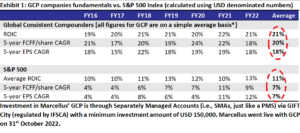

Marcellus’ Global Compounders Portfolio (GCP) focuses on investing in 25-30 highly fortified global companies listed mostly in developed markets. These companies align with global megatrends and possess robust moats built around process capability, research and development, and capital allocation. These factors play a pivotal role in driving the consistent compounding for GCP companies. Over time, these companies have witnessed an impressive annual CAGR of 20% in free cash flows per share. In this brief, we delve into the concept of modern utilities and elucidate why they hold a central position within the GCP strategy.

Portfolio Fundamental Characteristics:

The GCP Introductory newsletter deeply discusses how Marcellus’ GCP was conceptualized and constructed. In this newsletter, we focus on explaining our concept of modern utilities and contrasting them with traditional ones. Examples of modern utilities in the GCP portfolio include companies such as Microsoft/Amazon (cloud computing) and Intuitive Surgical (robotic surgery).

Characteristics of a Utility

Utilities possess distinctive characteristics that set them apart from other businesses. They cater to our daily lives by providing essential services. The value add from these service is often taken for granted For example – electricity, water supply, and public transportation, to name a few. These indispensable services create a unique dynamic:

- Scale and Time Advantage (Moat): Utilities thrive on the advantages of scale and being first movers. For instance, in electricity generation, scale plays a pivotal role, while in electricity distribution, being the first to establish infrastructure grants a competitive edge.

- Customer Lock-In: Customers typically rely on a single service provider, forming a captive customer base. Think of your local electricity distribution company—it holds a monopoly in your area, making it your only option.

- Recurring Revenue: The frequency of usage results in predictable and recurring revenue streams. Picture your electricity bill—a testament to the recurring nature of utility revenue.

Traditional utilities and why Marcellus GCP doesn’t invest in them

Historically, utilities encompassed the fundamental necessities of life—electricity, water, and transportation. These traditional utility businesses enjoyed monopolistic control over their geographic areas, secured through regulated access and oversight. For instance, your local electric utility company operates as the sole service provider in your region, shielded from competition by regulatory barriers.

However, investing in traditional utilities presents certain challenges. Firstly, growth opportunities are limited due to their saturation in well-penetrated markets. Secondly, these utilities face unique regulatory risks, such as pricing controls and return on equity regulations, which hinder their long-term performance. In fact, utilities indices in both India and the US have underperformed broader equity benchmarks by over 3% per annum in the past decade.

How modern utilities differ from traditional utilities

At Marcellus, we perceive a remarkable opportunity in what we term “modern utilities.” These businesses share commonalities with traditional utilities, such as revenue visibility, customer lock-in, and scale/time advantages. However, modern utilities possess key differentiators that make them incredibly attractive:

- Growth Potential: Unlike their traditional counterparts, modern utilities operate in relatively untapped markets, leaving ample room for penetration-led growth. For instance, cloud computing is still in its early adoption phase, with businesses and consumers exploring new use cases for cloud storage. Moreover, modern utilities have the flexibility to expand their product portfolios, offering a broader range of services. Amazon’s AWS started as a storage and compute rental business but has since expanded to include database offerings and a plethora of services. This adaptability fuels their growth unlike traditional monopolies, which rarely diversify their product offerings – e.g. cable TV and internet lines into homes are not laid by electric distribution companies, despite using the same poles.

- Technological Catalyst (drives moat creation): Modern utilities are at the forefront of technology, akin to the dawn of electricity in the early 20th century. Their availability is driving significant advancements in end markets. For example, the rise of cloud computing has revolutionized the software industry, leading to the emergence of the Software as a Service (SaaS) ecosystem.

- Lack of regulatory oversight (risk mitigation around pricing power) provides much greater freedom on pricing.

In essence, Marcellus’ Global Compounders Portfolio (GCP) focuses on deeply moated modern utilities—unregulated monopolies/oligopolies with recurring revenue streams and tremendous growth potential. By harnessing the benefits of traditional utilities while sidestepping regulatory headwinds and growth limitations.

EXAMPLES OF MODERN UTILITIES:

Example 1: Cloud computing (GCP Stocks: Microsoft, Amazon)

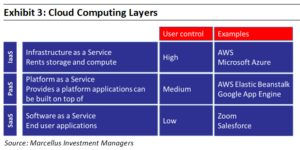

While cloud computing is a broad term, our focus is on the public cloud providers (Amazon AWS, Microsoft Azure, Google Cloud). These are neutral platforms which provide basic storage and compute on a pay as you go basis, largely to business customers (referred to Infrastructure as a Service or IaaS). Each of them has also developed a wide range of value-added services that they offer to support application development (usually referred to Platform as a Service or PaaS). These cloud native applications are generally referred to Software as a Service (SaaS). Public cloud in its current form started in in the mid-2000s. Amazon was the pioneer here with Amazon Web Services (AWS), launching in 2006. Microsoft and Google followed in subsequent years.

How cloud companies benefit from Modern Utility advantages ….

