OVERVIEW

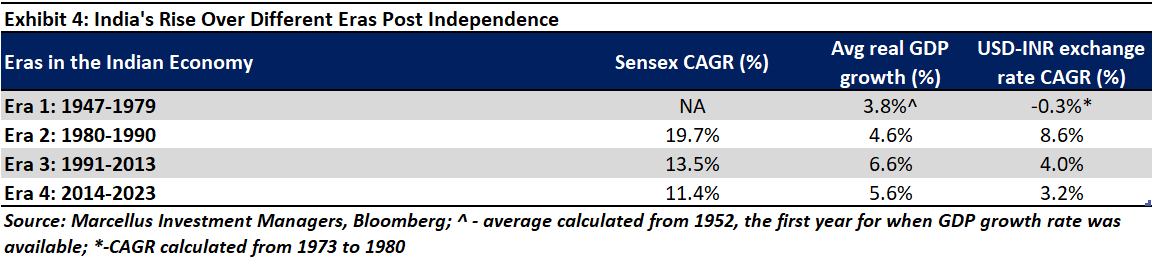

‘Master narratives’ are culturally shared stories that guide the thoughts and behaviours of the citizens of a country. After surviving the dark, desperate decades immediately following Independence, India has reinvented its master narrative over the past 20 years. The world-beating performance of the Nifty50 over the last 20 years, the widely hailed Mangalyaan mission that took India to Mars in its maiden attempt at a fraction of the cost, marked shift in India’s geopolitics when it retaliated against a terrorist incursion in Uri, Jammu and Kashmir, the euphoria of the Chandrayaan landing on the dark side of the moon, the gutsy resolve shown during the Silkyara tunnel rescue, the cerebral triumphs of chess grandmaster Praggnanandhaa, and the world-leading GDP growth clocked through CY22 and CY23 all point to the creation of a new, more confident and more determined master narrative. Central to the creation of this new narrative are: (a) the creation of a more secure society; (b) effective policymaking; and (c) creation of digital public goods which have allowed India to finally lock-in to a virtuous cycle of economic prosperity.

The first few decades post-Independence

In 2016, two psychologists, Kate McLean & Moin Syed, defined the term ‘master narratives’ in the following manner: “We propose that the concept of master narratives provides a framework for understanding the nature of this intersection between self and society. Master narratives are culturally shared stories that tell us about a given culture, and provide guidance for how to be a “good” member of a culture; they are a part of the structure of society. As individuals construct a personal narrative, they negotiate with and internalize these master narratives – they are the material they have to work with to understand how to live a good life.” – Kate McLean & Moin Syed in ‘Personal, Master, and Alternative Narratives: An Integrative Framework for Understanding Identity Development in Context’, July 2016, Human Development (Source: https://www.researchgate.net/

In the first few decades post-Independence, India’s master narrative was built around:

Failure as exemplified by the hammering that China handed out to us in the 1962 war or the country’s failure to generate per capita GDP growth north of 2%.

Frustration to generate employment as exemplified by Naxalite violence which swept across Eastern, Central and parts of southern India from the late 1960s onwards. Famines in 1966-67 & 1972-73 ravaged India and served as a recurrent reminder of the medieval state of India’s economy in those harrowing decades post-Independence.

Fear not just of losing one’s ability to earn a living but also fear of one’s life as wave after wave of terrorist attacks hit the country. When the Naxalite insurgency abated in the 1980s, the terrorist movement in Punjab gathered steam. When that abated, Kashmir became the new valley of fear.

The stifling socialism of the ‘License Raj’, where private capital was dissuaded from being employed in the economy, was partly to blame. The result was a nation perpetually low in confidence and that manifested in sub-optimal results not just economically, but in all spheres of life. This dire state of the country prompted the best Indian minds to migrate to the West at the first available opportunity. A massive scramble then ensued amongst those who stayed back to land a ‘government job’, largely to have some sense of certainty about one’s place in the world.

The 180-degree turnaround in the last two decades

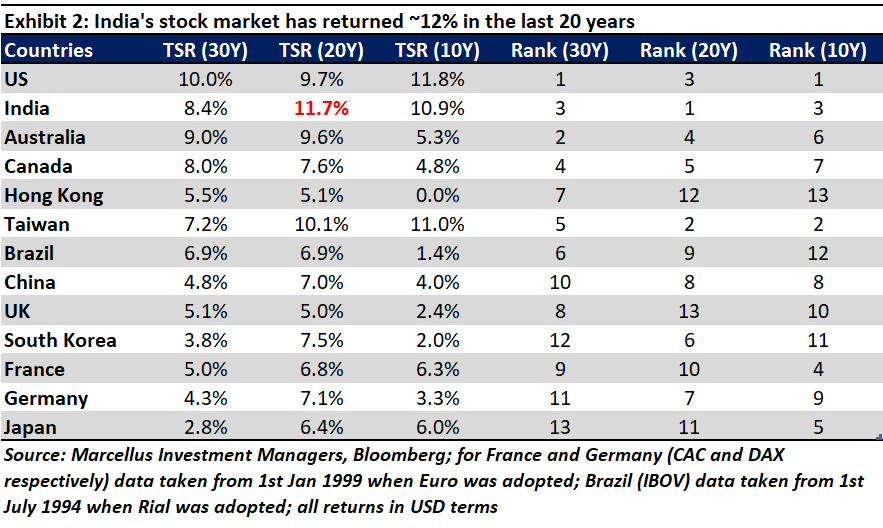

Fast forward three decades to 2023 and India is the only large stock market in the world to have a 20 year $ return CAGR approaching 12% – see the exhibit below.

