In our May 2020 blog (click here to read), we explained how under Deepak Parekh’s leadership, the HDFC group has become India’s most successful financial services conglomerate by dominating virtually every segment that it has entered. With the HDFC group, capital – both human & financial – has consistently been allocated prudently. Seeding HDFC Bank with Rs. 100Cr of capital when HDFC Limited had only Rs. 300Cr of net worth and the various M&As and IPOs (5 IPOs and at least 7 M&As as per our count) of HDFC group companies have been all value accretive decisions. Similarly, the Group has been able to replicate success across businesses by picking honest & capable leaders who have been able to build on the HDFC culture. Apart from prudence in capital allocation, there has always been a certain degree of fairness across all transactions where the HDFC group has been involved. In this context of prudent capital allocation and fairness – the HDFC Ltd – HDFC Bank merger is a fitting finale to crown Deepak Parekh’s career as India’s smartest capital allocator. The combined entity will be value accretive for both sets of shareholders and it has ensured that the succession planning for HDFC Ltd. is taken care of.

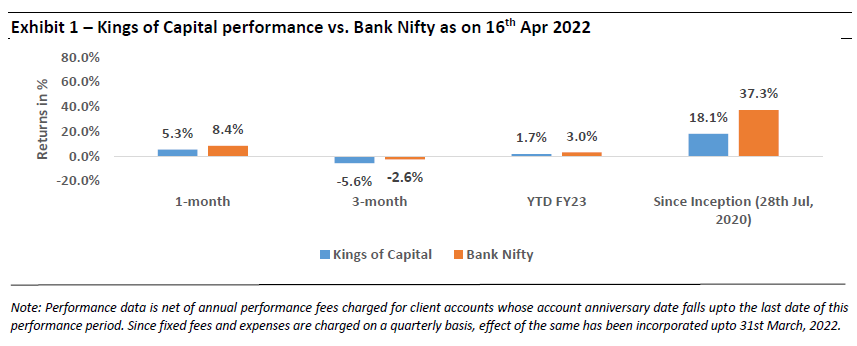

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Understanding the fundamentals and competitive position of HDFC Ltd.:

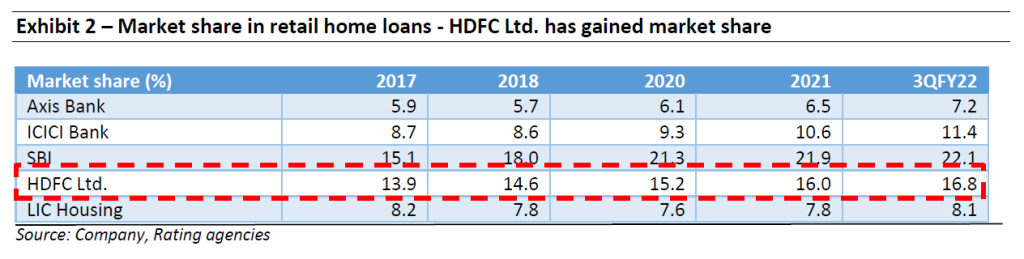

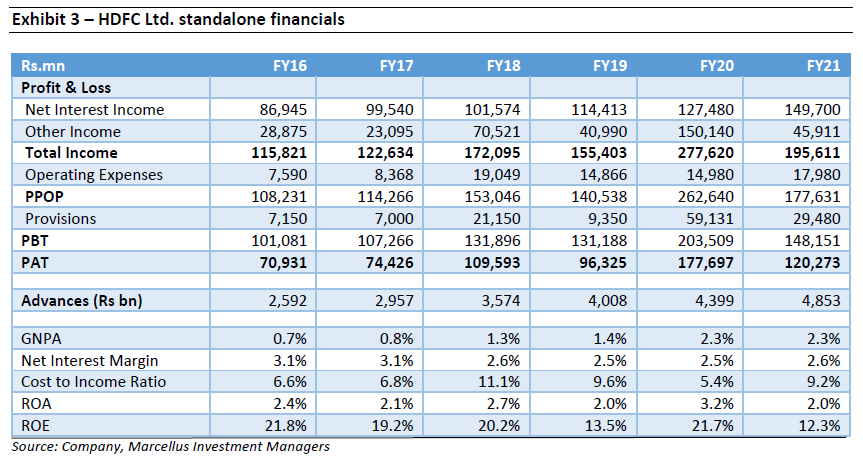

Dominant player in the mortgage market: HDFC Ltd. is one of the oldest companies in the mortgage market and enjoys a healthy ~17% market share (up from 13.9% in 2017) in India’s housing finance market. It has been able to grow its market share despite stiff competition from banks over the past few years. According to our estimates, excluding gains from stake sales in its subsidiaries, HDFC Ltd’s core business continues to deliver return on assets (RoAs) in the range of 1.9-2.0%.

- Subsidiaries are amongst the leaders in respective industries: HDFC Life (21.5% New business premium market share within private insurers), HDFC AMC (11.7% total AUM market share), HDFC Bank (11.5% loan book market share), HDFC ERGO (6.1% premium market share) are amongst the top five players in their respective sectors. Unlike other bank backed players – the promoter entity i.e. HDFC Ltd. is not a large active distributor of these financial products, but these companies have benefitted immensely from the HDFC brand and the distribution footprint of HDFC Bank.

- Benign asset quality and consistent return ratios: HDFC Ltd. has been able to grow its loan book at 15% CAGR over the last decade while maintaining steady asset quality leading to stable return ratios. Owing to the sale of stakes in subsidiaries, HDFC Ltd.’s return ratios look volatile in select years.

- Distribution model of HDFC: The majority of the loan origination of HDFC Ltd. is within the group. HDFC Sales (a wholly owned subsidiary of HDFC Limited) originates 54% of the loans for HDFC Ltd, while HDFC Bank originates 27% of the loans. DSAs (Digital Selling Agents) originate 17% of the loans and the balance 2% is sourced through direct walk-ins. HDFC’s physical distribution network now spans 593 outlets, which includes 203 offices of HDFC’s wholly owned distribution company – HDFC Sales.

Understanding the fundamentals and competitive positioning of HDFC Bank

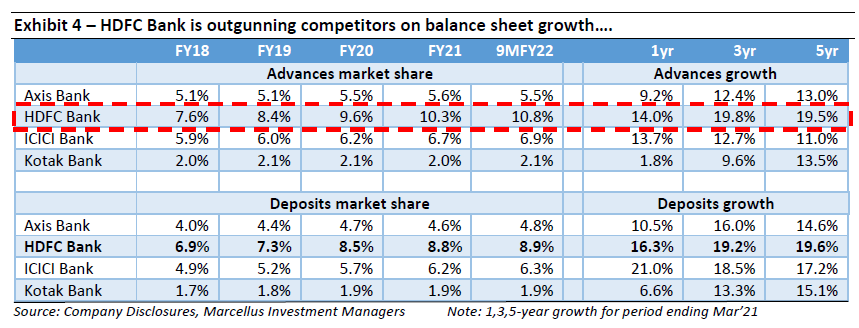

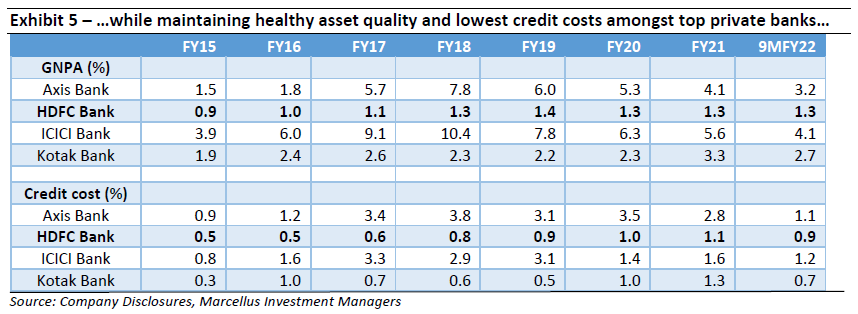

- Private sector leader: HDFC Bank is the leader amongst the private banks and has historically maintained pristine asset quality through multiple credit cycles. For a long time, ICICI Bank was the bank with the larger balance sheet; however over the past decade, HDFC Bank has emerged as the clear leader.

