OVERVIEW

Contrary to the fashionable view that the Indian stock market will crater alongside the American stock market (as the Federal Reserve pursues aggressive rate tightening), we believe that India is more likely to follow the trajectory of Japan in the 1970s. As oil prices rose 10x through the 1970s, the US stock market went nowhere whilst the Japanese stock market trebled. Leading Japanese companies – similar to our Consistent Compounders – delivered 20% per annum share price compounding in that pivotal decade for Japan.

“…a novel confluence of forces stands to transform India’s economy over the next decade, improving the lives of 1.4bn people and changing the balance of power in Asia. Technological leaps, the energy transition and geopolitical shifts are creating new opportunities—and new tools to fix intractable problems….

As the country emerges from the pandemic, however, a new pattern of growth is visible. It is unlike anything you have seen before…. These changes…help explain why India is forecast to be the world’s fastest-growing big economy in 2022 and why it has a chance of holding on to that title for years.” – The Economist, 13th May 2022 (source: https://www.economist.com/leaders/2022/05/13/the-indian-economy-is-being-rewired-the-opportunity-is-immense)

New challenges in an unlocked world

Over the last 12 months, as the world has emerged from Covid-19, various fiscal and monetary stimuli injected in 2020 – to the tune of approximately US$ 13 trillion – have resulted in a strong demand recovery across the world.

However, recurring Covid-19 waves and the lockdowns that accompanied them disrupted supply chains globally in 2020-21. Then came the Russia-Ukraine war in spring 2022 followed by China’s zero-Covid lockdown. In the face of strong demand and supply-shocks galore, CPI inflation has crossed 7% in almost all major economies. This in turn has led various central banks, led by the Fed, to begin what looks like a prolonged cycle of interest rate tightening.

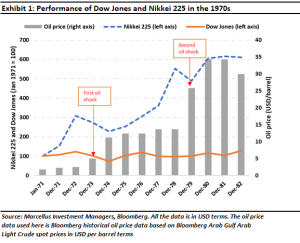

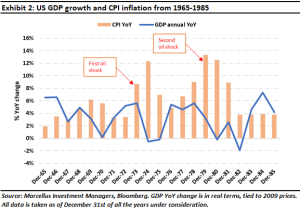

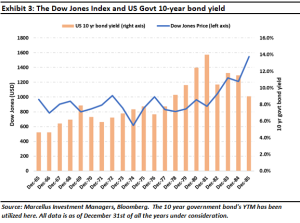

In such circumstances, the fashionable view to take is that we are going to see a recurrence of the 1970s, a decade in which soaring oil prices condemned America to live with high interest rates, recessions and zero stock market returns for a 15-year period – see the charts below.

Exhibit 3: The Dow Jones Index and US Govt 10-year bond yield

Japan in the 1970s: pivoting aggressively to become a super-efficient economy

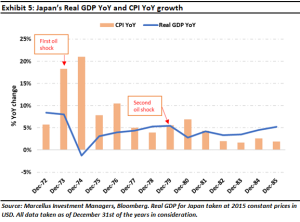

The proximate cause of the oil price shock in the 1970s was the Arab-Israeli war in October 1973 which tripled the price of crude oil. The second oil price shock came in 1979 when crude prices doubled in the wake of the Shah of Iran being deposed. Cumulatively, the two oil shocks ramped up the price of crude oil by more than 10x during the 1970-80 decade.

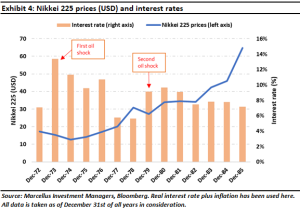

Even as America and most of the developed world struggled through the 1970s, Japan, the world’s third largest economy at that point time, saw its stock market treble even though Japan faced even higher energy prices than the US: “The energy crisis of 1973 had an enormous impact on the prices of energy in both Japan and the United States. Prices of petroleum and coal products in Japan were almost double those in the United States, … By comparison petroleum and coal products in Japan were only 1.6 times as expensive as those in the United States in 1970, while electricity and gas were only slightly more expensive in Japan than in the United States in that year.” (Source: D. Jorgenson & M. Kuroda, NBER, Productivity and International Competitiveness in Japan and the United States, 1960-1985, 1991).

Exhibit 4: Nikkei 225 prices (USD) and interest rates

The Japanese stock market’s performance in the 1970s was underpinned by solid economic fundamentals. After surging in 1973-74, when the initial oil shock hit, Japanese interest rates and CPI inflation normalized within a couple of years and stayed low thereafter. As a result, real GDP growth continued at a steady 5% per annum, lower than what Japan experienced in the 1960s but much higher than what the rest of the developed world could manage.

