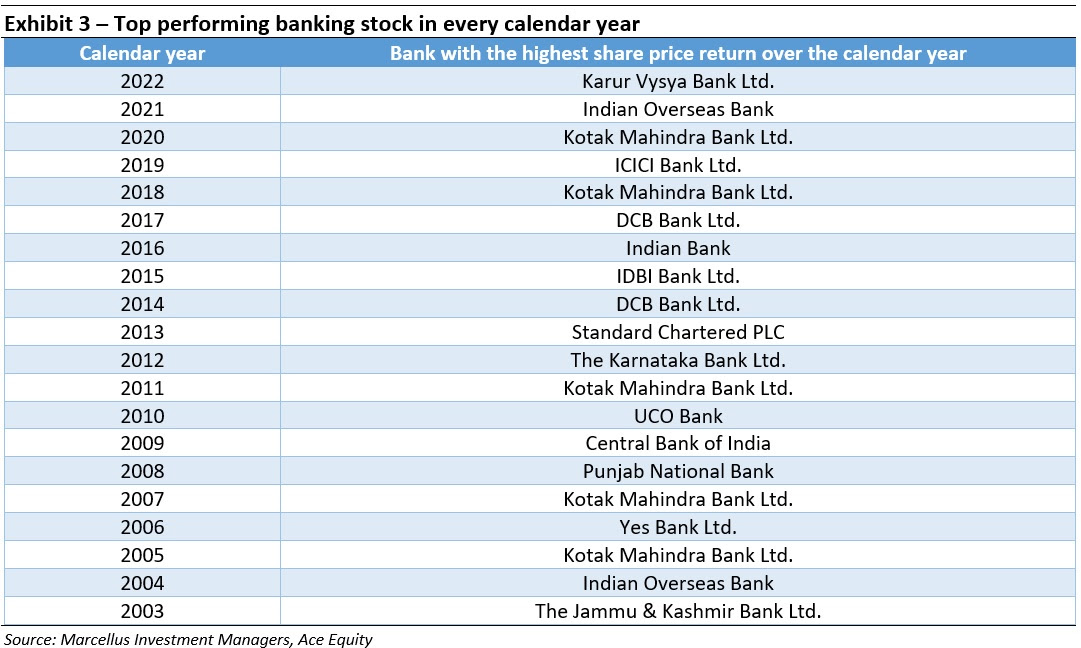

Investors who’ve studied Warren Buffett and Peter Lynch know that so-called “boring” stocks can turn out to be great investments in the long run. In India, a few lenders have been able to perform consistently across cycles. However, this also makes them prey to cycles where share prices don’t tend to follow fundamentals as investors are busy chasing cyclical recoveries which look exciting in the short run vs. boring lenders (who don’t have much to recover from as they never had suppressed fundamentals to begin with). For instance, over the last twenty years, HDFC Bank has NOT been the best performing banking stock in even a single year. However, its shareholders have compounded their wealth at 24% p.a. during this period. On the other hand, a bank like, say, Indian Overseas Bank has been the best performing banking stock twice in the past twenty years but has delivered a 4% CAGR return during the period. In this newsletter, we discuss how investors can compound their wealth in the long run by NOT chasing the shiniest new idea.

