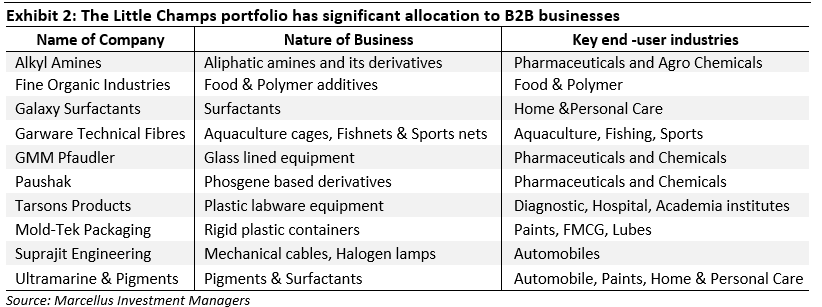

Given Little Champs’ philosophy of investing in smallcaps which are market leading franchises, the portfolio has a preponderance of niche B2B names. Conventional arguments against B2B companies centre around their weak bargaining power vs much larger customers & suppliers and lack of entry barriers around brands & distribution. However, unlike a typical B2B company, the Little Champs’ have been able to create enduring moats through the criticality of their products, their product & process differentiation, and their capital allocation initiatives (which has driven the diversification of their customer base). All of this is reflected in the Little Champs’ ability to grow profits and returns on capital employed over extended periods of time.

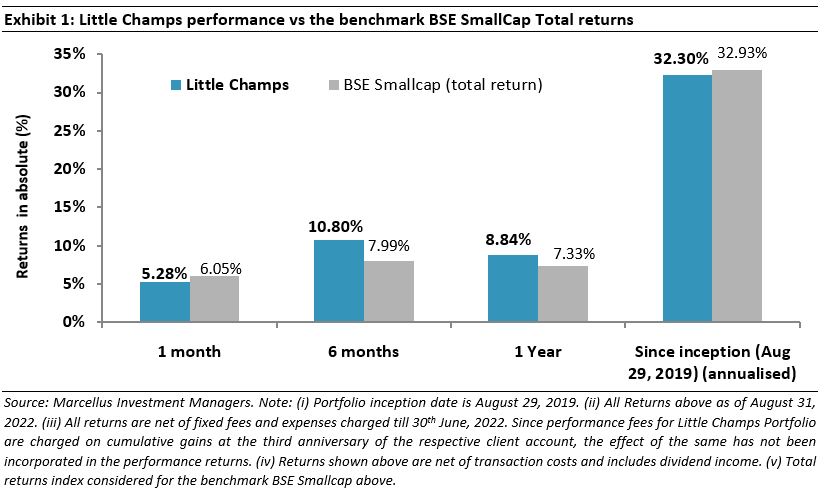

Performance update for the Little Champs Portfolio

At Marcellus, the key objective of our Little Champs PMS is to own a portfolio of about 15-20 sector leading franchises with a track record of prudent capital allocation, clean accounts & corporate governance and at the same time healthy growth potential. While we intend to fill our portfolio with companies having the above attributes, we want to stay away from names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

Portfolio updates: Addition of Vijaya Diagnostic Centre and exit from Gujarat Ambuja Exports

In recent months, we have made the following changes to the Little Champs model portfolio:

a.)Addition of Vijaya Diagnostic Centre Limited: Vijaya Diagnostic, started by Dr. Surendranath Reddy in 1981, has over the past four decades expanded to about 100 centres across Telangana and Andhra Pradesh.

Our investment team’s research points towards the following two key competitive advantages of Vijaya:

- Customer Convenience: Integrated business model of radiology and pathology offers one-stop convenient solution for clients. Furthermore, the extensive network of hubs and spokes built by the company in and around Hyderabad gives Vijaya an upper hand in corporate tie-ups & wellness packages as well.

- Quality of the diagnosis: Vijaya’s quality edge over peers is attributable to its high-end equipment quality and – more importantly – the quality of the radiologists employed by it. Radiology reports are hugely dependent on the interpretations of the radiologist and our channel checks suggest that Vijaya, due to its high-quality specialist radiologists, is often preferred for a second opinion by doctors on complex cases. Furthermore, attracting new radiologist talent is dependent on the existing quality of radiologists as well as the volume of cases that the diagnostic chain can provide. As higher quality radiologists join Vijaya, more cases flow to them, creating a virtuous loop for the company. Vijaya has been a pioneer in bringing high end equipment technology into the country and as the business flourishes it allows the company to keep investing in cutting edge technology – driving further volumes.