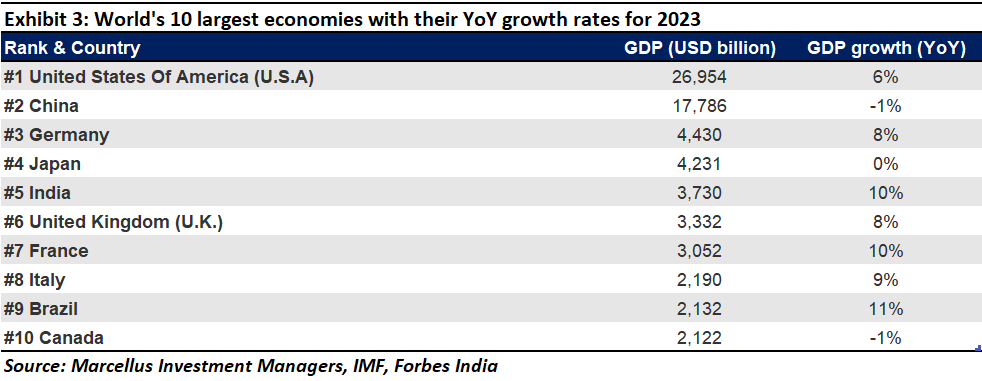

Not only is India the best performing large stock market in the world over the past two decades, but it is also by some distance, the fastest growing large economy is the world. As The Economist said last year:

“…a novel confluence of forces stands to transform India’s economy over the next decade, improving the lives of 1.4bn people and changing the balance of power in Asia…As the country emerges from the pandemic, however, a new pattern of growth is visible. It is unlike anything you have seen before…. These changes…help explain why India is forecast to be the world’s fastest-growing big economy in 2022 and why it has a chance of holding on to that title for years.” – The Economist, 13th May 2022 (source: https://econ.st/3xjIHj8)

Leaving aside stock market and economic metrics, a range of events which have taken place in CY23 capture the change in the psyche of the nation. In August, the Indian Space Research Organization (ISRO) successfully soft-landed its lander module Vikram and rover Pragyaan on the lunar south pole, making India the only country to achieve this in the world.

In November, 41 labourers working in the Silkyara Barkot tunnel were trapped in a landslide. Over the next 16 days, 5 agencies of the state & central governments deployed over 600 employees to help dig these trapped workers out. The final leg of this remarkable rescue was performed by rat hole miners from one of the poorest parts of one of the poorest states in India:

“A group of six skilled miners from Jhansi, Uttar Pradesh today successfully dug a safe passage to rescue workers trapped inside the Silkyara tunnel in Uttarkashi after high-tech American machines failed. These miners, known for their expertise in manual excavation, manually dig their way through the debris, covering a distance of 10-12 meters to reach the trapped workers. They rescued the workers in nearly 24 hours.” (source: https://economictimes.

In sports, for the first time in the Asian Games, India won 100+ medals and chess prodigy Rameshbabu Praggnanandhaa pushed reigning world champion Magnus Carlsson to the edge in the 2023 chess World Cup. India today has ~100 chess Grand Masters compared to just 20 in 2010.

As we have highlighted several times in the past, over the last decade, the public infrastructure in India has been visibly transformed with the national highway network seeing a near doubling from ~79K km in 2012 to ~140K km in 2022, domestic air travel passengers more than trebling from ~54 mn in 2009 to ~170 mn in 2019 (pre pandemic), households with broadband connections growing ~7x from ~20 mn in 2013 to ~137 mn in 2023, and the number of bank accounts growing ~3x from ~1,070 mn in 2015 to ~3,001 mn in 2023.

All of this begs the question, “How did India change its Master Narrative?”