So how did Japan, a country dependent entirely on imported oil, manage to stabilize its economy so swiftly in the wake of the oil shock?

a. Japanese conglomerates and the economy in general pivoted away from heavy industries (like shipbuilding and steel) and towards the production of light industrials like automobiles and electronic & electrical goods, which are less energy intensive but more knowledge intensive (i.e., require more R&D spend). As explained in an outstanding paper by two Japanese academics, “The heavy materials industries were slack during this period. Crude steel production, for example, stayed more or less unchanged. While 1975 production was 102 million tons, it rose to no higher than 105 million tons in 1985…On the other hand, electric machinery experienced marked growth, increasing 3.9-fold during these years” (source: Y. Murota & Y. Yano, Japan’s Policy on Energy and the Environment, 1993). Thanks to this pivot, Japan’s crude oil consumption barely grew in the 1970s (source: Oil consumption by country, University of Oxford, 2022).

b. The Japanese economy pivoted aggressively away from imported crude oil. Project Sunshine and Project Moonlight reduced dependence on oil and pushed Japan towards solar, gas, and nuclear energy. In fact, oil’s proportion in the electricity generation fell from 62% in 1975 to just 27% in 1985 (source: Japan’s Policy on Energy and the Environment, 1993).

c. Then, as now, Japanese households had a high savings rate – north of 20% of personal disposable income. The Japanese central bank pushed the banking system to aggressively disburse these savings to the large Japanese conglomerates whilst effectively giving the commercial banks a sovereign guarantee on corporate default. These loans financed the capex which underpinned the rise of giants like Toyota, Nissan, Honda, Sony, Panasonic, JVC, and Casio.

Case studies of two successful Japanese companies which compounded their shareholders’ wealth at more than 20% per annum through the 1970s underscore the power of Japan’s remarkable pivot:

1. Toyota Motor Corporation : Having started as a textile company, Toyota slowly scaled up to become the largest manufacturer of passenger vehicles not just in Japan but also in the US. In 1970, General Motor’s share of the US car market was 40% and Toyota’s was 2%. In the next 20 years, Toyota’s market share in USA rose to 8%. By 2006, it was 13% (source: Lessons from Toyota’s long drive (Harvard Business Review), 2007). Toyota’s success was based on a disciplined approach to R&D and superior levels of operating efficiency (source: Toyota success story: slow and steady wins the race, 2019). By focusing on highly fuel-efficient cars when its American competitors were producing more exuberant, large gas guzzlers, Toyota entrenched itself in the US market in the 1970s.

2. Casio Computer Company : In 1957, when the rest of the world was using electromechanical calculators, Casio came up with an electric calculator. With the advent of semiconductors in the 1960s, in 1965 Casio produced the world’s first electronic calculator with memory. These machines were more efficient and accurate than the electromechanical calculators. In the 1970s, Casio started marketing its products in the US. Thanks to its superior sales & marketing strategy, it soon built a strong foothold in the US. Eventually, amongst all the Japanese companies in this segment, only Sharp and Casio survived by the end of 1970s. During this decade, Casio kept innovating to come up with cheaper, more compact products. By the 1980s, the name Casio became synonymous with calculators (source: Company History: Casio Computer Company, 1997).

Can India do a Japan?

“As the country emerges from the pandemic, however, a new pattern of growth is visible. It is unlike anything you have seen before. An indigenous tech effort is key. As the cost of technology has dropped, India has rolled out a national “tech stack”: a set of state-sponsored digital services that link ordinary Indians with an electronic identity, payments and tax systems, and bank accounts. The rapid adoption of these platforms is forcing a vast, inefficient, informal cash economy into the 21st century. It has turbocharged the world’s third-largest startup scene after America’s and China’s.

Alongside that, global trends are creating bigger business clusters. The IT-services industry has doubled in size in a decade, helped by the cloud and a worldwide shortage of software workers…. India ranks third for solar installations and is pioneering green hydrogen. As firms everywhere reconfigure supply chains to lessen their reliance on China, India’s attractions as a manufacturing location have risen, helped by a $26bn subsidy scheme. Western governments are keen to forge defence and technology links. India has also found a workaround to redistribute more to ordinary folk…a direct, real-time, digital welfare system that in 36 months has paid $200bn to about 950m people.” – ‘India’s Moment’, The Economist’s cover story, 13th May 2022 (source: https://www.economist.com/leaders/2022/05/13/the-indian-economy-is-being-rewired-the-opportunity-is-immense)

India, the world’s fifth largest economy, stands at a similar juncture to where Japan stood in the 1970s. Whilst Japan’s economy in 1970 was dominated by manufacturing (accounting for approximately half of GDP), India’s economy today is dominated by Services (accounting for around half of GDP). However just as Japan’s economic success was underpinned by the world class efficiency & innovation of its manufacturers, India too has a Services sector characterized by world class firms. Here are the four factors which we believe will underpin India’s economic resilience over the next decade:

1. India’s energy footprint is relatively small: For a large, fast growing developing economy, India’s energy footprint is fairly modest thanks to the fact that the industrial sector constitutes only about a quarter of the country’s GDP (source: indiabudget.gov.in). This explains why crude oil shocks far larger than the current shock have failed to destabilize the Indian economy (e.g., in between 2001 and 2008, the price of crude quadrupled and yet the Indian economy grew at on an average 7% per annum through this period).

