Consistent compounding requires focus and discipline over long periods of time. However, just like assembly line workers in a manufacturing process may find themselves bored by the repetitive nature of their work; consistent compounders also run the risk of boredom / fatigue / complacency in the long run. This can then lead to mistakes cause by either: a) lethargy in the face of evolutions, disruptions and changing competitive environment; or b) capital misallocation. In this newsletter, we highlight the ‘lethargy test framework’ we use on an ongoing basis, to understand how our portfolio companies eliminate these risks. Over the last one month, we have made one change to our CCP PMS portfolio – ITC has been replaced with HDFC Life.

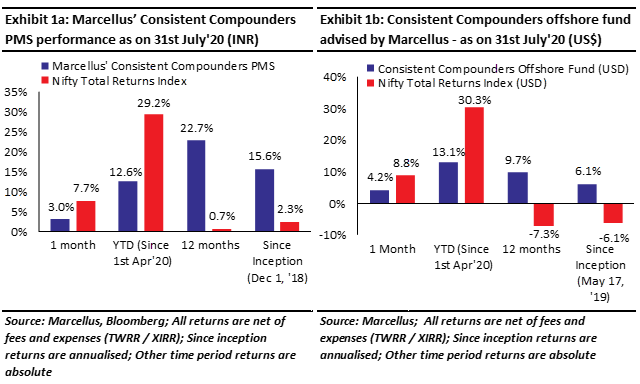

Performance update – as on 31st July 2020

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team of ten analysts focuses on understanding the reasons why companies in our coverage universe have consistently delivered superior financial performance. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS and offshore fund (USD denominated) portfolios is shown in the charts below.

As businesses, customers, competitors, and the macro environment evolves over time, our bottom-up research to understand the competitive advantages of a company continues even after the company’s stock has been included in our clients’ portfolios. In addition to this, we also keep track of the evolution of our portfolio companies through two proprietary frameworks – a) the lethargy test framework; and b) the succession planning framework. We discuss our lethargy framework in this newsletter and will discuss our succession planning framework in our next CCP newsletter.

First, let us take a few examples of how the boring aspect of Consistent Compounding makes it hard to execute, understand and appreciate.

Pete Sampras – the Consistent Compounder of Tennis

In tennis, Pete Sampras was ranked No 1 in the world for six successive years from 1993 to 1998 – an achievement he cherished even more than his overall major titles mark for the day-to-day consistency it required – a record not even Roger Federer, Rafael Nadal or Novak Djokovic have managed to touch. A recent press article compares Andre Agassi with Pete Sampras – “You cannot talk about Sampras without talking about Agassi. The two Americans were perfect foils: one the greatest server of his generation, the other the finest return player. And let’s be honest: everyone wanted Andre to win except your one friend who played tennis. The free-wheeling, flamboyant kid from Vegas traded in a charisma that was tailor-made for a society that increasingly craved sensation over humility and discipline. Agassi, who freely vented his emotions in the spirit of American predecessors such as Jimmy Connors and John McEnroe, gave the people what they wanted. Sampras, alternatively, comported himself the same way when he was two sets down as when he was two sets up. This unfashionable carriage may have contributed to his reputation as being “boring”, but Sampras didn’t care, at least not outwardly. He was less interested in being appreciated or understood than in winning. And win he did, more than anyone up to that point. Which is why saying Sampras is remembered simply for being good at tennis is disingenuous and an understatement of his greatness. It is unspeakably difficult to dominate in a sport where mental toughness is always tested.”

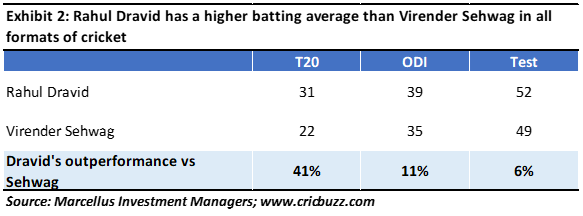

Rahul Dravid – the Consistent Compounder of Cricket

In cricket the ‘boring’ Rahul Dravid has beaten the ‘flamboyant’ Virendra Sehwag in batting averages across all formats of the game (see exhibit below). Not only this, the outperformance of Rahul Dravid over Virendra Sehwag is wider for the shorter formats of the game – a counter-intuitive outcome given that shorter formats intuitively offer more room for ‘excitement’ compared to test cricket.