- Consistent market share gains on assets and liabilities: HDFC Bank has consistently gained market share on both sides of the balance sheet. Advances market share has shot up from 7% as of Mar-17 to 11.5% as of Mar-22. Similarly, deposits market share has improved from 6% as of Mar-17 to 9.5% as of Mar-22. No other bank has been able to clock market share gains on this magnitude over the past five years.

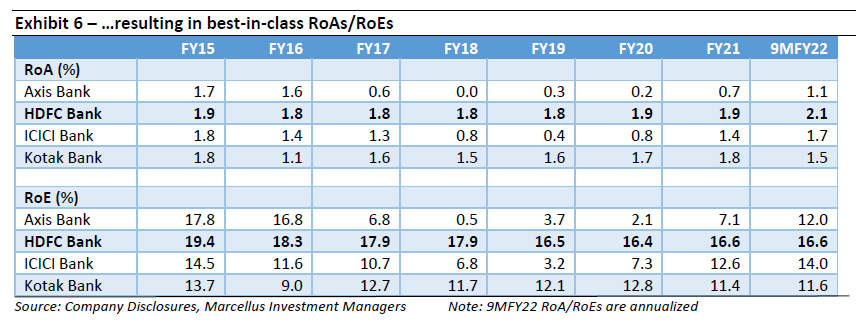

- Best in class return ratios: The bank has consistently posted healthy RoAs in the range of 1.8-1.9% and ROEs of 16-18% respectively during the past five years despite facing various macro headwinds. No other bank in India has been able to generate ROAs & ROEs comparable to HDFC Bank’s.

Understanding the implications of the merger and competitive strengths of the combined entity:

From the viewpoint of HDFC Ltd. shareholders:

- Increasing competitive pressure from banks: Data suggests competitive intensity from banks in prime mortgage has increased materially – banks’ market share in retail home loans has increased from 58.3% in FY17 to 62.6% in 3QFY22. Prime mortgage is a price sensitive market, and the lender with the lowest cost of funds is likely to underwrite the best-in-class customers at the lowest rates. Hence, given that banks will continue to have a cost of funds advantage, HDFC Ltd. shareholders are better off merging with an entity which has one of the lowest cost of funds in the country.

- Succession Planning: Most of the senior management of HDFC Ltd. is approaching retirement, Keki Mistry (age: 67 years) and Renu Karnad (67 years) are likely to not take any executive role in the merged entity. The merger solves the succession planning issue at HDFC Ltd. as the merged entity will be run by the HDFC Bank management.

- Removal of regulatory arbitrage: In the recent years, RBI has plugged various regulatory arbitrages which were available to NBFCs. Over time, it is expected that larger NBFCs will be closely regulated and hence, some of the advantages of the NBFC structure are likely to go away. Hence this merger is a timely exercise in light of the tighter regulatory regime.

From the viewpoint of HDFC Bank shareholders:

- Increase in tenure of retail assets: Owing to the lower share of long tenure assets (especially housing), HDFC Bank’s retail book runs-off faster when compared to some of the other large private banks. As per back-of-the-envelope estimates, in retail loans HDFC Bank has to disburse ~65% of the opening AUM to generate ~20% loan growth every year vs, 30% for some of the other large private banks. As HDFC Limited merges into HDFC Bank, the share of housing assets will increase materially (pre-forma from 11% of pre-merger to 33% post-merger), leading to lower run-off and higher steady state retail assets growth.

- Disbursement growth: HDFC Bank originates materially lower mortgages vs. other peer banks, as the bank was always an origination partner for HDFC Ltd. and the service capability/underwriting was always with HDFC Ltd. With the merger, these artificial constraints to growth will disappear. Hence the bank will be able to leverage upon its large footprint to originate more housing loans. Mortgages are one of the largest segments within retail housing, HDFC Bank had a materially lower market share in housing relative to its own overall loan book market share (only around ~11% of its overall book is from housing). With the merger, the banks gets access to the largest market within retail loans and will further support its presence as one of the most dominant retail lender in the country. According to estimates (KIE estimates), the consolidated entity will have 20%+ market share in mortgages.

