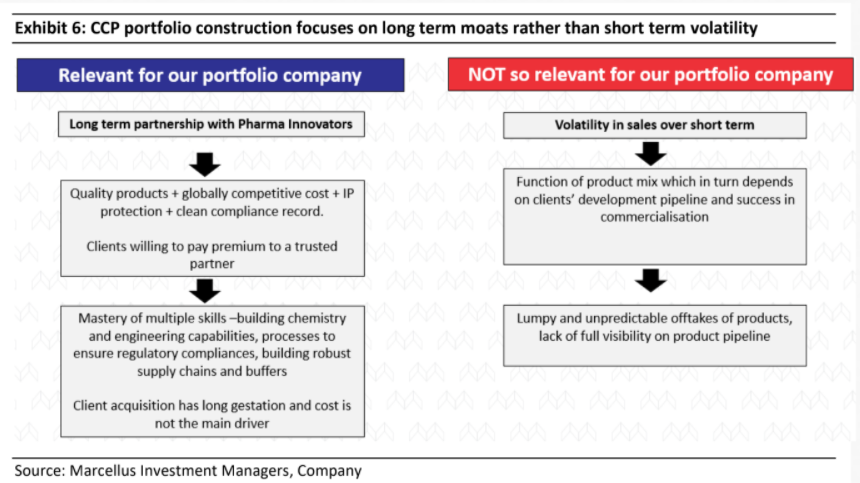

It is rare to find an Indian pharma company which makes systematic investments towards building the customer’s trust, improving compliance and ramping up manufacturing efficiency. Divis Labs is one such company that has delivered on these fronts for almost three decades. It has been the preferred manufacturing partner for major Western pharma companies on the back of three pillars – being 100% IP compliant, not competing with its own API clients by running a formulations business, and very efficient manufacturing processes. In addition, Divis has been able to garner scale advantages by exclusively focusing on key chemistries in which it can become world leader reinforced by disciplined capex using the mountains of free cashflows its business generates. We remain sanguine about Divis’ prospects. The firm has strengthened its moat through completion of several backward integration projects over the last two years and added new revenue growth drivers in generic APIs as well as advanced custom synthesis segments.

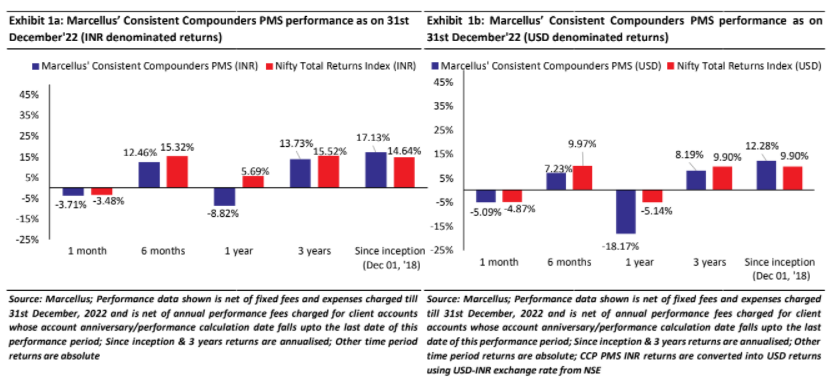

Performance update – as on 31st December 2022

We have a coverage universe of around 25 stocks, which have historically delivered a high degree of consistency in ROCE and revenue growth rates. Our research team focuses on understanding the reasons why these companies have delivered healthy and consistent historical track record and which of these companies are likely to sustain their superior financial performance in future. Based on this understanding, we construct a concentrated portfolio of companies with an intended average holding period of stocks of 8-10 years or longer. The latest performance of our PMS portfolio is shown in the charts below.

“Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace, and those who read their Graham & Dodd will continue to prosper” – Warren Buffet in The Superinvestors of Graham and Doddesville (Emphasis added by us)

In our Nov’22 blog ‘China’s Unravelling Creates a $300 Billion Opportunity for India’, we’d discussed how the West’s increasing apprehension about its dependence on China for active pharmaceutical ingredients (APIs) may create a $100bn opportunity (from ~$20bn currently) for the Indian pharma firms over the coming decade. However, in our Jan’20 blog on the challenges of investing in Indian pharma companies, we had discussed how most Indian pharma companies cut corners around manufacturing processes to save costs. As is well understood, this lands Indian pharma companies in hot water with regulators across the world. In an industry where non-compliance results in years of R&D investments being turned to naught, it is important for investors in the pharma sector to give regulatory-compliance and trustworthiness, at least the same level of importance as they give to its recent financial performance. It is in this context that we find Divis Labs a rare Indian pharma company that has been able to meet all of these requirements consistently over long time periods.

Over the past few months, we’ve had incoming queries from our clients regarding the rationale behind our continued optimism on the company which has underpinned the increase in Divis’ position size as per our proprietary MOSS (Margin of Safety and Sustainability) framework.