Basis the above two factors, Vijaya has been able to gain a market share of ~20% in Hyderabad and foray into the other cities of Andhra Pradesh & Telangana in the recent years.

b.)Exit from Gujarat Ambuja Exports Limited: In order to allocate space for Vijaya Diagnostic Centre as warranted by the Little Champs position sizing framework, we decided to exit from Gujarat Ambuja Exports Limited. Gujarat Ambuja Exports had the lowest score in our position sizing framework for the portfolio and also ranked lower compared to Vijaya Diagnostic Centre.

How Little Champs address challenges surrounding B2B franchises?

As stated above in the first para, the key objective of our Little Champs portfolio is to invest in market leading franchises. In most industries in India, the top players command disproportionately higher volumes, pricing power and thereby industry profit share. This explains the significant gap between the industry leaders and laggards on key metrics like margins, return on capital and debt. By virtue of the above advantages, market leaders are able to withstand the stressed market conditions much better than weaker peers.

However, in pursuit of the above objective in a smallcap portfolio like Little Champs, we typically encounter a problem. Most B2C sectors, worth investing in are large in size and investing in market leading franchises in such large sectors are outside the bounds of the portfolio (due to market cap restrictions). Whilst there are some portfolio stocks in niche B2C categories e.g. the pain balm segment in the case of Amrutanjan and regionally dominant retail players like V-Mart, Vijaya Diagnostics, such names are the exception rather than being the norm in Little Champs. On the other hand, the diverse nature of B2B businesses makes it a fertile breeding ground for finding niche market leading franchises. Hence there is a tilt towards B2B names in the Little Champs portfolio.

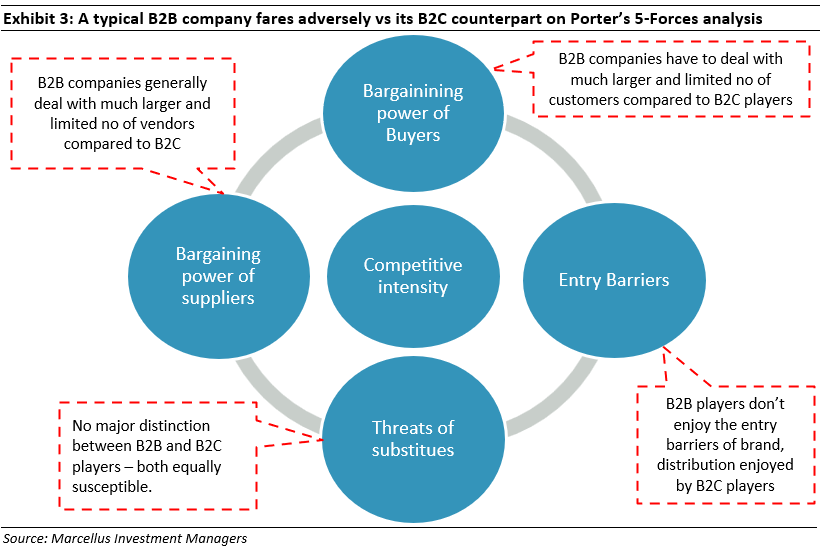

However, for the B2B franchises in the portfolio, we generally come across the following questions/concerns:

- Dealing with customers who are much bigger in size – doesn’t this substantially reduces the bargaining power of Little Champs as customers possess levers not only to squeeze the pricing but also to limit the quantum of business as they deem fit?

- Dealing with suppliers who are much bigger in size – again the same question as above.

- Are there any real entry barriers in a B2B business? For example, brand and distribution networks which act as important entry barriers in B2C businesses have no or very limited role in a B2B company.

The above concerns and differentiation between a typical B2C and B2B franchise can also be understood through their analysis in Porter’s Five Forces framework:

The above disadvantages pose significant challenges for a typical B2B company to generate RoCEs above cost of capital and build enduring long-term moats. However, B2B companies in the Little Champs portfolio have defied this trend and built dominant franchises on the back of strong moats which would be very challenging for competitors to replicate. We explain the key drivers of the same below:

1.Critical nature of products supplied by Little Champs B2B companies

Products sold by Little Champs do not form a significant portion of the overall operating costs for their end-customer. However, at the same time, these products are highly critical to customer’s operations as they either lend important functional characteristics to customer’s end products or the failure of the product can inflict significant financial and reputational damage on the end customers. Given that the cost of the product is not very significant, there is little motivation for the customer to shift to a competitor’s product even if it is available at a lower cost.

