OVERVIEW

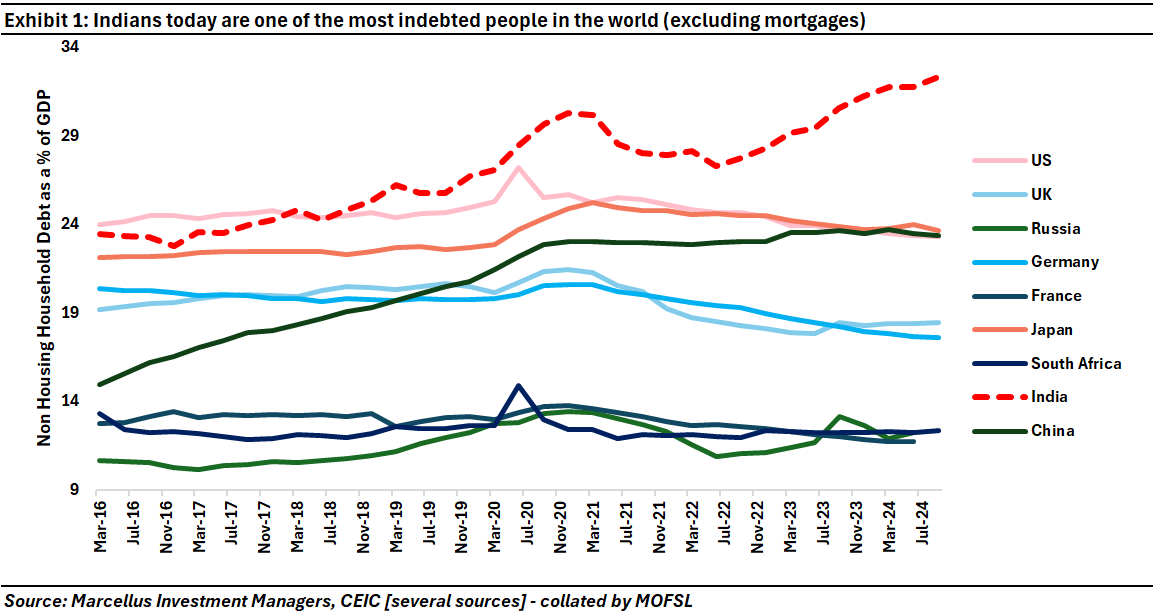

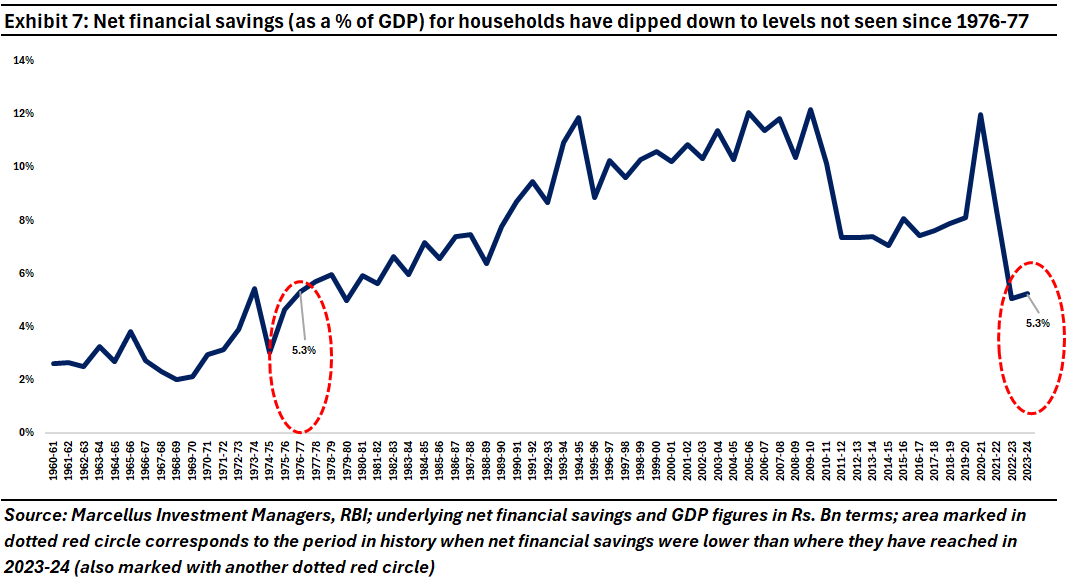

Over the past decade, not only have Indians borrowed at an increasing rate whilst their incomes have stagnated, but now they are also one of the most indebted people across the world (excluding mortgages), surpassing the US and China. Most worryingly , most of these retail loans are NOT for creating assets but for satisfying daily consumption needs. To put this in historical context, India’s NET household financial savings (as a % of GDP) is at its lowest level in the last 50 years due to a steep rise in household financial liabilities.

