OVERVIEW

Nandan Nilekani believes that the Digital Public Goods (DPG) used in India today will form the basis for India’s economic development because the three cornerstones of the modern economy are no longer roti, kapda, aur makaan; they are identification, financial inclusion, and mobile + internet connectivity. The creation of the ‘India stack’ – Aadhaar (universal identification), Jan Dhan (bank accounts for all), Unified Payments Interface (UPI: online transactions using mobile phones), and Open Network for Digital Commerce (ONDC: seamless & democratized eCommerce) – is helping India get closer to delivering on this critical trinity. These initiatives, Mr. Nilekani believes, will impact three key sectors – credit, logistics, and eCommerce – which in turn could have positive spillover effects thus propelling India towards becoming a $10 trillion economy. Click here to listen to Nandan’s address to our clients on 28th January in Bangalore.

“….three big revolutions will be—democratizing credit through AA [Account Aggregation Framework], democratizing commerce through ONDC; and essentially making the delivery of products much simpler and cheaper with logistics’ transformation. These three steps will lay the foundation for equitable commercial activity for both goods and services. India will move from a pre-paid cash informal economy to a post-paid formal cashless productive economy.” – Nandan Nilekani in an interview with the Livemint, 2022.

India’s road to become a US$10 trillion economy is via DPGs

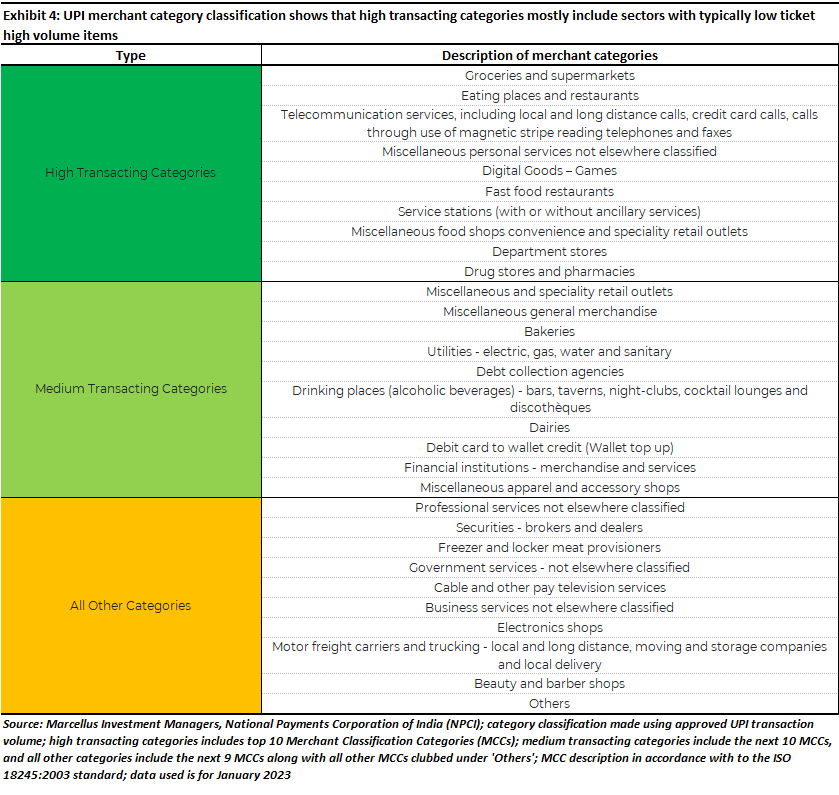

Over the past year, as the exponential surge in UPI transaction volumes has caught people’s attention, we have written how India has, step by step, built digital assets with long term advantage for its users, and by extension, the economy. Our 23rd September 2022 piece, From Aadhaar to ONDC: India’s Methodical Build of Digital Assets Creates Competitive Advantages, talks at length on this subject.

