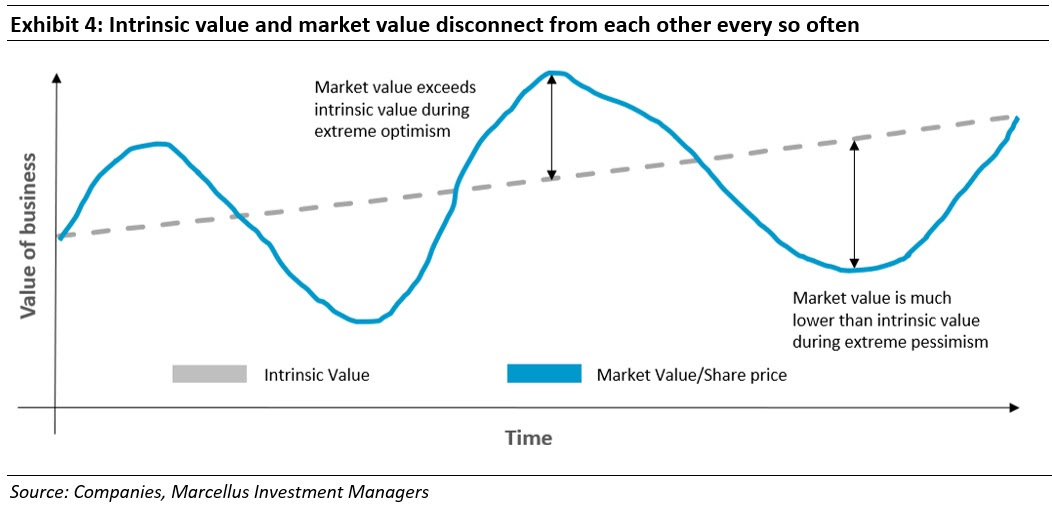

The long-term valuation of a company is determined by the growth and longevity of its free cash flows (FCF). Its share price, on the other hand, is heavily influenced by near term earnings/events. This creates a disconnect between the intrinsic value of the company and its share price. This disconnect has been stark for the Rising Giants portfolio (RGP) over the last year as the market is extrapolating the near-term headwinds for these companies at a time these companies are actually becoming fundamentally stronger (thanks to smart capital allocation and an uptick in FCF generation). We are taking advantage of this disconnect – using our proprietary Margin of Safety & Sustainability (MoSS) position sizing framework we are increasing our position in RGP stocks whose share prices have fallen the most over the past year.