Terminology:

- Custom Synthesis – Custom Synthesis manufacturing in pharma industry parlance refers to outsourcing of molecule development and synthesis of molecules by Innovator companies (who conceptualise new drug molecules) or manufacturing of generic molecules

- API – active pharma ingredient is the functional part of any drug. APIs carry out the targeted changes to effect the intended results. Remainder of the drug is made up of excipient which is the substance added to dosage form to enable processing of API, to control the rate of API dissolution, to aid drug stability, etc.

- TRIPS – Agreement on Trade Related Aspects of Intellectual Property Rights is an international legal agreement between all member nations of WTO. TRIPS lays down the guidelines for safeguarding and use of IPR.

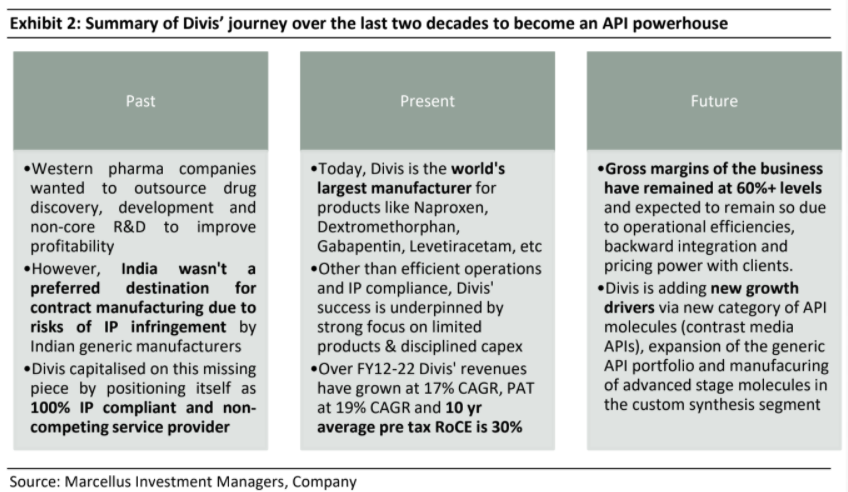

The crux of Divis’ right to win lay in the way Indian and global pharma industry operates

Divis’ journey began in the early 1990s as a consultancy firm engaged in engineering new and efficient processes for API manufacturing and then selling it to the highest bidder. No manufacturing was undertaken in initial years. After a couple of years in the business as consultants, Divis started adding manufacturing capacity focused on API manufacturing for high volume, low margin products with intense competition. In

order to get traction in the API market, Divis started with improving production efficiencies in the manufacturing of API for Naproxen (an anti-inflammatory drug which is the world’s most commonly used drug).

Divis’ core team comprised of organic chemists and pharma engineers and they came up with more cost efficient and less polluting manufacturing processes that used enzymes as catalysts instead of chemicals (simply put, a catalyst is a substance that makes a chemical reaction happen faster). This substantially reduced costs and improved productivity in Naproxen production. As a result Divis garnered significant market share for this API even after being the 22nd entrant in this category.

Separately, when it comes to patented chemistry (i.e. non-generics part of the industry), each new molecule patented by big pharma companies grants monopolistic pricing power to such company allowing it to (theoretically) earn abnormally high profits over the life of patent (~20 years) but there are exorbitant costs involved. For the commercial launch of any new drug molecule, on average, it takes around 10 years from pre

clinical trial stage (when the patent is typically provided) and costs around $800 mn – $1 bn. Such high costs are a result of extremely low (~10%) success rate in new drug development, a very long development period (which is getting longer due to even greater regulatory scrutiny) and high labour cost of skilled scientists. In a nutshell, the profits from a drug are a function of two key elements- residual patent period post commercial launch of drug and the costs involved around such launch.

Thus, for new drug developers, there are essentially two ways to make money:

- Shorten the timeline for commercial launch to earn profits for a longer time during the patent protection regime i.e. bring down the time period from pre-clinical trial to commercial launch to below 10 years, and

- Lower the cost of new drug development so that the profits earned during the patent period are justifiably high.

Since shortening the timeline for commercial launch is dependent on regulatory bodies and hence cannot be controlled, big pharma companies have looked at outsourcing the drug discovery and development process to reduce costs.

This gave rise to contract manufacturing over the last few decades. However, India during 1990s was not a preferred destination for western pharma companies to outsource production as Indian generics manufacturers were aggressively trying to enter the developed markets by challenging the patents of innovators, raising the issue of IP protection on new drugs. This is where Murali Divi has built a competitive edge for Divis Labs. Having seen the reluctance of western pharma companiesto give their IP to manufacturers in developing countries, Divis positioned itself as a 100% IP compliant and non-competing service provider.