These public cloud companies fit in the modern utility framework very well:

- Essential: Public cloud providers deliver indispensable solutions that form the backbone of modern businesses, catering to the diverse needs of enterprises across the globe.

- Lock-In: Once customers migrate their data to the cloud, the high costs associated with moving elsewhere create a powerful bond that keeps them locked in, fostering long-term relationships.

- Predictable Revenues: Consistent usage of cloud services leads to reliable and predictable revenue streams. This stability ensures a solid foundation for sustainable growth.

- Growth Opportunity: While cloud adoption has made significant strides, we are still at an early stage of this transformative journey. The full potential of Infrastructure as a Service (IaaS) is yet to be unleashed, promising ample opportunities for future growth.

- Lack of Regulatory Oversight: As business-to-business (B2B) entities, public cloud companies operate within a realm that grants them freedom from extensive regulatory oversight on economic and pricing matters. This agility enables them to navigate market dynamics with ease

….. and traditional utility advantages

Public cloud companies also see the classic utility competitive advantages of scale, time. This has multiple layers:

- Purchasing Powerhouses: With their vast scale, public cloud providers wield immense negotiating power, securing favourable terms from equipment providers. This influence even extends to the development of custom hardware, like Amazon’s Graviton chip.

- Efficiency Through Utilization: Running at high utilization rates, these data centres maximize efficiency by optimizing resource utilization, ensuring that every ounce of computational power is harnessed to its full potential.

- Expanding Dominance: The ability to add new data centres amplifies the customer experience, reducing latency and ensuring optimal uptime. This continuous expansion enhances their market dominance, while customers reap the benefits of improved services.

- Cost Leverage: The colossal size of their individual data centres, fuelled by the density of customers they serve, unlocks significant efficiency in design. This translates into substantial cost savings on both capital and operating fronts. The scale advantages enjoyed by public cloud companies compound over time, resulting in a continuous reduction in costs. This cost-efficiency fuels broader adoption and raises the barrier of entry for potential competitors.

- The Early Mover Advantage: Later entrants into the cloud landscape struggle to match the profitability achieved by the pioneering giants. Even if these newcomers manage to scale, their profitability lags due to ever increasing capital requirements to reach profitable scale. This discrepancy is evident when comparing the profitability of AWS and Google Cloud. While Google’s cloud revenue in 2022 exceeded $26 billion, the business reported an operating loss. In contrast, AWS reached the same revenue scale back in 2018 and boasted an impressive operating margin of 28% at that time.

Example 2: Surgical Robots–Modern Day Utility for the Surgeons and Hospitals (GCP Stock: Intuitive Surgical)

The concept of using robotic arms to perform surgery has existed in science fiction since the 1940s (Robert Heinlein’s story ‘Waldo’). However, it wasn’t until the 1990s that Dr. Fred Moll co-founded Intuitive Surgical with the goal of commercializing surgical robots. Their journey took a significant leap when they went public in 2000 with FDA clearance for gallbladder surgery.

Intuitive Surgical’s relentless pursuit of improved surgical outcomes led to the rise of Robotic Assisted Surgery (RAS), offering compelling advantages over the commonly used alternatives of Laparoscopic Surgery and Open Surgeries. RAS consistently outperformed in crucial areas such as shorter hospital stays, reduced complications, lower 30-day mortality rates, and minimized blood loss. While Intuitive Surgical spearheaded this disruptive innovation, what makes the company unique is the way they fortified their position with Utility Moats built on the pillars of both Time and Scale—a feat rarely accomplished by disruptive innovators.

Utility Moat 1 – Time: Early Mover Advantage + Trust Building:

Research and development breakthroughs helped Intuitive Surgical to secure a technology lead of at least a decade that persists. By installing their systems in major medical schools across the United States and beyond, Intuitive ensured that future healthcare professionals were trained on their Da Vinci machines. This resulted in a network effect within the surgeon community, where practitioners became advocates for adopting these surgical robots due to the clear benefits experienced by patients (quicker recovery, superior outcomes) and surgeons (enhanced accuracy, reduced tremor, decreased fatigue). We see this as a time-based advantage.

This early mover advantage is reinforced by the high switching costs faced by hospitals and doctors, who exhibit inertia in switching to alternative robotic systems unless compelling benefits are demonstrated. This creates a significant barrier (classic chicken-and-egg problem) for new entrants, as they need adoption to generate clinical data (from real world use) and, conversely, require such data to demonstrate benefits to drive adoption.

Intuitive Surgical leveraged this Time-based Moat to construct another pillar of their Utility Moat: Scale.

Utility Moat 2 – Scale. Powered by the Abundance of Data = Surgical Utility Platform

With over 24,000 peer-reviewed publications and four generations of minimally invasive, robotic-assisted technology, the da Vinci system has performed approximately 11 million procedures worldwide, establishing itself as the go-to soft tissue robotic surgery system globally with >80% market share. This extensive history of utilization equips Intuitive Surgical with a wealth of clinical data, supporting evidence, and best practices for surgeons and physicians.