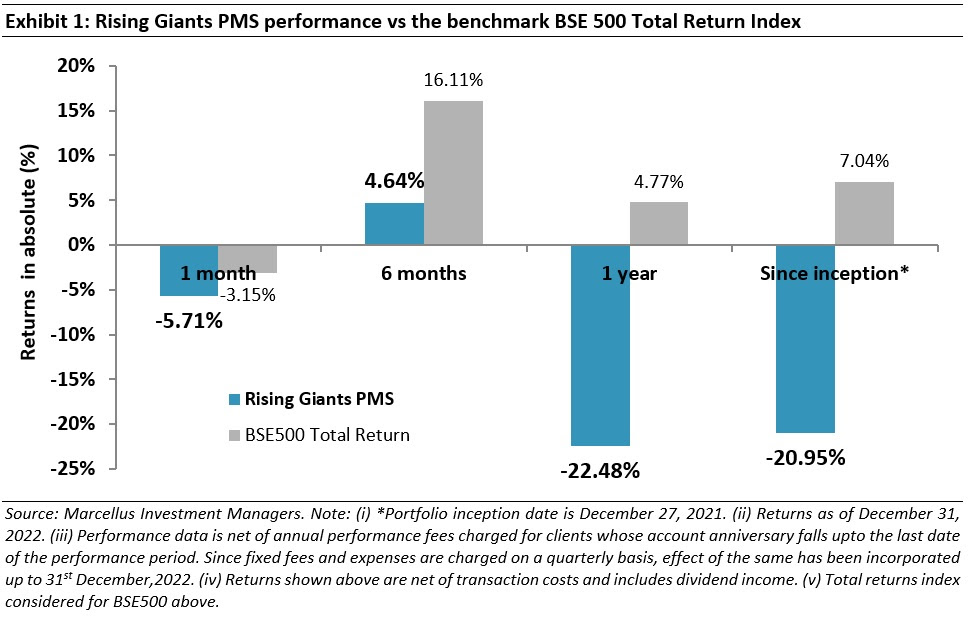

Performance update for the Rising Giants PMS

Portfolio updates: Enter Tata Elxsi, exit Relaxo Footwears

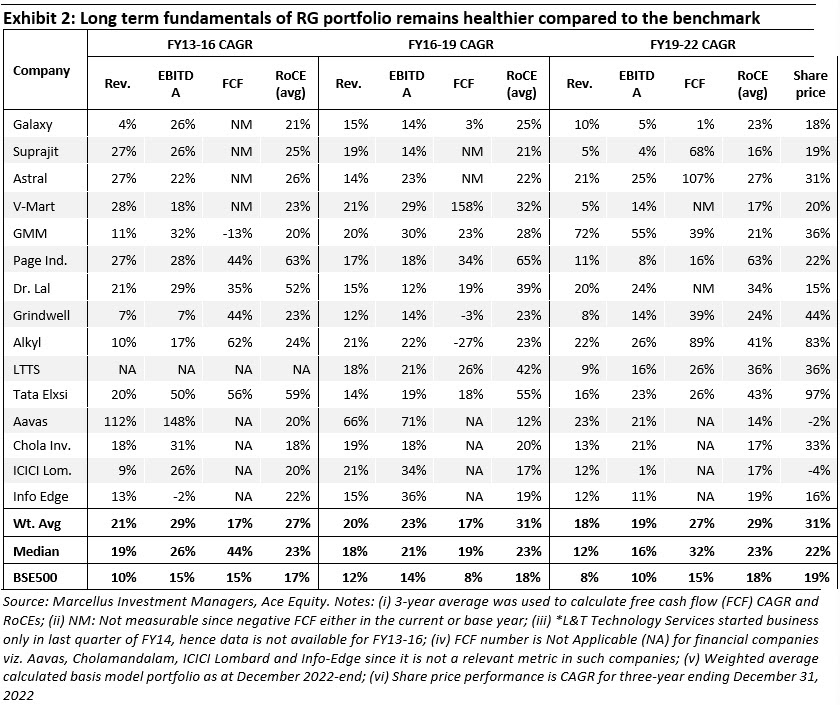

Rising Giants PMS portfolio intends to invest primarily in high quality mid-sized companies (less than Rs 75,000 crores market-capitalisation, predominantly in the Rs 7,000 crores – 75,000 crores range) with: 1) Strongly moated dominant franchises in niche segments; 2) A track record of prudent capital allocation with high reinvestment in the core business and continuous focus on adjacencies for growth; and 3) Clean accounts and corporate governance. From a universe of ~450 companies in this segment, a portfolio is constructed of 15-20 companies which make it past Marcellus’ proprietary forensic accounting & capital allocation filters as well as our bottom-up stock selection & position sizing frameworks.

Recently, we have made the following changes to the portfolio:

