OVERVIEW

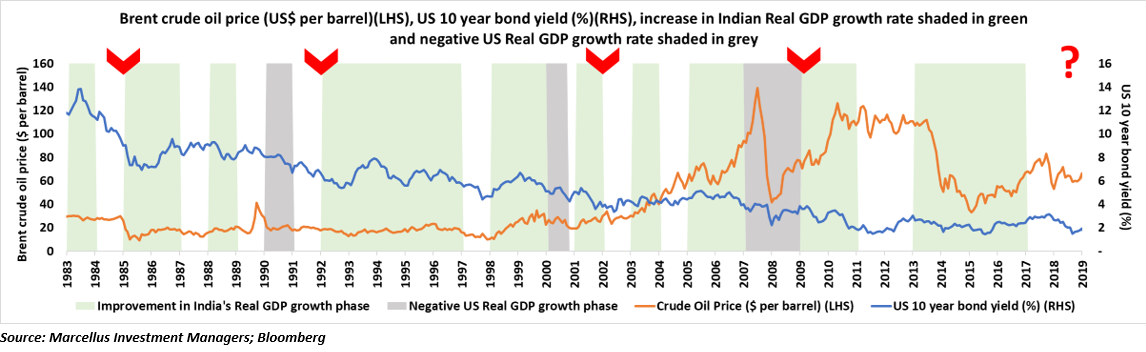

Four times in the last 40 years, a US recession alongside falling US bond yields and falling oil prices has been followed by a strong economic recovery in India. In fact, India has NEVER witnessed an economic recovery without a US recession preceding it! Now, all three conditions for an Indian economic recovery – a US recession, smashed crude prices and falling US Government bond yields are – in place. Our portfolios – CCP and LCP – are ideally designed to capitalise on such an economic recovery.

Five years ago, in December 2015 in my previous job as a stockbroker, I constructed a note which made me a hate figure in some circles. At a time when the bull run inspired by Prime Minister Modi’s 2014 election victory was still underway, the brokerage which I managed had said that India was heading for an earnings recession as the traditional model of crony capitalist capex was all set to be jammed by Prime Minster Modi and by Mr Rajan (the then RBI Governor). Hence, we said that getting all steamed up about the large cap benchmark indices in India – which were stuffed full of poorly managed crony capitalist companies – was pointless.

Since December 2015, Nifty EPS growth has been a measly 2.5% per annum. The 17 companies which have exited from the Nifty since then are: Cairn India, Punjab National Bank, BHEL, Idea, Grasim, ACC, Bank of Baroda, Tata Motors DVR, Tata Power, Ambuja Cements, Aurobindo Pharma, Bosch, Lupin, HPCL, Indiabulls Housing and Yes Bank.

Five years on, in the midst of the Coronavirus driven mayhem, we believe the opposite call is warranted since all the ingredients are now in place for sustained recovery in Indian earnings growth. These ingredients are: (a) cheap oil; (b) cheap money; (c) GST implementation; and (d) the corporate tax rate cuts.

Cheap oil: India’s economic reform process began tentatively in the early 1980s under Mrs. Gandhi and that led to India’s first economic growth spurt between 1982-87 (alongside a tremendous bull run in the Sensex) just as Ronald Reagan was bringing the US out of the 1979-82 recession. India’s second growth spurt came two years after the momentous economic reforms of 1991 and that too triggered a crazy bull run (which Harshad Mehta manipulated to his benefit). Both of these growth spurts and the golden growth period of 2004-08 and again from 2009-11 had a common feature – oil prices crashed at the beginning of the growth spurt alongside falling US Government bond yields (see the periods marked with red chevrons in the chart above). In each of these periods, the oil price crashes and the falling Government bond yields were triggered to a significant extent by a US recession [highlighted in grey in the chart shown above].

The correlation between a recession in the world’s largest economy, tanking oil prices and falling US Government bond yields is relatively easy to understand. But why does this cocktail of factors always trigger an economic recovery in India?

Cheap money: Ever since India liberalised its economy in 1991, foreign capital – both FDI and FPI – has been central to financing its growth story largely because over 80% of the flow of domestic savings has been directed towards physical savings (gold & real estate). As a result, capital inflows from America – which accelerate when US bond yields fall sharply – are all important for India. For example, the drop in the US 10 year bond yield from 6.7% in Jan 2000 to 3.4% in June 2003 (Link) was crucial for igniting China and India’s growth engines in the 2003-07 boom. Equally important for India’s post-Lehman recovery was the flood of foreign capital which swept through India in 2009 and 2010 (remember those oversubscribed crony capitalist IPOs & QIPs with prospectuses that reeked of corruption).