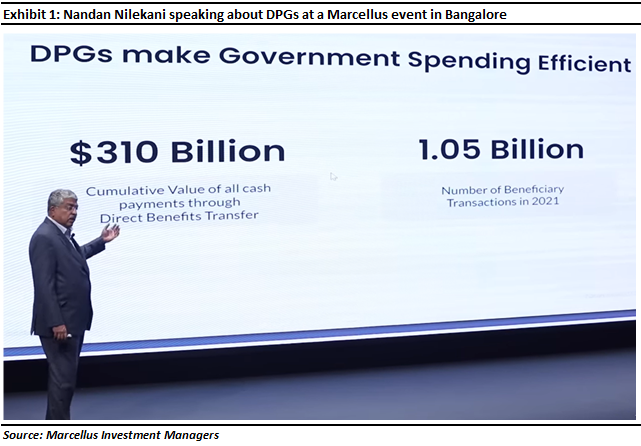

On 28th January in Bangalore, the architect of India’s DPGs, Nandan Nilekani, laid out a roadmap for India to become a US$ 10 trillion economy. We have summarized below the three broad takeaways from Mr. Nilekani’s session:

A. India’s tech build-out is very different to how the Western tech infra was built – Major western big tech companies primarily generated revenues via advertising. However, in India, the proliferation of technology (i.e., the India stack) has been through democratizing the basics of life such as identity validation (Aadhaar), financial inclusion (Jan Dhan), transactions and e-commerce using interoperable platforms (UPI and ONDC respectively). Therefore, the tech build-out in India has been centered around using it as an enabler for dispensing of public services on a massive scale.

To make this distinction clearer, let’s consider the model of a company like Google which uses advertising as the key driver of its profitability thanks to the creation of network effects i.e., the more people use Google search, the better its algorithm becomes at churning out relevant results, and attracting more people to it. This positive feedback loop feeds into itself and makes Google search the preferred and most used search platform, which is proprietary and owned by Google.

In contrast, for the ‘India stack’ there is no proprietary technology – that is the technology, and the software is open source. In fact, the whole architecture of India stack is open (implying that it is easily available for anyone to utilize) and interoperable (meaning that multiple distinct platforms can seamlessly integrate with each other thus creating incredible scope for exponential growth e.g., Cowin, the COVID vaccination platform, used Aadhar for ID validation; FASTag, the electronic toll payment system uses UPI for payment).

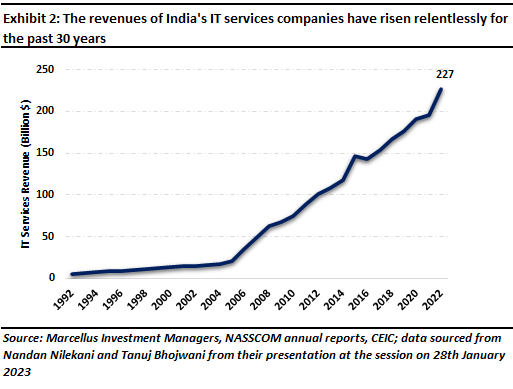

B. India’s tech build-out has been layered and has been conceptualized and built by India’s vast IT services community – The massive proliferation and rollout of platforms under the India stack has been possible primarily due to the existence and capabilities of the country’s massive IT services industry. Just to contextualize this, the Indian IT Services industry generated revenues of US$227 bn in 2022 (see the exhibit below), more than 7% of Indian GDP! Mr. Nilekani himself is a living and breathing example of the exceptional talent pool created by India’s IT Services industry. In his own words, he “left the corner-office, a well-paying and comfortable position at Infosys in 2009 to join the UIDAI in 2009 to work on the universal identification program called Aadhaar”. In fact, several of the key team members of the Aadhar launch team and the ONDC launch team cut their teeth in India’s IT Services sector.

Just as impressive as the totality of the India stack is the thoughtfulness with which each layer of the stack has been carefully rolled out so that it feeds on the preceding layers and enables the subsequent layers. It started with the rollout of Aadhaar in 2010-11 which was a necessity given that a lot of Indian citizens did not possess any proof of existence, let alone of residence in India. Once this basic step was created, then Jan Dhan bank accounts were rolled out (which could be created using Aadhaar) for financial inclusion of all Indians. Once this was achieved, UPI was rolled out for fast, easy, and efficient flow of transactions in the economy, cutting the need and incidence of cash-based large transactions which usually go unaccounted several times. Once the vast majority of India’s businesses – including streetside vendors – were on UPI, ONDC was introduced in ‘beta testing’ mode in 2022.

As Nandan Nilekani and Viral Shah point out in their book ‘Rebooting India – Realizing a Billion Aspirations’ (2016), “While individually powerful, together they deliver value greater than the sum of their parts. As a digital identity, Aadhaar allows for electronic identity authentication. E-KYC obviates the need for submitting paper documents and photos. The e-Sign platform allows people to endorse any document with a digital signature, guaranteeing the safety and authenticity of electronic documents. The Digital Locker platform is a secure repository for all digitally signed documents, from degree certificates to property documents. The National Payments Corporation of India has launched the Unified Payment Interface, allowing for the processing for mobile-based payments for any service. Taken together, these developments will empower the citizen to manage his life and all his interactions with the government digitally.”