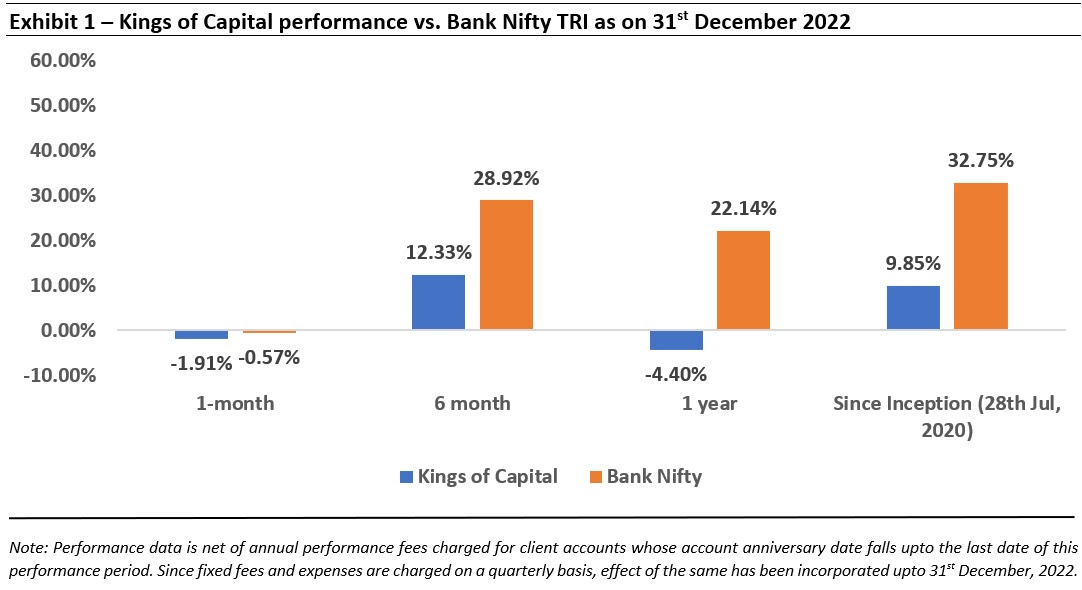

Performance update of the live fund

The key objective of our “Kings of Capital” strategy is to own a portfolio of 10 to 14 quality financial companies (banks, NBFCs, life insurers, general insurers, asset managers, brokers) that have good corporate governance, prudent capital allocation skills and high barriers to entry. By owning these quality financial companies, we intend to benefit from the consolidation in the lending sector and the financialization of household savings over the next decade. The latest performance of our PMS is shown in the chart below.

Why the best quality lenders seldom become the ‘top performing bank stock’

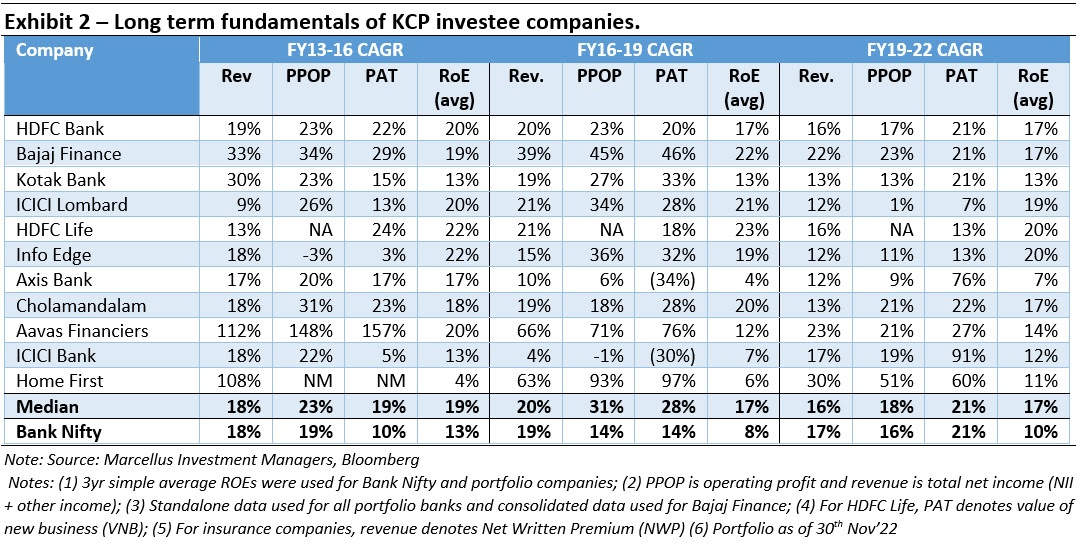

As discussed in our Dec’22 newsletter, at the start of every new credit cycle, public sector bank (PSB) stocks tend to outperform their high-quality private sector peers like HDFC Bank and Kotak Mahindra Bank for about a year. However, over time horizons exceeding five years, the performance shifts decidedly in favour of stocks that can consistently grow their earnings on the back of high ROEs and strong risk management practices.

So why are PSBs with weak ROEs able to outperform higher quality lenders in the short term? Because in the short term, stock prices are a reflection of the ‘noise’ in the market as investors often get swayed by myriad distractions and narratives and sell high quality stocks whilst buying stocks which look optically cheap on certain valuation measures and/or recent stock price performance. However, this dynamic has no bearing on long term wealth compounding.