Some examples of the above are:

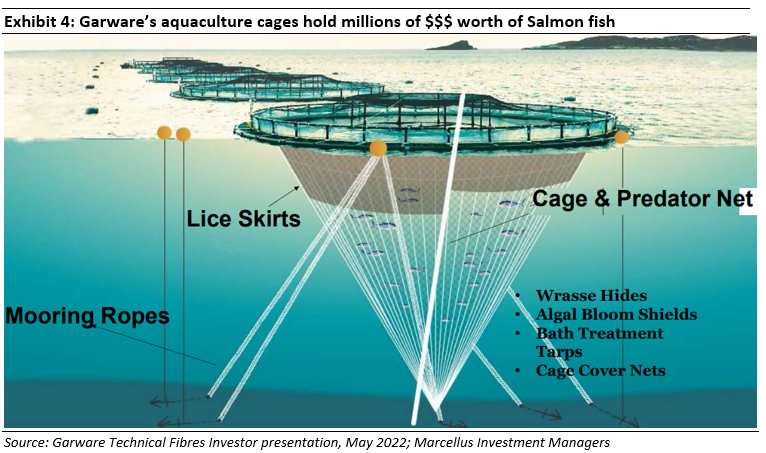

- Garware Technical Fibre salmon aquaculture cages constitute <10% of the total cost for running a salmon aquaculture farm. However, any defect in the cage can be devastating not only in terms of loss of fish but may even lead to the aquaculture farmer losing his license.

- Similarly, additives supplied by Fine Organics have very low molecular weight (less than 1%) in the final products manufactured by the clients. However, any issue surrounding the quality of the additives can impact the quality of the entire product.

- In case of Tarsons Products, plastic labware products forms <2% of the total costs of running a lab. However, quality of the labware products is very critical for the success of the reaction or for providing a fair result. Our channel checks suggest that customers prefer quality over cost and would not buy a lower quality product just because it is cheaper.

- Glass-lined Equipment (major driver of GMM’s revenues) forms only ~5-7% of the total cost required to set up a new chemical / pharmaceutical plant (excluding land costs). The quality of glass-lining is a key differentiator in this business for two reasons. The first is that the end-products made by customers need to have very specific chemical properties and there can be no compromise on the purity of these products during production process. Secondly, chemical reactions tend to corrode the reactor vessels, and poor quality of glass-lining would mean more frequent replacement/refurbishment of the reactors thus increasing the cost for the customers. While a B2B business is devoid of using brands and distribution as entry barriers (as mentioned above), there are other avenues that play such a role.

2.Moats around Product and Process differentiation

- Product innovation: Little Champs have focused on innovations rather than pricing as the key differentiator to gain market share. Their innovation, in turn, has been a result of relentless focus on a niche segment, often driven by a technocratic top management and a sound understanding of the customer needs. Some examples of Little Champs that have been successful in this aspect are described below:

- Fine introduced oleo-based additives for the packaging industry which replaced additives that were derived from animal fats. Resultantly, packaging manufacturers who uses Fine’s additives can now manufacture packing for vegetarian food items.

- Much of Garware’s recent success is attributable to its breakthrough innovations in Salmon aquaculture which has helped address customer problems such as: (i) V2 nets to prevent under-water bio-fouling; (ii) X12 nets for sea-lice solutions without impacting the water flow through nets.

- GMM Pfaudler’s dominance in the glass-lined reactors mainly boils down to its erstwhile parent Pfaudler’s innovations around the glass-lining technology. For example, they have developed Pharma Glass, a patented enamel specifically for the production of active pharma ingredients (APIs), vitamins etc., which is now the global standard for the user industry.

- Galaxy adopted the “Innovation Funnel” concept in 2007 which leads to proactive product and solutions research by studying consumer insights, analyzing market trends and having strategic intellectual tie-ups with customers. This has led to a consistent expansion of its product basket from 109 products in 2009 to now close to 216 products with new products like sulfate-free cleansers (Galsoft GLI 21), UV filters (GalShield UV Care Plus), waterless cleansing formulations (Galsoft Tils (G)) in the recent years. Today, Galaxy has 80 approved patents and another 15 global patents applied.