We believe there are 3 reasons that have led to this shift –

A safer and more secure country to live in

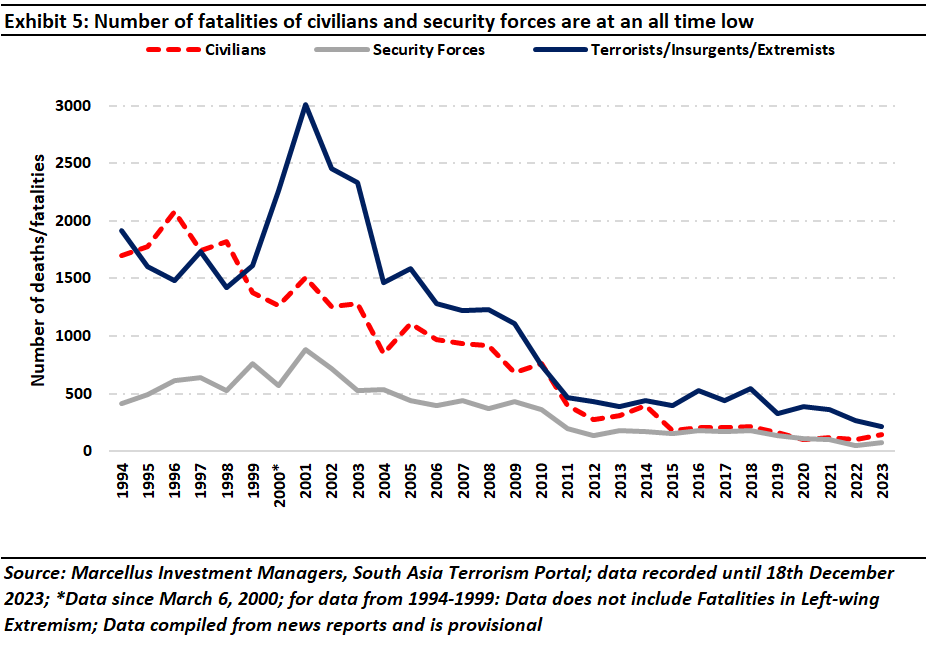

I. Reduced violence and terrorism in the country: Fear of violent attacks, of crime and of terrorism has reduced significantly in India as the number and fatalities of and in insurgencies and terrorist movements have abated – see exhibit below. This has not only created a secure atmosphere for citizens to live in, but it has also reduced the economic costs required to counteract such instances. We believe this is one of the key reasons of a change in mindset of people – Indians are now embracing entrepreneurship and taking risks because their physical and mental security is greater now than it was in the 20th century.

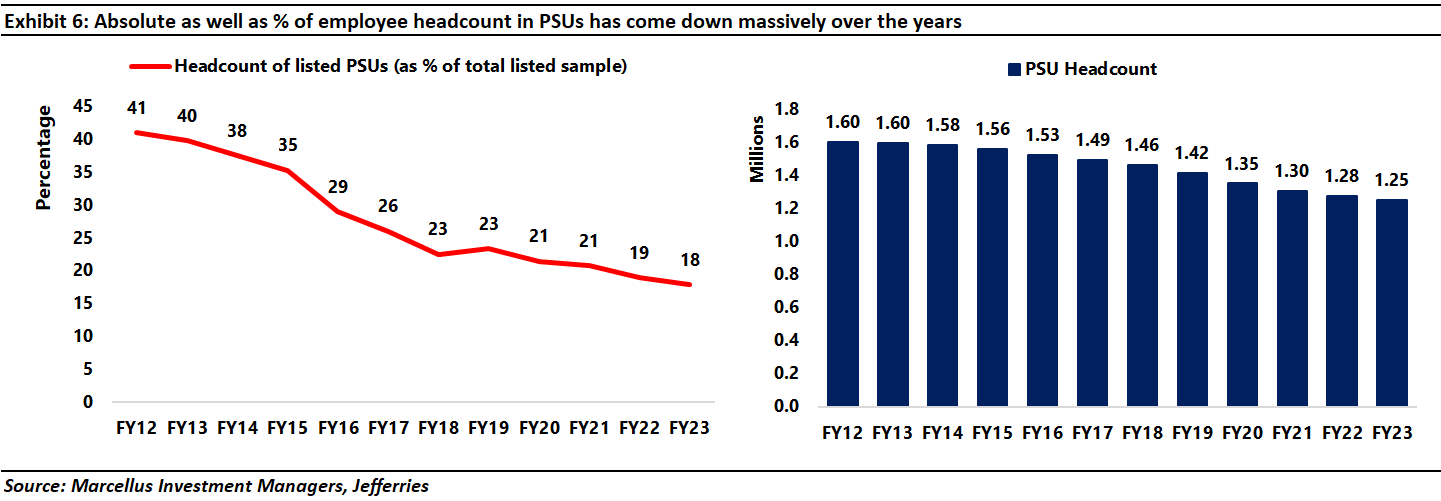

II. The creation of an economic safety net: Over the years, the typical preference of the Indian middle class has shifted from having a stable government job (with clarity regarding housing and pension benefits) to taking up more rewarding roles in the private sector. This is evident in the falling headcount figures for Public Sector Undertakings (PSUs) over the years (see exhibit below).