Addition of Tata Elxsi Limited: Tata Elxsi is an engineering research and development (ER&D) company providing designing and product engineering services to Transportation, Broadcasting & Media, Healthcare and other industries. It has consciously developed design as its core strength which acts as a key differentiator for the Company. This also helps in engaging with customers at a very early stage of the product lifecycle and with access to the C-suite (rather than, say, only R&D and Chief Information Officer (CIO) level customer personnel). The ‘Tata’ brand name helps the Company to attract customers as well as employees which is also visible in its higher offshore mix of projects vs peers. It has also invested in R&D (R&D expense as a % of sales has averaged 1.6% over the past five years) and filed numerous patents, thereby developing the various platforms/products like Autonomai (platform for auto OEMs and Tier 1 automotive suppliers), TEPlay (an end-to-end OTT video delivery), etc. The company has been engaging with customers to drive projects around Autonomous Driving (AD), Advanced Driver Assistance Systems (ADAS), electrification projects and digitalisation. It has also been investing in developing adjacencies for sub-segments like Off-Highway Vehicles, Aerospace and Railways to de-risk the revenues. To maintain its low-attrition advantage, the Company continues to invest in offices at two-tier cities of Kerala (where more than 50% of its workforce is located as per our channel checks). In the last six months, Tata Elxsi has inaugurated a new office at Thiruvananthapuram (which will house around 2,500 engineers) and a new office at Kozhikode (which will house around 1,000 engineers).

Exit from Relaxo Footwears Limited: Our recent channel checks raised market share loss concerns for Relaxo in two major categories – open footwear (specifically PU & EVA segment) and sports shoes.

In the open footwear (~40% of revenues for Relaxo are from the PU & EVA segment), channel checks suggest that in the last 6-9 months, Relaxo had taken significant price hikes on its key products due to the sharp increase in the prices of key raw materials. While this was done to protect margins, it had a negative impact on volumes in a category where the customer is particularly price-sensitive (due to the low-ticket nature of consumption). On one hand, the price differential gave smaller players an opportunity to take up the bottom end of the market by offering cheaper footwear by using low-quality material. And on the other hand, organised players like VKC took the mid and higher end of Relaxo’s market by keeping their prices competitive. While raw material prices have since corrected and Relaxo has passed on the same to consumers, it will be an uphill task for Relaxo to recover the space ceded to competitors.

In the sports shoes, players like Campus are taking market share with a focus on the design element, which is emerging as the key driver of customer buying preferences. While Relaxo has also been stepping up its focus on designs, Relaxo’s traction in the shoes market has so far been slow.

Whilst the correction in commodity prices should help Relaxo claw back its margins, the events of the past year has resulted in us reducing the firm’s longevity scores and free cash flow growth forecasts. When these reduced estimates are fed into our position sizing framework, the result is an exit for this longstanding Marcellus holding from the Rising Giants portfolio.

The disconnect between long-term fair valuation and near-term market price

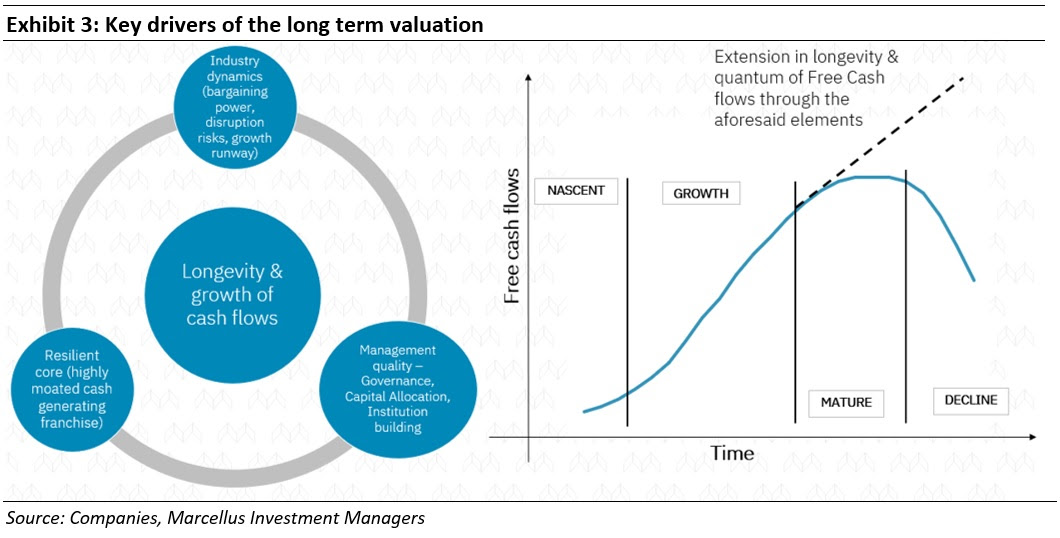

The fair valuation of a company is determined by the growth and longevity of its free cash flows: More specifically, the fair value (or intrinsic value) of a company is the net present value of all its expected future FCF over its life cycle. Long term intrinsic valuation is determined by two key elements:

1) The Growth rate of the Free Cash flows of the firm; and

2) Its longevity i.e. how far out into the future can the free cash flows keep growing.

