Financial services companies in general and Indian NBFCs in specific tend to encounter a crisis every few years. High-quality management teams not only deal with such crises but actually benefit from it. NBFCs in India have seen three challenging events in the last six years – demonetization, the failure of a large NBFC (leading to tightening of liquidity) and finally the Covid crisis. The Kings of Capital have emerged from these crises stronger, not weaker, on account of: (a) Smart risk management, (b) Proactive introduction of course correction measures, and (c) Leveraging their strengths to find better opportunities even when competitors are collapsing. While we cannot predict when the next crisis will hit us, the behavior of the Kings of Capital in difficult situations gives us the confidence that they will rise to the challenge when the crisis arrives.

Performance update of the live fund

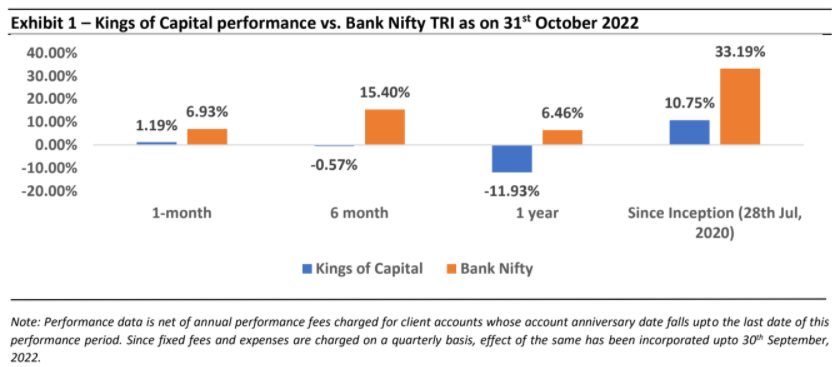

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

“We will have another squeeze five years from now so that you are all clear. It is part of the financial system, events differ every time squeezes happen. Last time around, it was a taper tantrum. This time, it is about a failure of a non-bank, five years from now it will be something else. It will teach us that good companies will take the message and build a stronger business model, which is the way we look at it.” – Rajeev Jain, MD, Bajaj Finance on company’s concall during the ILFS liquidity crisis (Oct, 2018)

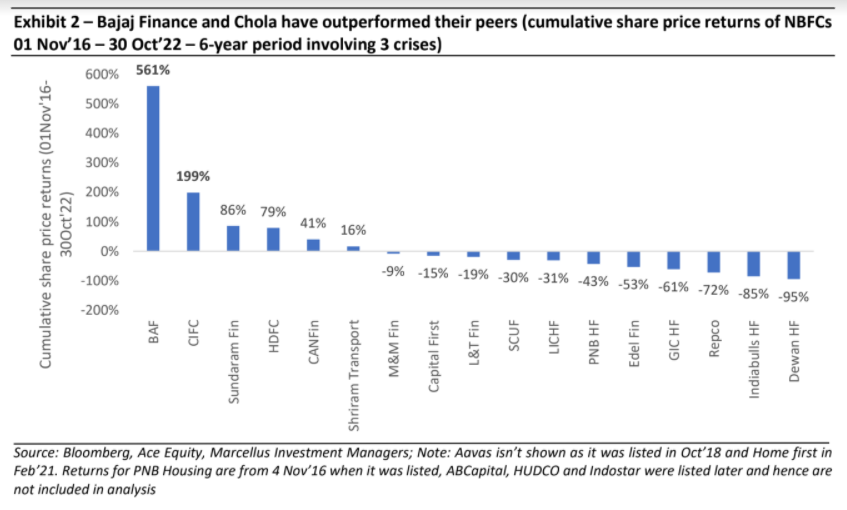

As is the norm in a large free market economy, every few years, the Indian financial system encounters a crisis such as Demonetisation (2016), the unravelling of IL&FS (2018) and Covid-19 (2020). If one was to look at the share price returns of the listed NBFCs over the six years encompassing these three crises (1st Nov’16-30th Oct’22), it’s the NBFCs with the strongest risk management that shine through.

In this newsletter we take a look at how the management teams of the four NBFCs in our portfolio (which cater to different customer segments) reacted to these successive crises over the past few years.