Further, the company has been able to build a stellar regulatory compliance track record where it has had only one instance of adverse outcome in its FDA inspection in its entire history. This track record becomes critical as the clients cannot afford to lose out on their sales due to compliance challenges at vendor’s end which can take months to resolve. Further, switching of vendors is a very lengthy process in pharma industry.

Simply put, Divis’ competitive advantage vs. peers is three pronged:

1. 100% IP compliant outsourced manufacturing;

2. Being a non-competing service provider; and

3. Having a high quality manufacturing process which also scores highly on regulatory compliance.

Divis’ success over the years has also stemmed from a clear focus on key chemistries and disciplined capex

Alongside manufacturing APIs, Divis also pitched to western pharma companies that they should outsource their high margin custom synthesis business to the firm. After an initial struggle as it built a track record, Divis started getting small sized orders in this segment too. Divis’ CRAMs business really picked up from FY2006 onwards after India had adopted TRIPS to provide IP protection to MNC Innovators. Over the years, the company has continuously increased its production capabilities for both generic API & custom synthesis by installing multipurpose lines and reactors.

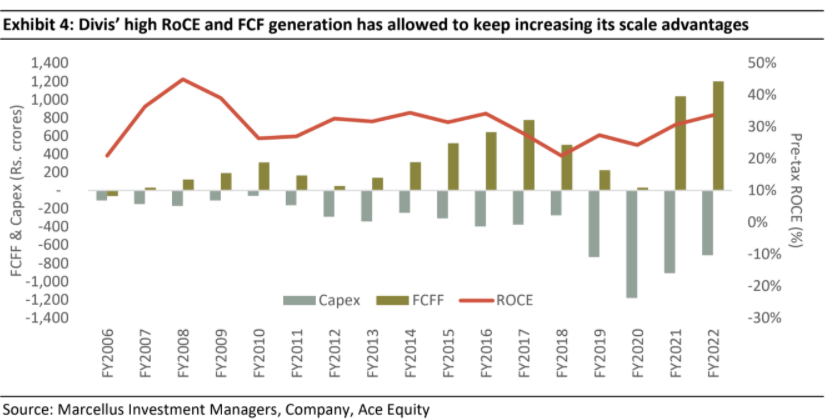

Today, Divis is a leading global manufacturer of generic APIs and a large-scale custom manufacturer of APIs for big pharma companies from both US and Europe. It is the world’s largest manufacturer for multiple APIs like Naproxen, Dextromethorphan, Gabapentin, Levetiracetam, etc. For Naproxen and Dextromethorphan, Divi’s accounts for over 70% of global market share (Source: Business Standard). In addition to its generic API business, Divi’s has a very large custom manufacturing business where some of world’s biggest pharma companies like Novartis, Sanofi, GSK, and Merck are its clients. Over the last decade (FY12-22), Divi’s revenues have grown at 17% CAGR, its PAT has grown at ~19% CAGR, FCF CAGR at ~38% and its 10-year average ROCE (pre-tax) has been ~30%.

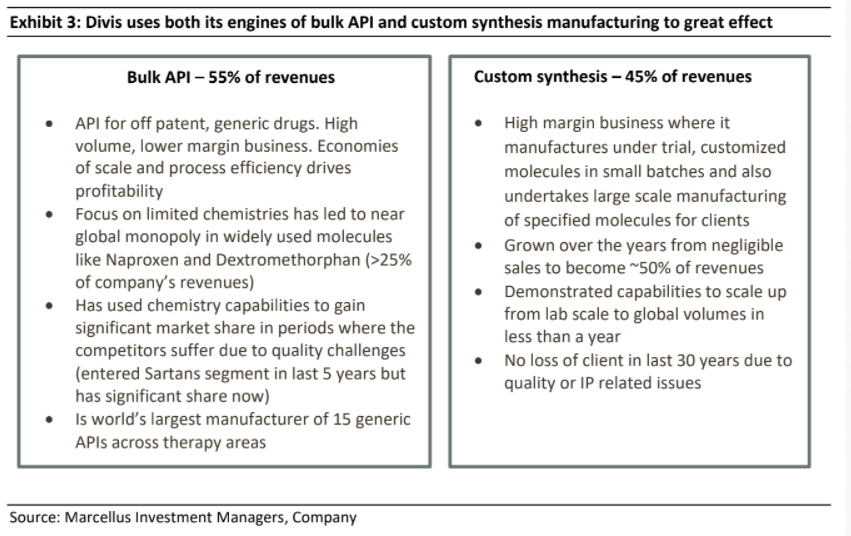

In terms of its business composition as it stands today, exports contribute ~ 90% of sales for the company with the US & Europe accounting for ~ 75% of all revenues and this contribution has been largely steady over last 16 years. The company has two main lines of business – Bulk API & Nutraceuticals manufacturing (55% of revenues on long term averages) and Custom Synthesis (45% of revenues on long term averages).

