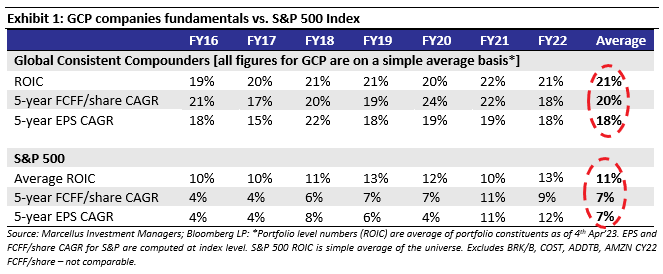

Marcellus’ Global Compounders Portfolio (GCP) invests in 25-30 deeply moated global companies listed in North America and Developed Europe. We employ a bottom-up company selection methodology that includes conducting primary research on moats, capital allocation, longer-term opportunities, and risks in order to comprehend the growth of cash flows over the long term. The nature of the products and services – which cater to global economic megatrends – and moats developed around process capacity, R&D, and capital allocation, are the key factors that contribute to the consistency of free cashflow compounding for GCP companies. As compared to the 6-7% p.a. growth seen in the S&P 500’s free cashflows, the GCP companies have produced 20% p.a. growth. The average age of the GCP firms is over 60 years, and they have more than 20 years of dominance in their chosen sectors. More than 80% of GCP’s allocation is invested in equities that are listed in the United States. 15 stocks constitute more than 75% of the portfolio.

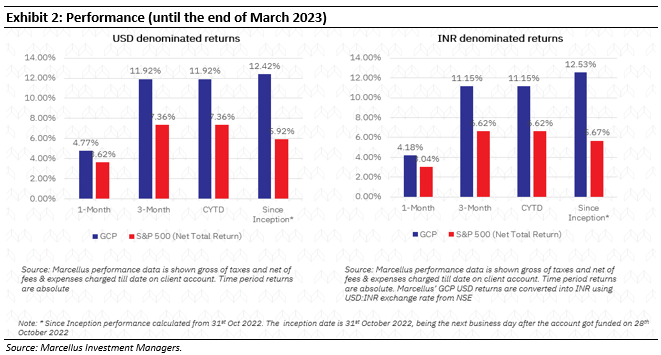

Investment in Marcellus’ GCP is through Separately Managed Accounts (i.e., SMAs, just like a PMS) via GIFT City (regulated by IFSCA) with a minimum investment amount of USD 150,000. Marcellus went live with GCP on 31st October 2022.

The GCP Introductory newsletter provides more details on why investing in the world’s greatest compounders makes sense.

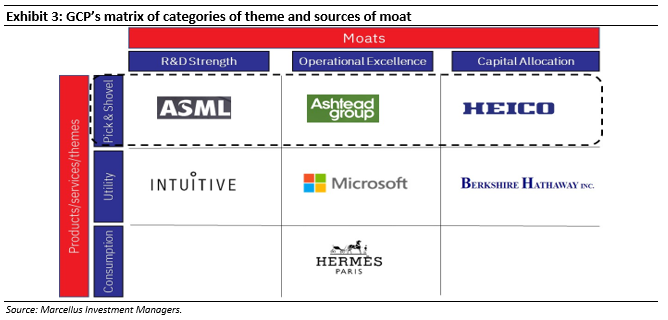

Exhibit 3 provides an example of how two critical pillars form the foundation of GCP Companies’ which drives dominance and excellence:

I. The nature of goods and services: GCP companies benefit from consistently strong and observable growth in revenues and earnings as a result of expanding underlying demand. We categorise them into three groups: Pick & Shovel (40–50% of the portfolio): Crucial for a sizable addressable market with structural growth. Utilities (30–40% of the portfolio): Unrestrained oligopolies, quasi-monopolies, and monopolies that respond to the growing demands of end customers. Consumption (20–30% of the portfolio): Meeting the demands of the wealthy class around the world.

