Large businesses often face the risk of stagnating growth due to saturation of their core market or disruption from new innovators. One way to mitigate this risk is to invest in disruption, innovation & expansion of the business into adjacencies. However, successful execution of such capital allocation decisions is not dependent only on strategic decision-making & a strong balance sheet. Instead, success in such endeavours is critically dependent on the availability of high-quality leaders, preferably internally groomed, to execute the new business initiative with focus, discipline and rigour. Hence, the longevity of such firms becomes a self-fulfilling loop – successful capital allocation decisions help retain high quality internally groomed talent, and the availability of such talent fuels success at disruptions / innovations / adjacency expansion. In this newsletter, we discuss some of such case studies from our global equities’ coverage (Amazon, LVMH and Google) and some investments from our domestic CCP portfolio (Asian Paints, Titan and Kotak) whose evolution demonstrates the interplay between succession planning, successful expansion, extended longevity of Free Cashflow growth (beyond the market’s expectations) and thus undervaluation of the stock.

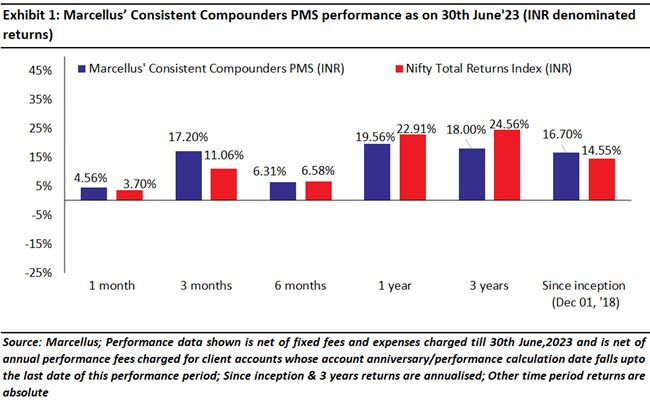

Performance update – as on 30th June 2023

“If you’re the chief executive or board member at a large company, your company should have management development processes and long-range succession planning in place to ensure a smooth transition from one generation to the next. The key is to develop and promote insiders who are highly capable of stimulating healthy change and progress, while preserving the enduring core ideology of the institution” – Jim Collins, author of Good to Great, Built to Last, etc. in an October, 1994 article on his website

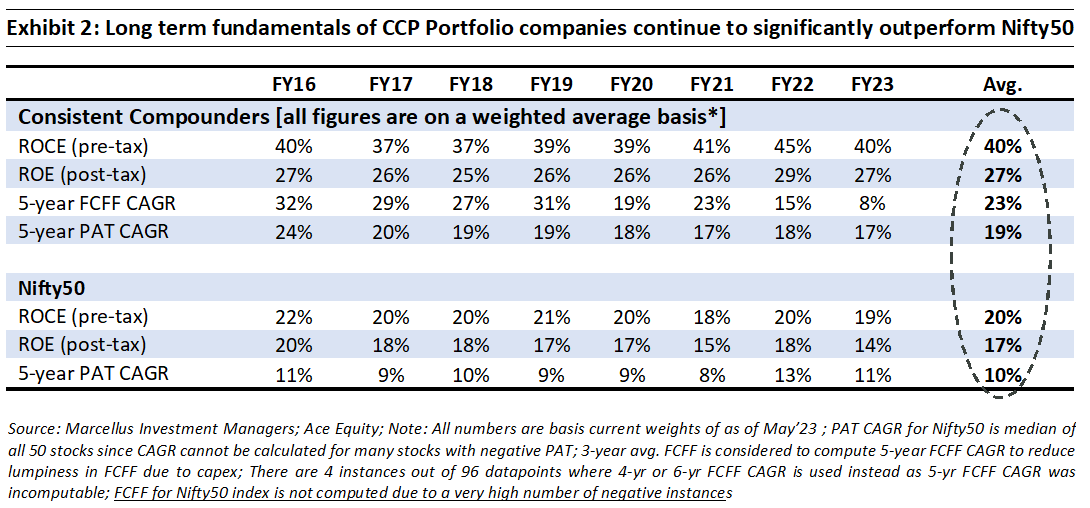

Marcellus’ Consistent Compounders PMS invests in a concentrated portfolio of heavily moated, market leading franchises that can drive healthy Free Cashflow growth over long periods of time. One of the criteria for inclusion of a stock in CCP’s coverage universe is – ‘historical capital allocation prudence for longer than a decade’. Due to such strong historical growth over long periods, several CCP companies have become corporate behemoths. A potential risk emanating from the large size of such businesses is around moderation in their growth rates going forward. There are several examples around the world of large businesses either stagnating or getting disrupted after having become behemoths in their respective industries.