Other than maintaining laser sharp focus on operational efficiency and IP compliance, Divis’ management has also been astute in two other areas:

-

Focus on limited products:

Rather than focusing on multiple products and spraying capital in various directions (which many other Indian pharma companies do), Divis has focused on only those chemistries its established skillsets (in re-engineering the process chemistry in the manufacturing of an API) and its production scale can help it become global leaders. Ever since it started API production, Divis has stuck to the same business segment and reinvested its profits in increasing the scale of its API business by adding clusters of reactors and manufacturing equipment which can manufacture multiple APIs. Even while selecting the APIs to manufacture, Divi’s has only chosen those APIs which are off patent and have very high volumes of consumption globally.

-

Disciplined capex:

Over the years, Divis has followed a philosophy of modular and gradual capacity addition. The firm’s discipline in project execution is evident from the fact that no capex project undertaken by company has faced a delay in commissioning over last 16 years. As a result of calculated capex, the company is debt free and the capex amount is usually recovered in two years in the form of incremental free cash flows.

Divis’ prospects are good & recent weakness in revenue growth is par for the course for its business mix

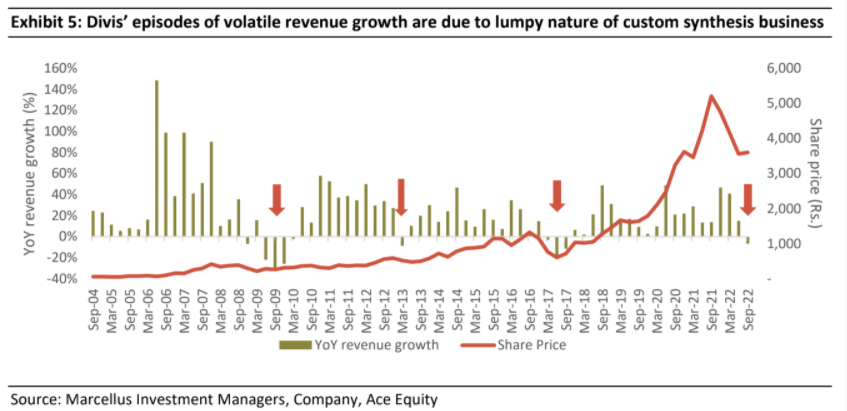

Divis’ business mix and segmental growth varies significantly every quarter (see exhibit below) as the custom synthesis business by its nature is unpredictable and lumpy. This is because the demand in this segment depends on success of client’s products and competitive intensity for client’s products. As a result, Divis’ revenues tend to be volatile, and this leads to short term share price volatility as well.

In Q2FY23 as well, Divis’ revenues were affected by the unpredictable nature of custom synthesis business as this segment reported a 33.3% QoQ decline amounting to around 400 crore rupees. Around 60% of this reduction was due to reduced supplies of covid drug which was expected to be a limited time opportunity. The rest of the decline is primarily on account of lumpy offtakes of certain non-covid products in Q1FY23 which impacted the volumes in Q2.

We remain confident about Divis’ future prospects is because:

- The generics API segment of company has stabilised and started growing as the use of non-covid medicines around the world returns to normal levels

- Although the generic APIs business was bigger contributor of revenues in Q2FY23 with 57% share vs 47% in preceding quarter, the gross margins of the company have remained very stable and healthy at around 63%. This points to

a) the efficiencies that company has been able to build in its generics manufacturing;

b) the benefit it is deriving from several backward integration projects completed in last 2

years; and

c) pricing power based on the track record of timely supplies with quality and compliance

adherence.

- Divis is building on its strengths and execution track record to add multiple growth drivers in the coming years as per management’s commentary in recent quarterly conference call. Potential new drives of growth include:

a) Supply of new category of APIs – contrast media APIs to global big pharma companies

having global sales of ~ $5 bn. As per management, client validation has already been

completed by one big pharma company and Divis is filing with regulatory authorities for

approval. At the same time, validation process is underway for another global big

pharma company

b) The generics API portfolio of the company is set to expand over FY23-FY25 as many of

the molecules targeted by Divi’s go off-patent over this duration. The current end

market sales value of these molecules is around $20 billion. Divi’s has started filing

paperwork for some of these molecules with the regulators in order to start commercial

supplies

c) Divis is getting increased queries for manufacturing of more advanced stage molecules

in its custom synthesis segment as its performance with Molnupiravir positions it

uniquely for those products where the big pharma clients expect regulatory approvals

and fast commercialisation (requiring large scale manufacturing in short period). Divis

has already received two such molecules in the recent quarter.

The initiatives highlighted above are expected to drive strong growth for the company in years to come and

given that there’s no discernible deterioration in the business’ underlying moats, the stock’s correction in

CY22 is a rebalancing opportunity for our portfolio’s position sizing.