While the first decade of this millennium (FY00-10) saw banking industry credit grow rapidly at a 22% CAGR, the past decade (FY11-21) has seen the banking system credit grow at only a 10% CAGR. The life insurance industry has also seen similar trends – premiums grew at 22% CAGR during FY01-10 vs. 8% CAGR during FY11-21. The general insurance industry saw slightly better trends this decade with 15% CAGR growth during FY01-10 vs. 17% CAGR during FY11-21. In stark contrast to this variability, KCP companies have consistently grown earnings at 20%+ CAGR thanks to: (a) conservative underwriting standards, (b) a sharp focus on segments that they deeply understand, and (c) clean management teams. In this newsletter we delve into their secret sauce. We also discuss the change made to the KCP portfolio over the past month – we sold City Union Bank and invested in Cholamandalam.

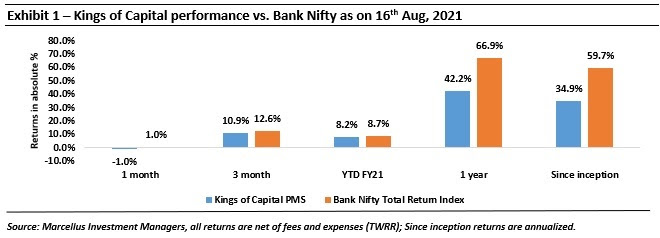

Performance update of the live fund

The key objective of our “Kings of Capital” Portfolio (KCP) is to own 10 to 14 high quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these high-quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

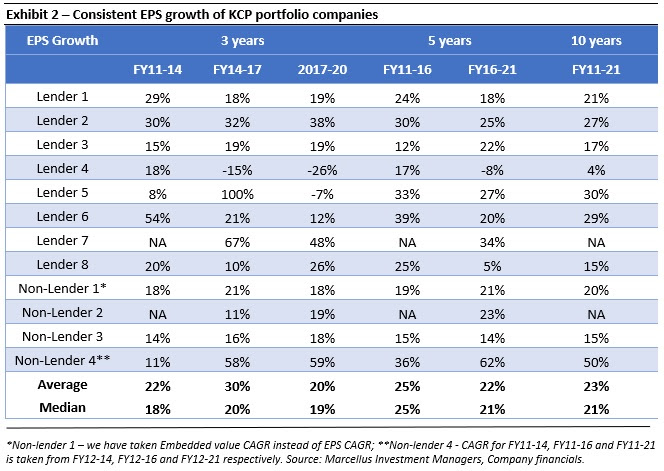

KCP portfolio companies have demonstrated consistent growth across time periods

As illustrated in Exhibit 2 below, KCP companies – regardless of whether they are lenders or non-lenders – have demonstrated consistent growth over the past decade despite the industries that they operate in growing at single digits or low double digits during this period. This ability to grow profits at a steady pace in a cyclical sector has made these Financial Services companies steady compounding machines. We delve deeper in the sections that follow as to why these handful of Financial Services companies have been able to stand tall in a sector which has been a graveyard for many prominent and well capitalised Financial Services companies.

The key conclusions from Exhibit 2 above are:

-

Consistent performance across time periods:

Irrespective of the length of time i.e. 3 years, 5 years or 10 years or the beginning or ending points, the KCP companies have delivered a healthy rate of compounding. As illustrated in our November 2020 newsletter, (click here to read) high quality financial services stocks have delivered not only superior absolute returns but also superior risk adjusted returns versus the Nifty over the past two decades.

-

Growth has been a result of market share gains:

The healthy growth of the KCP portfolio companies has not come because of the underlying Financial Services sector growing rapidly; a large part of the growth for KCP companies has come from market share gains. Over the past decade, the Indian financial system has been hit by several disruptive events such as the RBI’s asset quality review, demonetization, introduction of the Goods & Services Tax, the IL&FS crisis, Yes Bank’s struggles, the DHFL panic and now Covid-19. Although these events have led to an adverse impact on the Financial Services sector, the KCP companies have benefited from the challenges faced by their competitors. While the KCP companies also get impacted in an absolute way from a crisis like Covid-19, the relative impact on these companies is much lower than their competitors and as illustrated in our December 2020 newsletter (click here to read), Covid will lead to further market share gains for the KCP companies. The 20%+ EPS CAGR generated during FY16-21 (see Exhibit 2) is despite the excess provisions created by KCP lenders for Covid-19 related disruptions.

-

Portfolio approach to risk and returns:

In a ‘buy and hold’ portfolio with low churn, not every company in the portfolio will grow at the same pace every year. Hence the idea is to build a resilient portfolio which compounds at a healthy rate over a 3 to 5 year period. We can see that certain companies accelerate their growth and make up for the laggards during a 3-year period while the laggards become outperformers during other time periods. As a result, the overall portfolio is able to deliver a healthy rate of compounding for each 3-year period. For example, Lender 8 grew its EPS at a CAGR of 20% during FY11-14 and observed a deceleration in growth rate to 10% during FY14-17. However, during FY14-17, Lenders 2 and 3 further accelerated growth from the previous 3 year period.

