OVERVIEW

Summary: Focus on the ‘inner scorecard’ rather than the ‘outer scorecard’. Focus on continuous learning, knowledge & skill acquisition rather than credentialling. Look for new experiences, new opportunities to acquire knowledge and build new skills.

[To find out what the Ten Commandments of Indian Entrepreneurship are, pls click here: https://marcellus.in/blogs/the-ten-commandments-of-entrepreneurship-in-india/]

“We shall not cease from exploration

And the end of all our exploring

Will be to arrive where we started

And know the place for the first time.”

– From ‘Little Gidding’, T.S. Eliot

Disclaimer: Copyrights of the book is exclusively reserved with Author/Publisher of the above book; we do not claim any rights on the same.

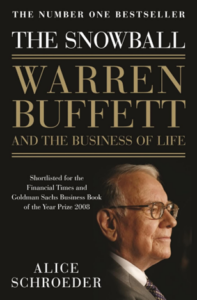

Warren Buffett famously made a distinction between the inner versus outer scorecard. His precise words were “The big question about how people behave is whether they’ve got an Inner Scorecard or an Outer Scorecard. It helps if you can be satisfied with an Inner Scorecard.”

I stumbled upon this point of view from the great investor around two decades ago just as I was discovering thanks to my erstwhile boss, Steve, that the MBA is a more like a modelling agency than the army (see my ‘First Commandment’ blog here for why a business school is like a modelling agency: https://marcellus.in/blogs/the-first-commandment-take-risks/).

My interpretation of what Buffett was saying as that the inner scorecard refers to living a life focused on learning & skilling and focusing on being true to the values you hold dear. The outer scorecard refers to living a life focused on credentialling and other achievements that can be flaunted in front of the others e.g. a nice house, an expensive car, luxury holidays, a muscular body. I understood that Buffett is saying that if you can find peace and comfort with your inner scorecard – rather than seeking validation from others – you are far more likely to live a happy life. In addition, Buffett is also warning us about those people who spend all their lives thinking about what the world is going to think about this or that subject, instead of what they themselves are going to think about it.

It took me another decade to understand the second layer of meaning embedded in Buffett’s seemingly simple dichotomy. I was in my mid-30s and was busy building my second business. That’s when I realised that you hit upon original business insights when you read around widely, meet experts from a range of fields AND THEN think about business problems from first principles. Applying what one learnt at university or in business school seldom leads to enduring competitive advantages in the world of business.

As I pushed further into this area of learning in my 40s, I realised that not only are the best business insights for your line of work self-generated (from your own thinking & observations of the wider world), just as importantly, happiness and self-worth are self-generated. Reading Chris Wright’s book on astronauts who went to space (and then struggled to find meaning on Earth) “No More Worlds to Conquer” in the opening days of 2018 was a revelation because that’s when it hit me that Alexander the Great shouldn’t have been weeping when he realised that there were no more countries left for him to conquer. He should have been dancing with joy because of the realisation that the only world worth conquering is the one inside your head.

To give myself an opportunity to push deeper into this subject, I teamed up with my friend Anupam Gupta in 2018 to write a book on how you can develop your mind, your mental clarity and declutter your life. The result was a bestselling book, “The Victory Project: Six Steps to Peak Potential”. Influenced by Robert Greene’s methodical process to gaining mastery of your chosen discipline, Anupam & I wrote:

“As you accumulate knowledge and experience in your chosen discipline, ideally under the guidance of a mentor, you will increasingly have to choose between: (a) keeping your mind active, hungering for more knowledge, asking increasingly difficult questions and seeking out new experiences; or (b) turning conservative with your knowledge acquisition, preferring to fit into groups of people and sticking to procedures which—for you—are tried and tested. If you want to attain mastery in your craft, you will have to choose path (a) rather than path (b). In other words, as you move towards the end of your apprenticeship, you have to be bold enough to expand your knowledge of related fields. You have to experiment and look at old problems from new angles. As you do this, Greene says that ‘you will turn against the very rules you have internalized . . . Such originality will bring you the heights of power.’..

Mastery, or the development of high-level intuition : As you push the frontiers of your knowledge and your skill set repeatedly, you will develop an understanding of all the parts involved in the discipline that you are studying (or the craft that you are learning). The knowledge will now be internalized in you in ways that even you will not fully understand. Albert Einstein, famously, was able to see a whole new way of seeing the whole universe—the timespace continuum as he called it—in one single visual image. Similarly, Thomas Edison was able to visualize how an entire city could be electrified in a single image. Greene says that this level of intuition can only be reached after 20,000—not 10,000—hours of learning and practice. Through sheer practice and experience, you transform the neural networks in your brain such that it is able to make connections no one else can. In short, you become a ‘master’.” – The Victory Project, pg. 57

Nailing down the various levels at which one can enrich one’s inner scorecard not only helped me focus harder on upskilling myself, but it also helped me spot which CEOs and promoters were deeply committed to developing their inner, rather than their outer, scorecard. I found in Kuldip Singh Dhingra, the former Chairman of Berger Paints, a man who is deeply committed to the inner scorecard and whose company has benefited spectacularly over the past 30 years due to his commitment (Berger has compounded more than 1,200x [source: https://stockpricearchive.com/berger-paints-share-price-history/ ] since the Dhingras acquired it in 1990). Over drinks on balmy Delhi evenings, I learnt plenty from Mr. Dhingra regarding how to think through business strategy and capital allocation. In 2016, I described Mr. Dhingra’s modest offices and understated lifestyle in my book “The Unusual Billionaires”:

“As per Forbes, the Dhingras are among India’s fifty richest families. And yet the Dhingras come across as different from the average Indian billionaire. They maintain a low profile and are rarely spotted in the press. They are neither in the business pages of the Economic Times nor on page 3 of ‘Bombay Times’. For a family of their stature, the office of the Dhingras in Delhi is a sparsely furnished, back-of-the-shopping-precinct affair in an unpretentious downmarket commercial complex adjoining Zamrudpur village. Berger itself is headquartered in Kolkata and runs its operations from a nondescript office building located at the low-profile end of Park Street. In my meetings over the past few years with the Dhingras, I have found them to be refreshingly grounded.” – The Unusual Billionaires, pg. 87

Saurabh Mukherjea is the Chief Investment Officer at Marcellus Investment Managers (www.marcellus.in).This material is for informational and educational purposes only and should not be considered as financial, investment, or other professional advice. The inclusion of any book does not imply endorsement or recommendation by the writer or the publisher of this material.

The above material is neither investment research, nor investment advice. Berger Paints forms part of the Marcellus Portfolio. We as Marcellus, our immediate relatives and our clients may have interest and stakes in the mentioned stock. The stocks mentioned are for educational purposes only and not recommendatory. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.