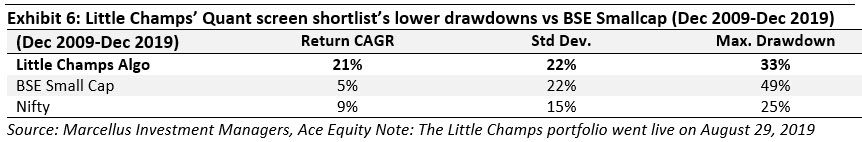

The need of protecting portfolio value in a downturn is equally, if not more, important than chasing returns in a bull market. Compounding from a larger base generates higher returns than compounding at a faster pace from a much smaller base. Indeed, sharper falls (drawdowns) during market downturns and higher frequency of such falls are key reasons for the BSE Smallcap’s underperformance vs Nifty and BSE500 over long periods of time. Through our investment process and thereby the quality of the portfolio stocks, we expect the Little Champs portfolio to exhibit a high degree of resilience in weak market conditions while generating healthy absolute returns in a market upcycle.

Performance update for the Little Champs Portfolio

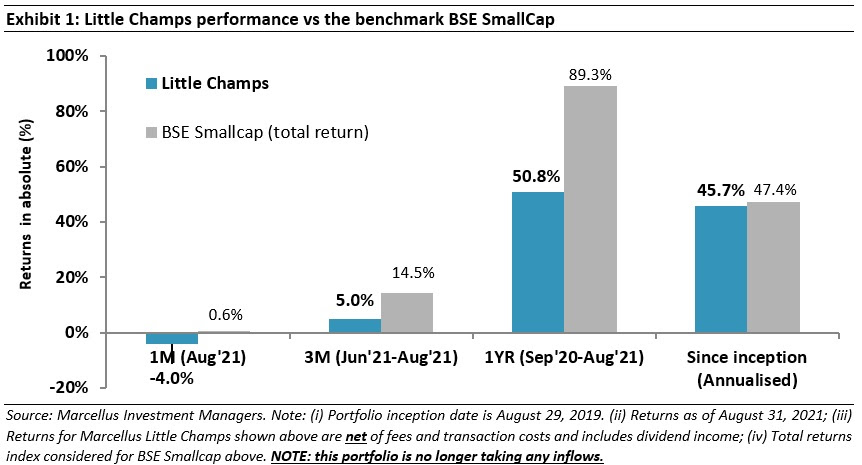

At Marcellus, the key objective of our Little Champs Portfolio is to own a portfolio of about 15-20 sector leading franchises with a stellar track record of capital allocation, clean accounts & corporate governance and at the same time high growth potential. While we intend to fill our portfolio with winners, we want to be sure of staying away from dubious names where we are not convinced about the cleanliness of accounts or the integrity of the promoters (even though the business potential may sound promising) as the fruits of company’s performance may not get shared with minority shareholders. We intend to keep the portfolio churn low (not more than 25-30% per annum) to reap the benefits of compounding as well as minimize trading costs. The Little Champs Portfolio went live on August 29, 2019. The performance so far is shown in the below table.

As can be seen in exhibit 1 above, over the last one-year the Little Champs portfolio has delivered a healthy net absolute return of ~51%. However, this return is lower compared to the benchmark BSE Smallcap’s corresponding ~89% return. This has led to some investors getting worried about their investments underperforming the benchmark. We discuss in this months’ newsletter why worrying about underperformance in a bull market (if the portfolio has delivered healthy absolute returns) may be misplaced and how the Little Champs portfolio is designed to hold up during the brutal drawdowns which the BSE Smallcap has to endure.

Downside Protection is More Important that Upside Generation in Smallcap investing

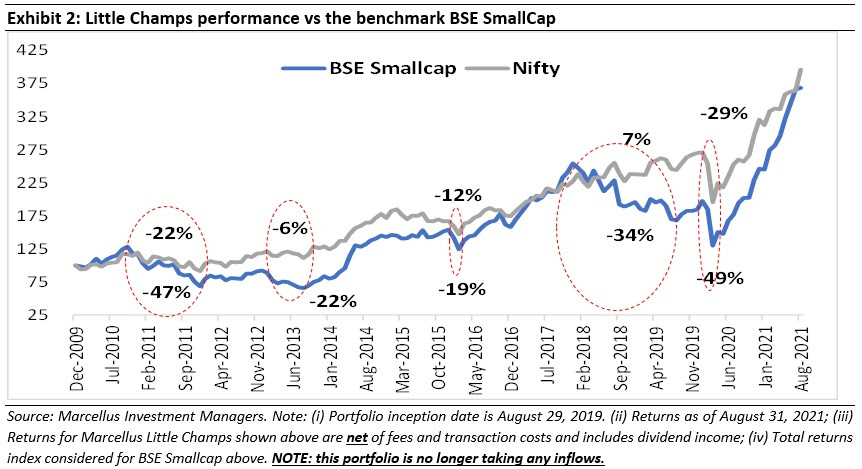

Looking beyond just the last one year or so’s spectacular run, BSE Smallcap’s longer term performance does not instill much confidence. For instance, From August 2011 to August 2021, the index delivered a total return CAGR of 15.5% compared to Nifty’s 14.9% over the same period (these returns include dividends & buybacks). While the BSE Smallcap’s absolute return mimics that of the Nifty50, the return looks poorer/inadequate in the context of:

- Much higher drawdowns- the maximum drawdown for the BSE Small Cap has been much sharper at 49% (based on monthly returns) between August 2011-August 2021 compared to 29% for the Nifty. Furthermore, as highlighted in exhibit 2 below, BSE Smallcap has seen much sharper falls than the Nifty during periods of market downturns; and

- Relatively higher frequency of downs- BSE small cap index fell by more than 5% MoM for 22 months between December 2009 to August 2021, more than twice compared to 10 months for Nifty.

Indeed, if not for the last one year’s stellar return, BSE Smallcap would have ended up significantly underperforming the larger cap indices even on an absolute basis despite much higher drawdowns and volatilities – BSE Smallcap’s August 2011-August 2020 return CAGR at 9.3% compared to Nifty’s 11.4%. Interestingly, this phenomenon of small-cap indices underperforming larger cap indices is now being seen globally – for example the Russell 2000 index delivered annualised return of 13.5% over August 2011-August 2021, lower than 14.9% for S&P500 while facing maximum drawdown of 34% compared to latter’s 20%.

Key reasons for BSE Smallcap’s higher drawdowns and volatility vs the Nifty and BSE500

The key reasons for BSE Smallcap’s underperformance relative to the Nifty and the BSE500 have been its much sharper drawdowns and much higher volatility (how drawdowns and volatilities impact portfolio returns can be read in our June 2020 Little Champs newsletter). Basis our analysis of BSE Smallcap’s performance over the years, we believe the following are the key factors driving the higher risks (volatility and drawdowns) and thereby the underperformance in small caps in general:

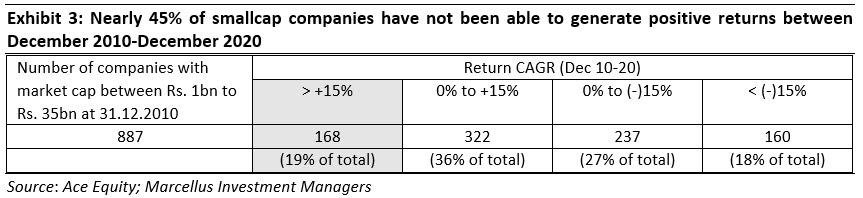

- Whilst accounting frauds and weak corporate governances permeate across all market caps, it is more relevant and prevalent in the smallcap space due to the lack of institutional oversight (often due to the absence of a strong professional layer of management and/or independent board of directors). For instance, as can be seen in the below exhibit, of the listed small caps (market cap between Rs1bn-35bn) at December 2010, only a small portion – just 19% – have been able to generate healthy returns (>15% p.a.). On the other hand, a majority of the companies i.e. nearly 45% have not been able to generate positive returns between December 2010-December 2020 – mostly companies with issues around corporate governance and capital allocation.

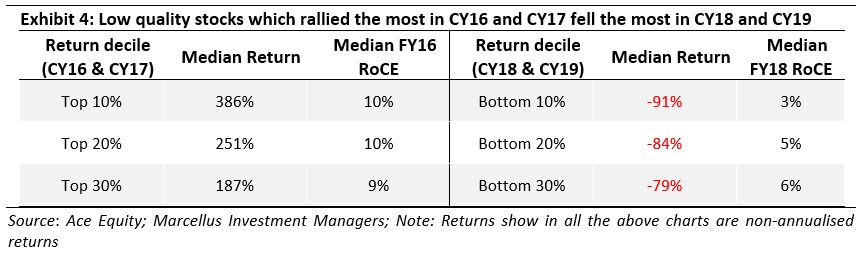

While abundant liquidity provides a strong cover to fraudulent companies during the bull market, such frauds typically come to the fore during bear markets bringing down with it the overall small-cap index performance. For instance, in CY16 and CY17, low quality small-caps (poor on accounting quality and low RoCEs) significantly outperformed the more expensive but quality stocks. But such a run does not last long – the same set of low-quality stocks which scored big time in CY16 and CY17 witnessed the steepest fall in CY18 and CY19 as liquidity dried up and share prices started tracking the underlying fundamentals.

- Most small caps are unable to survive the periods or at the very least see massive erosion in their earnings when the business cycle turns downwards. This is due to inherent issues surrounding small businesses like high leverage, customer/market concentration etc. In fact, a cyclical economic downturn often structurally damages small cap companies (for example – as they enter a persistent cycle of indebtedness). While economic cycles do have an impact, a large part of the blame also lies with the companies’ managements because of their inability or unwillingness to diversify and deleverage during good market conditions.

- In addition, the lack of liquidity for small caps during periods of market dislocations further accentuates the drawdowns in the small caps space.