Aavas Financiers – a seasoned crisis manager

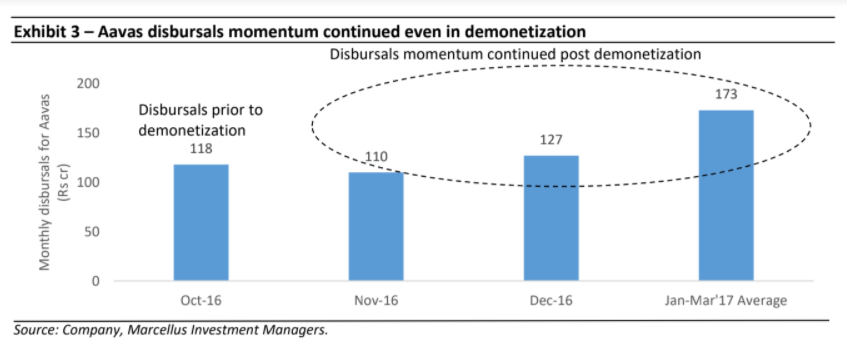

Demonetisation (2016) – The key challenge after demonetisation was around the collection of proceeds from the borrowers given the high cash component involved especially in the pre-UPI days in the affordable housing industry. Aavas was proactive in ‘digitizing’ its services via: (a) creation of an online payment gateway to allow borrowers to pay their monthly installments through debit cards; and (b) empowering its executives with POS & MPOS machines to provide doorstep repayment facility to customers.

Corporate restructuring (2016-17) – After AU Financiers was granted the Small Finance Bank license, it was required to sell its stake in its housing finance subsidiary i.e. Aavas Financiers as per regulations. Aavas thus faced challenges pertaining to a possible: (a) decline in its credit rating; (b) impact on collections; and (c) impact on its banking relationships.

To counter such a disruption the company:

- Established new and exclusive branches equipped with the latest equipment and migrated the erstwhile IT systems and processes into Aavas’ servers;

- Went on the offensive and recruited localized manpower to be the company’s face in remote areas; • Infused Rs 300 crore equity capital through private equity investors (Kedaara Capital and Partners Group).

IL&FS liquidity crunch (2018) – This was arguably the toughest phase for the NBFC industry as in the space of six months Yes Bank, Dewan Housing and IL&FS unravelled. While the IL&FS default in Sept’18 was the key trigger, the problem lay in the widely mismanaged asset and liability tenors with long term assets being funded using short term borrowings.

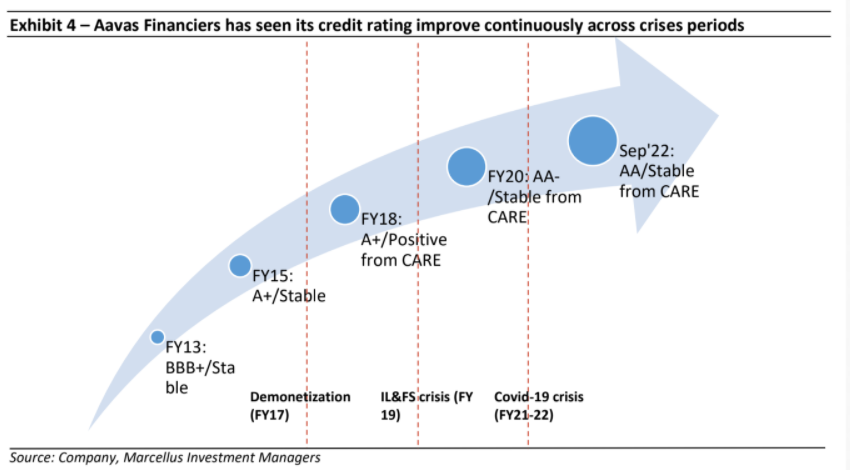

At a time when it was challenging for the sector to raise liquidity, Aavas successfully mobilized Rs 678 crore in Q3FY19 (~17% of its book in just one quarter) thus strengthening its liability profile. Over the whole of FY19 – the period encompassing the major pain period of IL&FS crisis – the company mobilized an aggregate Rs 2,144 crore through various instruments. While industry wide sectoral mortgage assets came under pressure, Aavas’

1+DPD (% of customers whose monthly installments are due for one day past the due date) remained an at attractively low 3.43% as on March 31, 2019 compared to 4.77% during the same period in the previous year. Given their weak ALM profiles most mortgage companies suffered rating downgrades while Aavas’ long term rating was enhanced to “AA-/Stable Outlook” by CARE Ratings in FY20.

