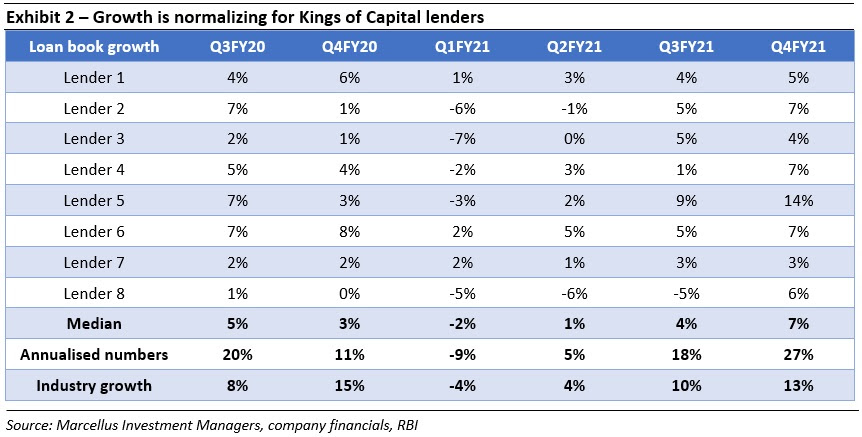

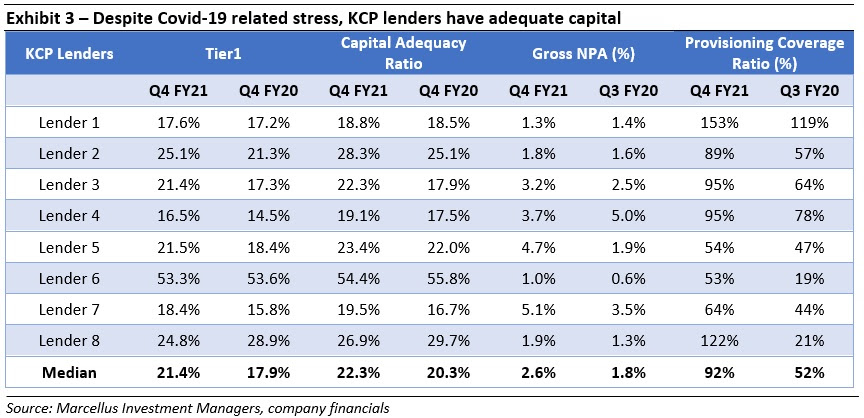

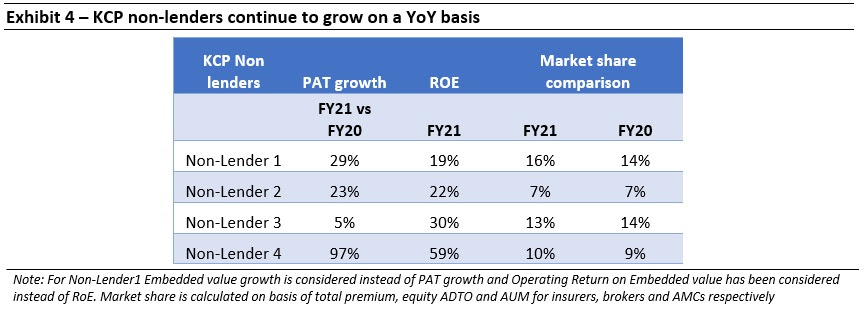

Over the past 15 months, the Kings of Capital (KCP) lenders have focused on broadly three aspects to counter the impact of Covid induced lockdowns and restricted economic activity: (i) augmenting collection capacity to sustain NPAs at manageable levels; (ii) preserving liquidity by raising debt/deposits at competitive interest rates; and (iii) maintaining healthy capital adequacy after making accelerated provisions for expected loan losses. These proactive measures have resulted in the Net NPAs of the KCP lenders staying at manageable levels of 1.1% vs. pre-Covid NNPA of 1.0% and the Tier-1 capital increasing to 21% in Q4FY21 vs. the pre Covid levels of 18%. This balance sheet strength of the KCP lenders will enable them to gain market share and capitalize on the revival of credit demand as the Indian economy recovers from the second Covid wave. This was visible during Q4FY21 when the KCP lenders saw an annualized loan book growth of 27% vs. banking sector credit growth of 13%.

