OVERVIEW

The joining up of India, digitally and physically, has democratized access to economic opportunities. This has helped new groups of people rise in the Indian economy. These newly ascendant people are neither based in India’s megacities, nor did they study in elite universities and nor do they belong to the socially privileged castes. From India’s smaller cities, from hundreds of local universities and from the dozens of less privileged castes, a new entrepreneurial and professional class is rising to grab the reins of power & privilege in India.

“…India was, in the simplest way, on the move, that all over the vast country men and women had moved out of the cramped ways and expectations of their parents and grandparents and were expecting more.” – VS Naipaul in ‘India: A Million Mutinies Now’ (1989)

Introduction

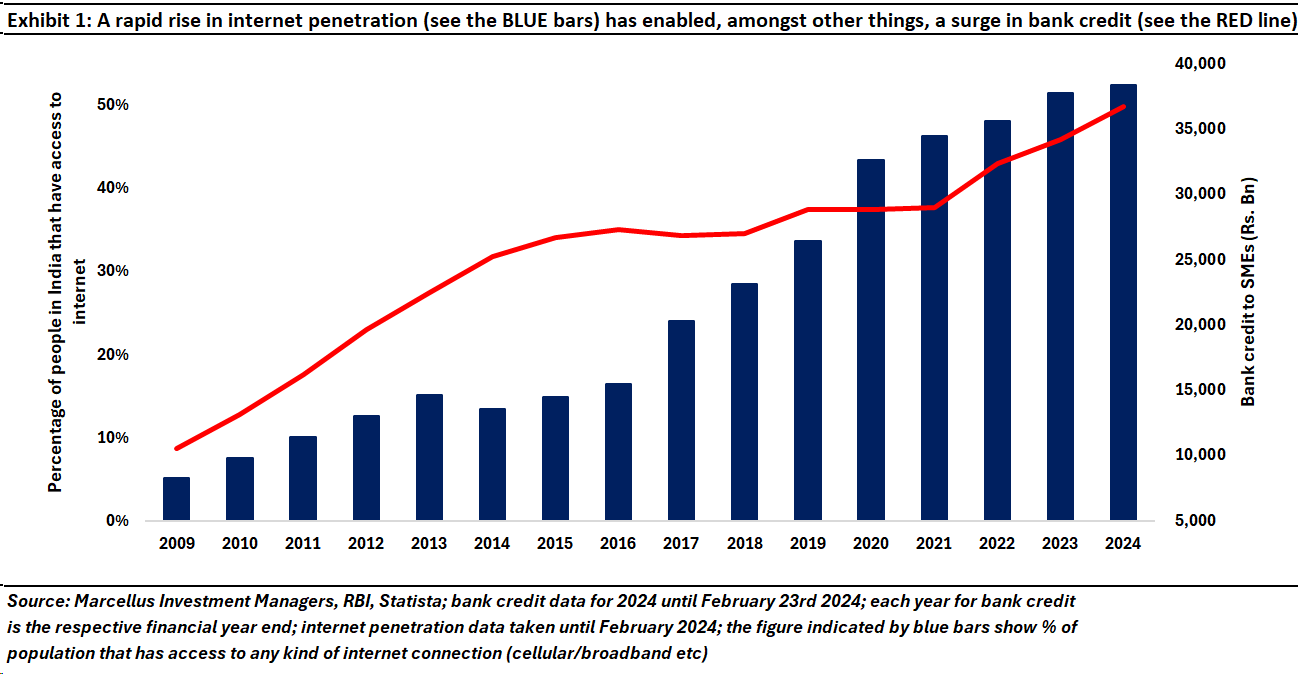

The joining up of India is a very visible spectacle. With the national highway network seeing a near doubling from ~79K km in 2012 to ~140K km in 2022, with domestic air travel passengers more than doubling from ~58 mn in 2012-13 to ~136 mn in 2022-23, with individuals having access to internet surging by ~4x from 14% in 2014 to 51% in 2023 (see exhibit below), and with the number of bank accounts growing ~3x from ~1 billion in 2015 to ~3 billion in 2023, the last decade has seen a dramatic improvement in physical and digital infrastructure in India.