The upside of astute risk management became evident as even the most cautious of lenders were willing to partner with Aavas. The company diversified its cost-effective long-term financing through engagement with 37 lenders – leading to 89% of its borrowings being derived from term loans, assignment, NHB financing and cash credit facility and only 11% from the debt capital market (with no reliance at all on commercial paper, a form of unsecured short term debt used by most NBFCs to finance their liabilities). Given their healthy financial position Aavas was also able to front load their investments in business – especially related to technology, management team and branch expansion.

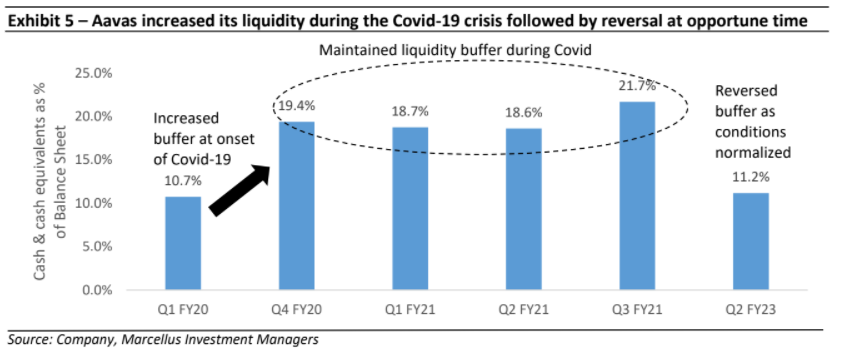

Covid-19 crisis (2020 and 2021): Smaller businesses reliant on in-person cash transactions stood to lose the most which included the kind of customers that Aavas catered to. In response, the company raised liquidity on the balance sheet significantly to Rs 15,05 crore (~19% of the balance sheet) in Jun’20, from around 10% earlier. To keep its cost of borrowing at manageable levels, Aavas proactively repaid all the major obligations to its financiers for FY21 during the first wave of Covid, thus reestablishing the trust of its financiers

On the asset side, the peak moratorium levels for Aavas were kept under check (exposure under moratorium reduced from 24.0% as of Apr’20 to 17.8% as of Jun’20). This was done through a correct assessment of its customer credit profile by physically meeting customers (~20k) who availed the moratorium and understanding change in each customer’s scenario and impact on future cash flows. The results showed that the hospitality (the most affected segment) constituted only 2.99% of customer base that availed moratorium – giving investors confidence of improvement in collections in the months ahead.

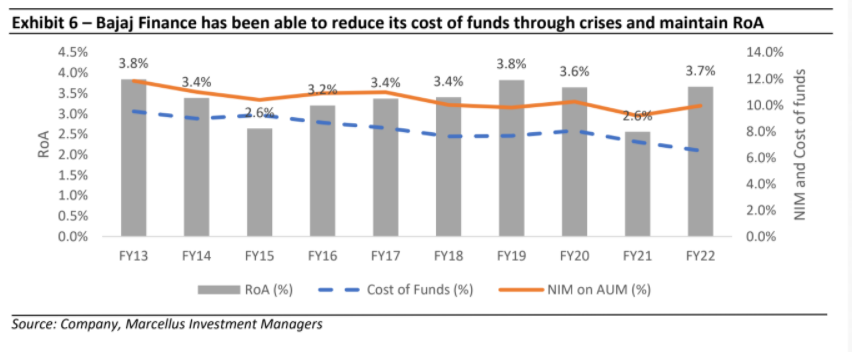

Bajaj Finance (BAF) – Using successive crises to transform itself

IL&FS liquidity crunch (2018): During the liquidity freeze post the IL&FS debacle, the Company continued to get access to funding from money markets, banks, retail and corporate depositors. During Q3FY19, in the aftermath of the ILFS crisis, Bajaj Finance raised ₹15,748 Cr from the money market & Rs. 3,125 Cr by way of bank loans. Bajaj Housing Finance Ltd. raised Rs. 3,583 Cr from the money market & Rs. 3,200 Cr by way of bank loans.

“We had been showing ALM data for the past five years. Two years ago, nobody paid much attention to it, so we pushed it back as annexure in our presentations. Now when investors ask for it, I tell myself, ‘Thank God, I did not treat ALM as an annexure to my business model ” – Rajeev Jain, MD, Bajaj Finance after the ILFS crisis

Covid-19 crisis (2020-21): To counter the impact on its lending business, BAF increased its focus on fee-based products (such as health card, health insurance, etc.) and turbocharged the requisite product innovation. Utilizing its then ~43 mn strong customer franchise, the company sold over 500,000 health cards to its existing EMI card customers in a single quarter during the Covid lockdown (Q1FY21). This product comes with higher limit, EMI financing tie-ups at multi speciality hospitals and various other wellness benefits and generated Rs 35 crores of net fee income in the quarter for the company. BAF’s other effective crisis management measured through Covid-19 were:

• Risk management over short term profitability: As of Jul’20, the Company had a consolidated liquidity

buffer of Rs. 20,590 crore and SLR investments of Rs. 2,550 crore representing 19.2% of its total

borrowing. The company actively communicated its intention to give risk management a higher

weightage given the prevailing environment and said that it would continue to run a high liquidity

buffer, despite possible impact on margins in the short term.