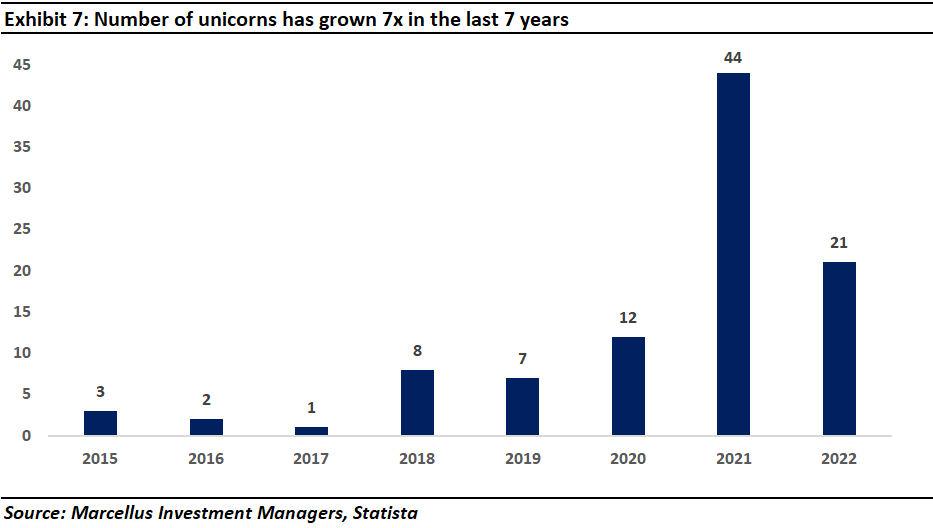

In fact, rather than working in PSUs, ambitious Indians are either launching their own companies (150K+ companies were launched in FY22 compared to just 23K companies launched 20 years ago) or choosing to work in start-ups. The number of ‘unicorns’ or companies with valuations over USD 1 bn has grown rapidly in the past few years (see exhibit below). Increasingly Indians are shedding their shackles of insecurity and diving headfirst into ‘making a life’ and not just ‘making a living’, as Mr. Gurcharan Das has aptly put it in his book ‘Another Sort of Freedom – A Memoir’ (2023).

III. The rise of hitherto suppressed sections of society: The last three decades has seen people across all echelons of the Indian society – including those subjected to abuse and repression for centuries – ascending as far as their social and economic standing is concerned. This has been evident in:

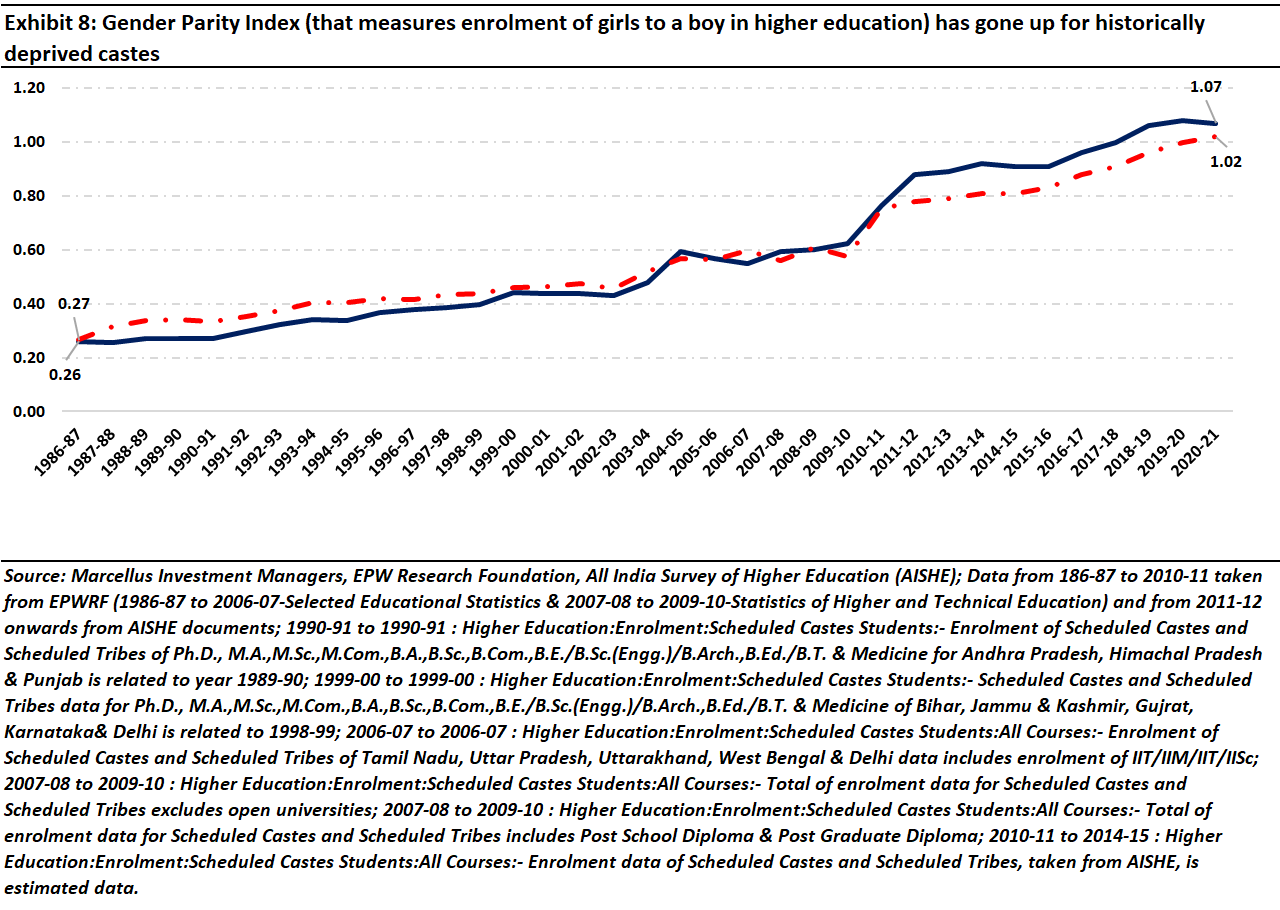

- Better educational results for historically oppressed castes: Improved access to opportunity and gradual change in social perception has led to historically oppressed castes faring far better on education (especially higher education – including college and university) today than 30-40 years ago. Even more encouragingly, women from these castes have pulled far ahead of their male counterparts with the Gender Parity Index (GPI) exceeding one around five years ago and staying there consistently (see exhibit below). [Note: GPI measures how many women are getting enrolled in higher education per man. A GPI in excess of one indicates that more women are getting educated than men.]

- Massive reduction in caste-related wage gap in blue collar jobs: As per researchers at the Azim Premji University, caste convergence has been observed in some if not all categories of workplaces. For instance, the gap between Other Backward Classes (OBCs) and Upper Castes has reduced significantly, with the former moving incrementally into services and manufacturing. Scheduled Castes (SCs), on the other hand, have shifted out of agriculture (i.e., stopped being oppressed by zamindars and landowners) and into the construction sector (source: Basole, A., Abraham, R., Rakshit, A., Vijayamba, R., Shrivastava, A., & Halder, T. (2023). State of Working India 2023: Social Identities and Labour Market Outcomes.)In fact, according to Ashwini Deshpande of Ashoka University and Rajesh Ramachandran of Heidelberg University, wage disparity basis caste has almost become non-existent (i.e., wages have converged) for below median salary earners but not so in jobs that pay above median (source: Deshpande, A., & Ramachandran, R. (2019). Traditional hierarchies and affirmative action in a globalizing economy: Evidence from India. World Development, 118, 63-78.)

Economic policy reforms have been gradual and very effective

The year 1991 marked a paradigm shift in India’s policymaking with the liberalisation of the economy and the ending of the ‘License Raj’. As we had explained in our note dated 25th November 2023, How Policymakers Have Driven Economic Change in India, “For those of us who lived through the momentous summer of 1991, it was an unforgettable time. In the space of two months, Prime Minister Narsimha Rao and Finance Minister Manmohan Singh used the then dire balance of payments crisis to leave behind four decades of socialism and open up the Indian economy, both, to the private sector and to foreigners…

“After four decades of believing that foreigners will ‘drain’ India, India’s policymakers – under pressure from the IMF and the World Bank – now opened up the Indian economy to foreign investors. After four decades of trying to prop us PSUs to build the Indian economy, the government now allowed the private sector to invest capital across most parts of the economy.”

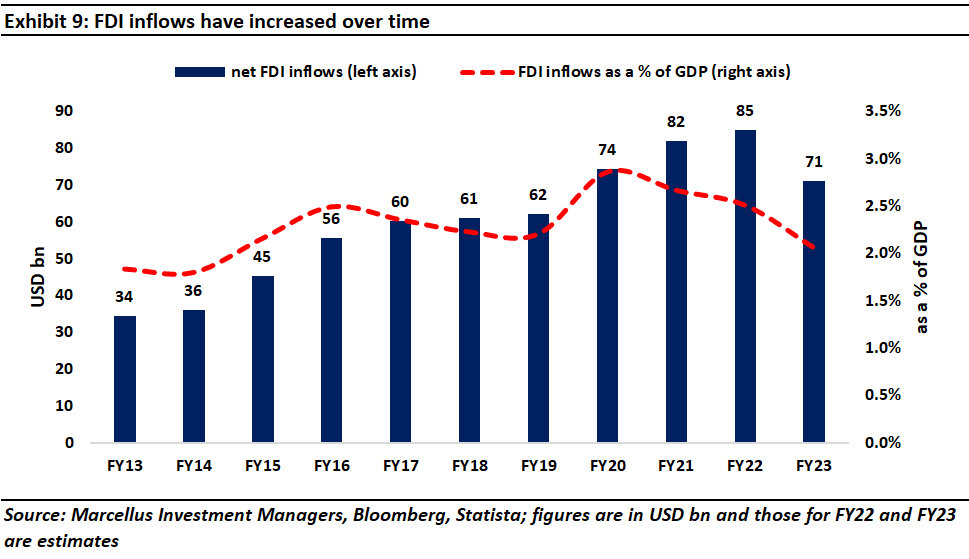

India’s economic reforms continued post-1991 at a more gradual pace. For instance, in 1991, Foreign Direct Investment (FDI) was allowed in India with a limit of investment to 51%. Today, more than 30 years later, in almost all sectors the FDI limit has been revised to 100%. The result unsurprisingly is increased FDI inflows into the country over the years, as evidenced in the exhibit below.