The growth and longevity of free cash flows are in turn affected by an interplay of the following factors.

1) Industry dynamics: The growth runway available in the industry (i.e. the scope for further penetration), the risk of disruption, and the industry structure (i.e. the bargaining power of the Company vs the customers and vendors, the threat of substitutes, number of competitors, etc) are important determinants of the quantum and longevity of revenues, margins, returns on capital employed and thus the free cash flows.

2) Franchise strength:A highly moated cash generating core adds to the longevity of the cash flows by providing resources which can be used to fend off competition for long periods of time. It also provides capital to seed and sustain the new growth drivers.

3) Management quality :The macroeconomics of the country at large and the industry structure are in most cases beyond the control of management. However, management itself can significantly influence the quantum and longevity of the business fundamentals through:

-

- Governance: An organisation run with high level of ethics and governance standards typically outlasts one with dubious standards.

- Capital allocation: High quality management teams invest free cash flows proactively in the core business (gain market share through accelerating revenue growth, operational efficiencies and mitigate industry risks like disruption) and value accretive new ventures that can lead to an increase in both the eventual quantum of free cash flows and their time duration.

- Institutionalisation: Bringing more high-quality professionals into the fold/institutionalizing the operations and decentralizing the business decision making can help reduce overdependence on the promoters and thus enhance the longevity of the franchise.

…on the other hand, the current market prices are heavily influenced by near term earnings/events

On the other hand, the share price movements in the short term are mostly a function of the market’s perceptions of the business in question. Such perceptions also reflect the market’s tendency to extrapolate short term performance (good or bad) many years into the future.

Indeed, near term events can structurally impact a set of companies – particularly companies with dubious accounting practices (which comes to fore during periods of market slowdown) and companies with weak business models (for example – high leverage, high customer/market concentration, etc). However, high quality companies are able to recover from near term headwinds and get back on the path of long-term FCF and share price compounding.

This disconnect between the fair valuation and the current share price tends to exacerbate during periods of excessive market optimism or pessimism.