2. Pivot away from fossil fuels: Solar energy already constitutes 14% of India’s total power generation (source: gov.in). Electric Vehicle (EVs) sales account at present account for 1.3% of total vehicle sales (source: India’s EV market to grow by 90% to touch $150 billion by 2030: report, 2021). On both of these fronts, given supportive public policy, India is likely to see an aggressive Japan-style pivot away from a dependence on fossil fuels.

3. CPI inflation will be controlled: Around half of India’s CPI basket comprises of food and historically, a succession of Indian governments have used a tried & tested playbook to arrest food inflation. For instance, India recently banned both wheat and sugar exports (source: India isn’t the only one banning food exports. These countries are doing the same, 2022). Next on the list will be containment of the Minimum Support Prices for food grains. The Indian government has also announced excise duty cuts on fuel, subsidies for gas cylinders, additional fertilizer subsidies and export duty hikes for steel (source: Kotak Institutional Equities macro economy note, May 23rd, 2022).

4. Structural changes in the Indian economy: Japan’s success in the 1970s was in large part due to the structural improvements its economy underwent in the 1960s – mainly investments in infrastructure (both public infrastructure development like construction of expressways, dams, ports etc. and private infrastructure development especially in the heavy industry segment), the creation of an R&D ecosystem, and improvement in technological knowhow. On similar lines, the structural improvements seen in India over the last decade should bear fruit in this decade. As The Economist pointed in its May 13th, 2022, article, “The national highway network is over 50% longer than it was in 2014 (it also uses a digital tolling system to avoid queues). The number of domestic air passengers has doubled; air-freight volumes are up by 44%. There are more than three times as many mobile-phone base stations, supporting 783m broadband subscribers…Technological leaps, the energy transition and geopolitical shifts are creating new opportunities—and new tools to fix intractable problems.” (source: The Indian Economy is Being Rewired and the Opportunity is Immense, 2022).

5. The RBI will not have to tighten as much as the Fed: Given that US Fed interest rates have a target range of 0.75% to 1% whereas CPI inflation in USA stands at 8%, the Fed must raise rates substantially to bridge this huge gap – we reckon the Fed will have to expedite rate hikes of 3-4%. The RBI is in a better position in this regard given that the current repo rate is 4.40% whereas CPI inflation in India is near 8%. A 1.5-2% hike should be sufficient for India. Basically, India is likely to hike rates by half as much as America.

Investment implications

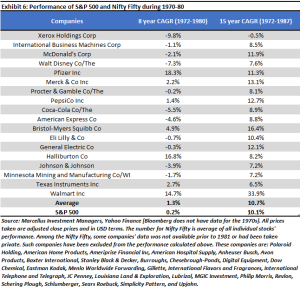

During the 1970s, the S&P500 gave zero returns and the ‘Nifty Fifty’ stocks in the US, which had done well in the 1960s, also went nowhere (although interestingly they compounded at 1.3% CAGR over the period 1972-80 vs the S&P500’s 0% return).

For those who are interested in understanding why the US Nifty Fifty glamour stocks outperformed even after the oil shock, we recommend that you read Wharton professor, Jeremy Siegel’s super book “Stocks for the Long Run”. The relevant excerpt from the book can be found using this link: https://docplayer.net/23716591-Valuing-growth-stocks-revisiting-the-nifty-fifty.html.

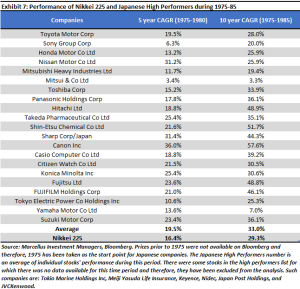

In Japan, whilst the Nikkei 225 compounded at 12% through the 1970s, Japanese companies that led the pivot away from heavy to light industry – like Toyota, Honda, Nissan, Sony, Panasonic, Casio, Citizen, Konica, etc – compounded upwards of 20% – see the table below. In their innovativeness, their obsession with efficient production processes, their relentless approach to building competitive advantages which can help in conquering new markets, the Indian companies that we invest in are similar, we believe, to these Japanese giants.

The moral of the story is that the world belongs to countries and companies who can deal with exogenous shocks with enterprise, innovation, and hard work. Japan has been Asia’s shining star in this regard for most of our lifetime. The baton now shifts to a very different kind of economy – one whose enterprise lies in its world class Services economy. As we wrote in our blog – How Cold War II Will Impact Your Wealth – in April 2022, “Services account for US$ 1.3 trillion of India’s US$ 2.6 trillion economy currently. India’s total export of Services currently stands at US$ 0.25 trillion (i.e., around 9% of GDP as of today). Given that the combined Services sectors of USA, Canada, the UK, and the EU currently stands at US$ 15.2 trillion, even if we assume that a mere 10% of this is outsourced to India, India’s Services exports a decade hence could be around US$ 1.5 trillion implying a ten-year CAGR of 20%. All other things being equal, this would add approximately 1.2% points each year to India’s nominal GDP growth rate over the next ten years, making Services almost 21% of GDP”.

Nandita Rajhansa and Saurabh Mukherjea are part of the Investments team in Marcellus Investment Managers.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.