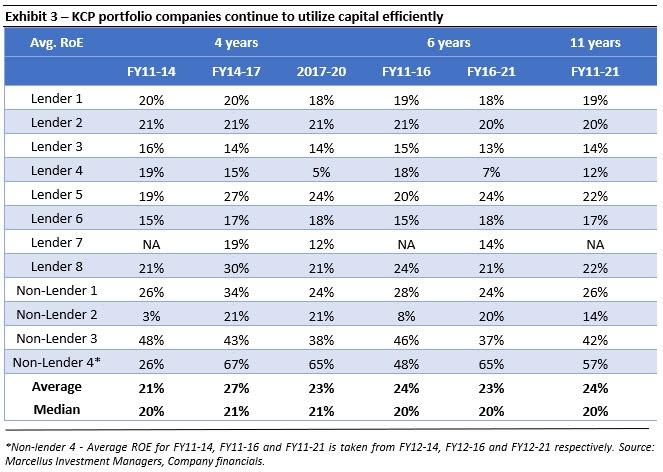

KCP portfolio companies continue to generate 20%+ return on equity consistently

Looking at the PAT growth of Financial Services companies in isolation can be misleading as these firms can raise equity capital, lend it out and increase their profitability in absolute terms. However, every time a Financial Services firm raises equity capital, its existing shareholders get diluted. It is therefore important to look at the return on equity (ROE) that a Financial Services company generates in addition to its PAT growth. As illustrated in Exhibit 3 below, the ROE for the KCP companies remains consistently above the 20% mark and the earnings growth of KCP portfolio companies has not come at the cost of excessive dilution to existing shareholders of these Financial Services companies.

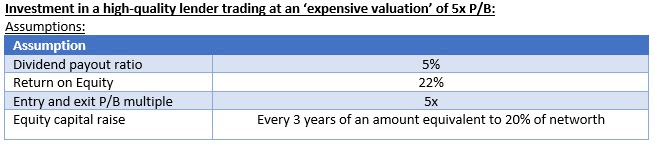

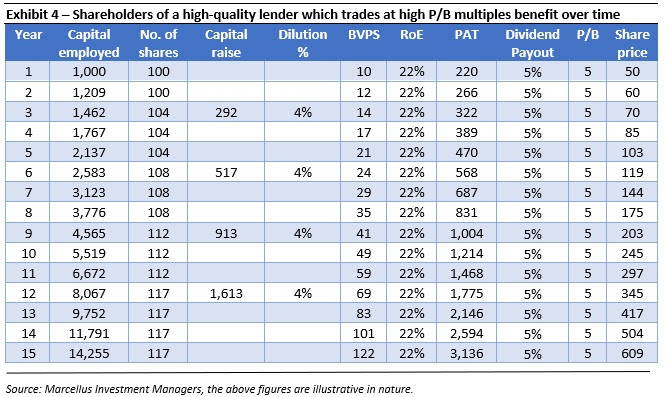

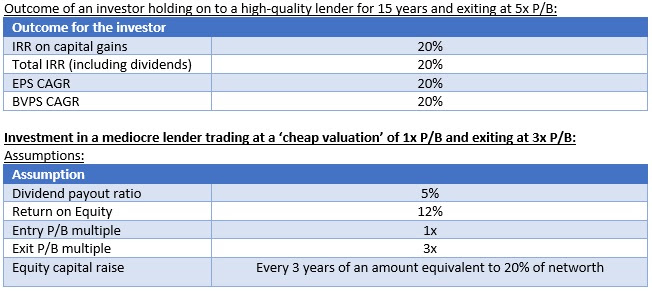

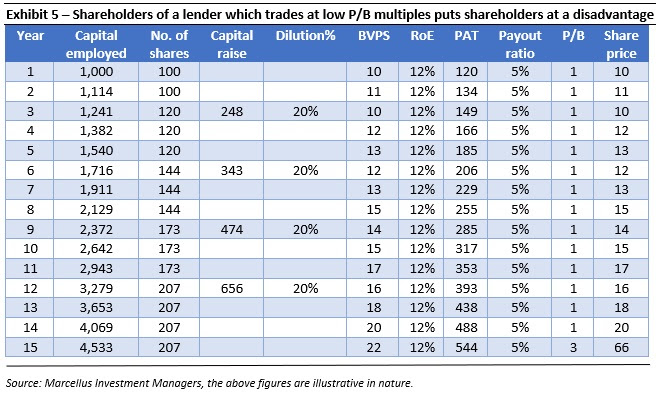

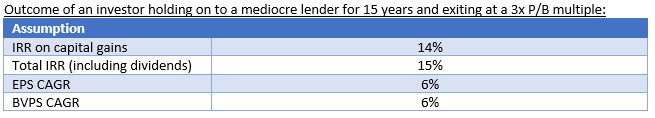

The ‘expensive’ valuation of certain KCP portfolio companies works to their advantage

In the February 2021 KCP newsletter (click here to read) we had illustrated how more than 80% of shareholder returns arise from book value per share growth and less than 20% of share price returns are attributable to entry P/B multiples. In addition to a lower BVPS compounding, shareholders of low-quality lenders are at a disadvantage as they get repeatedly diluted over time while a high-quality lender trading at a high P/B multiple sees a lower dilution while raising equity. Consider the two illustrations below:

|

|