Urbanization, improved affordability (low interest rates and stable house prices), support from government initiatives (PMAY), and emergence of unique underwriting models has led to the sustainable growth of the affordable housing finance sector in India. Affordable Housing Finance Companies (AHFCs) are solving a large problem for a section of the society which does not have access to bank funding. Whilst their penetration looks abysmally low (like most segments of financial services in India), in this newsletter we discuss how the AHFCs have found a win-win for all the stakeholders. We also discuss why we have invested in two of the leading AHFCs – namely Aavas Financiers and Home First Finance.

Performance update of the live fund

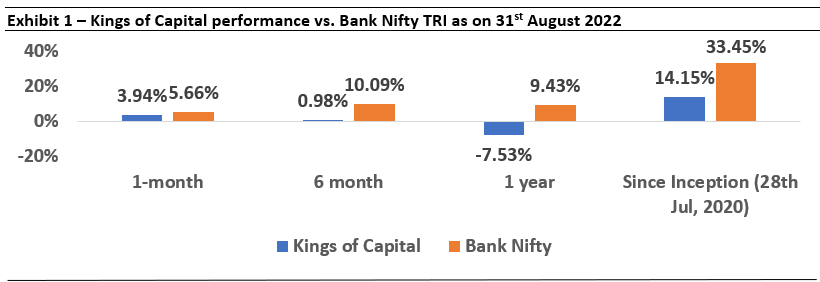

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Note: Performance data is net of annual performance fees charged for client accounts whose account anniversary date falls upto the last date of this performance period. Since fixed fees and expenses are charged on a quarterly basis, effect of the same has been incorporated upto 30th June, 2022.

Understanding the affordable housing industry

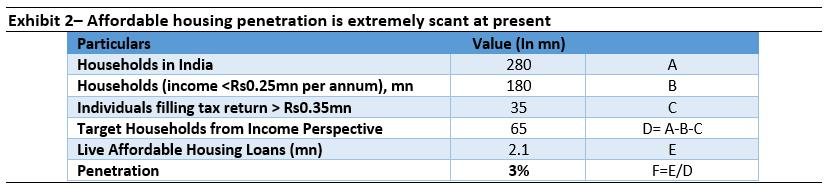

- Low penetration: As per the RBI Bulletin dated January’18, the need for adequate supply of housing is the most prevalent for the economically weaker sections in the urban areas of the country.

“As per the Report of the Technical Group (TG-12) on Estimation of Urban Housing Shortage (2012), there has been a huge gap in demand and supply of urban housing in India. The economically weaker sections (EWS) and low income group (LIG) accounted for 96 per cent of the total housing shortage in India” – Affordable Housing in India, RBI Bulletin, January 2018″

Source: Income tax Department, Census 2011

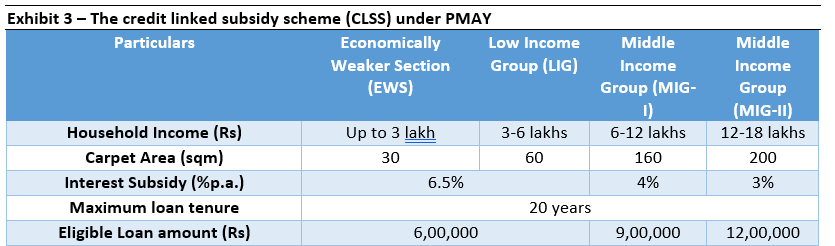

PMAY has provided a fresh impetus: While the focus on providing low-cost housing has been there in some shape or form even in the past e.g. National Housing Policy, 1994; Jawaharlal Nehru National Urban Renewal Mission, 2005; Rajiv Awas Yojana 2013, the Pradhan Mantri Awas Yojana (PMAY) launched in 2015 provided a fresh impetus to the objective. Apart from the various incentives provided to private developers and slum redevelopment authorities, the scheme also had provision for easy credit availability for the economically weaker sections (EWS).