Marcellus’ investment process to minimise the conventional Smallcap risks

Given the very nature of smallcaps, it is difficult to control the risk mentioned under point 3 above i.e. those associated with lack of liquidity during bear market periods. However, it is possible to minimise the risks mentioned under points 1 (accounting quality, corporate governance) and 2 (weak financials, lethargic management) above through a rigorous investment process and philosophy. In fact, minimising risks associated with smallcap investing is central to our Little Champs investment process.

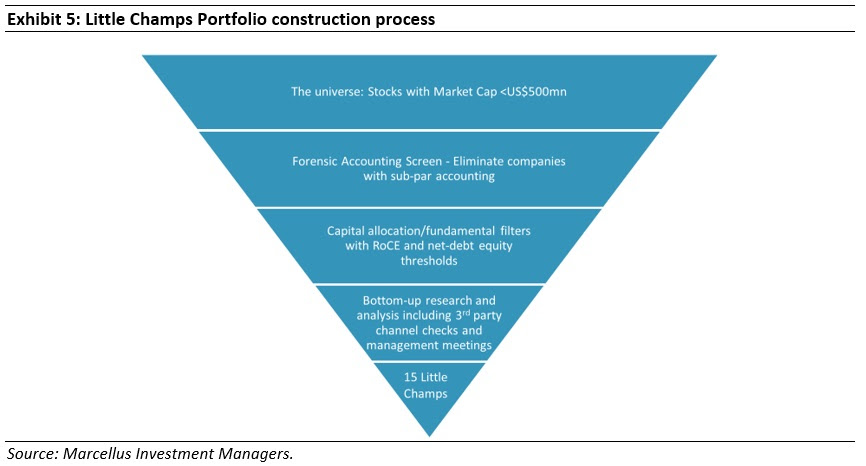

Little Champs investment process is broadly divided into two parts:

A. Use of forensic accounting and capital allocation quantitative frameworks to help shorten the large universe of more than 1,000 small caps companies into a researchable universe of 40 companies. The shortlist arrived through both the above screens are companies with generally clean accounts/governance and which have demonstrated the ability to grow efficiently (by maintaining pricing and balance sheet discipline), generate cash and redeploy that cash to grow further. In other words, these companies carry much lower risks around corporate governance and financials than a typical smallcap firm. This is also reflected in lower standard deviation and drawdown for both the backtest of our Little Champs algorithm (i.e. just using the quantitative framework without any bottom-up research).

B. The stocks shortlisted by our screening frameworks are then taken up for deep dive research and diligence by the twelve analysts in our team. Besides analysis of the published financials and other secondary data, we aim to build insights into the companies through interacting with a host of primary data network sources. Here, we draw upon our following strengths:

- Forensic accounting skills – We have a deep pool of accounting talent in our team, most of whom are qualified Chartered Accountants and/or Chartered Financial Analysts and who have cumulatively done more than 1,000 bespoke accounting projects over the last ten years.

- Access to primary data and insights – The team has built a pan-India network of primary data sources which include dealers, distributors, promoters, ex-employees, customers, vendors, etc.

Besides getting comfort on the management’s integrity and corporate culture, our diligence is also focused on finding the sources of the competitive advantages of these companies, their track record of dealing with technological or competitive disruptions and the wisdom of their capital allocation decisions. Here, our longevity framework (see our Sept 2021 CCP Newsletter) provides an objective framework surrounding moat, lethargy, succession and capital allocation to our investment team to both decide (rank) the stocks which will make it to the portfolio and portfolio allocations to each such stock.

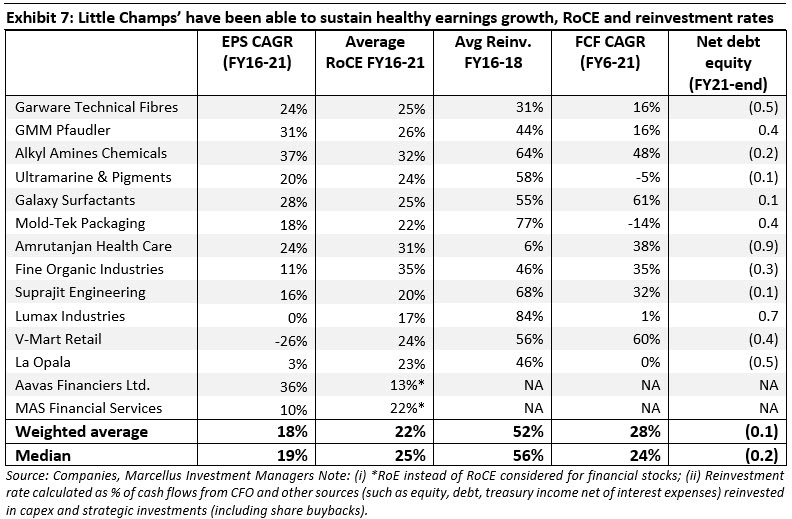

The culmination of the above research process is that Little Champs are an exceptional set of small cap companies which have been able to sustain a combination of high RoCEs, high reinvestment rates, high free cash generation and strong balance sheet (in most cases net cash surplus) over long periods of time. The performance shown in the below exhibit is despite the macroeconomic challenges of the recent years where economic growth has been weak.

|

|