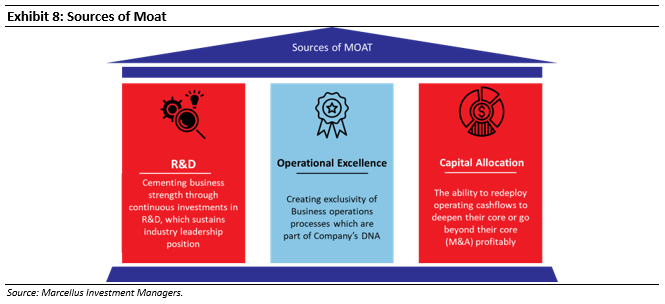

II. Sources of Moat: GCP companies’ moats arise from their R&D capabilities, Operational Excellence and Capital Allocation.

|

#Reason 1 – Despite being an absolute necessity for the end market, these industries tend to fly under the radar for a long time

These industries start small and niche. As such, they don’t attract the attention of large players in the ecosystem. By the time the industry has scaled and is capturing a significant portion of value, early movers would have created exclusivity and deep moats, protecting against entry from potential competitors. An example of this phenomenon is lithography equipment.

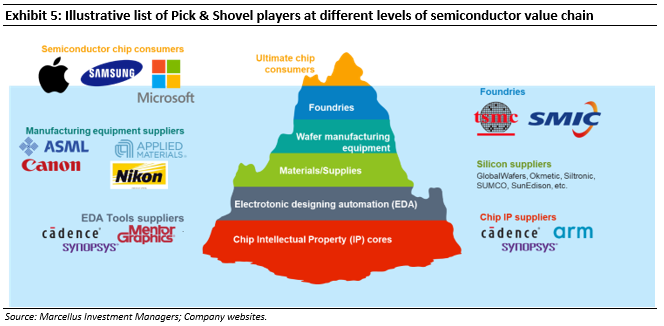

As per Semiconductor Industry Association (SIA), the semiconductor market has expanded at 7% CAGR over the past decade, and lithography machines are its pick & shovel. Lithography is an essential step in the etching process of chip manufacturing. Despite this, it represents less than 5% of the $600 billion market for semiconductors. Decades ago, the major manufacturer of lithography machines – the Japanese juggernaut Nikon, did not prioritize cutting-edge lithography R&D because the business opportunity was too modest compared to their main area of interest, consumer electronics. ASML, a GCP company, recognized the opportunity and strengthened its position to the point where it now controls 90% of the market for lithography equipment.

#Reason 2 – A range of customers (in the same industry) and exposure to a variety of end markets help generate predictable cash flows

Industries with structural growth draw rivalry, which can result in falling profitability, excessive cash burn, and extended payback times. Such a situation makes it very challenging to identify the next leader for an extended period of time. A pick & shovel company, however, behaves like a “neutral-arms-dealer”; regardless of who prevails in the product war, the arms dealer wins.

Specific end markets may experience volatility due to product cycles or downturns in linked industries.

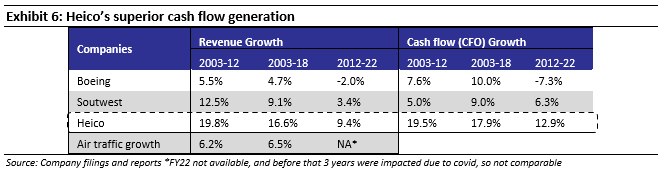

HEICO, a GCP company, supplies parts to major airlines around the world. These airlines are required by regulators to replace spare parts based on usage. This in turn improves predictability of revenues for HEICO. Over the past three decades, the firm has taken advantage of those predictable cash flows to create a separate business vertical and become a monopoly parts supplier to defence contractors.

#Reason 3 – Value capture > value addition

Value addition happens at multiple levels in any sector. However, value capture, as measured through superior return on capital, only happens in a very small part of that ecosystem. In any industry, most companies tend to focus on the largest parts of the value chain with high headline revenues, which results in increased competition and reduced profitability in these parts of the value chain. In contrast, a small minority of companies target the underutilised sections of the value chain, establish their dominance, successfully capture value while remaining relatively small in revenue terms, leading to superior returns. For instance, ASML’s Return on Capital is more than 2x that of the typical S&P500 business or the semiconductor industry. Both Boeing (the leading manufacturer of aircraft) and Southwest (a best-in-class airline), significantly lag HEICO in terms of growth and returns by a factor of about two times.