This integration of the Indian economy is altering the composition of the Indian elite by creating opportunity and prosperity for hitherto disadvantaged end economically marginalized groups. How so, you might ask. As the editor The Print, Shekhar Gupta, explained in a recent article:

“As long as the economy was small and growing slowly, the few privileged institutions sufficed to produce the talent India needed, from corporate boardrooms to the civil services and the judiciary. Now, a rapidly growing economy needed many more talented people and a much larger catchment area. St. Stephen’s/Doon/Mayo/St. Columba’s/St. Xavier’s/La Martinière… are still great institutions — they may be India’s finest even now — but they are just too few to meet India’s need for talent.

That’s why a Tata Administrative Services equivalent today needs to go way beyond these institutions, family networks and checking the names of the candidates’ fathers. The desperate, slog 24×7 push of middle, lower middle and poor India, meanwhile, has made it much, much more competitive to crack the UPSC examinations. Track the lists of toppers and rank-holders published by IAS academies when you open our full front pages now, and check if there are any from these old institutions. It is just too hard to compete, and even in the interview process, there is no premium on pedigree.” – Source: The Print, see https://theprint.in/national-interest/college-pedigree-daddys-name-bbc-accent-no-longer-golden-ticket-india-has-a-growing-new-elite/1621127/

So, who are the new elites in India? And what are the investment implications of their economic ascent?

Methodical Build of Basic Infrastructure in India

“Networking inherently implies equality. Everyone, rich and poor, is plugged into the same electric, water, sewer, gas and telephone network. The poor may only be able to hook up years after the rich, but eventually they receive the same access.” – Robert Gordon in ‘The Rise & Fall of American Growth’ (2016).

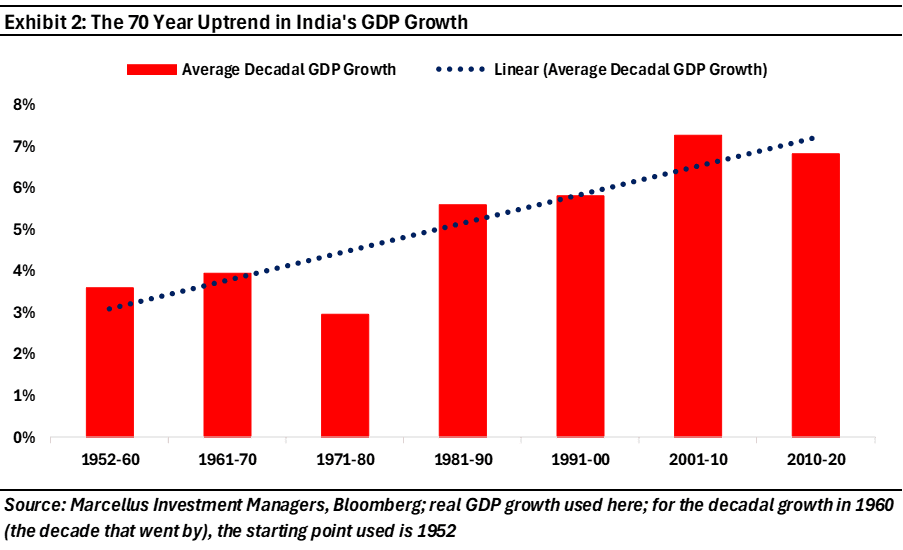

After decades of spirit-sapping, soul destroying rules for doing business in India, in 1991, the then prime minister PV Narsimha Rao and finance minister Dr. Manmohan Singh liberalized the economy and allowed foreign as well as domestic firms to participate in most sectors of the economy without seeking hundreds of licenses & permissions. What followed was a decade of newer private players entering the fray and starting to build their businesses.

This entrepreneurial verve was further fueled by the global economic boom of 2003-07. The noughties in India were thus marked by stellar economic performance, with animal spirits working in full force.

The irrational exuberance of the noughties came to a halt in 2010, when the then Comptroller and Auditor General of India, Mr. Vinod Rai, published detailed accounts of how the Exchequer had been shortchanged and public interest sacrificed in a variety of sectors.

