OVERVIEW

Published on: 19 Nov, 2018

The combination of a rising fiscal deficit & tighter monetary policy in the US is pushing the world’s risk free rate upwards thus reversing a 40-year trend of money become ever cheaper. Alongside adverse developments in global trade and politics, this could change the way we think about risk-reward tradeoffs.

“There are those who are persuaded that some new price-enhancing circumstance is in control, and they expect the market to stay up and go up, perhaps indefinitely…Then there are those, superficially more astute and generally fewer in number, who perceive or believe themselves to perceive the speculative mood of the moment. They are in to ride the upward wave; their particular genius, they are convinced, will allow them to get out before the speculation runs its course. They will get the maximum reward from the increase as it continues; they will be out before the eventual fall…built into this situation is the eventual and inevitable fall. Built in also is the circumstance that it cannot come gently or gradually. When it comes, it bears the grim face of disaster. That is because both of the groups of participants in the speculative situation are programmed for sudden efforts at escape…” – John Kenneth Galbraith in “A Short History of Financial Euphoria” (1990)

A 40-year trend in the world’s risk free rate….

In September 1981, the US 10 year Government bond yield hit a post-World War II high of 15.4%. In September 2016, it touched an a 50-year low of 1.6%. This epic downward trend in the world’s risk free rate has defined most of our careers. Had it not been for this downward trend, it is doubtful whether Emerging Market equities or Private Equity or Real Estate for that matter would be as big an asset class today as it has become. In fact, in the broader scheme of things, the “financialisation” of the global economy which has taken place in our lifetime has been underpinned by this epic bull run US Government bonds. (To see the 50-year trend in the world’s risk free rate, click here: https://www.macrotrends.net/2016/10-year-treasury-bond-rate- yield-chart)

…seems to have been reversed

From 1.6% in August 2016, the US 10-year Government bond yield has nearly doubled to 3.1% in mid-November 2018. Ex-post, it is easy to attribute this to the Fed’s strategy of ending QE (which happened a year ago) and hiking interest rates (over the last two years, the Fed has hiked the Fed Funds rate by 200bps). However, if one looks forward, there is good reason to believe that the Fed Funds rate and hence the US 10-year bond yield, will continue rising at a similar rate as: (a) the US job market – already overheated – starts showing pronounced wage inflation; (b) China – the world’s largest buyer of US Government bonds (after the Fed) – reduces its purchases; and (c) the US budget deficit rises courtesy Trump’s tax cuts – the US budget deficit will be nearly $1 trillion in FY19, up 18% YOY

There is another way to view the rise in the world’s risk free rate – as a reflection of rising risk in the financial system. The perception that risk is rising could be fuelled by: (a) the fraying of the implicit understanding in the West that free trade between countries is a good thing; (b) the increasingly entrenched belief that the free market left to itself will result in a small group of people becoming super wealthy everybody else is left behind; and (c) the rising popularity of autocratic leaders in major economies across the world and implications it has for norms which define liberal democratic politics.

Investment implications

Whatever be the reasons, the odds are in favour of the US 10-year bond yield continuing to rise over the next few years. If the US 10-year bond yield returns to the level of around 5% (which is where it was in 2007, before the Lehman-crisis struck) what effects could it have an India? There are five important effects to consider:

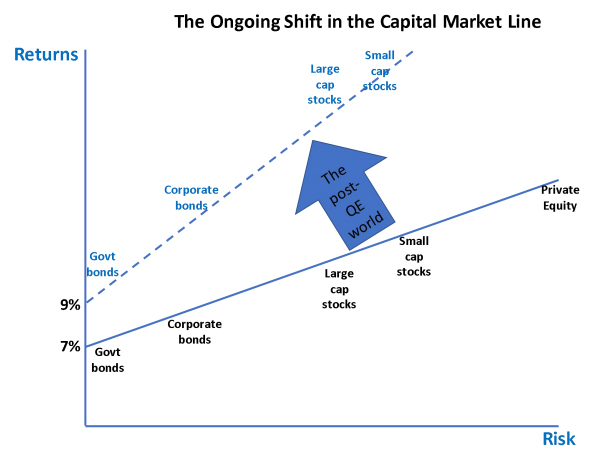

- If all we get is a rise in the risk free rate in the US then all we should get in India is India’s 10-year risk free rate rising by a similar amount (so India’s 10- year bond yield, currently at around 7-8%, should end up at around 9-10%, which is where it was before the NDA came to power). That implies a parallel shift upwards of the Capital Markets Line (CML) which is the risk-return trade- off that all of us use whilst weighing up investments. If, on the other hand, risk appetite also wanes (say, because of a breakdown in global trade), then the CML tilts upwards as shown in the chart at the beginning of the note.

- It follows from the above that not only will our discount rates go up (and thus exert downward pressure on asset prices), the riskier the asset, the sharper the drop in asset prices. Therefore, prices of Private Equity funded assets should fall more than, say, prices of large cap stocks.

- Another way of putting this is the premium that investors will seek for taking extra risk looks likely to rise. So, for example, until a year ago, investors seemed happy to invest in small cap stocks if the returns were a third higher than large caps. Going forward the same investors might want small caps to give returns 50% higher than large caps

- This in turn implies that assets which promise safety/certainty eg. premium commercial real estate in Mumbai, well run companies with strong ROCEs, predictable cashflows and formidable moats might actually get repriced upwards as investors seek certainty. Continuing with this line of thought, one ends up feeling bullish about gold.

- Finally, the 40-year downward trend in the US 10-year bond yield has famously enriched many Finance professionals the world over. The manager of a large privately run hospital in Mumbai will earn a fraction of what a manager of a large equity mutual fund in Mumbai will earn. The nurse in the same hospital will earn a fraction of what a junior sellside analyst earns. If 2016 was “peak Finance” then the future earnings of Finance professionals will face a reality check.

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this email in any shape or form. Marcellus Investment Managers is regulated by the Securities and Exchange Board of India as a provider of Portfolio Management Services

Saurabh Mukherjea is the author of “The Unusual Billionaires” and “Coffee Can Investing: the Low Risk Route to Stupendous Wealth”

Copyright © 2018 Marcellus Investment Managers Pvt Ltd, All rights reserved.