown imposed during the first wave – has helped drive the doubling of FCF in FY21. Investment implications – Little Champs on a much stronger footing now than pre-Covid-19

|