Source: Ministry of Housing and Urban Affairs

Separately, the Government is also looking to introduce reforms so as to provide a more conducive regulatory environment for affordable housing:

“The central government will work with state governments for reduction of time required for all land and construction related approvals, for promoting affordable housing for the middle class and economically weaker sections in urban areas. We shall also work with the financial sector regulators to expand access to capital along with reduction in cost of intermediation” – Finance Minister Nirmala Sitharaman, 26 Feb’22, Livemint

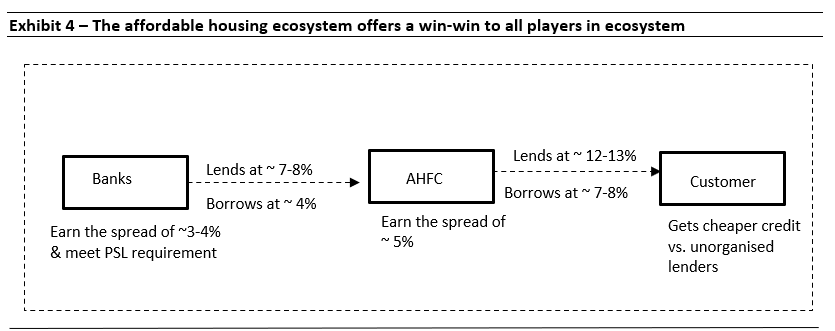

Creating a win-win for all stakeholders: Resultantly, on the one hand the customers are able to avail cheaper credit at 12-14% interest rates, even after the end of CLSS in Mar’22. This is much lower than the 20%+ interest rates prevalent throughout the unorganized sector. Lower rates obviously reduce the purchase cost of the house. In parallel, the Government is able to meet its objective to provide housing for a large urban populace.

With respect to the lending institutions, affordable housing (ticket size below Rs 25 lakhs) represents a segment which is expected to grow at least at 9-10% CAGR over a decade (as per industry estimates) on the back of formal credit availability to an otherwise overlooked customer base and severely underpenetrated housing supply. Housing Finance companies (HFCs) catering to the affordable housing segment can potentially earn spread of around 5%+ (cost of borrowing for the HFC ~7-8% versus lending rate to end customer of 12-13%) and keep growing their loan book by reinvesting the profits from such lending. That being said, the future profitability of any given HFC would depend critically on astute risk management both on the customer side as well as with respect to their asset-liability mix (something we discuss in the next section)

Meanwhile the lenders to such HFCs, namely the big banks, can earn a healthy spread (cost of deposit – ~4% versus lending to HFCs at ~7-8%) without going through the hassle of managing the unique idiosyncrasies associated with the affordable housing customer segments in various geographies. For bigger banks, cross selling of various products is a key element of driving operating leverage while affordable housing segment requires a focussed niche segment approach.

Secondly, bigger banks also tend to focus more on the higher ticket housing segment given the more muted risks associated with such segment (as well as the opportunity to cross sell savings & investment products).

Thirdly, banks are also able to procure the affordable housing loans from such HFCs in order to meet their own Priority Sector Lending (PSL) requirements without doing the legwork themselves. Lending to well managed HFCs thus provides an opportunity to the banks to deploy funds and earn a decent spread without undertaking high customer risk or deploying too much operational muscle.

Source: Marcellus Investment Managers

Why our portfolio companies – Aavas and Home First have a bright prospect in affordable housing finance?

Company overview:

Aavas Financiers Limited (Aavas) is a housing finance company based in Jaipur, Rajasthan. The Company is principally involved in offering housing loans in rural and semi-urban under penetrated markets in states of Rajasthan, Maharashtra, Gujarat, Madhya Pradesh, Haryana, Uttar Pradesh, Chattisgarh, Uttarakhand, Punjab, Himachal Pradesh, Delhi, Odisha and Karnataka. The Company has a branch network of 314 (as on March 31, 2022) and assets under management of Rs 11,350 crore as on March 31, 2022. Please see our webinar with Managing Director and CEO of Aavas, Mr. Sushil Agarwal here to understand more about how this firm works.