For example, in the automotive industry, Ford established its dominance 100 years ago by introducing mass production with the first moving chassis assembly line in 1913 that transformed manufacturing. However, through the 1950s and 1960s, General Motors won market share from Ford by increasing the scope of offerings through product-specific assembly lines. Subsequently, Japanese carmakers like Toyota won market share by bringing novel, compact cars to the markets. More recently, electric vehicles (EV) are seeing increased adoption, led by Tesla and BYD.

In India’s oral care industry, Colgate has historically benefitted from increase in penetration of toothpastes, increase in frequency of consumption (from once-a-day to twice-a-day brushing) and gain in Colgate’s market share. However today, with 90%+ penetration of oral care category and 60% market share, Colgate has grown topline growth has slowed down low to mid single digits annually over the last 5-7 years.

Risk of stagnation of large dominant companies emanates from lethargy around capital allocation decisions

Why do large dominant companies run the risk of stagnation? Key phrases that immediately come to mind include: ‘saturation of growth potential’, ‘disruption from new competitors’ etc. However, these adverse outcomes are nothing but the result of imprudent capital allocation decisions taken by highly cash generative companies on two fronts –

- Innovation / disruption; and

- Adjacency expansion

Consider the Innovators dilemma for instance – a term first coined by the late Harvard professor Clayton Christensen in his pathbreaking book “The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail” in 1997. In this book, Prof. Christensen discusses why incumbents in many sectors are upended by new entrants. According to Christensen, while large companies are good at sustaining technologies (which lead to incremental improvements in existing products), they are left wanting when it comes to disruptive technologies (technology that suffices the needs for low end of the market at the start but is moving up the value chain rapidly).

The key reason for this according to Christensen was that disruptive technologies do not satisfy the demands of high-end markets initially and given their sub-par profitability, are overlooked by large companies. Eventually however, disruptive technologies surpass sustaining technologies in satisfying market demand with lower costs. When this happens, large companies who did not invest in the disruptive technology sooner are left behind.

The evolution of audio formats over the years is a good example. The industry evolved from vinyl records to audio cassettes in 1980s to Compact Discs (CDs) to MP3 players in 1990s-2000s to internet streaming now. Interestingly, none of the dominant companies of a particular phase in the industry sustained their dominance through the subsequent phases of evolution of the industry.

Lack of adjacency expansion is another source of imprudent capital allocation that leads to stagnation of growth. For instance, in the sporting goods industry, Nike pulled away from Reebok during the 1990s because while Reebok remained stuck with shoes, Nike branched out from shoes to clothing line endorsed by a sport’s top athlete, to balls, equipment and other such adjacent categories.