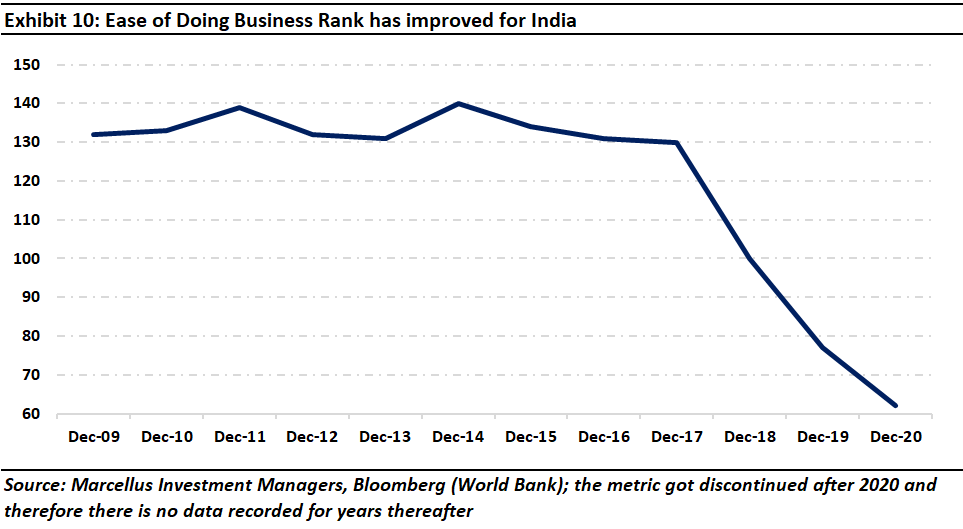

As the founders of Marcellus will testify, starting a new business in India and doing business in India is now easier than ever before. Whilst more can be done on this front, the nation’s improvement is tangible especially in comparison to how the rest of the world has shaped up in this century.

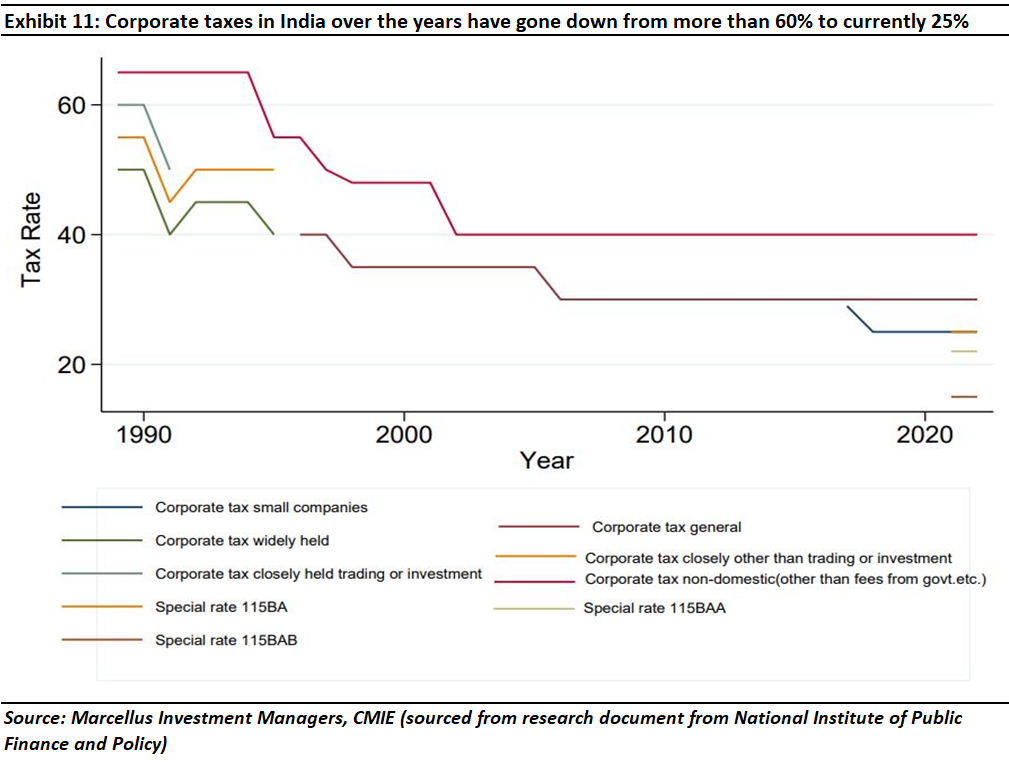

In addition, both corporate tax rates and income tax rates for low-income earners have fallen sharply over the past decade (see exhibit below).