Part of the fallout of these exposes was a loss of face for the then ruling UPA-II government which in turn created the opportunity for the NDA to triumph in the 2014 General Elections. However, even before the NDA’s victory in 2014, the seeds of transformational change had already been sown thanks to the formation in 2009 of the Unique Identification Authority of India (UIDAI), helmed by Mr. Nandan Nilekani.

UIDAI or Aadhar as it is better known marked the beginning of a new era of massive buildup of social, financial, and physical infrastructure all across the country. As we had observed in our July 2023 note, The Democratization of Opportunity in India’s Boardrooms, “Leaving aside the NDA’s victories in the General Elections of 2014 and 2019 which led to the broader policy changes that the country witnessed, three other sets of factors have kicked-into play over the past decade:

- India has got networked. The national highway network saw a near doubling from ~79K km in 2012 to ~140K km in 2022, domestic air travel passengers more than trebling from ~54 mn in 2009 to ~170 mn in 2019 (pre pandemic), households with broadband connections grew ~7x from ~20 mn in 2013 to ~137 mn in 2023, the number of bank accounts grew ~3x from ~100 crores in 2015 to ~300 crores in 2023.

- The India stack was built. It began with Aadhaar (UIDAI or Unique Identification Authority of India) in 2009 which gave a digital identity to all the citizens of the country. This was followed by Jan Dhan bank accounts introduced in 2014 which successfully gave every Indian family a bank account. This combined with the proliferation of mobile phones in India and the launch of Jio’s ultra cheap mobile broadband services in 2017 networked India digitally. This in turn paved the way for the creation Unified Payments Interface (UPI), where anyone with a bank account, a smartphone with an internet connection can transfer any amount of money to anyone in the country instantly! Today, more than 9 bn UPI transactions are taking place each month and over half of India’s GDP is being transacted via UPI (see our blog dated September 2022 From Aadhaar to ONDC: India’s Methodical Build of Digital Assets Creates Competitive Advantages)

- The cost of capital dropped sharply measured not just by the 10 year-Government of India bond yield (which has dropped from ~9% in Aug ’13 to ~7% now) but also by the large pools of PE and VC money which now flow into India each year [anywhere between $20-70bn depending on what the Federal Reserve is doing with its monetary policy]. Alongside foreign capital, the rapid financialization of savings (e.g., the number of brokerage (Demat) accounts has grown 8x over the past decade) drove a structural downtrend in the cost of both debt and equity capital.”

Three sets of new elites who have risen to prominence in the country

As a result of the country getting networked and joined up through physical and digital infrastructure, economic opportunities which were once upon a time available only to the elites in the megacities now became more widely available. As Nandan Nilekani has explained:

- Indians who didn’t hitherto have any officially verifiable identity got a valid & digitally verifiable identity in the form of Aadhaar.

- Indians who did not have access to information & knowledge now got all the information & knowledge that they needed courtesy of Jio’s low cost data connections (which costs 1/40th of what American telecom companies charge for mobile data).

- Indians who hitherto lacked access to financing from the banking system (and thus has to borrow in the black market at usurious rates) now got access to affordable financing via Jan Dhan bank accounts.

This trifecta of changes made identity, knowledge and financing available to hundreds of millions of Indians who had been living lives of quiet desperation outside the enclaves inhabited by the big city elites.

- Rise of the non-elite educated entrepreneurs and executives

“Kunal Shah, an angel investor, entrepreneur and founder of fintech company CRED and Freecharge, had to resort to working odd jobs like delivery agent and data entry operator due to his family’s bankruptcy. This was revealed by Sanjeev Bikhchandani on social media platform X after meeting Kunal Shah at a coffee shop in Delhi. Bikhchandani recounted meeting Shah at a Delhi coffee shop and learning about his unconventional background. Shah, a philosophy graduate from Wilson College in Mumbai, explained that he chose philosophy because its classes fit his work schedule, not out of personal interest or academic constraints…

“In a world of IIT IIM Founders he stands out as a philosophy graduate from Wilson College in Mumbai,” Bikhchandani said in a post.”- Source: Economic Times, 7th Feb 2024 [https://economictimes.indiatimes.com/magazines/panache/forget-iit-iim-degrees-the-inspiring-story-of-cred-founder-kunal-shah-who-once-worked-as-a-data-entry-operator/articleshow/107475170.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst]