Home First Finance Company (HFFC) is a technology-driven affordable housing finance company with AUM of Rs 5,380 crore as of March 31, 2022. The company targets first-time home buyers in low and middle-income groups and caters mostly to the salaried segment (~73% of AUM) with a well spread-out business mix across 13 states – Rajasthan, Maharashtra, Gujarat, Madhya Pradesh, Haryana, Uttar Pradesh, Chattisgarh, Uttarakhand, Delhi, Telanagna, Andhra Pradesh, Tamil Nadu and Karnataka. Please see our webinar with Home First’s CEO Mr. Manoj Viswanathan and CFO Ms. Nutan Gaba Patwari here to understand more about how this firm works.

Competitive advantage #1 for these AHFCs: Low Cost of borrowing

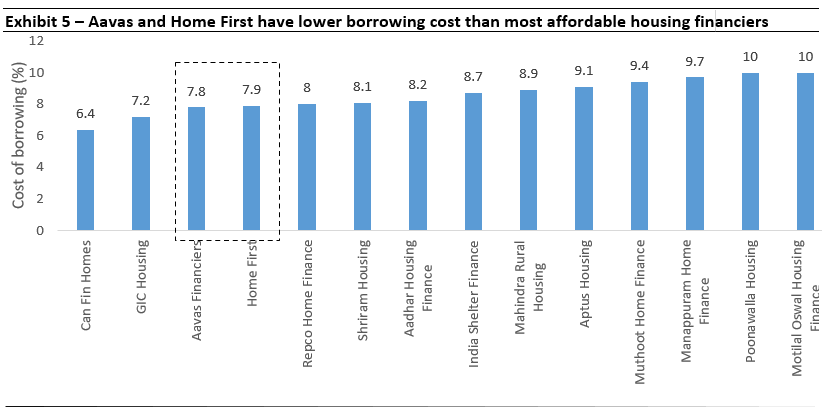

The ability to borrow funds at attractive rates is one of the biggest advantages in a lending business as lenders with higher cost of funds are forced to lend to riskier borrowers. Lower cost of funds not only allows lenders to earn higher margins, but it also allows lenders to pick and choose segments/products/geographies they want to lend to. As can be seen in the exhibit below, Aavas and Home First have much lower cost of borrowing compared to most affordable housing financiers in India.

Source: Marcellus Investment Managers, Company, Kotak Institutional Equities; Data as of FY21

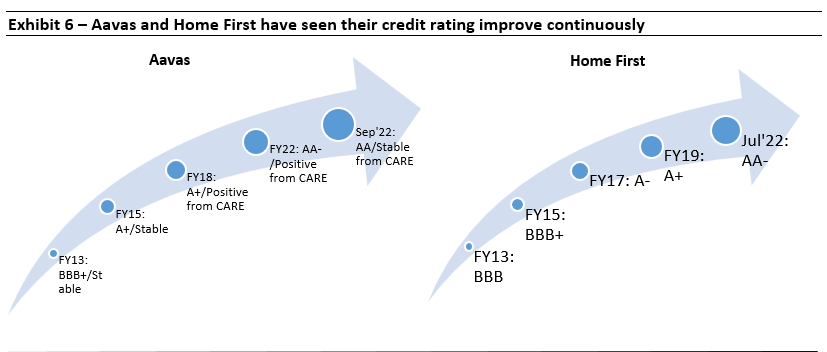

Such low cost of borrowing is a function of stable asset quality (Gross NPA as a % of loans outstanding < 2%), better product mix (high share of housing loans) and strong capital adequacy (Capital as a % of total loans > 50%) which has led to continuous improvement in these lenders’ credit rating over the years.

