The most sustainable way for a firm to compound profits over the longer term, is to sustain high ROCE alongside a high rate of capital reinvestment. However, such businesses face the challenge of consistently finding avenues for incremental capital redeployment in areas which deliver high ROCE. Some of the most common capital allocation mistakes made by cash generating firms include diversification across geographies and product categories, often inorganically (i.e. through M&A). Using examples, we highlight how important it is for a ‘Consistent Compounder’ to focus on capital allocation as a means of shareholder value creation. We made one change to our Consistent Compounders portfolio in January 2020: we exited Marico and replaced it with Divi’s Labs.

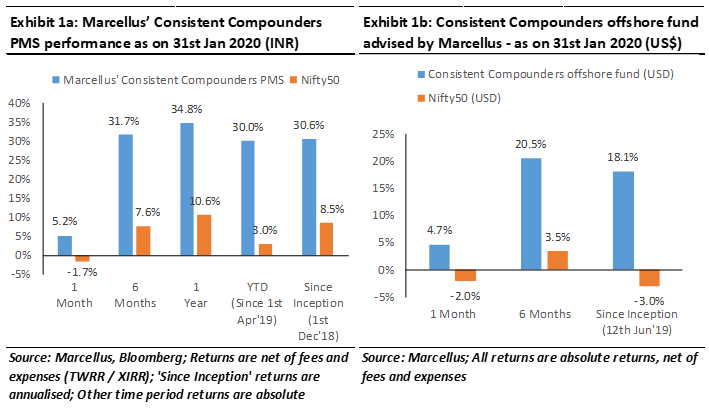

Performance update – as on 31st January 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of seven analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

Capital redeployment is one of the key drivers of shareholder value creation for firms with high ROCE

Firms with deep-rooted competitive advantages deliver returns on capital employed (ROCE) substantially higher than their cost of capital (CoC). The gap between ROCE and CoC is surplus cash flow generated by the firm, which can either be returned to shareholders through dividends / share buybacks, or it can be redeployed on the balance sheet. For a firm to consistently grow its profits over the longer term, it must sensibly allocate cash flows from operations. The options available to such a promoter / senior management for capital deployment, can be broadly classified into three areas:

Invest in the core business:

Redeploy capital back into areas in which the firm already possesses deep-rooted competitive advantages (which have led to the existing high ROCEs and hence free cash generation in the first place). Although this sounds obvious, as the firm grows and deepens its competitive advantages, the quantum of free cash flow available for redeployment tends to far exceed the amount that can be reinvested to grow the core business further. This then leads the promoter to explore one of the following two options.

Option 1: Diversification, usually inorganically:

Promoters with aspirations of ‘empire building’ or those who want to add to their business, new revenue growth drivers for the longer term, tend to use surplus capital to diversify across geographies or product categories. This could either be organic, or inorganic diversification. Many firms prefer the inorganic route towards diversification, acquiring companies in related or unrelated businesses, forging joint ventures with other companies, acquiring minority stakes in other companies etc.

Option 2: Returning the surplus cash back to shareholders through dividends or buybacks:

When surplus cash cannot be effectively deployed without dragging down the ROCE sharply, it is prudent to return it to shareholders though special dividends or share buybacks.

Whilst all this sounds straightforward, many firms with a great core franchise that consistently generates high ROCE, have found it difficult to sensibly allocate surplus capital to diversify their business, as highlighted in some examples below.

Creating shareholder value through M&A and offshore expansion, has proved to be difficult for firms which have sustained high ROCEs in India

Over the past 3-4 decades, middle class household consumption in India has grown substantially across several essential products of day to day consumption. This has meant that over the past two decades, most dominant firms in these sectors, have generated substantial amounts of surplus capital (i.e. capital after meeting the core capex requirements of the firm).

Between 1995 and 2005, there have been various examples of firms deploying their surplus capital towards M&A to acquire businesses in India. Many of these acquisitions have ended up generating substantial value for shareholders with ROCEs of the acquired businesses being well above their cost of capital. Some examples of these successful acquisitions include: Hindustan Unilever’s acquisitions of TOMCO (Tata Oil Mills Company), Kwality, Brooke Bond, Kissan, Lakme etc during the 1990s; Dabur’s acquisition of Balsara (2005); Marico’s acquisition of Nihar (2006); and Pidilite’s acquisitions of Ranipal (1999), M-Seal (2000), Dr. Fixit (2000), Steelgrip (2002), Roff (2005) etc. These acquisitions have successfully added sustainable earnings growth drivers for these firms with high ROCEs.

However, after 2005, several dominant Indian companies have deployed surplus capital towards international expansion / acquisitions – for example GCPL (Africa, Indonesia, Latin America), Pidilite (Brazil, US, Middle East), Marico (Middle East, Bangladesh, South Africa), Dabur (Africa, US, Turkey, Egypt), Havells (Sylvania), Tata Steel (Corus), Asian Paints (Berger International, 2001), Bharti Airtel (Africa) etc.