“In his peak years, between 2001 and 2006, it was Dravid’s batting that secured victories in England, Australia, Pakistan and the West Indies. Yet, even in that period, Dravid’s self-deprecatory manner, unusual among Indian players, was remarkable. “People want me to get out quickly so they can watch Tendulkar bat,” he said on one occasion; later he often compared himself to Virendra Sehwag, to his own disadvantage. Asked if he would make a triple century someday, Dravid replied that you would need a ten day test match for that to happen.”– Suresh Menon, editor of the Wisden Cricketers’ Almanack India in the book ‘Rahul Dravid – Timeless Steel – Collected writings on Indian cricket’s go-to man’ (2012)

“Test cricket, he often says, is such a fulfilling experience because it challenges the mind continuously for four or five days. Dravid belongs to that priceless breed of champions whose mental resolve is at its strongest when the situation is dire.” … “Dravid’s batsmanship was often taken for granted because it was so firmly rooted in time-worn traditions – leaving the good balls, not hitting in the air or on the up, and because it was so utterly comprehensible and lacking in mystique. But only those who have played the game at the highest level can fully appreciate the true meaning of Dravid’s craft.” – Sambit Bal, editor of ESPNcricinfo in the book ‘Rahul Dravid – Timeless Steel – Collected writings on Indian cricket’s go-to man’ (2012)

Risk of lethargy is a key risk for Consistent Compounders

“Loss of focus is what most worries Charlie [Munger] and me when we contemplate investing in businesses that in general look outstanding. All too often, we have seen value stagnate in the presence of hubris or of boredom that caused the attention of managers to wander.” – Warren Buffett in his 1996 annual letter to shareholders (click here).

While driving a car on ‘cruise control’, fatigue and a false sense of security can lead to lack of attention and an accident. When it comes to both equity investing as well as business management, the philosophy of ‘Consistent Compounding at a healthy pace’ requires an investor or a management team to focus only on their core strengths in a disciplined and sustainable manner over a long period of time. Although this sounds too simple and traditional, it is one of the hardest characteristics to develop, partly because consistent compounding over the longer term tends to get monotonous or boring, especially when the external environment offers ‘exciting’ opportunities. As a result, investors in these firms run the risk of their management teams either doing too little to sustain their competitive advantages, or doing too much by chasing exciting opportunities aggressively. In both of these scenarios, management loses it focus on core strengths (in cricketing parlance – after a long and successful innings, either the batsman gets clean-bowled out of fatigue or gets caught while hitting the ball on the up out of excitement).

Marcellus’ “Lethargy Test” framework

This framework focuses on identifying the following signs of lethargy / complacency / indiscipline using secondary data research (annual reports, quarterly management commentary) as well as primary data checks (e.g. extensive discussions with ex-employees, channel partners, raw material vendors, customers, IT and HR consultants):

Lack of incremental deepening of moats:

Over time, a Consistent Compounder faces three key risks – competition, disruption, and evolution:

-

Competition:

Our portfolio companies operate in large industries and generate high returns on capital employed. Hence, they always attract competitors who try to narrow down the gap between return on capital and cost of capital for these companies. Such competitors could try to either replicate the offerings of our portfolio companies, or get into a price war, or attempt to introduce a new way of catering to the requirements of various stakeholders (customers / channel partners / raw material vendors etc). For instance, in 2019 JSW Paints entered the paints industry with ‘any colour one price’ offering. In 2017-18, Van Heusen (Aditya Birla Fashion and Retail) launched premium innerwear to compete directly with Jockey by offering higher incentives to distribution channel partners. Dr. Lal Pathlabs faced a massive price war from competitors like Thyrocare in 2017. Reactive research of understanding the response of our portfolio companies to such competitive action is important, but not sufficient.

Our lethargy tests proactively aim to understand how our portfolio companies are deepening their competitive advantages, strengthening ties with various stakeholders, and refreshing their offerings so as to leave no room for a competitor to take away market share through such actions. For instance, in addition to speaking to dealers post-facto about JSW Paints’ aggressive entry into decorative paints, our lethargy tests done in the years prior to such competitive changes have to understand whether Asian Paints has left enough room for any new entrant to make a successful entry into the sector.

