Despite having access to enough capital and the experience of running financial services businesses for decades globally, foreign players have struggled in India. While the multinationals did not have any dearth of talent, capital, or technology, sustainable growth has eluded them (loan book market share has halved from ~8% in FY2000 to ~4% in FY2021). Key reasons which have resulted in these players gradually downsizing or exiting from India – (i) foreign businesses were never built for scale and only catered to the niche segment of elite corporates and HNWs; (ii) foreigners struggled to deal with the Indian regulatory environment and unique Indian regulations (40% of loan book towards priority sector lending, restrictions on branch expansion, etc.); and (iii) the foreigners neither empowered local management nor followed a consistent strategy vis a vis India from global headquarters. On the other hand, over the past couple of decades, Indian private banks have narrowed the gap with the MNCs on talent, access to capital and technology whilst continuing to widen distribution.

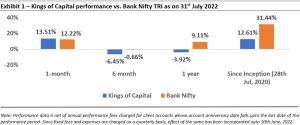

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

MNC banks have announced a spate of exits from India in recent past

“Citigroup Inc on Wednesday announced that it would sell its Indian consumer businesses to private lender Axis Bank for $1.6 billion, as the US bank exits retail operations in 13 markets. The transaction includes the sale of the consumer banking businesses of Citibank India, which includes credit cards, wealth management, retail customer accounts and consumer loans, Citigroup said” – 30th March 2022, Livemint

“Deutsche Bank is selling its Indian asset management business to Pramerica Mutual Fund… Deutsche is the sixth global financial services company to exit the domestic mutual fund industry in the last three years. Fidelity, Morgan Stanley, Daiwa, ING and PineBridge Investments are the others which have sold their local assets management businesses”- 8th August 2015, Economic Times

A theme that has consistently played out over the years in the Indian financial services sector has been the inability of MNCs to make any meaningful mark despite operating in a relatively fast growing credit starved economy. The instances highlighted above are just a few of the many examples where global financial services firms have announced an exit from India after pouring billions of dollars into their Indian operations.

Rationalization of global business, focus on profitability & RBI’s changing regulations have kept MNCs from scaling in India

- Rationalization of global business: One of the reasons for such a phenomenon has been the drive for rationalization of global lenders especially those were hammered first by the Global Financial crises in 2008 and then by the Eurozone crisis in the early part of the last decade. The exit of such lenders from India was usually part of larger plan to exit from multiple non-core geographies as these banks looked to set their house in order. For example,“Royal Bank of Scotland NV (RBS), the UK’s third largest bank with $1.7 trillion in assets, will shut down operations in India and 24 other countries to cut costs and improve returns for shareholders… RBS inherited branches in India after the global acquisition of Dutch bank ABN Amro Bank NV in 2007…The acquisition, however, proved costly for the UK bank, which needed a £46 billion ( ₹ 4.43 trillion) bailout by the British government after the global financial crisis in September 2008. RBS has since been winding down its operations in India… In a statement on Thursday, RBS said it will focus on “more sustainable business”, mainly in the UK and western Europe ‘supported by trading and distribution platforms in the UK, US and Singapore’.”- 27th February 2015, Livemint

- Lack of focus on scale: Another aspect of why MNCs haven’t garnered a meaningful share of the banking pie in India is because their focus has been on serving only the elite corporates and HNWs. As a result, even after several decades of operations in the fast-growing Indian economy, many of the foreign banks have not been able to capture meaningful market share in loan advances or in deposits. In fact, these banks have lost market share to their Indian counterparts over last 2 decades as can be seen in the exhibit below.

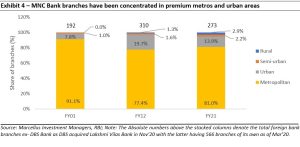

This outcome can be attributed to the preference exhibited by the MNC lenders of focusing on the urban elite (see exhibit below). Such a focus was perhaps driven by the unique underwriting risks that come with servicing large swathes of the Indian population. As a result of their high underwriting standards, many MNC banks were not able to offer their full suite of products to the end customer residing outside the big cities. Indian lenders obviously applied their mind and came up with scalable systems & processes to cater to the broader country beyond the urban elite. This sentiment is echoed by veteran MNC bankers who believe that retail banking is a more domestically focused business with local banks in India having an edge over the global counterparts:

“In my view, unlike investment banking or capital markets which are truly global businesses, retail banking is a home market or at best a multi country business. The exception being credit cards and wealth management, both of which can be global businesses. In most countries, the top 5 retail players are the local banks with multinationals playing for the number 5 to number 10 position in retail banking market share” – Gunit Chaddha, former CEO of Deutsche Bank Asia, April 2021, Times of India

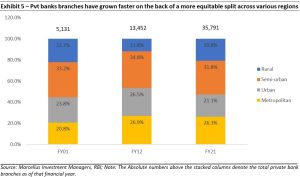

If we were to look at the branch additions, foreign banks have not added any meaningful branches over the last 20 years, with branch count growing at a ~2% CAGR (excluding DBS’ acquisition of LVB). In contrast, Indian private banks have grown their branch count at ~10% CAGR during the same time.

