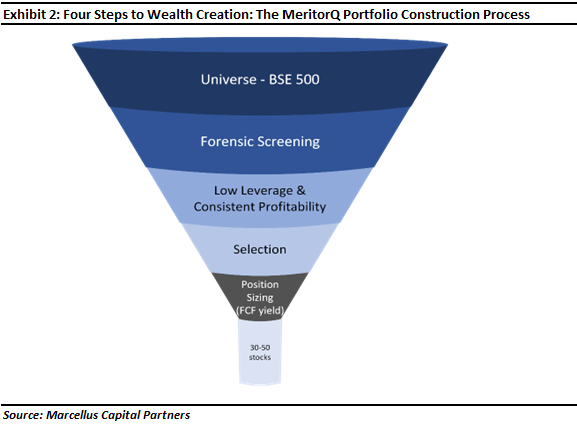

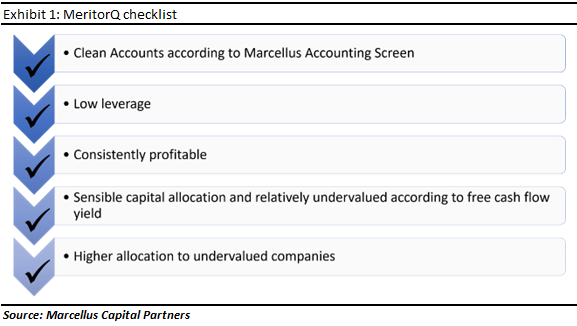

Most of us have used a checklist at some point. Humans need checklists because most of us have imperfect recall. Checklists provide a cognitive safety net. They prevent us from having to suffer due to our flaws —flaws of memory, attention, and thoroughness. Checklists have been found to be effective in performing complex tasks in varied domains like aviation and construction, among others. Investing is a probabilistic task, where having a clear process or a checklist is critical for avoiding mistakes and consistently outperforming. The investment rules in MeritorQ can be thought of as a checklist which when applied regularly with minimal discretion reduce behavioral and analytical errors thus maximizing wealth generation potential.

“No wise pilot, no matter how great his talent and experience, fails to use his checklist” – Charlie Munger

|