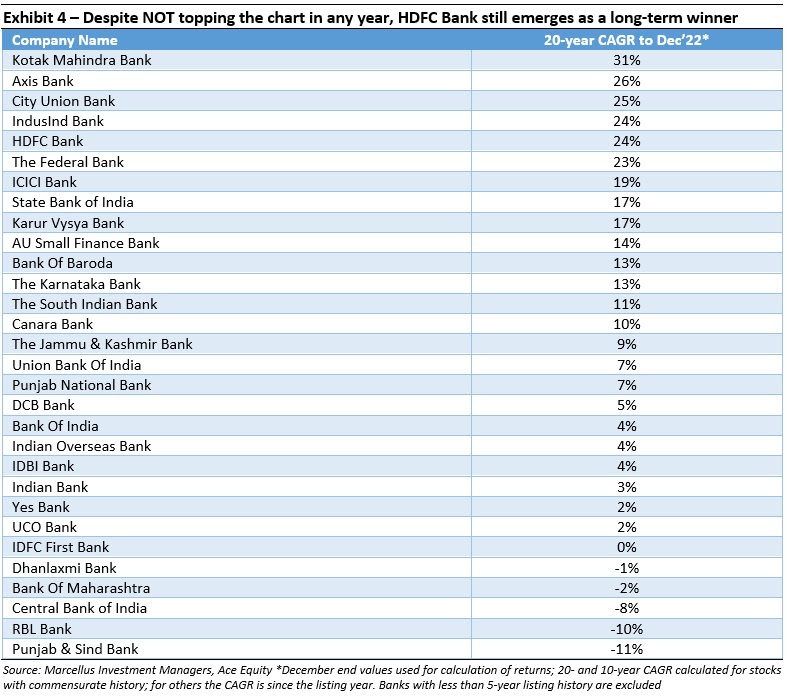

A case in point is the fact that if one was to take a look calendar year return for banking stocks over the last 20 years, stocks like HDFC Bank and Axis Bank have NEVER been the top performing banking stock in any calendar year!

However, in the long term being a ‘boring’ lender is good

The futility of looking at these short-term returns, however, can be gauged by looking at long term time horizons like 20 years and 10 years. Over such horizons, stocks like Kotak, HDFC Bank and Axis Bank are amongst top performers. Many of the star performers in the previous table (DCB, IOB, Indian Bank, IDBI, UCO Bank etc.) in fact rest nicely at the bottom of the table with single digit or even negative long term share price CAGR returns. This data becomes very relevant at a time like this when cyclical recoveries in PSU banks have garnered a lot of investor attention over the past couple of years.

There will always be some or the other ‘worry’ around the corner

The advent of the information age has brought to us many discernible advantages – from digitization of many services to removal of information arbitrage in the financial world. However, any technology comes with its downsides. The constant barrage of information we’re exposed to on a daily basis sends some investors into an overdrive of action.

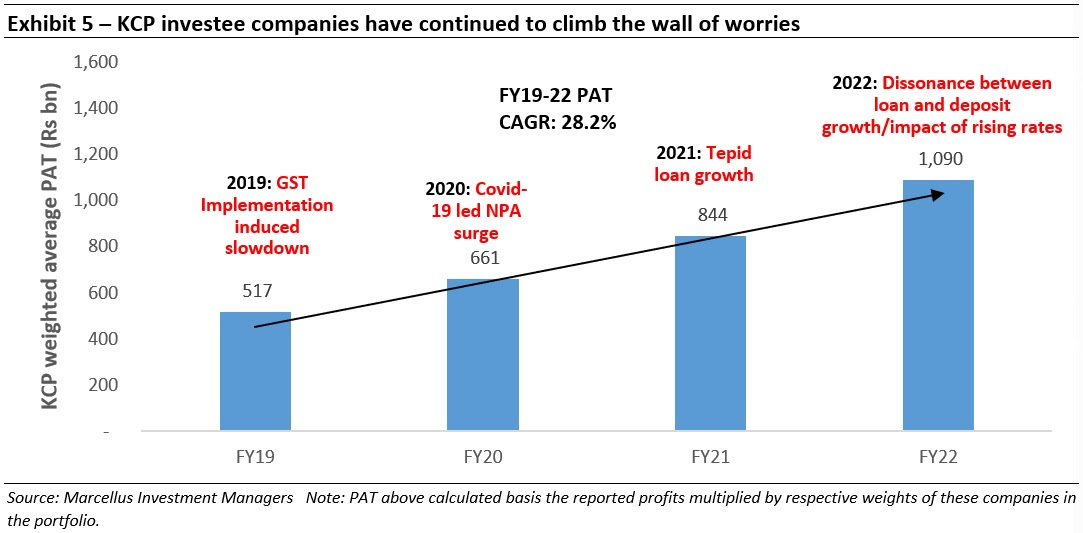

The intermediaries in the market (media outlets, broking companies, etc.) who benefit from frequent news consumption and market transactions have cleverly utilized the ease of information dissemination to that effect. By creating narratives around some or the other event and appealing to human ‘greed & fear’ psyche, they’ve made it all but impossible for an average investor to do nothing and let high quality investments compound year after year. Because “fear” gives the media eyeballs & traction, the narrative of “fear” keeps shifting. For instance, since the inception of KCP in July ‘20, the market narrative had moved as follows:

- Mid 2020: Covid-19 led NPA surge in the banking system will lead to massive write offs.

- End of 2020: Impact of RBI mandated moratorium and restructuring of stressed customer accounts.

- 2021: Tepid loan growth for the banking sector is structural. As banking sector loan growth was down to single digits, most people worried that the new digital India might not need large amounts of debt from the banking sector.

- Mid 2022: Inflation, rising interest rates and global geopolitical crisis.

- Late 2022: Deposit growth lagging credit growth – how will banks be able to fund credit growth?

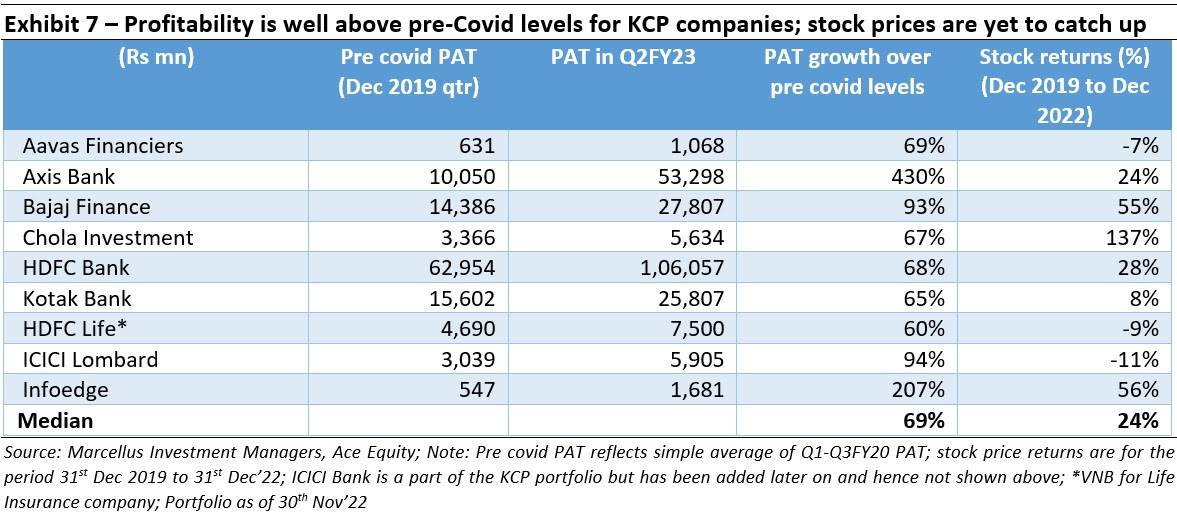

This shows how we have come from worrying about NPAs and structurally low credit growth to not having enough deposits to fund high credit growth! However, through all of this drama, the fundamentals of the KCP companies have witnessed continuous improvement (see exhibit below).

To assuage these concerns of our investors in real time over the past couple of years we had written how:

1) KCP companies had more than adequately provided for NPAs:

In our Dec’20 newsletter we had written how KCP lenders had used their discretion to aggressively provide for Covid NPAs. Two years hence, almost all of the KCP lenders are either sitting on excess provisions or releasing provisions on a quarterly basis.

2) Banks having solid liability franchisee actually benefit in a rising interest rate environment:

In our May’22 KCP newsletter we highlighted how during 3 out of the 4 rising interest rate cycles over last 2 decades, the Bank Nifty has outperformed the Nifty and high quality lenders see an expansion in net interest margins (NIMs) during such a period. Further, for high quality banks we have historically not seen any correlation between NPAs and interest rates. Well run banks where risk management capabilities are well established have showcased steady asset quality across cycles. Since then, KCP portfolio companies have seen an expansion of NIMs and banks in our portfolio are generating all time high NIMs as well as RoAs.