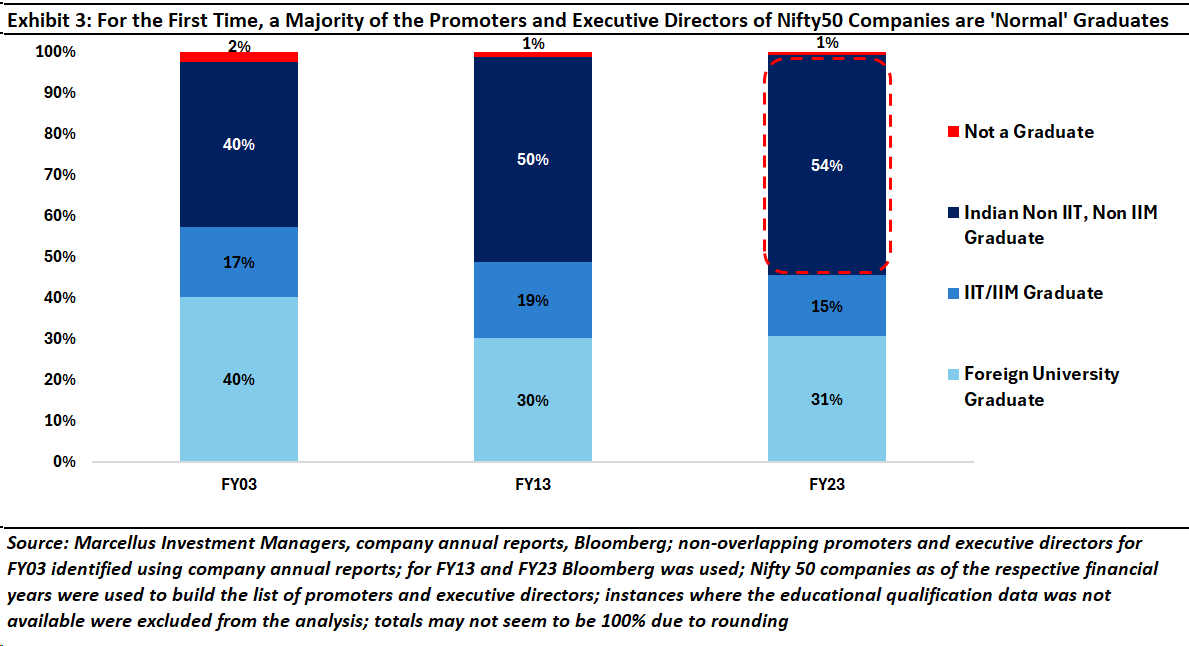

For the first time in the last twenty years, a majority of the promoters and executive directors of the Nifty 50 companies are neither from an IIT/IIM nor a graduate from any foreign university. This is remarkable because, twenty years ago, in FY03, this figure was just 40%, rising to 50% in FY13. What this graphic and data show is that the largest 50 companies in the country today are run by people who belong to the non-elite educational institutions. This is a natural outcome given the supply-demand mismatch in the educational sphere in the country – there is simply just so much talent in all corners of the country, which was not able to rise hitherto due to certain restrictions on access to information and opportunities, and not enough premier institutions to cater to this vast pool of talent. Until now, because of lack of access to opportunities, this section’s demand never came through and the premier institutions kept going at their own pace. Today, because of joining up of the economy, access to information and opportunities has risen disproportionately, making the premier institutes incapable of serving this surge in demand, and therefore, quality talent springing up from all over the country.

For instance, in HDFC Bank, other than Mr. Sashidhar Jagdishan, none of their executive directors are from an IIT or IIM or from any foreign university. They are all University of Mumbai graduates. The largest bank in the country by market cap is emblematic of the change that is underway in the country at large – the rise of people from non-elite educational institutes.