Source: Company, Marcellus Investment Managers

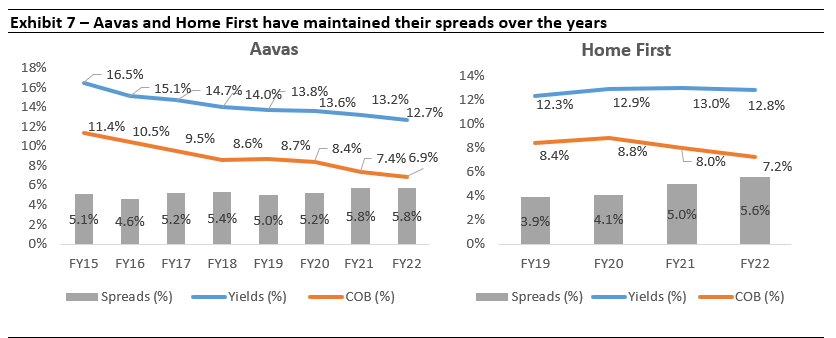

Competitive advantage #2: Ability to maintain spreads (Yields – Cost of borrowing) across rate cycles

Over the last eight years, Aavas’ spreads have consistently remained upwards of 5% as the matched loan book and liability composition (fixed vs. floating) allows for resilience across the rate cycles. While there may be quarter-to-quarter volatility in spreads, over longer time horizons, we expect Aavas’ spreads to remain over 5%+. Similar is the case for Home First as well, we have seen its spreads increase from 3.9% to 5.6% mostly on the back of declining borrowing costs.

In the event of floating rate liabilities getting repriced (due to rising interest rates), given that the majority of loan book is of floating nature for both these lenders, that too can be repriced accordingly. Moreover, both Aavas and HFFC have a well-diversified liability side with average tenure of borrowings largely matched with the behavioural tenure of assets and have no exposure to short term borrowings (such as CPs). These factors give us confidence about their ability to ward off any pressures from rise in interest rates.

Source: Company, Marcellus Investment Managers

Competitive advantage #3: Potential to increase RoE through higher leverage

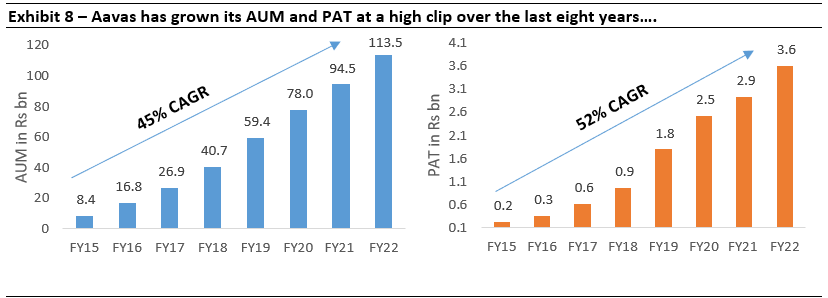

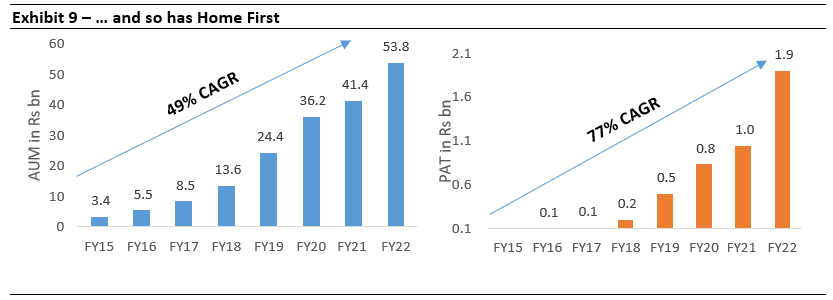

Both Aavas and Home First have grown their AUM and PAT at an impressive rate over the last few years (see exhibits below). The growth in loan book was mostly funded by the equity in the initial stages of their operations as the companies were relatively small and unknown and didn’t have relationships with many banks that could provide term loan financing. Now however, both these institutions actively borrow even through debentures.

Source: Company, Marcellus Investment Managers.

Source: Company, Marcellus Investment Managers.

