OVERVIEW

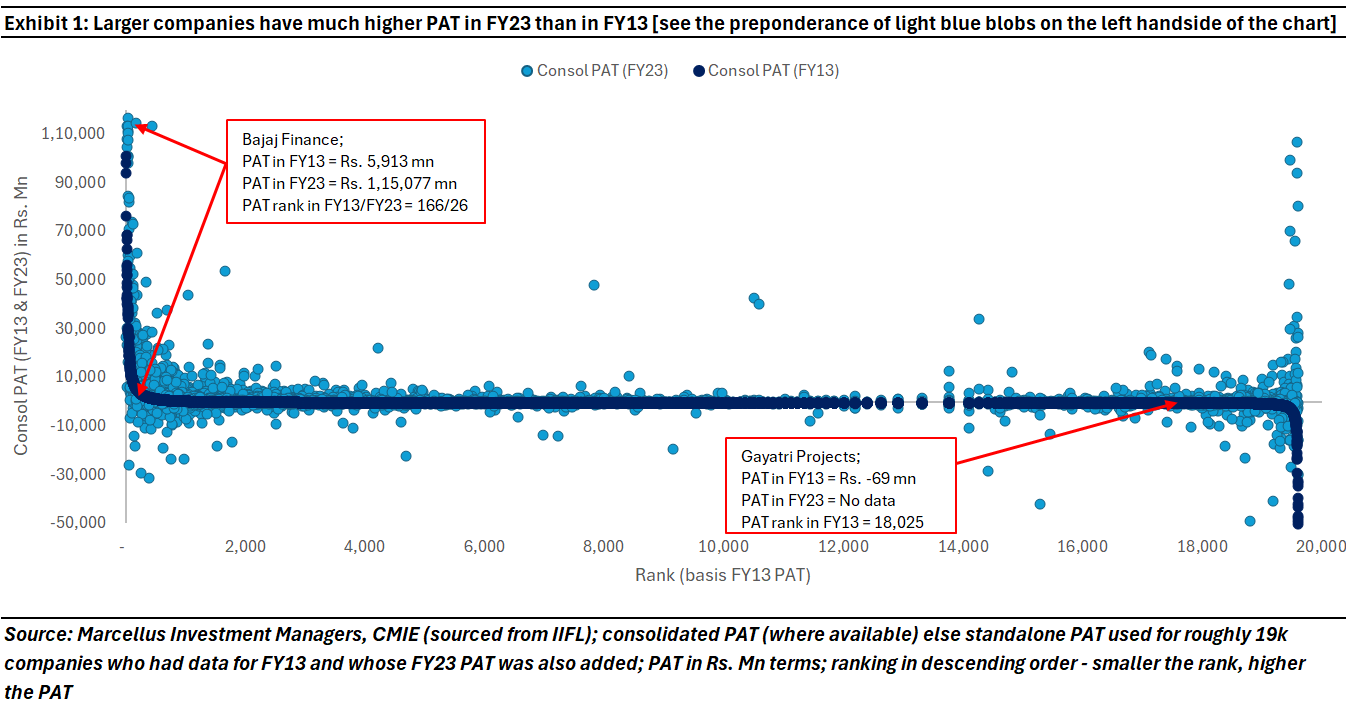

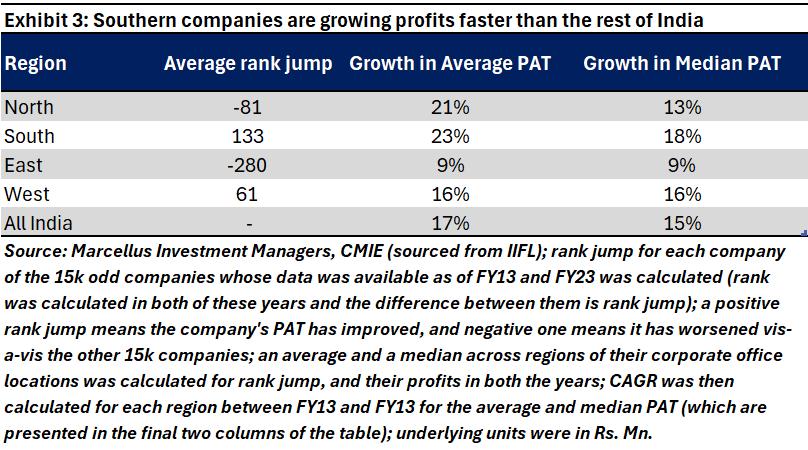

Over the last 10 years, whilst India Inc’s PAT has grown at 17% p.a. on an average, the median Indian company’s PAT has grown at 15%. Delving into this gap between the average vs the median gave us two findings: (a) larger companies have grown profits faster than smaller companies; and (b) southern Indian companies’ profits have grown MUCH faster than companies from the rest of the country. As we have explained in our bestselling book, ‘Behold the Leviathan: The Unusual Rise of Modern India’, these two facts have become a central feature in India’s economic evolution.

The Smallcap rally is deceptive

As everybody in India knows, over the past four years, Smallcaps in India have had a stellar run. Indeed, if we have a look at BSE SmallCap, in the last 1 year, the index has returned 46%, vs 24% p.a. in the last 3 years, and 17% p.a. in the last 10 years (source: Ace Equity). To be specific, BSE Smallcap has compounded 15% points faster than the BSE 500 over the past four years.

If we were to look beyond the listed universe, of the 376K+ startups registered in India, ~117 are unicorns (i.e., startups with value of US$ 1 billion or more). And India is the third largest country when it comes to unicorns (by number), following China (247) and the US (997)