The demise of residential real estate in India as a credible asset class since 2015 has in this regard been useful – it has encouraged households to save through the financial markets. Unfortunately, in parallel, the overall households’ savings rate has fallen in India – from around 25% of income ten years ago to around 17% today. As a result even today, India is dependent on foreign risk capital to finance an economic recovery. Indian lenders can provide debt financing but NOT risk capital. There is only source of risk capital for the Indian economy – the US of A.

In this context, it looks likely that the flooring of interest rates by Western central banks could be doubly beneficial for India. Firstly, it is likely to encourage foreign capital to head towards India as and when the Corona panic abates. Secondly, it will encourage the RBI to do cut rates sharply (since CPI inflation is likely to be taken care of by compressed crude prices). If the Government of India also cuts the rates its offers on its savings schemes, this will help the banks cut their deposit rates and thus their lending rates. Rate transmission can then finally happen in India and SME lending – far more important for spurring GDP growth than crony capitalist capex – could potentially come to life.

With Brent crude having corrected from US$83/barrel to US$30/barrel now, with US Treasury yields now below zero and with the US economy now likely to be in recession, key prerequisites of an Indian earnings recovery are in place. But that is not all – two key domestic reforms have also set the scene for a select few companies to benefit from the rapid formalisation of the Indian economy.

GST is a massive driver of formalisation: Out of India’s workforce of around 600 million people, we estimate that around 250 million people work in the retail sector (shops, markets, supermarkets, etc). A further 50 million odd work in the logistics sector (driving trucks and the assorted light vehicles used for last mile delivery). Thus 50% of India’s workforce is associated with the retail sector. Until GST came along, most of these people never paid taxes and hence enjoyed tax free profit margins of 12-15%. With the Government going full throttle to implement GST due to fiscal compulsions, these profit margins have dropped to 2-4%. As a result, the retail sector is now gasping for working capital (for a detailed explanation see our 17th September 2019 blog). This in turn is pushing these retailers towards seeking financing from organised lenders. However, these lenders – banks like HDFC Bank, Kotak Bank and NBFCs like Bajaj Finance – are discriminating between retailers who sell leading brands like Relaxo, Asian Paints and Pidilite (their retailers seem to be getting channel financing at 8% interest rates) and those who sell laggard brands (such retailers are getting funded at 15%). As a result, the market leaders are gaining market share every quarter from the laggard brands. See, for example Asian Paints’ consistent double digit volume growth in a sector which is unlikely to be growing at more than 6%.

Corporate tax rate cuts help the market leaders: In September last year not only did the Government cut corporate tax rates from 35% to 25%, the Finance Minister also said that if companies committed to fresh capex in new entities, they would get a discounted corporate tax rate of 15%. For market leading firms whose ROCE is well above cost of capital – and hence who generate lots of free cash flow which can be used for capex – this announcement is manna from heaven. Companies like Relaxo, Asian Paints, Nestle and Pidilite anyway double the size of their operations every 3-5 years. Hence their effective corporate tax rates five years hence could be sub-20%. However, for their weaker competitors – who don’t have the financial means to expand capacity – the corporate tax rate is likely to continue to be 25%. A 500bps+ differential in profit margins will decisively swing the balance of power in favour of market leading companies who will then either acquire the smaller companies in their sector (see what Pidilite is doing) or turn them into outsourced suppliers. For more details on the benefit that our investee companies are deriving from these corporate tax rate cuts, read our latest Consistent Compounders newsletter.

Investment implications

Across both our portfolios – Consistent Compounders and Little Champs – we continue to stay invested in companies with clean accounts selling essential products & services with high barriers to entry. These companies have high ROCEs (because of their high entry barriers). As a result they have adequate cashflows to not only self-finance their growth but also to buffer their balance sheet from Coronavirus related lockdowns which could continue for several weeks. Supply issues vis a vis China also seem to be largely under control: see this presentation from our fund managers – Rakshit & Ashvin – on this subject.

In short, we have created two painstakingly curated portfolios which stand to benefit strongly from an economic recovery in India. We reiterate that the power of cheap money and cheap oil is such that the last 40 years of data shows that a recession in America is a necessary and sufficient condition for a subsequent recovery in India.

Disclosure: HDFC Bank, Kotak Bank, Bajaj Finance, Asian Paints, Pidilite, Relaxo and Nestle are part of most of Marcellus’ portfolios.

Saurabh Mukherjea is the Founder and CIO at Marcellus Investment Managers. He’s also the author of “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”