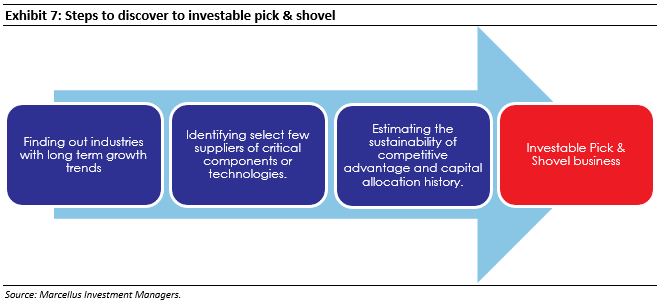

How to identify investable Pick & Shovel companies?

Step – 1: Look for industries with good structural growth prospects alongside the prospects of an expanding use case:

The first stage is to determine which sectors stand to benefit from structural tailwinds which can drive long-term growth. Only if the end market stays strong will the pick & shovel companies be able to produce consistent growth in cash flow. One such industry, in our opinion, is semiconductors. As the world becomes more digital, it will require more computing power and therefore more semiconductors. The use of semiconductors is also expanding across and within sectors. For example, a car’s semiconductor content has nearly tripled over the past decade. Moreover, in a car, there are typically 800 chips, which is nearly 6 times as many as in a smartphone. No matter which automaker produces the most intelligent and sought-after vehicles, ASML is likely to continue to dominate as long as there is demand for ever-more complex chips.

Step -2: Identify the choke points

The next phase is to identify the participants in the value chain which provide the most value addition or serve as a single supplier of crucial components/technologies in an industry with long-term sustainable growth prospects. These companies are likely to have the greatest bargaining power and the capacity to provide strong economic development and greater returns on investments. Since ASML has constructed its moat using a variety of strategies, from technology to building a complex global supply chain for itself, ASML’s lithography machines are practically impossible to duplicate. In the generic aircraft components market, HEICO has achieved the same results, virtually monopolising the majority of its SKUs. HEICO’s Federal Aviation Administration(FAA)-approved generic parts help airlines drastically save costs by addressing one of the biggest issues the industry has always faced. As a result, airlines have become heavily dependent on HEICO.

Step -3: Assess capital allocation history and estimate the sustainability of competitive advantages

The identification of a pick & shovel businesses does not mean that it is investable – further evaluation is needed on strength of its moats (competitive advantages), history of capital allocation, stewardship (performance of CXOs) and consistency free cash flow generation.

For GCP Companies, there are three main sources of moat: R&D, Operational Excellence, and Capital Allocation. ASML cemented its moat through consistent R&D investments, which helped deliver and sustain the firm’s technology leadership, further moated by consolidating its critical suppliers. ASML’s 90% market share in the lithography market (across logic foundries like TSMC, Intel, SMIC as well as memory foundries like Micron) reflects its contribution to the fulfilment of Moores Law (i.e. the doubling the chip capacity every year) over the past 25 years. It has continued its stewardship of innovations through investing ~40% of its operating cashflows into capex and acquisition, which has helped the firm maintain its monopoly in the market. Over past 10 years, it has compounded its revenue and free cash flows by 13% and 28% respectively.

Shortcomings of the Pick & Shovel strategies

All three elements of a pick & shovel companies need to be met for value creation. For instance, if we observe the Auto industry in India, the strategy has not worked out. Taking the NIFTY auto index as the base, as per NSE India, the current consolidated market cap of the seven Auto OEM companies stands at ~US$113bn whereas the eight largest auto parts companies stand at just ~US$35bn. This low value creation reflects the relative lack of suppliers in the chain who could rise to being critical suppliers with monopolistic pricing power. In the following situations, pick & shovel strategies may not work:

- The long-term industry, on which the pick & shovel businesses are dependent, itself get disrupted by other industry due to innovations, regulatory changes, loss of utility etc. Pick & shovel businesses that have diminishing competitive advantages tend to lose their pricing power and end up fighting against several new competitors.