The rise of the Small Company is NOT a universal phenomenon

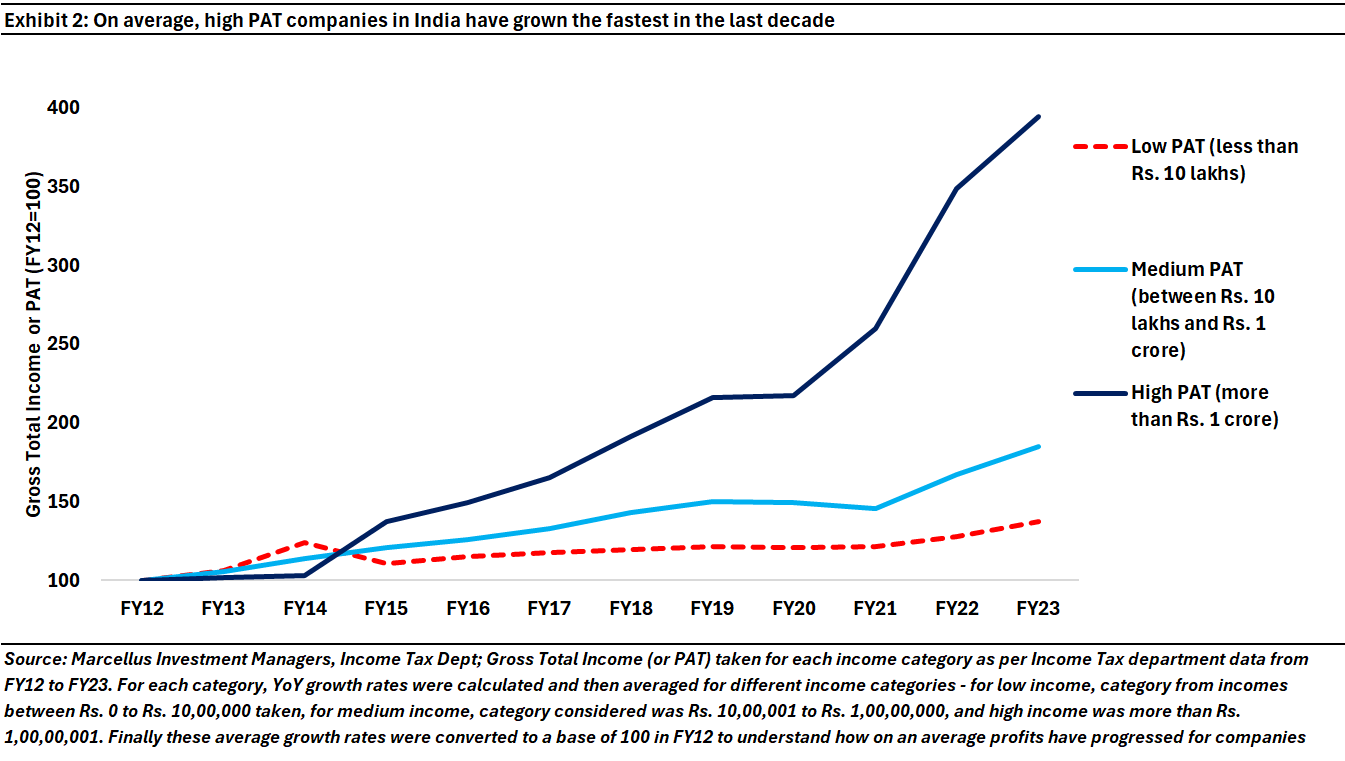

Companies with high Profit After Tax (PAT) or PAT greater than Rs. 1 cr (~US$120K) as of FY23 accounted for more than 98% of all of India’s profits and companies earning PAT more than Rs. 300 cr (~US$ 36 mn) accounted for 79% of India’s profits. This is data from the Income Tax department, and therefore looks at only profitable, tax paying companies.

Using the same data from the Income Tax department, if we go back to FY13, these high PAT companies accounted for 96% of India’s profits then, and more than Rs. 300 crore PAT companies accounted for just 73%! Effectively, over the last 10 years, these high PAT companies and specifically the greater than Rs. 300 crore PAT earning companies have incrementally taken share from rest of India’s smaller companies. This can be seen visually in the chart below.

Whilst the IT department’s data is large, it does not give constituent-wise or company wise granularity. Therefore, other data sources had to be scoured to follow the same company’s PAT over time. The Centre for Monitoring Indian Economy (CMIE) has a database of roughly 40k companies in the country as of today and for these companies they have data going all the way back to FY13. We took these companies, their regions or addresses of corporate and head offices, and looked at how they ranked as per their profits in FY13 and FY23, and their PAT growth per annum over the last 10 years across regions. The following exhibit summarizes the findings from this crunch.

Note, however, that even in the South, average PAT is growing much faster than median PAT implying that the biggest companies are growing faster than the rest. That in turn begs the question that why are we seeing bigger companies pull away from the rest of the corporate sector when it comes to profit growth.

Integration of the entire country on multiple fronts often leads to polarization

In our latest book, ‘Behold the Leviathan: The Unusual Rise of Modern India’ (2024) we have explained at length why we think larger corporations are going into another orbit of profitability altogether whilst the majority of smaller players are left in the dust.

“Imagine a village economy cut off from the rest of the world with no road or telecom connectivity to anywhere. In such a village, a range of smaller businesses, such as the barber, the greengrocer, the butcher, the blacksmith, the moneylender, etc., will build profitable local monopolies.