- Ability to cross sell to a broader set of customers: As per the HDFC Bank management, ~70% of the customers of HDFC Ltd. and its subsidiaries do not bank with HDFC Bank and ~8% of the HDFC Bank customers have mortgage product from other mortgage providers. Post the merger, the bank will get access to a large pool of untapped customers who can be cross sold, both, mortgages and other products manufactured within the HDFC empire.

- RoA accretive: We believe whilst the merger is NIM dilutive (given that mortgages have lower spreads compared to other retail products), the merger will be RoA and EPS accretive given the lower cost of funds of the bank and the synergy benefits. RoEs are likely to moderate marginally over the short term, as leverage (average assets/average equity) will be lower. However, with time as leverage builds up, RoEs are likely to rebound back to levels ahead of HDFC Bank’s standalone RoEs (17-18%). Since mortgages inherently require lower capital backing (basis lower risk weights imposed by the RBI), this merger will allow the bank to further lever its balance sheet.

Implications on the competitive landscape in the lending sector:

Other large banks such as ICICI Bank (market share in retail mortgages up from 8.7% in FY15 to 11.4% in 3QFY22) and SBI (market share up from 15.6% in FY15 to 22.1% in 3QFY22) have gained market share in retail mortgages while HDFC Bank – despite being the largest private bank – was originating materially lower home loans as compared to its banking peers (housing loans per branch at Rs 18 cr for HDFC Bank vs. Rs 23/46 cr for SBI/ICICI Bank). Thus HDFC Bank was allowing peers to gain market share in the mortgage segment. We believe, the competitive landscape in the prime mortgage market is set to change as HDFC Bank gets ready to command its fair share of the pie.

If one were to look at incremental lending, ~38%/44% of the incremental domestic loan book for ICICI Bank/SBI over FY18-21 came from mortgages. HDFC Bank has dominated other profitable segments such as unsecured retail and SME/MSME lending. As HDFC Bank significantly ramps us its presence in the mortgage segment – it will put further pressure on the largest segment of its competitors.

Impact on subsidiaries

The promoter of these subsidiaries will change from HDFC Ltd. to HDFC Bank. HDFC Bank is one of the largest distributors of the HDFC’s Life insurance products, but currently doesn’t have any direct economic interest in these companies, while other banks such as ICICI Bank or Kotak have direct economic interest in the value creation of their insurance/ asset management subsidiaries. We believe, after this merger, interests of HDFC Bank and the insurance/ asset management subsidiaries will be aligned and the relationship between the entities is expected to further deepen.

Unknown unknowns

Buyout of stake or stake sale in HDFC Life: HDFC Bank will become the promoter of HDFC Life, owning 47.8% stake. According to the Banking Regulation Act, 1949, as amended, a bank can hold either less than 30.0% or more than 50.0% in a company. HDFC Bank will apply to the RBI and to IRDAI to buy additional 2.2% stake or more in HDFC Life. If HDFC Bank doesn’t get the approval from RBI for this stake acquisition, then the bank will have to pare down its stake in HDFC Life to less than 30% over a period of at least 2 years. The bank will likely get large sums of capital (Rs 250 bn+) from the stake sale over the period which the bank will judiciously use to optimize RoE for shareholders. We do not foresee any impact of stake sale by HDFC Bank on the business prospects of HDFC Life.

Dispensation of certain regulatory requirements from RBI: Banks are required to meet the 40% PSL (Priority Sector Lending) requirement, which is not applicable to NBFCs. Post the merger, the consolidated entity will therefore have an enlarged PSL requirement. As of now, details of the PSL compliant portfolio of HDFC Ltd. is not known; hence it is difficult to estimate the drag on P&L from buying PSL certificates. Moreover, HDFC Bank has written to RBI to allow the bank to meet these regulatory requirements in a phased manner.

Note: HDFC Bank, HDFC Life and HDFC AMC are part of many of Marcellus’ portfolios. Since inception of KCP (28th July, 2020) HDFC Bank has delivered 28.4% absolute return vs. 66.2% for the Bank Nifty. Also, HDFC Bank’s return from 1st April 2022 (1 day prior to merger) to 18th April 2022 is (7.3%) vs. (1.1%) for the Bank Nifty.