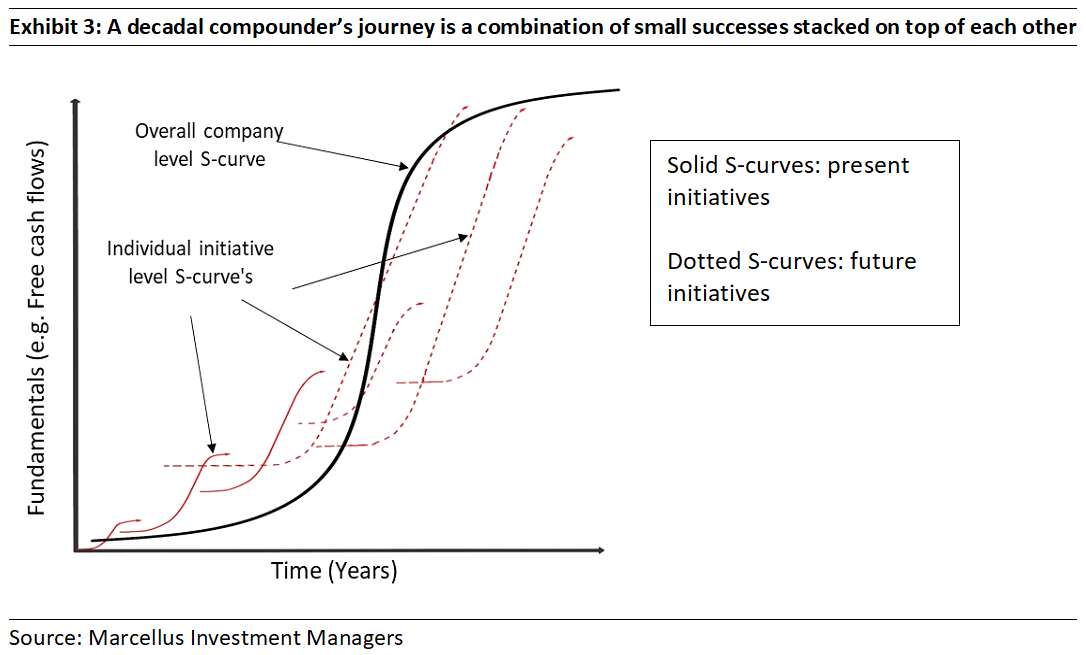

Effectively, as highlighted in our Dec’21 newsletter, large companies that avoid stagnation of growth add new ‘S-curves’ in the business (i.e. new initiatives) periodically and increase the durability of value addition from each initiative – see exhibit below.

Processes for internal grooming of talent is one of the key drivers of successful execution of strategic initiatives around adjacencies, innovation and disruption

While an incumbent organization may have the right mindset & resources to keep growing (in terms of having a strong R&D engine, strong balance sheet, visionary leader etc.), it may still fall short of desired results if it does not have an adequate supply of high-quality CXO level talent to execute the planned strategic initiatives.

This is because the individual S-curves (highlighted in the exhibit above) represent new divisions / businesses which need capable leaders at the helm to become successful. While the main leader (the group CEO/MD) would be in-charge of the overall capital allocation and business execution, he/she may not have the bandwidth to do justice to execution of capital allocation across such new avenues. Thus, it becomes imperative to have a well populated layer below him/her which would have the P&L responsibility of individual business lines.

The importance of an evolving corporate hierarchy triangle

We’ve discussed the new business initiatives taken by our portfolio companies extensively in the past (see our Jul’22 and Nov’22 newsletters for instance). In this newsletter we discuss the softer aspect that underpins the success of such initiatives i.e. the grooming and availability of talented business leaders in the organization.