Introduction

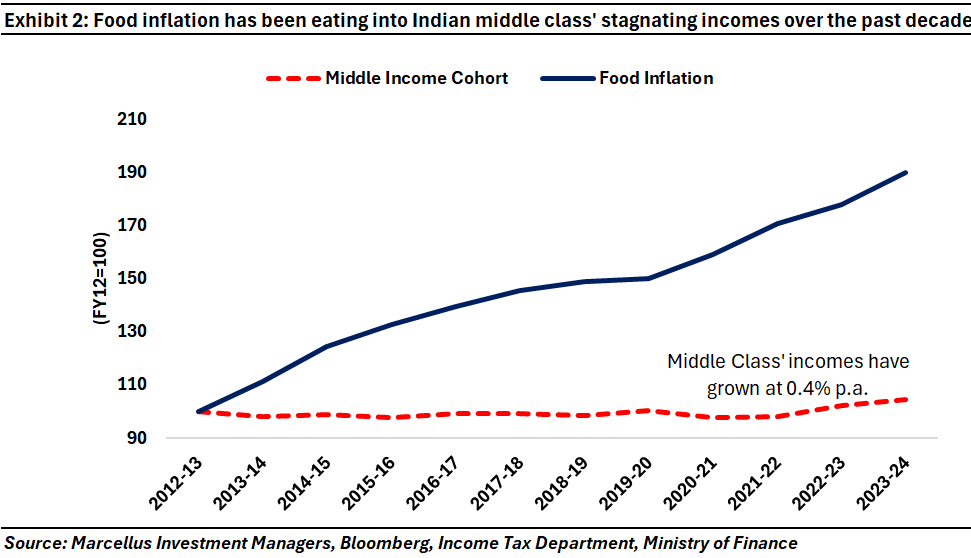

Over the last decade, whilst incomes for the Indian middle class have been stagnant, food prices have nearly doubled. As a result, not only has the ability of the middle class to consume discretionarily been reduced, but their inability to finance day to day consumption has also led to a rise in their indebtedness.

In our note published on 12th February 2025, Excessive Debt and the Illusion of Wealth, we explained that: “The reluctance of Indian lenders to finance capex combined with the rise of automation has jammed the ability of the Indian middle class to get jobs & pay hikes. With incomes stagnant and with Income Tax & GST taking away a growing share of the disposable income of the middle class, it has loaded up on debt to finance its lifestyle in a country with soaring aspirations fueled by social media. Now evidence is growing that 5-10% of middle-class Indians are in a debt trap i.e., they are taking multiple loans to finance day-to-day consumption and keep up with their debt repayments. Consequently, we are likely to see an extended period of depressed consumption for mass market products in sectors like auto, consumer durables, real estate, building materials and FMCG.”