- Dealing with Indian regulations has been a challenge for foreign players: An additional layer of complexity emanates from dealing with changes in regulations pertaining to the Indian banking sector. For instance, while earlier the foreign banks would have lobbied hard to get a share of the branch licenses issued by the RBI every year, things changed when in 2013 the RBI tweaked the rules related to Priority Sector Lending (PSL) for foreign banks with more than 20 branches (source: ET). While earlier such banks were required to allocate 32% of Adjusted Net bank Credit (ANBC) or credit equivalent amount of Off-Balance Sheet Exposure (whichever is higher) towards priority sectors like Agriculture and small and medium businesses, now this number was increased to 40% with banks given a time frame of five years. Global bank executives were quick to react with their displeasure.

“The regulations are saying we have to go to 40% [for Priority Sector Lending] in five years, while our balance sheets are doubling. We don’t think it is either sensible or achievable” – Stuart P Milne, CEO at HSBC India interacting with ET , April 2013. [Brackets are ours]

Moreover, given the regulator’s agenda for financial inclusion, historically the regulator has given branch licenses with a preference for lenders offering a more even spread in the Urban, Semi-urban and rural India. Even for banks operating under the Wholly Owned subsidiary (WOS) mode, there’s a requirement that at least 25 percent of the total number of branches opened during the financial year must be opened in unbanked rural (Tier 5 and Tier 6) centers, i.e. centers which do not have a brick and mortar structure of any scheduled commercial bank for customer based banking transactions. As a result of such requirements, foreign banks in India have been less than keen to expand their presence in the country.

“We don’t want to open branches in smaller cities. The economy is only growing at 5%…We have reasonable coverage in major cities and we need to make these branches work for us. Being in smaller cities is not particularly attractive” – Stuart P Milne, CEO at HSBC India interacting with ET, April 2013

Even if we were to look the advances growth for two of the largest MNC banks in India, one can see from the data shown below (Exhibit 6), that the last decade was a lost decade with advances growing at low single digits.

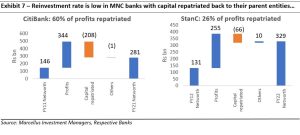

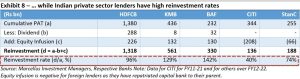

MNC banks’ capital allocation decisions also emanate from the same point of view – despite having healthy RoAs at 2.2%/ 1.7% (10Y average) for CITI and Standard Chartered respectively, these banks have repatriated ~60%/26% of their decadal profits to their parent banks! Indian private lenders on the other hand have been re-investing more than 100% of profits back in the business, leading to superior book value compounding (discussed in detail in our June 2022 Kings of Capital newsletter (link)).

Lack of distribution and success in the lending businesses has affected the asset management and insurance businesses of global players

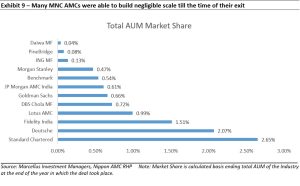

The factors outlined above which have affected the scale of MNC banks in India have also affected their other financial services businesses – such as asset management and insurance. Over the years, a number of foreign asset management companies (AMCs) have sold their operations to their Indian competitors (as can be seen in the exhibit below). As is the case for MNC banks, the decision to exit the Indian operations has been led by either a global overhaul of the business or is a result of the inability to scale up operations due to the lack of requisite distribution firepower.

“We have built a substantial onshore funds business in India over the past decade. As a result of a global strategic review and after careful consideration of what is best for our clients and employees, we have decided to find an acquirer for this business” – Michael Falcon, CEO of Asia Pacific, Global Investment Management for JP Morgan Asset Management on selling JPM Asset Management to Edelweiss, March 2016, Indian Express

The importance of having a large banking partner with a pan-India distribution presence is visible in the case of insurance businesses. As can be seen in the exhibit below, partnerships formed between insurers and smaller local players (who don’t have distribution firepower) have struggled to gain significant market share. In fact, at an aggregate level just 5 insurance JVs which have included 5 of the biggest banks in India as key distribution partners have gained significant market share at the expense of all others (see the final five rows of the table below).

Most MNC financial firms in India have struggled to scale their operations because of frequent global business overhauls, focus on servicing only certain niche segments of the Indian market and/or the inability to deal with India’s regulatory environment. As a result, many such firms have decided to exit their operations in India over the years leaving the most efficient local players to capture a higher share of fast-growing financial services business. Banking and financial services is largely a local business and with the gap between global and indigenous financial services firms narrowing especially in terms of access to technology and capital, we expect the dominance of Indian private sector players to continue over the next decade.

| If you want to read our other published material, please visit https://marcellus.in/blog/

Copyright © 2022 Marcellus Investment Managers Pvt Ltd, All rights reserved Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form. |