- Rise of small-town India

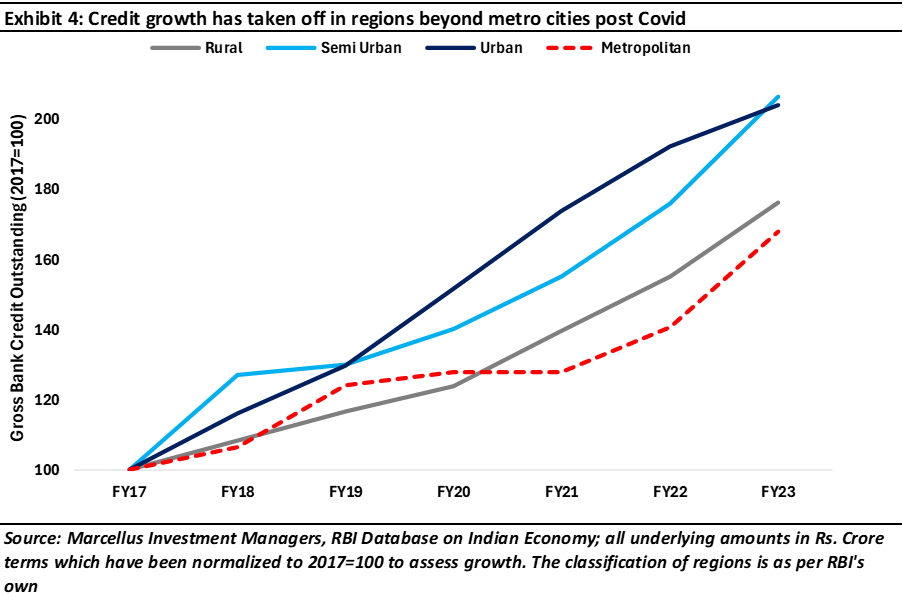

Contrary to what is generally believed, the growth in financialization of small town India is even more dramatic than what has taken place in India’s megacities. Thanks to Aadhaar and Jan Dhan accounts, a massive portion of the population came into the formal banking system for the first time since independence. This has opened up multiple opportunities for them in the world of organized financial services. As you can see in the exhibit below, every geography type has witnessed rapid growth in credit offtake (at around 11% per annum) especially in the last seven years. However, as per RBI data, credit growth data for banks in urban and semi-urban areas has far outpaced big city credit growth (represented in the chart below as ‘Metropolitan’).

In fact, as we travel around India, raising assets for our portfolio management services franchise, we can see that in small town India, owners of SME businesses have figured out for themselves that their land, their property and their gold will not be enough to fund them through retirement – the RBI’s remarkably well researched August 2017 Household Financial Committee report says that 95% of Indian households’ stock of wealth is in physical assets. As everyone in India now knows, physical assets struggle to keep up even with the rate of inflation (and therefore cannot create wealth in real terms). Unfortunately, for these SME owners (and for 99% of other Indians) very few Indian families have the wherewithal to retire with a corpus of Rs 15 crores of financial assets and thus adequately fund a 25-year long upper middle-class retirement [assuming the need for a post-retirement annual income of Rs 50 crores).

The practical implication of this is that the smaller the town, the quicker the SME owner warms up to our offering. So, using Tamil Nadu as an example, a pitch which takes an hour in Chennai, takes 45 minutes in Coimbatore (population: 1.6 million), 40 minutes in Tirupur (population: 0.8 million) and around 30 minutes in Erode (population: 0.5 million). There are several reasons we believe for this pattern (which we have seen in Maharashtra as well):

• The financialization of savings has happened to a certain extent in big cities like Mumbai, Delhi, Bengaluru and Chennai. In smaller cities, most SME owners have only a smattering of financial assets (usually fixed deposits and life insurance policies).

• The market for residential property and land still has some liquidity in the big cities – at least a few flats are being bought and sold in cities like Mumbai and Chennai. In smaller cities, the market for real estate is completely frozen solid. There have been no deals all year long in several of the smaller cities we have visited.

• The audience which meets us in the bigger cities tends to have a greater proportion of people from white collar professions – people who have a steady income and hence a greater sense of security. In the smaller cities, the audience is overwhelmingly SME owners who have to live by their wits e.g., textile traders, spice traders, car dealers, local real estate developers. These people have to live with volatility in their day job and hence crave the security that comes from investing in a relatively predictable financial asset.