The disconnect between fair value and RGP share prices

RGP stocks’ share prices have corrected…

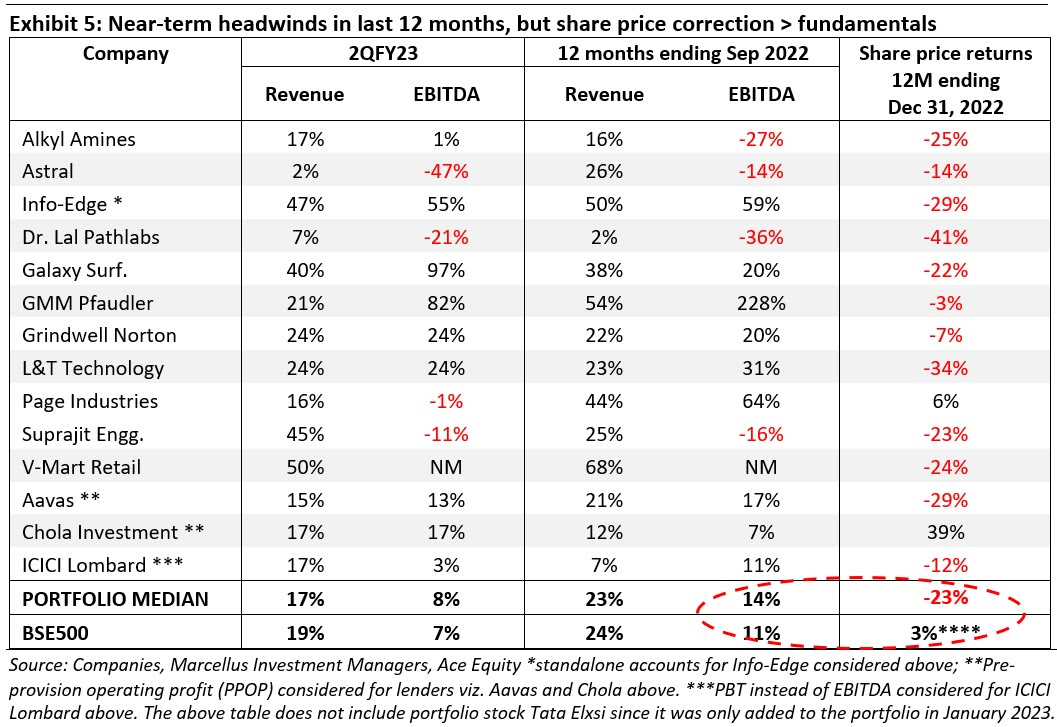

In our December 2022 newsletter, we discussed near-term drawdown in the earnings of some of the portfolio companies in 2QFY23 as well as in the trailing four quarters due to reasons ranging from significant inflation in input prices to Covid-19 related revenues ebbing off. But akin to the discussion in the previous section, many of these companies’ share prices have witnessed a far steeper correction (than warranted by the modest reduction in profits) as the market extrapolates this temporary weakness far into the future. Interestingly, even some of the RGP stocks whose operating profits have grown have seen their share prices decline substantially (Eg.V-Mart and Aavas) thus underscoring the broader divergence between the share prices and fundamentals. We reproduce the below exhibit from the December 2022 newsletter to highlight this aspect.

…at a time when the RGP companies are structurally gaining muscle

In the December 2022 newsletter, we highlighted how business headwinds are not new for the RG portfolio companies. However, the RG companies have emerged stronger, not weaker, from such headwinds by strengthening their businesses through transformational capital allocation initiatives.

In the current period of slowdown too, we have seen the RG companies applying a time-tested template of ramping up capex. For instance, the median spend of RG portfolio companies towards capex/investments in FY22 is nearly 2.3x vs the annual average spends between FY19-21. Many of the portfolio companies have witnessed significant enhancement in their addressable market coming from globalisation as well as getting into new product adjacencies.

Furthermore, as explained in our previous RG newsletters, there has been a structural improvement in the free cash flow generating abilities of the portfolio companies thanks to the improvement in their profits margins, a reduction in their working capital cycles and an improvement in their asset turnover. Ever expanding cash flows have opened up several opportunities for the portfolio companies to keep investing and growing the franchise for many years to come.