The combination of lower taxes, GST (which was introduced in 2017) and the India Stack (discussed in more detail in the final section of this note) has meant that: (a) the incentive to evade taxes has reduced; and (b) it has become easier for authorities to catch tax evaders courtesy the electronic trails created by the GST payment system. This in turn has meant that over the past couple of years, tax collections have grown faster than nominal GDP growth [20% vs 17%].

A further beneficial effect of reduced tax evasion is the financialization of savings. As per RBI data 95% of Indian households’ savings are in physical assets – real estate, land, and gold (source: Report of the Household Finance Committee, 2017). Historically, one of the reasons Indian households have preferred physical savings is because it is easier to park black money in physical assets. However, over the past 20 years, these physical assets have struggled to beat inflation after taking taxes into account. In other words, physical assets have not created wealth in real terms.

On the other hand, thanks to the rise of mobile phones, Aadhar and UPI, not only has information regarding financial assets become easy to access, setting up an account and investing has also become paperless and relatively straightforward. Combine this with the stellar run that the Indian stock market has had over the past decade [Nifty has compounded at 13% p.a. over the past decade] and you have a recipe for a boom in financial assets.

To give a sense of the scale at which financialization is playing out in India, it is worth looking at the following numbers:

– The number of demat accounts has grown 10x over the past decade to 130mn.

– The number of mutual fund folios has grown 3.5x over the past decade to 145mn+

– Annual equity inflows into Indian MFs have risen from Rs 20,000 crores/yr a decade ago to roughly Rs 1.6 lakh crores/yr now i.e. an 8x rise (26% CAGR).

– The annual gross written premiums written by life insurers has risen Rs 2.8 lakh crores/yr a decade ago to roughly Rs 7 lakh cr/yr now i.e. a 2.5x rise (9% CAGR).

– The annual gross written premiums written by general insurers has risen Rs 74k crores/yr a decade ago to roughly Rs 2.5 lakh crores/yr now i.e. a 3.5x rise (13% CAGR).

– Add to that the roughly Rs 1.8 lakh crores flowing every year in NPS and EPF and what you can see that each year, Indian households are investing roughly Rs 13 lakh crores/yr into the Indian financial system. A decade ago, the figure was just Rs. 4 lakh crores/yr i.e. over the past decade, annual financial inflows (from Indian households) into the financial system have tripled.

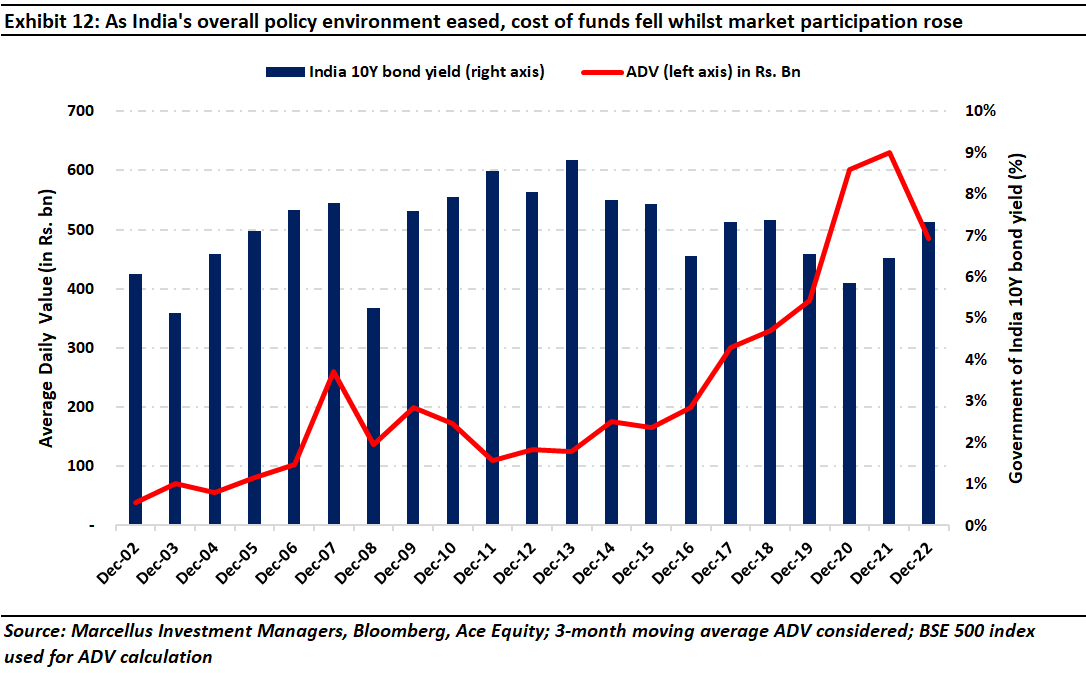

Rs 13 lakh crores is $160bn per year. That’s the amount of annual financial inflows from Indian households into the Indian financial system. Naturally, since rapid financialization of savings has resulted in the cost of capital dropping, one can see this both in the cost at which the Indian sovereign finances its deficit in the bond market – see exhibit below – and in the cost of equity leading to greater participation in equities.