C. As these DPGs are enhanced further and find greater acceptance, the scope for synergistic interplay between them grows manifold – “We envision electronic payments as the first step on the ladder of financial inclusion. The immediate next step would be the creation of bank accounts to house these payments. As soon as people have bank accounts, they become eligible for other financial services as well. The next rung of the ladder are loans, insurance schemes of all kinds – for crops, health, life, accidents – and pension schemes. As people move upward, they become integrated into India’s formal financial sector, with all its attendant benefits.” – Rebooting India: Realizing a Billion Aspirations (2016)

In his January 28th address, Mr. Nilekani highlighted three powerful use cases where such synergistic interplays may work out for the benefit of the public at large:

1. As Small and Medium Enterprises (SMEs) build their businesses using UPI, they create a digital transaction trail on their bank accounts. Now as per the Account Aggregator (AA) construct laid out by the RBI, any lender can ask other lenders to make bank account statements (upon consent from the customer) available to them. Once this is done, any type of credit can be easily disbursed using the detailed and relevant digital trail available. This can effectively be leveraged by SMEs to avail credit at competitive costs whilst also helping lenders/banks increase the velocity of underwriting without materially raising the risk of defaults and bad loans. Gradually, businesses which continue transacting in cash will find themselves cut off from the modern Indian economy and will therefore be unable to access credit at affordable rates.

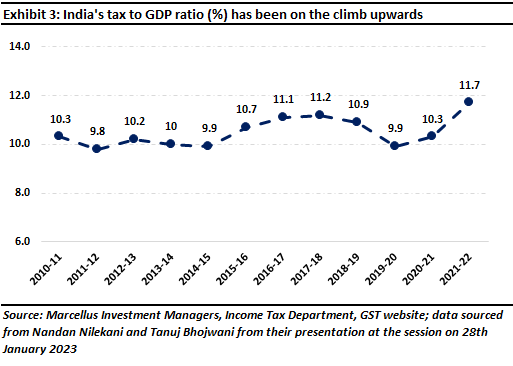

2. As digital transactions have increasingly become commonplace (~88% of transactions by value in Indian today are via digital mode – read in our blog dated 24th December 2022, ‘Winner takes all’ in India’s new, improved economy), the tax department using digital means can increasingly track down any tax theft that may have been happening before. What has made this even easier is the introduction of a single Goods and Services Tax (GST) which eliminates the need for multiple taxes at different levels in the production process, thereby reducing the complexity and as a result errors that could be caused. The fact that tax evasion is becoming increasingly difficult in modern India would naturally mean higher tax buoyancy led by higher and error-free tax collection (see exhibit below).

|

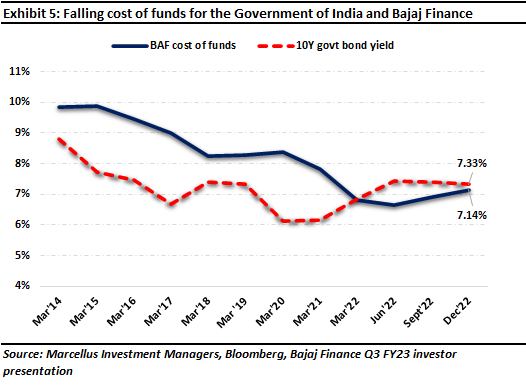

B. Reduction in the cost of capital: Once this cycle of higher credit uptake, more efficient logistics/supply chain fulfillment and eCommerce democratization kicks in, it will be increasingly unattractive for firms to operate in the black economy. The faster formalization of the SME sector which will, as a result, make households invest their increased savings in financial assets rather than physical ones. According to a survey conducted by RBI in 2017, ~95% of household savings in India are in physical assets like real estate and gold and only 5% is in financial assets. If we were to consider that Indian household’s total assets are around US$ 10 trillion – of which 95% i.e., $9.5 trillion is still in physical assets – even if we conservatively assume a 1% per annum to shift to financial assets, over the next decade $1 trillion of incremental household savings will flow into the Indian financial services sector. This in turn should further reduce the cost of capital in India thus accelerating a powerful trend which is already in place (see exhibit below).

|

|