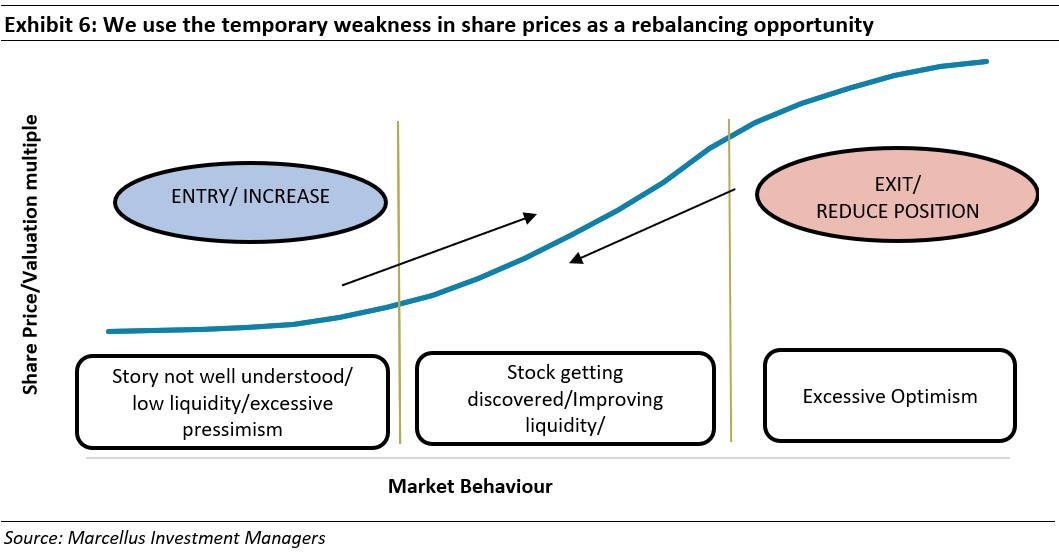

How are we trying to benefit from this near term disconnect?

For the portfolio companies, where structurally, the fundamentals have remained strong (or have gotten stronger) but which have been at the receiving end of market’s pessimism, we use the near-term share price correction to our advantage by increasing the position size (using our proprietary Margin of Safety & Sustainability or MoSS framework).

For example, we have used the share price weakness over the past year in stocks like Dr. Lal Pathlabs and LTTS to increase their position size in the portfolio. Both these stocks have seen their share prices correct by around 40% in the past year.

For Dr Lal Pathlabs, the concerns in the broader stockmarket surround the new entrants in the diagnostics space who are aggressively pricing their offerings. However, in our view, the turnaround time, quality and accuracy of reports are more important drivers of competitive advantage than pricing.

For L&T Technology Services, the concerns surrounding a possible US recession have been weighing heavily on the stock price. However, such concerns ignore the structural opportunities surrounding the outsourcing of engineering R&D by large Western companies. These opportunities typically rev up during periods of economic slowdown/recession in the West. For more details on the concerns and our take surrounding both these stocks as well as other stocks which have witnessed significant share price pullbacks, please refer the July 2022 Rising Giants newsletter.

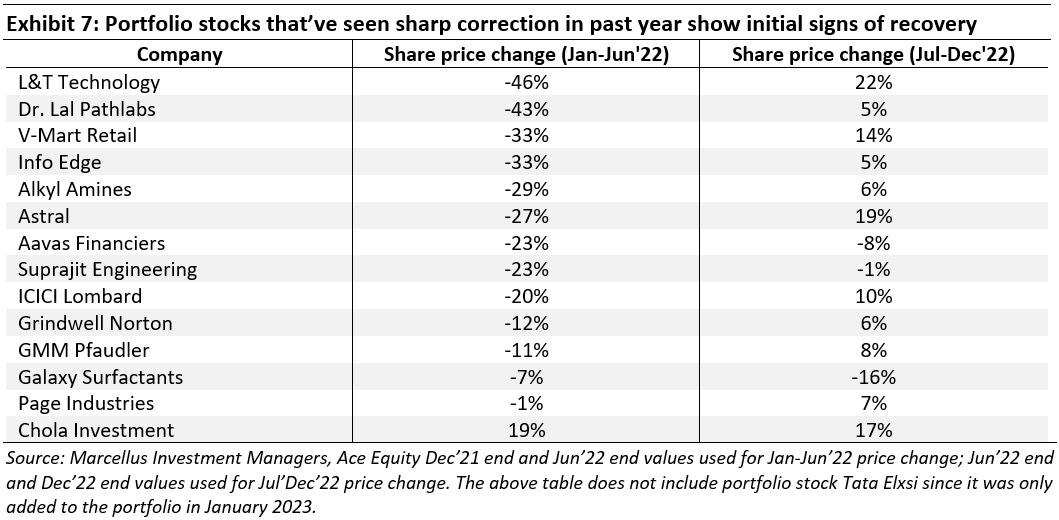

As can be seen in the table below, many of the stocks which saw a sharp correction in the first half of the last calendar year, have started showing signs of recovery. We remain confident that much like in the past, as economic conditions globally revert to normal and the gains from continuous improvements in underlying business fundamentals becomes evident, share prices will converge towards the intrinsic value for RG stocks.