Most of these acquisitions have delivered ROCEs well below cost of equity. We have carried out the analysis of some of these companies (GCPL, Marico, Dabur and Pidilite) where most international businesses are outside the standalone business. The analysis computes the difference between consolidated ROCE and standalone ROCE for these firms, because most of the acquisitions and overseas businesses are NOT part of the standalone operations, when their core Indian business is included in the standalone operations. This ‘non-standalone’ ROCE is reflective of the returns generated by using cash from the high-ROCE standalone entity, to execute international expansion.

The following points are worth highlighting from this analysis:

- A substantial part (at times more than 100%) of operating cash flows generated from the standalone business has been deployed towards international acquisitions – see the second column of Exhibit 2.

- Domestic (standalone) businesses of these firms have generated ROCEs substantially higher than cost of capital, many at times even higher than 50% – see chart on the right in Exhibit 3. This is reflective of the strong moats built by these firms in India.

International (non-standalone) business ROCEs of these firms have been sub-par, many at times substantially below cost of capital – see chart on the left in Exhibit 3. This is reflective of the weak moats existing in these international businesses.

Some of the common factors why most international capital allocation decisions of dominant Indian firms have delivered sub-optimal returns include:

Complex organisation structures:

It is operationally difficult for an Indian company to manage an acquired business which operates in a foreign un-known (or less known) geography with a legacy employee team / legacy culture / legacy systems and processes. Some firms choose to decentralize management, while others choose extreme centralization of management. Both structures have their pros and cons. For example, GCPL and Pidilite follow more of a decentralized approach while Marico follows a lot more centralised approach towards management. Dabur, we believe, is somewhere in the middle – a combination of both – empowered local management, with high quality due diligence from the Indian head office. Pidilite’s experiences in Brazil and Middle East led them to eventually change the local legacy management team due to unacceptable practices being carried out by them post-acquisition.

Acquiring companies which run unrelated businesses

that are outside the core competence of the Indian management.

Acquiring businesses are not ‘consistent compounders’

in their local markets, which necessitates the Indian management to understand the local business in order to make it a ‘consistent compounder’.

Stretched management bandwidth:

The Indian promoter and management team would have had single-minded focus on the core business before the international acquisition. After the acquisition, they would have faced bandwidth challenges due to the issues highlighted in the bullet points above.

Steep valuations

paid for the acquisitions.

Investment implications

Most firms in our Consistent Compounders Portfolio have a combination of: a) high ROCE; b) high rate of reinvestment of cash flows; and c) history of using surplus capital to acquire businesses – see exhibit below.

Hence, one of the biggest areas of diligence that our philosophy requires is around the exposure of our portfolio companies to the opportunities and challenges of capital allocation highlighted in our analysis above. Whilst it is difficult to precisely forecast future capital allocation decisions of any firm, our research team builds conviction on the capital allocation approach of our portfolio companies by analyzing the long term historical track-record of capital allocation – how / why were certain capital allocation decisions taken in the past, what were the learnings subsequently and how has the approach towards capital allocation evolved for the firm.

Track record of firms in our Consistent Compounders Portfolio can be divided into two types:

Type 1 – Capital redeployed only in core businesses historically:

Firms such as Page Industries and Relaxo Footwears have redeployed on average 50% and 90% of their annual operating cash flows, respectively. This entire capital has been reinvested to expand manufacturing capacities in their core operations, enhance IT systems etc. Moreover, every layer of geographical (within India) or product category expansion has been carried out organically in adjacencies which have a significant overlap with their existing core business. For instance, Relaxo has expanded pan-India into sports shoes, various sub-segments of casual footwear, from being just a north-India focused flip-flops oriented firm 2 decades ago. Page started offering only mens innerwear in the 1990s, and has subsequently expanded into leisurewear, sportswear and outerwear categories for men, women and kids. For such companies, we focus on building conviction on the runway of growth available to the firm’s core business, and the ability of the firm to maintain high ROCE on incremental capital deployment in existing core businesses.

Type 2 – Learnt from historical experiences around M&A:

Firms like Asian Paints and Dr. Lal Pathlabs are open to doing acquisitions to grow their product portfolio or geographical presence respectively. However, the promoter and management teams of these firms have demonstrated significant caution and restraint in considering such opportunities in the past. They have executed bolt-on acquisitions which do not risk a large part of the firm’s capital employed and have been cautious in deploying incremental capital into these acquired businesses. One exception though is a firm like Pidilite which has had three distinct phases of large sized M&A transactions in its history (as summarized below). The firm has acknowledged its mistakes, and implemented course-correction subsequently, which gives us conviction on capital allocation discipline likely to be pursued in future.