• Building capacity before moratorium was lifted: On the asset side, BAF’s consolidated moratorium

book reduced to 15.7% of AUM in Jun’20 from 27.1% of its AUM in Apr’20 owing to a reduction in

bounce rate coupled with improved collection efficiencies. The company continued to augment its

collections infrastructure through the addition of 2,800 collections officers and approximately 16,000

collection agency staff in Q1FY21.

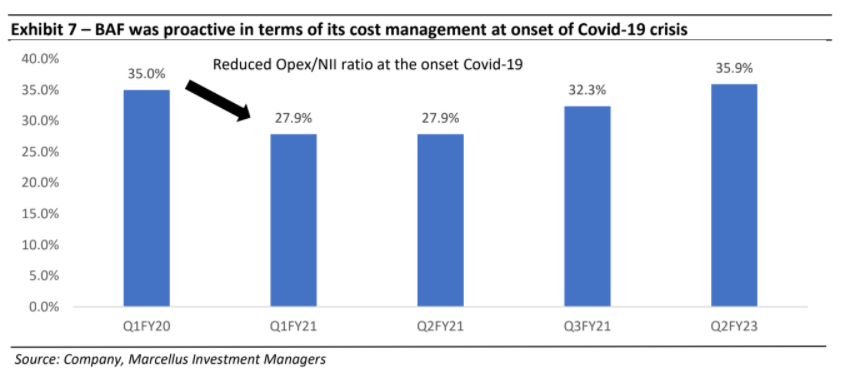

• Cost reduction measures: the company introduced cost management steps such as a fixed pay cut

(5% at junior level to 17.5% at the senior most level), call center optimization, freeze on branch

expansion, hiring, advertising & promotion etc. The resulting impact on Opex/NII ratio can be seen

below:

- Business transformation – ‘Never let a crisis go waste’: Finally, the company utilized the crisis to (and continues to) completely remodel and transform itself by leveraging its technology and analytics led strengths. In what might be the most ambitious tech transformation for a large, listed company in India, Bajaj Finance is working towards transforming its offline NBFC business to an omnichannel fintech and payments company. All businesses and functions are getting into micro detail of every process to enable a stronger digital orientation and a leaner cost structure.

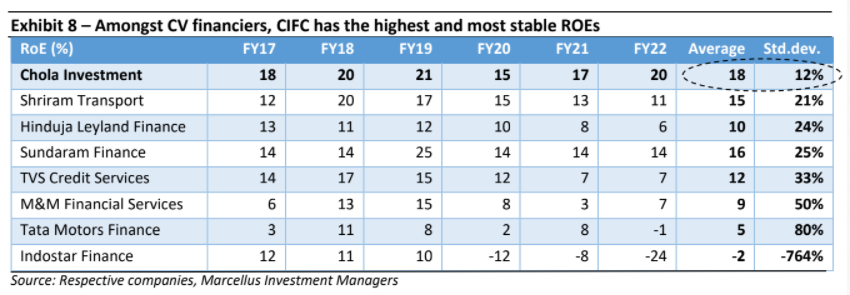

Cholamandalam Investment & Finance Company (CIFC)– consistent performer in a cyclical segment

Amongst the Commercial Vehicle financiers, CIFC was able to keep its fundamental performance stable and strong across the various crisis periods of demonetization (FY17), ILFS liquidity crunch (FY19) and Covid-19 crisis (FY 21-22). CIFC’s decision to diversify its offerings outside of just CV financing (which tends to be cyclical) and into passenger vehicle financing, Loan against property, Home Loans, etc. had a key role to play in this performance alongside other steps like digitization as highlighted below.

Demonetization (2016): Much like Aavas and Bajaj Finance, CIFC focused on its digital initiatives to ward off challenges inherent in the ‘cash’ collection process. The company introduced a customer facing app with both IMPS and UPI functionality for digital payments for the customers. It also incorporated a dealer app that made the interaction with the company’s dealers fully digital as well.