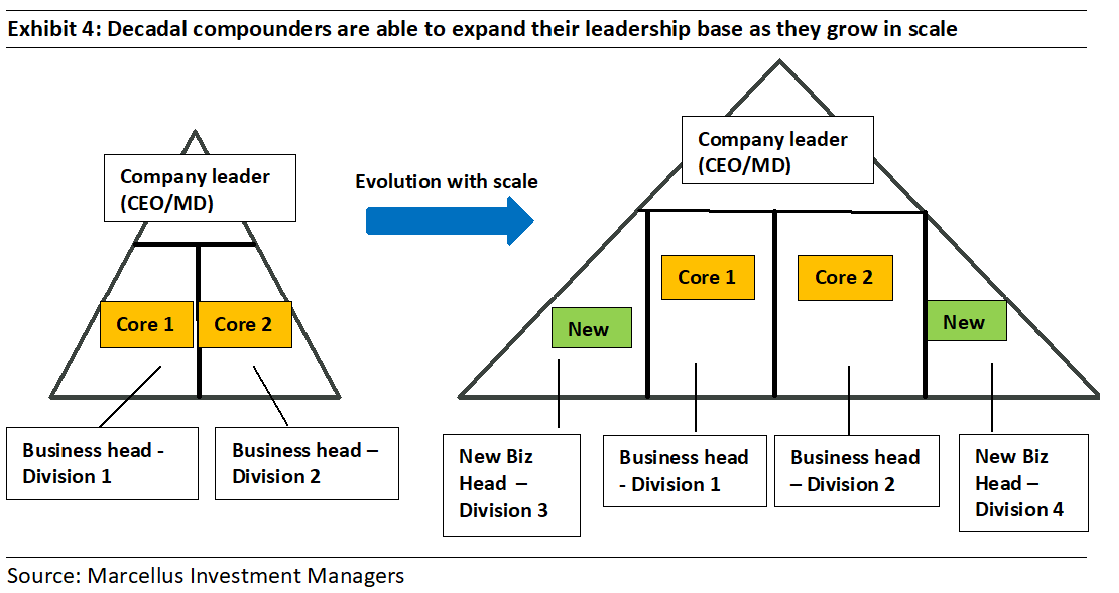

The corporate hierarchy triangle for a decadal compounder evolves as new growth drivers are incorporated. As shown in the chart below, the base of such hierarchy triangle is narrow in the initial years – 1 or 2 business heads reporting to the company CEO. However, because of incorporation of new growth drivers over many decades, the base of the triangle, particularly the CXO/senior management layer, expands with the requirement of new leaders who are assigned the responsibility to lead the new business verticals.

Such evolution is necessary for a large company to successfully execute capital allocation decisions for future growth (new business incubation/innovation, etc). As the core segments (which led growth in earlier years) become a cash cow for the company, having individual new business leaders which’ve been with the firm for a long time (many a times in cross functional roles) and are well versed with the company’s ethos around prudent capital allocation, competitive advantages and corporate governance becomes key for increasing the success probability.

Many firms try to work around the scarcity of such leaders through lateral hiring. While this may work in some cases, given the uncertainties around differences in corporate culture, stakeholder (employees & vendors) relationships etc. success is largely a matter of chance. On the other hand, internal grooming of leaders that have been with a successful firm for over a decade is far more productive. Such internally groomed leaders are well versed with all the nuts and bolts of the business that made the firm successful in the first place and are therefore best suited to combine the best business practices they’ve learned with their own entrepreneurial hunger.

Learning from ‘Global Compounders’ – the importance of talent grooming in successful execution of disruptive capital allocation decisions

Companies under coverage of Marcellus’ global equities research team are on average 60 years old. Many of these businesses have successfully avoided stagnation of growth over long time periods by leveraging on large pools of internally groomed talent. Here are some examples:

Amazon started as an e-commerce operation mainly focussed on selling books in 1994. With new (differentiated) product/service incubation at its core, over past ~30 years, it has tapped into its vast trove of talented leaders to lead successful verticals like Amazon Prime and Kindle. For instance, Jeff Wilke joined Amazon just 5 years into its inception to handle the logistics operations. Over the next few years, he redesigned the logistics chain and introduced the concept of fulfilment centres. Simultaneously, custom software and infrastructure were built as vendors weren’t able to handle Amazon scale – something that enabled the introduction of “super saver shipping” in 2002. Eventually, as costs of fast shipping were brought down, Prime was introduced in 2005. Jeff eventually went on to lead teams that launched Prime Video, Prime Now, Prime Day, Amazon Fashion, and many other innovations that are now part of the Amazon customer experience before becoming the CEO of Amazons overall consumer business (over 80% of Amazon revenue in 2022).

Steve Kessel who’d been looking at Amazon’s physical books division since 1999 was tasked with building an e-reader by Jeff Bezos around 2004. The ‘atoms to bits’ movement was visible in music (as we’d discussed earlier under Innovators dilemma) and the company needed a vertical to not just ward off disruption risks but actually benefit from the transition. Kessel brought out the first Kindle in 2007, which has since driven Amazon’s dominance over the digital books market. Later, Steve went on to lead Amazon’s offline store foray as well as oversight of Whole Foods Market (4% of 2022 revenue at $19bn).

LVMH is a conglomerate comprising 75 of the world’s most powerful brands such as Louis Vuitton, Christian Dior, Hublot, Bvlgari, Tag Heuer etc. Whilst most of these brands have been acquired over the last 30 years, their success emanates from turnarounds and efficient execution by the firm’s internally groomed management team. Size has not been an impediment against LVMH’s ability to continue acquiring, innovating and expanding in adjacencies over time – for instance, the acquisition of Tiffany for $16bn in 2020 and its successful turnaround happened after LVMH had grown to a size of $54bn in revenues by 2019!