Example – Pidilite’s capital allocation track record:

Phase 1 (1999 to 2005) – Successful domestic M&A:

After having spent five decades to establish a monopoly in white glue (Fevicol), Pidilite started acquiring and building other adhesive and sealant brands to expand its product portfolio, and to extend the firm’s channel presence and intermediary influence. The acquisitions included: a) Ranipal in 1999 for Rs 4 crores; b) M-Seal and Dr. Fixit in 2000 for Rs 32 crores; c) Steelgrip in 2002 for Rs 10 crores; and d) Roff in 2005 for an undisclosed amount. Capital deployed towards acquiring these firms was approx. 11% of total operating cash flows generated by Pidilite over this period. Most of these acquisitions have become monopolies in their respective categories by now, and have delivered ROCEs substantially higher than cost of capital for Pidilite. Thanks to this phase of expansion, Pidilite is one of the most diversified consumer firms, with its products reaching various distribution channels, including convenience stores (kiranas), hardware stores, paint shops, modern retail outlets, e-commerce, paanwalas as well as stationery shops.

Phase 2 (2006 to 2014) – Unsuccessful international M&A:

Pidilite deployed close to ~Rs 685 crores in international acquisitions (26% of operating cash flows over this nine-year period) in Brazil, Middle East, USA and in acquiring an elastomer manufacturing plant from France. Pidilite bought small companies, some of which were operating in unrelated industries, without any market leadership. In countries like Brazil, the acquisitions were faced with an economic collapse in the country, and issues with the legacy management team of the company. Over the past decade, Pidilite has written off ~Rs 175 crores worth of its investments in subsidiaries in Brazil and Middle East, and ~Rs 300 crores of its investments in the elastomer project. The acquisition made in the USA (Cyclo) has been sold off in 2017 for ~Rs 30 crores.

Phase 3 (2014 to 2019) – Successful domestic acquisitions:

Having learnt from its mistakes made in the preceding phase of international acquisitions, Pidilite has resumed its focus on frequently acquiring smaller domestic competitors in its core business. For example, Bluecoat has been acquired for ~Rs 260 crores, 6% of FY14-19 operating cash flows and Suparshva for undisclosed consideration. These acquisitions have turned out to be substantially ROCE accretive for Pidilite. The firm has also deployed ~Rs 300 crores over FY14-19 (~7% of operating cash flows and ~2-3% of capital employed over this period) to acquire businesses in adjacent categories (CIPY – floor coatings; Nina and Percept – waterproofing contractors) and has formed JVs with MNCs like ICA for niche products like wood finishes. In the JV with ICA, the MNC provides the world class technology for making the product and Pidilite uses its strong distribution network to push the product. These businesses have shown significant improvement in financial performance post acquisition. In addition to disciplined capital allocation towards M&A in this phase, Pidilite also announced (and completed) a share buyback of Rs 500 crores in FY18 at Rs 1,000 per share, a 12-13% premium to the prevailing market price. This share buyback amounted to 14% of capital employed and 63% of operating cash flows in FY18.

Changes made to our Consistent Compounders Portfolio in January 2020:

Exited from Marico Ltd.:

Marico maintains its dominant position across Parachute Coconut Oils, Saffola Edible Oils, and Value Added Hair Oils – the three largest segments of its revenues and earnings in India. The firm’s competitive advantages are centred around efficiencies of raw material procurement and IT investments to run an efficient supply chain and distribution infrastructure. However, in Saffola edible oils, Marico has delivered only 7% volume CAGR over FY12-19 (compared to 12-14% volume growth rates consistently prior to FY12) despite market share gains over this period, and two years ago, the management downgraded their medium-term guidance of volume growth in this product from ‘mid-teens’ to ‘high-single-digit’. Based on our recent research on this issue, we understand that this moderation in growth is due to the premium edible oils category witnessing reduction in consumption of oil per household because consumers of this product are increasingly becoming health conscious around the quantity of oil consumed in their cooking. Also, in Value Added Hair Oils, we understand that the low hanging fruits available around market share gains in areas like Amla-Hair-Oils have largely been plucked and hence VAHO segment is unlikely to report volume growth rates higher than 15% in future. In light of this, we believe that Marico is not likely to deliver earnings growth rates of 18-20% CAGR which we had previously envisaged.

Added Divis laboratories:

Divi’s Labs is a Hyderabad based API and nutraceutical ingredient manufacturer. It is primarily an outsourced pharma manufacturing and export franchise. Its key strengths are: a) outstanding regulatory compliance track record; b) deep relationships with big western pharma companies for contract manufacturing (CRAMS) built around trust on IP protection and product quality; c) management’s focus on deepening capabilities and increasing capacities only in bulk drugs and CRAMS segments (rather than risking dilution of focus through diversification); and d) its highly cost-efficient bulk production of key APIs for global customers. Divi’s is amongst the world’s top 3 API manufacturers. It is a global leader in production of few critical and highly voluminous molecules, and accounts for over 50% of global production of these molecules. Considering the business strengths, opportunity from relocation of outsourced manufacturing in pharma away from China and the capacity expansion and backward integration for key raw materials being undertaken by the company (with good track record of sweating assets), we expect Divi’s Labs’ profits to grow at more than 18-20% CAGR.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/