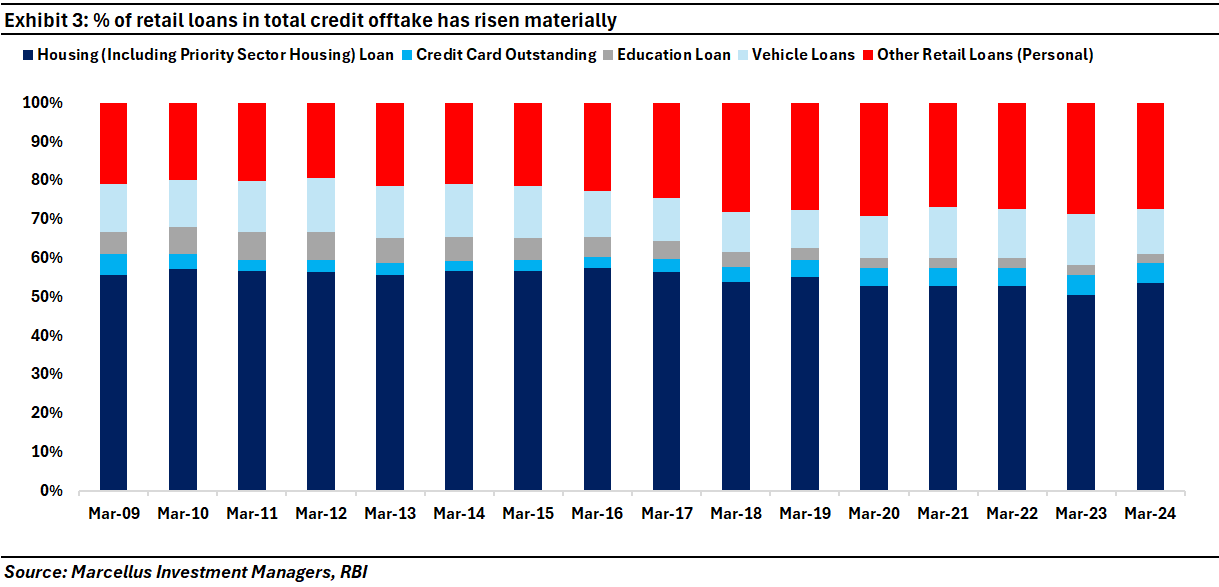

This is also evident in data from the RBI. Specifically, the share of retail credit in RBI’s total credit offtake has ballooned over the last 10 years, which means people are borrowing for activities other than asset creation (for example home loans whose rise has been modest).

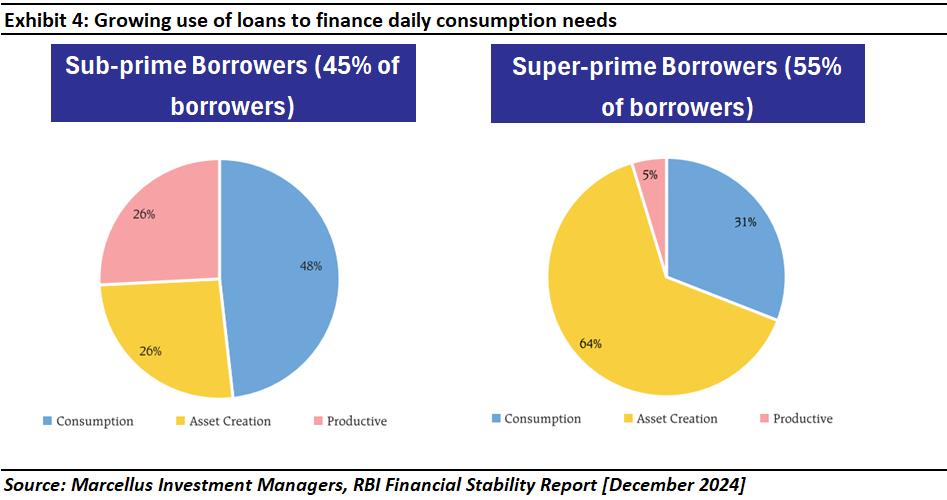

Furthermore, if we were to look at the RBI’s Financial Stability Report from December 2024, it shows that not only have consumption related loans risen in the past several years, but also that 45% of all borrowers are sub-prime and nearly half of their loan requirement is towards consumption (see charts below).

Together, this means that Indians today have not only borrowed money, but they have done so increasingly for sustenance and not asset creation.

Interestingly, when we published our previous blog on the subject, we ran into a body of thought which claims that Indians are traditionally parsimonious, and especially watchful when it comes to debt. Further, we realized that the widely held view is that the penetration of consumer credit is low in India. The question is “Is this view correct?”

Ex-mortgages, Indians are one of the most indebted people in the world

Cross country data shows that Indians today are amongst the most indebted people in the world if we exclude mortgages (or loans taken towards home or property). If we were to look at the data for both developing and developed countries in the world, India’s non housing household debt as a percentage of GDP (at 32.3%) is only second to that of South Korea’s (43.2% – not in the chart), and higher than countries like the US and China [see exhibit 1].