Leveraging their Scale, Intuitive continuously expands its product portfolio (devices) and capabilities (surgical procedures), further cementing its technological edge over competitors and mitigating concerns that arose from the expiration of their original patents in the earlier part of this decade. Intuitive has steadily evolved into a provider of a Surgical Utility Platform. In the realm of robotic surgery, Intuitive stands out by investing substantially more in research and development than any other industry player, solidifying their position as the top choice for exceptional biomedical engineers. Effectively, Intuitive turned scale into a moat.

Turning the Utility Moats into Recurring Utility Type Revenue Model

The adoption of Da Vinci robots enables hospitals to retain top surgical talents while attracting well-informed patients seeking advanced procedures. Intuitive capitalizes on this relationship through a revenue model where recurring revenues from disposable instrument (usage based) and services (usage and time based) contribute to approximately 80% of their total revenue, a significant increase from less than 50% in 2007.

Significant Runway for Growth

Robot-assisted surgeries (RAS) represents merely 5% of all “soft tissue” surgeries performed globally, leaving substantial room for growth. The ongoing challenges and delays faced by deep-pocketed competitors in launching equivalents to the “Da Vinci” system serve as a testament to the depth of Intuitive’s moats. The long adoption cycle, particularly for venture capital-backed startups lacking profitability, acts as a significant deterrent. In the most likely scenario, a moderately competitive environment would facilitate greater uptake, with significant benefits accruing to the strongest player—Intuitive Surgical. This sets the stage for continued success and significant growth in the realm of modern-day utilities.

INVESTMENT IMPLICATIONS FOR GCP INVESTORS

“Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result.” – Charlie Munger

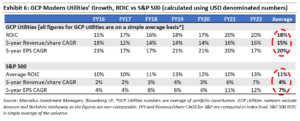

Fundamentals of businesses that are modern-day utilities built on the Time and Scale based moats, aided by lack of restrictive regulatory constraints, include:

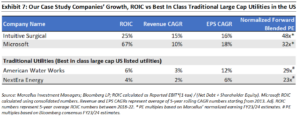

- Higher Return on Capital Employed (For instance, GCP Modern Utilities demonstrates an average ROIC of 18% compared to the S&P 500’s 11% and the 5-6% range seen in best-in-class traditional utilities in the US).

Higher Growth Rate (Over the past 10 years, GCP Modern Utilities have achieved an EPS CAGR of 15-20%, surpassing the 7% of the S&P 500 and the 6-10% range observed in best-in-class traditional utilities).

Marcellus’ Approach on Valuation of Modern-Day Utilities:

Let’s delve into our thoughts on valuing modern-day utilities. We ponder over the following questions:

- How long can these businesses continue to outperform (i.e., fundamental compounding) the average companies in the market? To gauge this, we look at the S&P 500’s long-term EPS compounding + Dividend Yield as a benchmark for an average company. We have defined this as “OutGrowth Duration” period. However, we set a cap of 20 years for this duration.

- What happens after the “OutGrowth Duration”? Do these companies become average or even below average? Or is there a significant risk that their core businesses might face disruption?

- Considering the answers to both A and B, how much growth in fundamentals is necessary to justify the current valuation multiple?

- Do we have enough confidence that the company can achieve the growth mentioned in question C?

The answer to question D allows us to evaluate the margin of safety when it comes to the stock’s valuation.

Let’s take our examples:

- Intuitive Surgical, which, in our view, is trading at approximately 48 times Normalized Forward P/E (adjusted for under-earning during the COVID-19 pandemic due to deferred surgeries in FY20/21). This is in comparison to the S&P 500’s forward earnings multiple of 20x. This relative multiple of 2.4x (48/20) can be justified if Intuitive Surgical can compound its fundamentals at a rate of 15% for 15 years, assuming S&P’s long-term fundamental compounding rate stands at 9% (including dividends for simplicity).

- Similarly, Microsoft (at a consolidated level) is currently trading at 32x Normalized Forward PE. To justify this valuation, Microsoft would need to compound its fundamentals at 14% for 10 years.

We believe that both Intuitive Surgical and Microsoft have the potential to meet the requirements of “fundamental compounding,” considering their strong positioning in fields like robotic surgery and cloud infrastructure, which are still in the early stages of adoption. Therefore, both companies deserve a place in our portfolio. However, they exhibit varying levels of margin of safety. By utilizing this valuation approach in conjunction with our proprietary business quality score framework (which is qualitative) and our proprietary style-based quantitative framework (TORQUE), we make informed decisions regarding the appropriate position sizing for a stock. Through the implementation of this comprehensive approach, we effectively address instances of extreme valuation discrepancies that may arise, such as those witnessed during the dot-com boom and bust, or the volatile market conditions experienced in 2021-2022.

Our guiding principle is to refrain from buying Quality and Growth at any price. However, when faced with the choice between investing solely based on short-term cost (“cheap valuation”) and long-term value (“high quality,” as seen in modern-day utilities), we wholeheartedly embrace the wisdom of Charlie Munger: “It’s better to buy a wonderful company at a fair price than a fair company at a wonderful price.” As devoted students of investing, we strive to maintain a fine balance between the price we pay and the value we receive, recognizing it as the most proven approach to achieve exceptional wealth compounding.

Happy Investing!