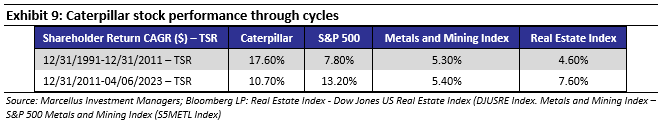

Caterpillar is the construction industry’s pick & shovel. Caterpillar expanded its market reach into fresh countries and industries, such as the mining, oil, and gas markets, greatly increasing value for shareholders. However, Caterpillar noticed increased competition from developing nations like China (e.g. Zoomlion Heavy Industries) as the mining and oil & gas boom began to slow down in the early 2010s. Moreover, Caterpillar has had difficulty identifying more recent adjacent markets in the last decade that could favourably change the company’s revenue mix. As we can see in the table below (Exhibit 7), Caterpillar’s stock compounded (driven largely by growth in the firm’s fundamentals) at a far higher pace from 1991 to 2011 than the broader market did, despite real estate and metals and mining’s weak profit growth. However, Caterpillar could not sustain the value compounding in the ensuing years (2011-2023) whereas the end market expansion continued at a similar rate.

- When the gap between value capture and value addition becomes noticeably wider, the consumer business moves up the value chain and disrupts those industries since the Pick & shovel business may be relatively small in comparison to the consumer business. This has occurred to many “single product” technology enablers in the enterprise productivity tools (picks and shovels) industry. Microsoft (another GCP Company) has frequently been on the winning side of it, mostly driven by its biggest moat – Enterprise Sales. In an effort to unseat Slack as the leader in business communication tools, Microsoft packaged Teams with Office365.This led to Teams capturing a large incremental share of the business communication market and further increased the criticality of Office tools for enterprise customers.

- Often, pick & shovel industries are small. In such situations, it is hard to find in publicly listed pick & shovel companies in that industry. This is often the case for domestic/single country-oriented pick & shovel industries.

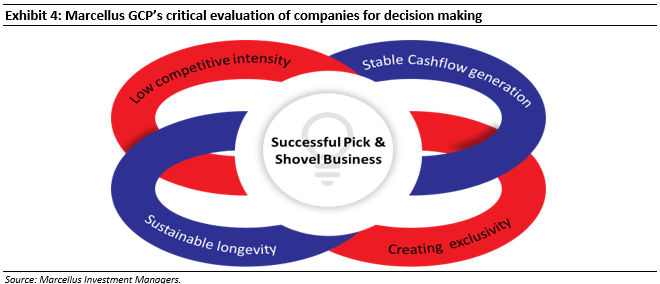

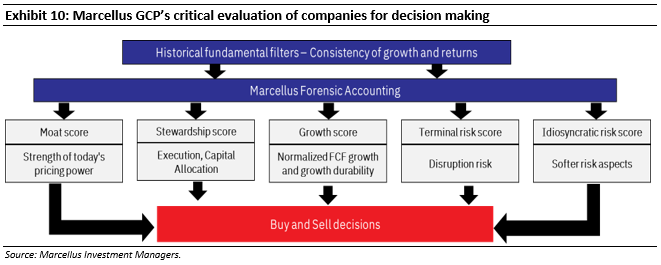

For Marcellus’ GCP, the identified Pick & Shovel businesses goes through further evaluation on various parameters as shown below in the Exhibit 10.

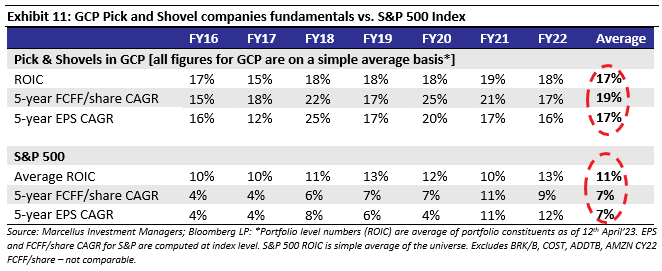

Outcome: Fundamentals of the Pick and Shovel companies in GCP

The fundamentals of the pick & shovel companies significantly outperform an average S&P 500 company on fundamental parameters as seen in Exhibit 11. Specifically, the average return on invested capital is more than 1.5x of S&P 500 and free cash flow growth rate is almost 3x of S&P 500. This outstanding performance comes from efficient operational performance, strong competitive advantages and sensible capital allocation.