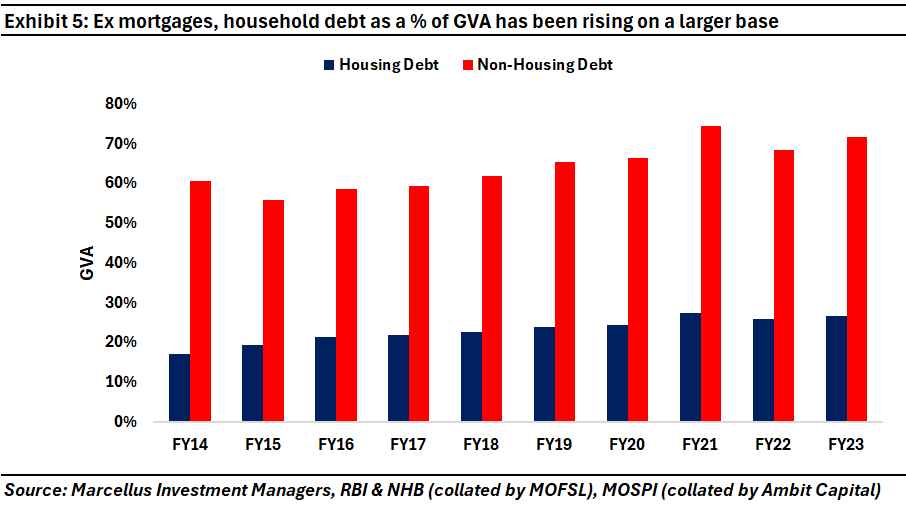

What exhibit 1 shows is that until 2019 India’s non-housing household debt was broadly in line with other countries. In 2020, post-Covid India witnessed one of the steepest falls in its GDP and resultantly the line spikes up during this period. After this shock, India’s non-housing household debt has surged at a rate faster than any of the countries shown in the chart above. As a result, India has now surpassed developed countries that are traditionally considered to be consumption heavy like the US as well as developing countries that have typically relied heavily on bank credit for development like China. As the chart below shows, non-housing household debt as a % of households’ Gross Value Added – a proxy for household income – now stands at 72%, up from 59% in FY17.

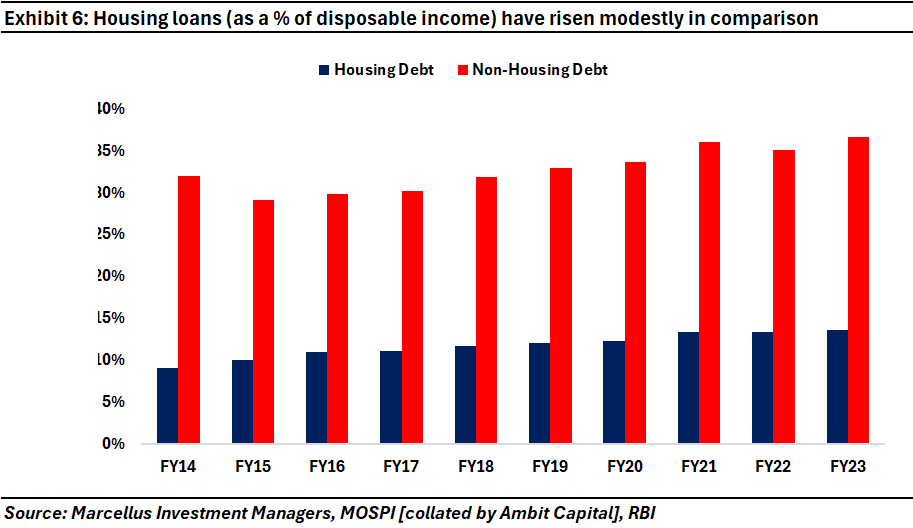

That being said, there is one ray of hope – India’s mortgage debt as a % of its household disposable income has NOT shot up (see chart below).

The post-Covid surge in non-mortgage household debt in India is not just remarkable relative to other countries, it is also without precedent relative to India’s own history. The chart below shows RBI’s data on net household financial savings as a percentage of GDP data in conjunction. This figure has now reached a 50-year low due to rising financial liabilities and not so much due to an absolute fall in savings.

Investment implications

- We are likely to see an extended slowdown in consumption especially pertaining to the major products that the middle class buys e.g., scooters, entry level cars, entry level consumer durables, rail tickets, FMCG products. “Data from the National Statistical Office (NSO) shows that India’s private consumption growth slowed down to 5.3 per cent in 2022-23, compared to 7.9 per cent in 2019-20.” (Source: Businessworld, 9 Dec 2024)

- We are already hearing reports from several Indian cities that supply of new flats is exceeding demand. A corollary of excessive middle-class indebtedness would be slowing demand for real estate and consequently for building materials. More generally, the purchase of anything which the middle class deems to be non-essential is likely to be postponed until the debt burden eases and/or incomes start rising at double digits.

- The combination of rising NPAs and falling savings exerts a double squeeze on low quality lenders and squeezes, both, their earnings growth and the growth in their net worth. That in turn is likely to drag down credit growth in the country as a whole.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). The views and opinions expressed in this material are those of the writers/authors and do not necessarily reflect the official policy. This material is for informational and educational purposes only and should not be considered as financial, investment, or other professional advice. The inclusion of any book does not imply endorsement or recommendation by the writers or the publisher of this material.

The above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.