- Rise of non-upper caste talent

“When the people of Sankarapadu entered Hindu society with no caste of their own and the most impure occupation of all, that of landless labourers, there was no question where their place would be: at the bottom, as despised outcastes. Outcastes are also called untouchables because they are supposed to be so ritually unclean that the slightest contact with them will defile even low-caste Hindus. Untouchables cannot share meals with others, much less intermarry with them, and are made to live apart from the rest of the village in a segregated colony on its outskirts. Sankarapadu became the untouchable colony of Polukonda, albeit an unusually remote one.” – Sujatha Gidla in her book ‘Ants Among Elephants: An Untouchable Family and the Making of Modern India’ (2017).

Historically, oppressed castes in India have been given a raw deal – social, financial, workplace, and political ostracization has existed across the country and at varying intensities. Caste-based discrimination robbed a large swathe of Indian people of economic opportunities and reduced the changes that such people had to break free of poverty.

Whilst affirmative action – which the Indian state has implemented since 1947 in favour of the hitherto discriminated castes – has helped, the democratization of opportunities over the past decade has supercharged the economic emergence of non-upper castes.

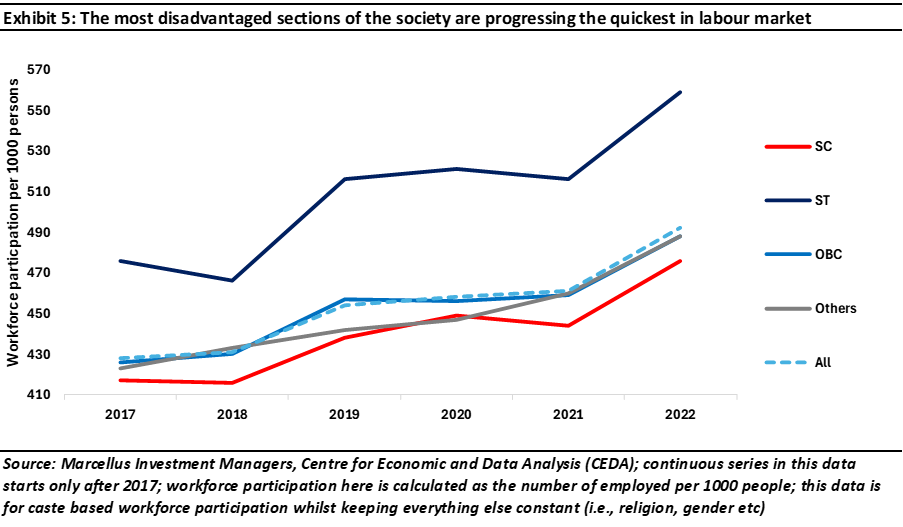

For example, the data on workforce participation (which is defined as the number of people employed out of the total labour force which includes employed and unemployed people) shows that the most disadvantaged castes have closed the gap with the rest of the population. In fact, the workforce participation for scheduled tribes in India is actually higher than that for the rest of the country, at 559 per 1000 people versus 492 per 1000 people respectively in 2022 (see exhibit below).

This suggests that given an increasingly level playing field, some of the most historically disadvantaged segments of society are rising faster than their more privileged counterparts. A somewhat similar phenomenon was also witnessed in the US with Jews racing far ahead of their fellow American counterparts: “Negotiating between American and Jewish identities, they operated with a sense of empowerment. They did not believe that they had to accept America as it was, nor did they see Judaism as a fixed entity that they could not mold to fit their needs. They could put their impress on both to ease the traumas of accommodation and to bring the two into harmony” – Hasia R. Diner, professor of American Jewish History at New York University (Diner, H. R. (2004). The Jews of the United States, 1654 to 2000 (Vol. 4). Univ of California Press.)

