|

|

|

|

|

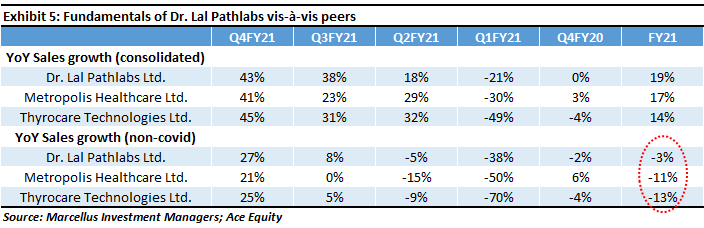

Amongst the diagnostic labs, as shown in the Exhibit 5 below, Dr. Lal Pathlabs has reported far more resilient fundamentals compared to other large listed national chains. Moreover, revenue growth of organized players is likely to have been significantly higher than that of standalone / unorganised diagnostic labs.

|

|