Performance update of the live fund

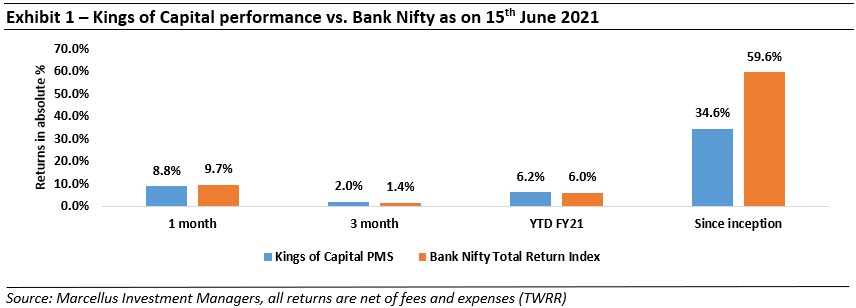

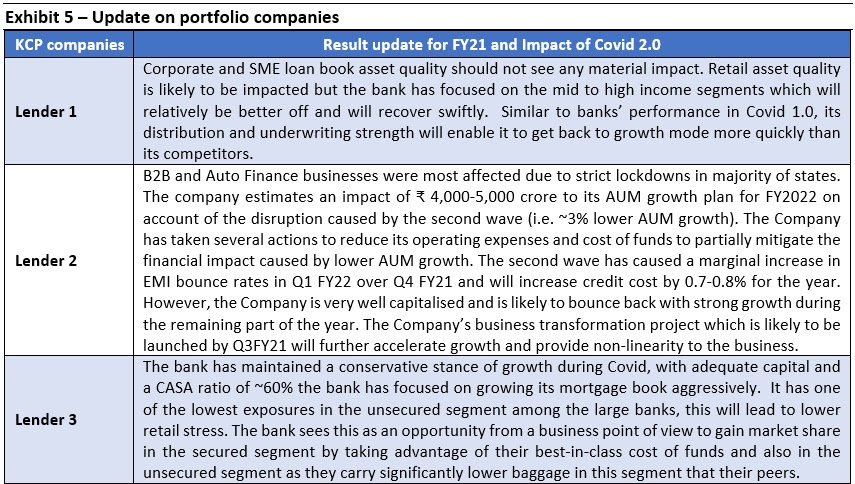

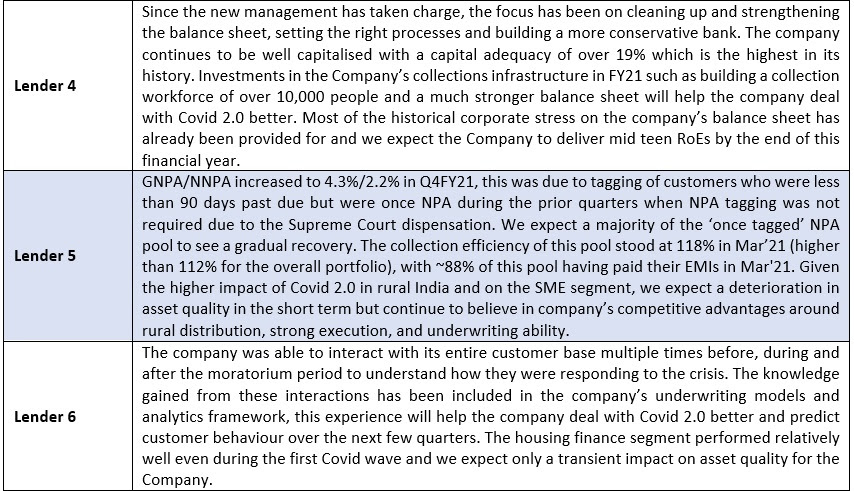

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

|

|

|

|

Team Marcellus