LVMH’s Chairman and CEO Bernard Arnault recently commented in the 4Q 2022 earnings concall – “In a large company, as in any human organization, one needs to evolve. It’s not a good thing to keep a form of organization that leads to a routine mindset. I think we need to push innovation so that the executives after a certain while, after giving them time to prove their quality to succeed, they must use their management skills by changing. Mustn’t get used to things”.

In one of our primary data checks with an ex-employee of LVMH, the expert said “LVMH is family owned and managed. At Kering the degree of autonomy left for each and every brand is too less. If you observe, Kering has Gucci, and other brands at Kering try to leverage on the strengths of Gucci. At LVMH, for instance, every single brand of LVMH develops its own e-commerce sites, sometimes with the same outside provider. The philosophy of LVMH is – entrepreneurial steward of each brand comes first and then if we have smart things to do as synergies, we’ll do them. Kering is slightly different in going for synergies and developing brands. Kering will apply tried and tested successful recipe to the sister brands. LVMH is not about copying a recipe, it’s about inclined consistent management methodology.”

Google has been a powerhouse of successful business incubation for much of its ~25 years of history. Its ‘Innovation Time Off’ policy wherein Google engineers are encouraged to spend 20% of their work time on projects that interest them has led to origination of services like Gmail, Google News, Orkut, and AdSense. Future leaders are identified from within the organization – like Susan Wojcicki who served as CEO of Youtube from 2014-2023 had joined Google in 1999. In 2003, she was the first product manager of one of Google’s seminal advertising products—AdSense and later became Google’s senior vice president of Advertising & Commerce. In 2006 she advocated the $1.65 billion purchase of YouTube followed by $3.1 billion purchase of DoubleClick in 2007.

Her predecessor, Salar Kamangar who served as CEO of Youtube from 2010-14 was the company’s ninth employee in 1999. Over the years, he led various functions at the firm and was founding member of Google’s product team, which launched Google Groups. In 2001, he launched the AdWords product to monetize the company’s growing search traffic. Today, AdWords serves as the engine that drives Google’s advertising revenue.

Investment implications for Marcellus’ CCP Portfolio

Several companies in Marcellus’ CCP portfolio either control large market shares in their current core businesses or are in industries where disruption / innovation is likely to redefine the drivers of market share gains. For example, Asian Paints controls more than 50% of the organised paint industry’s market share. Businesses such as Titan in Retail, Dr. Lal Pathlabs in diagnostics and Bajaj Finance in unsecured lending are in industries which are ripe for disruption.

However, we remain comfortable about the ability of CCP companies’ future compounding potential on the back of both increasing investments in last few years (see more in Jul’22 and Nov’22 newsletters) as well as exemplification of the corporate hierarchical triangle when it comes to leadership and succession management.

For example, based on our understanding, the benefits of Asian Paints’ internal talent grooming are clearly visible through its journey over last 2 decades (broken down into three phases).

First phase: This was the time when Asian Paints’s market share in the organized market was less than 50% and overall revenues were less than Rs. 5,000crs. The firm had enough scope to further increase market share and keep growing revenues at 20% CAGR in one segment i.e., Paints. Mr. PM Murty took over from promoters in 2009 and APNT’s revenues grew at 19% CAGR and profits grew at 26% CAGR led by doubling of Colour world stores from <12,000 to >24,000 over his tenure from FY09-13.

Second phase: With increasing scale, the leadership at Asian Paints realized the need to make their core business operations more process driven in order to free management bandwidth as well as improve business efficiency. PM Murty’s successor- KBS Anand led this transition by investing ~Rs 3,500crs in automation of paint plants at Rohtak and Khandala, in warehouses and in replenishment etc. Operating Margins resultantly expanded from ~16% to ~19-20% (from 2013 to 2019/20). While the paints business continued to remain core APNT’s core segment, with size and scale the growth slowed down from earlier ~20% to ~15%. This is when seeds for future growth were sown with acquisitions of Sleek (kitchen) & EssEss (bath fittings), 3x increase in Colour Idea stores, and launch of paint consultancies. Two people from the senior management were given the ownership of these initiatives allowing them to satisfy their entrepreneurial ambitions – Satish Kulkarni (services & retailing) and Pragyan Kumar (Kitchen & Bath). By the end of KBS Anand’s tenure (in 2020), paints business became highly process and automation driven and despite the various macro headwinds like Demon, GST etc. the firm crossed Rs. 20,000crs topline with improved profitability.

