OVERVIEW

Published on: 30 Oct, 2018

Sixty years ago Solomon Asch showed that we start believing in nonsense if enough people around us are believers. Social media has amplified this problem manifold and thus become a hazard to HNWs’ portfolios. Cutting oneself off from social media and using simple behavioural rules mitigates this problem to a significant extent.

“These services [social media] are engineered to be addictive – robbing time and attention from activities that more directly support your professional and personal goals…Eventually, if you use these tools enough, you’ll arrive at the state of burned out, hyperdistracted connectivity…The use of network tools can be harmful.” – Cal Newport in ‘Deep Work’ (2016) [Square brackets are ours]

Social media = social pressure

Polish psychologist Solomon Asch conducted a series of groundbreaking experiments in the United States in the early 1950s which redefined our understanding of how peer pressure influences us.

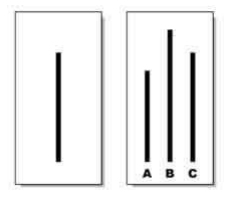

Suppose you and seven other people are seated in a table in a small room. Everyone seated around the table is shown two cards – see above. The experimenter asks all of you, one at a time, to choose which of the three lines on the right card matches the length of the line on the left card. The task is repeated multiple times with different cards and you are always the final person the room called up to answer.

How do you think you would behave if you were involved in this experiment? Would you go along with the majority opinion, or would you “stick to your guns” and trust your own eyes (that the correct answer is clearly “C”)?

Just to make things trickier, on some occasions, the other “participants” unanimously choose the incorrect answer. It is clear to you that they are wrong, but they have all given the same answer. Do you feel tempted to go along with the consensus opinion or are you independent enough to have an anti-consensus view?

What Asch found is that when other participants unanimously choose the wrong line, you will often go with the mass opinion. Asch found that “on average, about one third (32%) of the participants who were placed in this situation went along and conformed with the clearly incorrect majority on the critical trials. Over the 12 critical trials, about 75% of participants conformed at least once…” On the other hand, “in the control group, with no pressure to conform, less than 1% of participants gave the wrong answer.”

Asch showed us the perils of being plugged into consensus thinking generally (via mass media, via friends and family). In order to view issues originally, we first have to pull ourselves away from mainstream thinking. As Asch demonstrated, it is easy to start believing in nonsense (eg. residential real estate is a good investment) just because everyone else believes in it. The fact that social media damages our clarity and independence of thought is now increasingly well accepted thanks to books like “Stand Out of Our Light: Freedom & Resistance in the Attention Economy” by former Google strategist James Williams.

[The above is an excerpt of a longer piece that my friend, Anupam Gupta, and I have written for The Ken. Click here for the same: XXXXXXXXXXXXX.]

Seeking clarity of thought

Quitting social media is the first step towards developing greater clarity of thought. Three different books – “Deep Work” by Cal Newport, “Focus” by Daniel Goleman, “Peak” by Anders Ericsson & Robert Pool – point in the same direction. These books contend that if you want to come up with simple but powerful insights (useful thumb rules for building great products or a great portfolio) you have to specialise and focus – focus on deliberative practice, focus on reflective thought. Running from meeting to meeting whilst Whatsapping and emailing is unlikely to be a productive way to work in a world where insights are the key source of value and hence wealth.

Investment implications

Deliberative, reflective thought leads to simple thumb rules akin to a “Lakshman Rekha” i.e. lines in the sand which we do not cross. These play rules forces us to stay within our narrow circle of competence and rely upon the expertise of others for matters outside our circle. To quote, Ben Carlson: “The interesting thing about very intelligent and successful people is that they’re usually the ones who have figured out that making things simple is the correct path to success. Because they understand how things work, they are able to appreciate and utilise simplicity. Those who don’t have a hard time grasping this.” (Source: “A Wealth of Commonsense: Why simplicity trumps complexity in any investment plan” (2015).)

Since at Marcellus our only area of expertise is analyzing Indian companies and then buying shares in outstanding companies with clean accounts, we have implemented our own Lakshman Rekha wherein:

Step 1 is to look for companies which in the preceding ten years have grown their business at a certain rate (say, revenue growth has been at least 10% per annum 3 each year) whilst delivering a certain minimum rate of profitability (say, post-tax Return on Capital Employed of 12%).

Step 2 is to ascertain whether buying the sort of stocks thrown up by Step 1 is appropriate for the client. If, for example, the client says that she is not willing to take any of the risks associated with stocks, then we should not apply rule 1 on the client; she might be better off buying government bonds.

Step 3 is to implement the rule (from Step 1) for the client with necessary adaptations. So, for example, if the client is an NRI, we have to take Page Industries out of the portfolio even though it satisfies step 1 (NRIs are not allowed to buy Page at present).

Step 4 is taking feedback from the client as to whether she’s satisfied with the consistent compounders which we are identifying for her (or whether she would prefer a more speculative form of investing).

Intelligence and judgement are two very different things. The former is a steady ally. The latter tends to be influenced by prevailing social opinion. By using a rule-bound investment process, we aim to maximise the utility of our grey cells whilst minimising the “noise” arising from the latest fads in the stockmarket.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services.

Saurabh Mukherjea is the author of “The Unusual Billionaires” and “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”. He’s also the Founder of Marcellus Investment Managers.

Copyright © *2018* *Marcellus Investment Managers Pvt Ltd*, All rights reserved.

Saurabh Mukherjea can be reached on Saurabh@marcellus.in