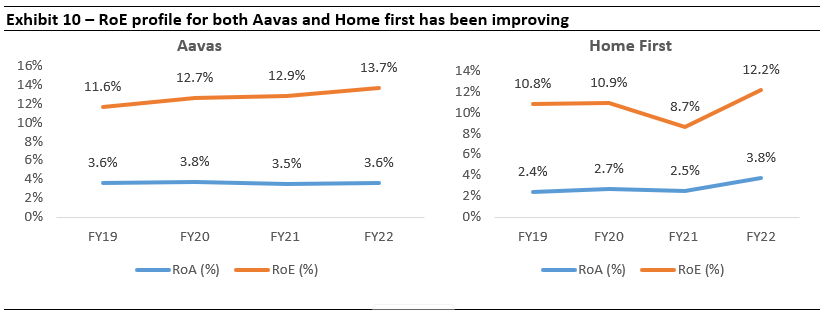

As the two AHFCs have become larger with a growing base of lenders on board, they have been able to increase leverage which in turn has led to improving RoE profile. Going forward, we expect increasing leverage (since the ratio of capital: loans is still at 50%+ proving enough headroom) alongside sticky spreads (as discussed in previous sub-section) to keep improving the return ratios.

Source: Company, Marcellus Investment Managers.

Competitive advantage #4: Niche segment focus to ward off potential competition

“We have around 186 branches out of which we have only 35 branches where population is more than 10 lakhs, so in those markets most of HFCs like HDFC, ICICI, LIC, and top guys and small guys also present. But the segment which they cater and the segment which we cater is the different. We source 100% in-house, and they source from DSA, DMA, and intermediary. Their main focus is on builder debt supply, our main focus is on construction, self-construction cases and smaller houses. Their more focus is on salaried customers, our main focus is on self-employed customers. The other branches which is 186 minus 35 where population is less than 10 lakhs, there our competition is from small HFCs, small NBFCs, cooperative banks, and in some part of areas, some nationalized banks also, but there we have an advantage in terms of cost of borrowing. Smaller HFCs and NBFCs, have cost of borrowing at around 10% plus and whereas our cost of borrowing is around 8.6%. So in those areas, we do not see that much competition because of these pricing aspects.” – Aavas Financiers Limited, Q2 FY19 Earnings Conference Call

Aavas’ approach of penetrating deeper into select states rather than expanding rapidly across multiple states vs. other HFCs has allowed it to build a strong base of local knowledge which is necessary to cater to affordable housing segment profitability. Given that the self-employed segment has informal income sources, a

substantial part of credit risk evaluation includes collation/analysis of local market intelligence, local laws (which may vary from state to state) and physical verification which is difficult for even banks to execute at scale. Further, given the nature of Aavas’ loan book, it is classified as priority sector lending (PSL) for banks. There is high demand from banks for a good quality PSL book and this enables Aavas to enter into “assignment transactions” wherein Aavas downsells its loans to the banks and de-risks its balance sheet – providing a win-win solution for both parties.

In terms of competition from lower rates being offered to customers, Aavas derives high pricing power by lending to customers who have a limited credit history and have income levels of less than Rs 50k per month (its average ticket size is Rs ~0.9 mn). For a 15-year affordable housing loan the monthly EMI is ~Rs. 12 to 15 thousand which doesn’t change materially even if some other lender offers a lower rate. Aavas’ deep understanding of the geographical market in which it lends, its ‘close to customer’ proximity model, its in house sourcing and servicing capabilities are key strengths which are difficult for competition to replicate.

Changes to the Kings of Capital portfolio – replacing ICICI Securities with ICICI Bank

We believe over the last few years, ICICI Bank has successfully turned around its corporate bank (with legacy issues from the era of the previous CEO now having been dealt with), while the retail bank continues to do well. Risk practices and choice of businesses is well calibrated now with a conservative CEO running the bank. Cultural changes (on risk selection) and incentive related changes made in the bank suggests the bank does not work in silos anymore. Primary data checks also point to a material improvement in risk assessment; in fact most checks suggest deepening of relationships with the corporate client with an intent to generate more income from the same corporate. This in turn allows the bank to generate respectable RoEs in the corporate book and hence, reduces the requirement of taking incremental credit risk by going down the credit risk curve. The bank has more than adequate contingency related provision buffers built in the balance sheet, very strong Provisioning Coverage Ratio (~80%) and strong capital position (Capital as a % of loans: 18.9%). RoE now is comfortably above cost of capital, with a visibility of strong earnings growth over the medium term. ICICI Bank has a higher longevity score than ICICI Securities resulting in our exit from ICICI Securities.