Third phase: In the third (ongoing) phase KBS Anand’s successor – Amit Syngle inherited a well-oiled core paints business with close to ~55% market share in the organized industry. To ensure the highly talented and ambitious senior managers are not left wanting for new high growth entrepreneurial opportunities, APNT established 5 business verticals viz. Paints, Sleek, EssEss, Home décor stores & Home décor services. Amongst the Top 25 CXOs, almost 10 CXOs (either AVP or GM level) are directly working on one of these new business divisions. Today, in addition to Vishu Goel who is the AVP Paints division, there are 3 AVPs who are working on new businesses – Shyam Swamy (AVP Décor, Services & Retailing), Ashish Rae (Home improvement), and Sameer Salvi (Strategy) – all of whom have been with the firm for 15-25 years. While these businesses contribute <5% to the topline currently, APNT has ensured that the talented human resources available to them did not leave for greener pastures and was in fact utilized in the best way possible for the next era of growth for the paints behemoth.

In similar vein, Titan runs a companywide initiative where all the managers in the firm brainstorm ideas for new business lines. The selected ones are approved by the BOD and Management for incubation and once the business viability is established, the business is spun off into a separate vertical with a separate CEO having the P&L responsibility.

For example, Eyewear was incubated under the Watches division while Taneira was incubated under the jewellery division. Managers at Titan get cross-functional exposure as well as the opportunity to satisfy their entrepreneurial hunger + develop leadership skills by working in the new business divisions. Ajoy Chawla before becoming CEO of jewellery had multi-faceted experience spanning watches, international businesses, strategy function and sarees.

Previously, Ronnie Talathi who started in the finance team at Titan went on to head Fasttrack and then become CEO of Eyewear division before retirement. His successor, Saumen Bhaumick started his career in jewellery manufacturing plant at Hosur and went on to become the person responsible for driving Tanishq’s Golden Harvest Scheme as GM-Retail of Tanishq.

Another portfolio company of CCP, Kotak Mahindra Bank was one of India’s leading player in the brokerage and investment banking space when it got its banking licence in 2003. In the succeeding years this ‘new division’ was scaled up to become one of India’s best banks resulting in very lucrative returns for shareholders.

As Kotak Mahindra Bank grew, the need for institutionalization of group’s HR practices was realised and Kotak group developed leadership platforms like KLT (Kotak Leadership Team), KIT (Kotak Initiatives Team) and Regional Forums (RF) to promote cross-functional reach of leadership across the organization. Much like Titan, the Kotak group believes in moving leadership across functions to retain its best talent as well as foster their leadership skills.

For instance, KVS Manian (ED, head corporate bank at Kotak Group) who’s been with the bank for 27 years handled roles across Consumer banking, corporate banking, retail brokerage and steered bank’s integration with ING Vyasa bank. Shanti Ekambaram (ED and Group President, Treasury, 811, Human Resources, Group Marketing & Corporate Communications etc.) who’s been with the firm for 30 years was CEO of Kotak Mahindra Capital Company Limited, President – Corporate & Investment Banking and Head of Consumer Banking before her current leadership position.

As digitization of financial services gained pace, the bank launched Kotak 811 in 2017– a digital bank within the bank. Kotak 811’s current business head Manish Agarwal has been with the firm for 19 years and was the VP of Credit Card business and later VP of Non-Resident business before his current avatar.

In summary, the presence of internally groomed talent is a necessary (although not sufficient) condition for incubation of new businesses and launch of disruptive initiatives. Such hierarchical evolution needs to be backed by strategic capital allocation decisions to give such talent opportunities to add value beyond the core of the business and avoid stagnation in the foreseeable future. Longevity of greatness in such businesses ends up being one of the biggest sources of undervaluation in CCP companies – and hence is one of the most important factors for investors to understand about these businesses.

Disclaimer: Please note that Amazon, LVMH, Asian Paints, Titan and Kotak Mahindra Bank forms part of Marcellus’ portfolio, clients’ portfolios and portfolios of Marcellus employees and their immediate relatives.

Consistent Compounders Portfolio (CCP) is a strategy offered by Marcellus Investment Managers Private Limited and Global Compounders Portfolio (GCP) is a strategy offered by GIFT City branch of Marcellus Investment Managers Private Limited.