-

Disruptions:

Over the past few years, event-based disruptions like GST, demonetization, financial crisis (e.g. IL&FS, GFC), COVID-19 crisis have become very frequent. On the other hand, there are several disruptions caused by new technology or new infrastructure (digital or physical) to meet a customer’s requirement. Consistent compounders typically use such disruptions to consolidate the dominance of their franchise by benefitting from the challenges faced by their competitors through such disruptions. Our lethargy tests try to keep a close track of the attempts made by our portfolio companies during periods of disruption. For instance, it has been a fascinating journey over the past 4 months to watch our portfolio companies take initiatives which will help them gain substantial market share from their peers on the other side of the COVID-19 crisis. Hence in-depth lethargy tests carried out for our portfolio companies through the previous as well as the current crisis have helped us stay invested with broadly the same portfolio of stocks over the past four months, and in fact buy more of companies whose stock prices had fallen the most during the crisis.

-

Evolution:

As time progresses, there will be changes in customers’ preferences, India’s demographics, scale of operations of our portfolio companies, penetration levels of the products and services of our portfolio companies in existing geographies etc. Our lethargy tests try to measure how alive, awake and adaptive are the business models of our portfolio companies to such evolutionary changes so as to ensure that they sustain the longevity of earnings growth in their business in future. This includes new product launches, marketing campaigns, IT initiatives to improve operating efficiencies, and investments in systems and processes to help institutionalise processes and manage growing scale of operations.

The risk of capital misallocation:

In our 2nd Feb 2020 newsletter (click here), using several examples we had highlighted that as Consistent Compounders grow and deepen their competitive advantages, the quantum of free cash flow available for redeployment tends to far exceed the amount that can be reinvested to grow the core business further. Promoters with aspirations of ‘empire building’ or those who want to add to their business, new revenue growth drivers for the longer term, tend to use surplus capital to diversify across geographies or product categories. This could either be organic, or inorganic diversification. Many firms prefer the inorganic route towards diversification, acquiring companies in related or unrelated businesses, forging joint ventures with other companies, acquiring minority stakes in other companies etc. Whilst all this sounds straightforward, many firms with a great core franchise that consistently generates high ROCE, have found it difficult to sensibly allocate surplus capital to diversify their business in the past. Hence, our lethargy tests focus substantially on capital allocation decisions taken by a firm on an ongoing basis.

Recent changes made to our PMS portfolio: one entry and one exit

New stock added to the portfolio – HDFC Life Insurance Company Ltd.:

HDFC Life is one of India’s largest private life insurance companies with a market share of 22% in the private life insurance industry. While products can be copied, the DNA of being first to market with innovative products has become a part of HDFC Life’s culture which has led to the improvement in its new business margins from 13% in FY13 to 26%, one of the highest in the industry.

The company has been able to grow its value of new business (VNB) by 27% CAGR over the previous five years (FY15 to FY20). HDFC Life has focused on keeping a diversified product mix and a balanced distribution mix to maneuver multiple business cycles and regulatory changes. It has also been proactive in making investments in technology and automation which have helped in building an efficient distribution channel and reducing operating costs. Being part of the HDFC group gives HDFC Life multiple advantages: (a) insurance being a long term product requires the customer to trust the brand and our primary date checks show that the HDFC brand provides comfort to a life insurance customer; (b) a tie up with HDFC Bank ensures a strong pan-India bancassurance network without any fixed costs and (c) a strong parent in the form of HDFC Ltd. which maintains board oversight, helps nurture a strong DNA and can infuse capital as and when required.

The life insurance industry is at a stage where banking was in the early 2000s when PSU banks used to dominate the banking sector. Over the last two decades, the more agile and innovative private sector banks such as HDFC Bank and Kotak have gained market share and have been able to create substantial wealth. Similarly, LIC dominates the life insurance industry but bank backed private life insurers have been gaining market share over the past few years. These favourable industry dynamics along with the under penetration of insurance in India present a long growth runway for HDFC Life.

Exit from ITC Ltd:

We continue to believe in ITC’s competitive advantages in its cigarettes business, other-FMCG businesses, and paper and agri businesses. However, we expect ITC to deliver only 11%-13% CAGR in earnings over the next 3-5 years (unchanged vs our previous expectations). Whilst there is possibility of inorganic growth of earnings at a higher rate as ITC deploys the approximately Rs 37,000 crores of surplus capital available on its balance sheet, we do not intend to bank upon the unpredictable timing and quality of such capital allocation decisions. Given the availability of HDFC Life as a substitute with higher earnings growth expectations, we have decided to make space for HDFC Life by exiting from ITC in our Consistent Compounders portfolio.

Regards

Team Marcellus

If you want to read our other published material, please visit https://marcellus.in/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services and as an Investment Advisor. The performance related information provided herein is not verified by SEBI.

Copyright © 2020 Marcellus Investment Managers Pvt Ltd, All rights reserved