Transformation of technology for the benefit of Indians far and wide

Technology in various shapes and forms has transformed the way humanity has gone about conducting its life. In the 18th century, industrial tech revolutionized how factories were run whereas in the late 20th and early 21st century the widespread use of computers and internet increased efficiency of workers multi-fold.

Interestingly, in all these instances, the economic upside of tech adoption was found to be the greatest when these benefits were shared across all sections of the economy i.e. not just the owner-industrialist class but also the worker class. In the 18th century, initially the factory owners were the clear winners of the newly introduced industrial technology. However, as workers became skilled in their use of machinery their efficiency increased and so did their incomes. In the 20th century, the Western economies reaped the benefits of another bout of tech innovation centred around the use of computers and automation in the factory and in the office.

As Daron Acemoglu and Simon Johnson have pointed out in, Power and Progress: Our Thousand-Year Struggle Over Technology and Prosperity (2023), “After World War II, much of the Western world, and some countries in Asia, built new institutions supporting shared prosperity and enjoyed rapid growth that benefited almost all segments of their societies. The decades following 1945 came to be referred in France as the “les trente glorieuses,” the thirty glorious years, and the feeling was widespread throughout the Western world. This growth had two critical building blocks, similar to those that had begun to emerge in the United Kingdom during the second half of the nineteenth century: first, a direction of travel for new technology that generated not just cost savings through automation but also plenty of new tasks, products, and opportunities; and second, an institutional structure that bolstered countervailing powers from workers and government regulation.”

Over the past 20 years tech visionaries in India like Nandan Nilekani have teamed up with policymakers to bring the benefits of technology to the masses. The overall set of tech innovations – called the ‘India Stack’ – have been built step-by step.

It began with a vision to provide all Indians with a social security like number for identity (Aadhaar) in 2009, which was then overlaid by bank accounts for all (Jan Dhan) in 2015, and finally massive proliferation of low-cost internet and smartphones by 2017 (launch of Jio). Together, known as the JAM trinity, these building blocks allowed 1.4 bn Indians to get an identity, a bank account, and a medium of connecting (at low cost) with the digital economy and the financial system.

The next step was to build Unified Payments Interface (UPI) which enabled currency-less and digital transaction as well as the transfer of money. Launched in 2016, according to National Payments Corporation of India (NPCI) the total value of transaction using UPI for the calendar year 2023 has crossed USD 2 tn or 50% of Indian GDP!

The next step in this journey is a similar infrastructure for goods and e-Commerce via Open Network for Digital Commerce or ONDC (refer our note dated 23rd September 2023 From Aadhaar to ONDC: India’s Methodical Build of Digital Assets Creates Competitive Advantages to understand more about this topic).

As Nandan Nilekani remarked in November 2022, “….three big revolutions will be—democratizing credit through AA [Account Aggregation Framework], democratizing commerce through ONDC; and essentially making the delivery of products much simpler and cheaper with logistics’ transformation. These three steps will lay the foundation for equitable commercial activity for both goods and services. India will move from a pre-paid cash informal economy to a post-paid formal cashless productive economy.” – Nandan Nilekani in an interview with the Livemint, 2022

Unlike how tech in the US has created a narrow elite of billionaires, India’s story is different in this respect where ‘digital public goods’ have been employed to benefit consumers and producers of all shapes and sizes. This has reduced transaction costs for almost every Indian, reduced working capital cycles for most businesses, made access to financial funding easier for tens of millions of low-income borrowers and SMEs, and enabled the sovereign to collect taxes more easily.

Investment Implications

As Vladimir Lenin said, “There are decades where nothing happens; and there are weeks where decades happen.” India’s first few decades post-Independence were decades in which nothing much happened from the perspective of this vast nation’s master narrative. In the last few years, India is beginning to make up for those difficult decades.

What India has found at long last is a flywheel where a combination of incentives, enforcement, and modern tech drives tax collections (at a faster rate than GDP growth). That in turn allows the sovereign to finance infra investments. In parallel, thanks to the same flywheel, savings are financialized (rather than going into low yielding physical assets). This lowers the cost of capital which in turn makes it easier for companies to fund themselves and drive capex. That capex in turn drives GDP growth. And thus, the virtuous cycle continues.

As we continue to live, work, and invest your and our monies in the most populous nation in the world, we wish you and your loved ones Merry Christmas and a Happy New Year.

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in).