Investment Implications

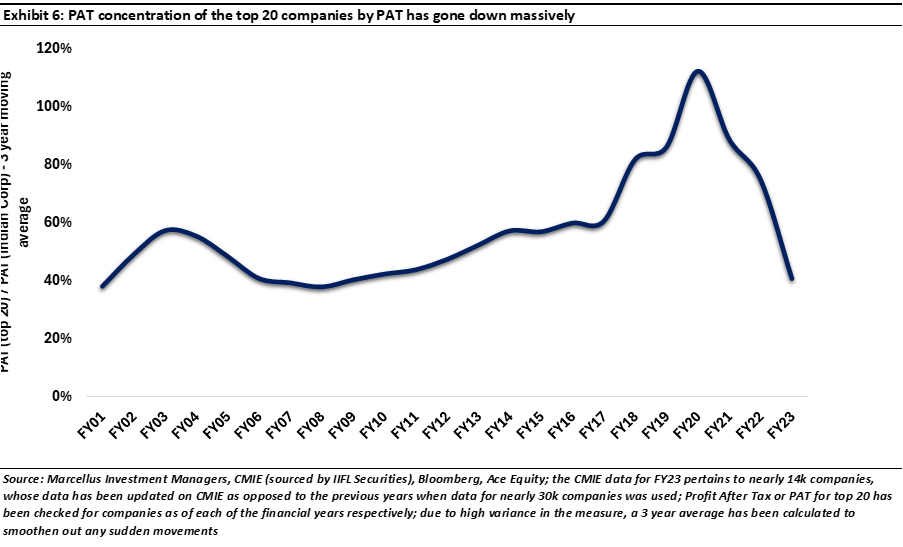

As new groups of entrepreneurs and professionals rise in India, it is highly likely that they will ramp up the intensity of competition for incumbent businesses run by the entrenched elites. In fact, you can already see this increase in churn in India Inc. As shown by the exhibit below, the profit share of companies which are NOT in the “top 20 by PAT” has risen very sharply in the last three years (see the dashed RED line).

What this dramatic upsurge in the profits of smaller companies also means is that in our small & midcap portfolios, we can now access several companies which are forging new paths to profitability in the Indian economy. For example:

Fine Organics: Headquartered in Ghatkopar, Mumbai, Fine Organics supplies additives that have very low molecular weight (less than 1%) in the final products manufactured by its clients. Their clients are willing to pay a premium not only due to the high quality of products but also endeavor on part of Fine to keep pushing the envelope and improve economics for the clients. For instance, the company introduced oleo-based additives for the packaging industry which replaced additives that were derived from animal fats. Resultantly, packaging manufacturers who use Fine’s additives can now manufacture packing for vegetarian food items – thus increasing their addressable market size. This seemingly small company is indispensable for anyone selling packaged food products in the country and exemplifies the rise of the small yet ambitious people in the country willing to create high quality products and making their presence felt.

Prudent Corporate Advisory Services: Over the past 8 years, India’s monthly SIP inflows have surged ~6x (~9x by count of number of live SIPs), reaching US $2.5 billion/month. In this context, Prudent Corporate is India’s second largest non-bank mutual fund distributor (based on commissions earned). Its AUM grew at 31% CAGR over the last five years versus the industry CAGR of 23% for the same period. Whilst the company stands to benefit from the rising demand for equities as a savings medium, Prudent is also solving for the supply-side by bringing more professionals into the financial products distribution ecosystem. As a result, Prudent today enjoys the trust of ~28K+ IFAs and commands sustainable competitive advantages to onboard more IFAs under its technology-enabled, comprehensive investment and financial services platform. In a way, Prudent Corporate is an exemplification, both, of the widespread access to financial markets for ordinary Indians and is itself a beneficiary of the democratization of opportunity in India where in the space of two decades working class professionals have built a giant Financial Services franchise.

Tarsons Products:A leading supplier of plastic labware products in India with a growing exports business (1/3rd of revenues), Tarsons enjoys industry leading operating margin (FY19-23 average EBITDA margin nearly 2.5x the second-best player’s) and significantly superior returns on capital employed vs peers (30% average over FY19-23 vs second best’s 21%). The key success factors for Tarsons have been its difficult to replicate in-house manufacturing set up (vs peers who rely mostly on imports/outsourcing), long standing relationships with distributors, and focus on the plastic labware market (heavy reinvestments of operating profits in capacities, automation, market expansion). Tarsons is another fine example of small yet quality company being able to take on labware giants and MNCs with their high quality products.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). Amongst the companies mentioned in this note, HDFC Bank, Fine Organics, Prudent Corporate Advisory Services, and Tarsons Products are part of Marcellus’ portfolios. Nandita and Saurabh may be invested in these companies and their immediate relatives may also have stakes in the described securities. The described stocks/securities are for educational/illustration purpose only and not recommendatory.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.