- Innovation and excellence around manufacturing processes: Little Champs’ innovative bent is not just limited to products but also to the process through which they offer significant value proposition to their customers. These companies focus on reducing the cost of production, improving yield levels, reducing the capex requirement, etc. Some examples are:

- Alkyl’s R&D’s team not only focusses on the products but also on the process improvements and developing in-house process technologies. While the Company initially relied on outside technology for commissioning the plants, over the years it has developed strong in-house engineering capabilities which has helped it master complex process technologies (such as vapour-based reactions) and the use of catalysts (to speed up reaction time). This has enabled Alkyl to reduce cost of production, capex costs (debottlenecking), improve yields and also scale up new product such as Acetonitrile successfully. Similar to Alkyl, Fine and Galaxy’s key competitive strengths reside in their in-house engineering skills developed over the years.

- Mold-Tek is possibly the only Indian packaging company to develop in-house moulds, robots, and labels at significantly lower cost compared to competitors, who mainly rely on imports. For instance, Mold-Tek’s in-house developed robot costs 60% lower vs the market price. Further, in-house mould making capabilities also help with faster product development and market introductions. These capabilities are of special importance in IML which requires a high degree of reliance on automation. Whilst peers are still struggling to adopt IML technology, Mold-Tek is making incremental advancements in IML (QR coded, square packs, tamper proof packs, etc.) further widening its gap vs. peers.

- In the case of Ultramarine & Pigments (UMP), the process to manufacture Ultramarine Blue inorganic pigment is very long (a single batch takes 30 days to manufacture) and complex as it involves factors such as the weather/climatic conditions surrounding the plant (which influences temperature particularly during the natural cooling process), the amount and time of introducing oxygen, etc. Any deviation in these parameters can result in significant drop in yields and difference in quality across batches. Over time, only a handful of players globally such as UMP have enhanced the yield levels by optimizing the process conditions (through automation, sophisticated instrumentation techniques etc).

3.Capital allocation initiatives around reducing customer dependency

Little Champs B2B companies have reduced their dependence on a single or narrow set of customers through conscious capital allocation and through management’s focus on building a granular and diversified customer base. As highlighted in our July’21 and Aug’21 newsletters, Little Champs companies have followed two-broad strategies of ‘soft diversification’ and ‘globalisation’ to grow their business.

Some examples of how prudent capital allocation has helped reduce customer concentration:

Over the last seven years, Suprajit has made three global acquisitions: (i) Phoenix Lamps, a leader in automotive halogen lamps in FY16, (ii) US-based Wescon Controls, a leading supplier of control cables to the outdoor power equipment and certain other non-auto segments in FY17, and (iii) Acquisition of Lights Duty Cable (LDC) unit of Kongsberg Automotive, a control cables suppliers to Auto OEMs in America and Europe. Resultantly, Suprajit’s exposure to Indian 2-wheeler segment has reduced from ~65% in FY10 to ~25% in FY22.

- Over the last decade, Galaxy has built a strong global franchise (now derives nearly 2/3rd revenues come from outside India) through setting up a plant in Egypt (to cater to African, Turkey and Middle Eastern markets) and acquisition of Tri-K Industries, a US based company focussing on specialty care products.

- In the Inorganic Pigments business, Ultramarine & Pigments is a global top 3 supplier which finds applications in plastic masterbatches, paints, laundry, etc. Exports now account for ~63% of the total pigments business.

Such a granular diversified customer base has helped Little Champs to delink their fortunes from their customers and bargain on equal terms.

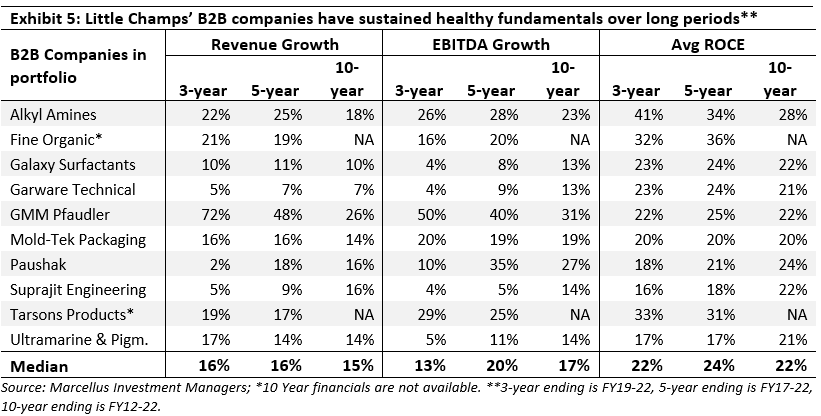

In summary, thanks to the points discussed above, LCP B2B companies have been able to sustain healthy revenue, earnings growth and returns on capital employed over long periods of time as shown in the below exhibit.