Now imagine that one fine day, this village gets road and telephone connectivity to the nearest large city, which is ten kilometers away. Here is what is likely to happen now:

- The most profitable and most enterprising companies in the village will set up branch operations in the large city, and if they prosper there, repatriate some of their profits back to the native village to scale up their village enterprise, thereby grabbing profit share in their native village.

- Aggressive companies from the large city will enter the village and offer lower prices alongside better products to the villagers. This will lead to many of the village enterprises shutting down as they will not have the technology, the expertise and the scale of the big-city competitors.

- Over time, the number of companies in the village will shrink, both because of consolidation in each sector in the village as the smaller village enterprises struggle to survive, and also because of imports of many necessities coming from the big city.

“… the joining up of India took place digitally (through the advent of Jan Dhan bank accounts, Aadhaar, Jio, UPI and the India Stack), which in turn made accessibility to the markets, payment systems and information less asymmetric. Post-2017, this intertwined with GST and the doubling of the national highway network to deliver a transformational change in the economic landscape, one which a few companies (the largest 7000 companies in the country, most of whom are ‘Challengers’) were able to seize but most were overwhelmed by.”

The moral of the story, we think, is to: (a) focus on southern India as that part of the country seems to have a far more dynamic economy than the rest of the country; and (b) understand in more detail the 7,000 largest companies in India in terms of PAT. These 7,000 companies after all account for ~85% of India’s PAT.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. All recipients of this material must before dealing and or transacting in any of the products and services referred to in this material must make their own investigation, seek appropriate professional advice. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer, or an employee. This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.