3) Distribution, technology, execution rigor and better risk management practices feeding into market share gains:

The Jul’22 newsletter highlighted how high quality lenders like HDFC bank have captured the largest incremental market share of advances as well as deposits over FY12-22. We also reiterated our view that the best lenders would continue to gain market share from PSBs (with 60% loan advances market share) as the latter remains conflicted between value add for minority shareholders versus the Government’s public welfare objectives. With superior credit risk management, superior return ratios, better technology and faster increase in distribution touchpoints (branches), the best lenders would continue to increase the gap in long term investor returns vis-à-vis their peers.

Temporary periods of dissonance between fundamentals and share prices is a near certainty of markets

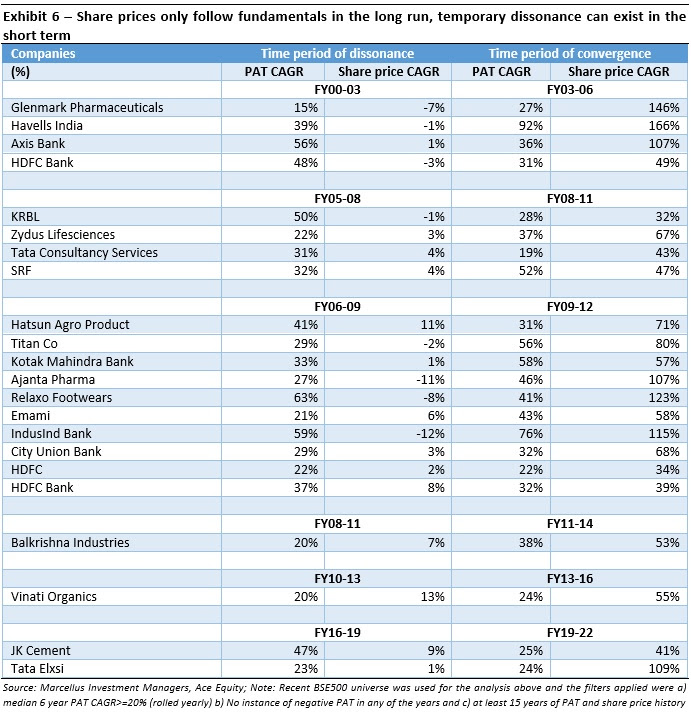

Given the impact of investor psychology on the flow of monies into stocks, the inter-relationship between stock prices and a business’ underlying fundamentals tends to break down over the short term (even as it converges over the long term). In fact, such dissonance between the share prices and the business performance tends to affect businesses across various sectors and is not just limited to quality stocks in the financials domain.

Over the last two decades there have been several instances wherein stocks that compounded earnings at a healthy rate, nevertheless, saw their shares generate sub-par returns over a 3-year horizon. However, such underperformance was resolved in the succeeding 3-year period as the share prices bounced back strongly, converging with the business fundamentals over a complete 6-year cycle.

The table below highlights some examples of such dissonance at different points in time over the last 25 years for stocks that compounded their earnings at 20%+ rate over any given six-year timeframe (using the BSE500 universe as of 13 Jan’23 and annual PAT figures). Within such a 6-year timeframe, the first 3 years saw a wide divergence developing between the way earnings (PAT) progressed vis-à-vis the share price movement. In the next 3-year period however, the share prices bounced back sharply (compounded at a higher rate than PAT) closing the aforementioned gap with the earnings growth.

Even within the wider Marcellus coverage universe, we’ve seen temporary periods of stagnation for stocks like Asian Paints (Jul’10-Dec’11, Jan’15-Apr’16, May’17-Apr’18), Dr. Lal Pathlabs (Oct’16-Jul’19), Pidilite (Jun’11- Jul’12, Mar’15 – Apr’16) on the back of concerns ranging from input cost inflation, rising competitive intensity, tepid consumer demand etc. However, as highlighted in our CCP May’22 newsletter, all these stocks recovered spectacularly from periods of stagnant performance to clock 20%+ CAGR returns over 7-10 year horizons.

All said and done, the divergence of stock price performance vis-à-vis underlying fundamentals of a business cannot continue ad infinitum. Temporary periods of divergence between share price movement and earnings are par for the course in stock markets, but such divergence tends to get resolved sooner rather than later. We’re currently undergoing a similar phase of divergence for few KCP companies (see exhibit below). However, as seen in the examples above, earnings and share prices tend to converge over a period of time.