IL&FS liquidity crunch (2018): “We want to be bit selective wise choosing the customer as of now because of dearth in market of financial, most of the HFC, NBFC, they are not able to fund, we are getting lot of proposals in market but we are bit choosy about it.” – Rupinder Singh, Business head, LAP (Jan,2019)

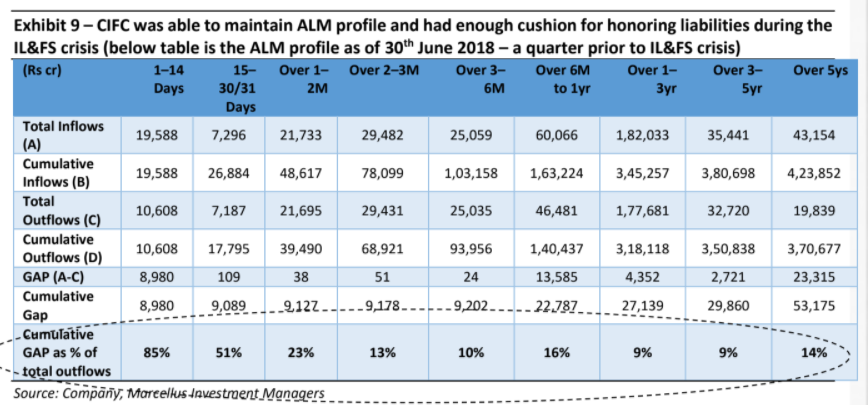

Even though in the euphoric phase prior to the IL&FS crisis, the assets growth for the business was suffering as customers indulged in balance transfer with exciting offers from frivolous players who were borrowing short and lending long the company didn’t budge. It maintained its focus on risk management by choosing only best of customers who would be able to honor their repayment commitmentsthus maintaining its ALM profile (see table below). Once the ALM mismatch bubble burst this stopped and CIFC was able to improve its marginal yield by almost by 100 bps.

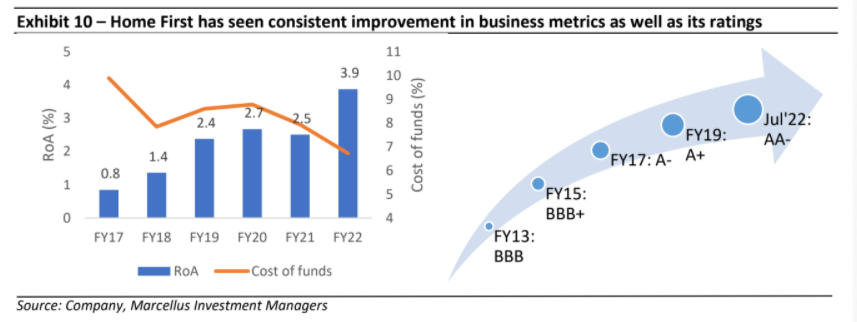

Similarly, Home First has also seen consistent improvement across metrics through the crisis ridden period of the last 6 years. The company saw uninterrupted supply of debt capital from its lender banks throughout the crises periods with marquee investors like Warburg Pincus even buying equity stake in the company (Oct-20) at the height of Covid crisis in India. The upward trending credit rating of the firm (as shown in the chart below) is a testament of its risk management ability.

Further, much like the other firms discussed thus far, Home First’s focus on digitization (since its very inception in 2010) also helped the company in being proactive during crises like Covid, when physical collections came to a standstill. The availability of a large pool of customers on the company’s proprietary app allowed collections to continue without significant interruption. Interestingly, the number of customers registered on its app has gone up from 67% in Q1FY22 (during covid wave -2) to 87% as of Sep’22. This has resulted in both lower cost of collections and easier resolutions of customer queries as a host of functions are available on the app in DIY (Do-it-yourself) mode.

In good times for the lending industry – like the conditions which we are living through i.e. when the industry credit growth is touching ~18% YoY and risks around asset quality are not visible – it appears there is no difference between an ordinary lender and a high quality lender. The quality differential emerges only when the industry is hit by unforeseen events. The response of the KCP NBFCs to such unforeseen events (demonetization, covid, ILFS crisis etc.) has been significantly better than the competition’s response. High quality companies and management teams thrive on uncertainty as that is when the competitors falter and quality companies are able to gain market share. While we cannot predict when the next crisis will hit us, the behavior of the Kings of Capital in difficult situations gives us the confidence that they will rise to the challenge when the next crisis arrives.