OVERVIEW

As India reaps the benefits of a decade long infra build and economic reform journey, Indian women – more than Indian men – are emerging as gamechangers. The rapid growth of a Service-oriented economy, the spread of affordable education, and the mushrooming of smartphones and social media have helped Indian women rise more rapidly over the past decade than Indian men. If these trends continue, Indian women will continue closing the gap with their male counterparts at home, in academia, and in the workplace.

“…ordinary women practicing ordinary change are everywhere around us. Encouraged by education and access to information, a new generation of women, with a stronger sense of ‘I’, hopes for more. They watch films and lust after an actor. They have friends and casual sex. They dare to imagine a self which deviates from their prescribed function as dutiful caregiver.” – Shrayana Bhattacharya in her book ‘Desperately Seeking Shah Rukh: India’s Lonely Young Women and the Search for Intimacy and Independence’ (2021)

Introduction: Digging Deeper to Discern the Real Story

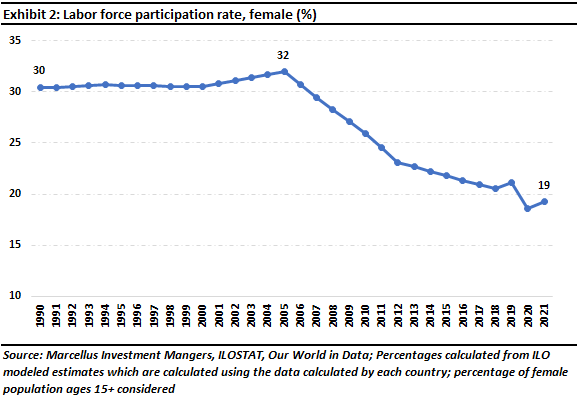

Indian women, historically as well as in contemporaneous times, have been typecast as the primary caregivers in the household. As a result, they are perceived as non-contributors to the economy as far as employment is concerned. This is reflective in the women’s labour force participation rates (LFPR) in the country which have been low and falling for more than a decade (see the chart below).

This, coupled with the rising incidents of crime against women – over 32k rape cases were reported in 2021 vis-à-vis 24k in 2011 (source: NCRB (archives) and the Wire) – would make one think that India is actually regressing instead of progressing when it comes to gender equality.

However, anecdotal, and other empirical data shows that more Indian women are venturing out today in greater numbers than ever before in search of a better life. According to Anirudha Dutta, the author of ‘Half a Billion Rising: The Emergence of the Indian Woman’ (2015), “Women today spend lesser time, energy, and effort on the simplest of tasks for survival and can invest their saved time in actually learning something or building something.” Whilst researching the book, Anirudha observed that increasingly more women are stepping out of the house and engaging in small scale production which has increased their income from virtually nothing to a level where they have some degree of spending autonomy. Testimony to this effect is the emergence of a local business aggregator app like Meesho and its increasing popularity in tier 2 & 3 cities in the country. Businesses listed on Meesho mostly belong to local women entrepreneurs who engage in cottage or micro industries producing small artefacts and selling them in local markets.

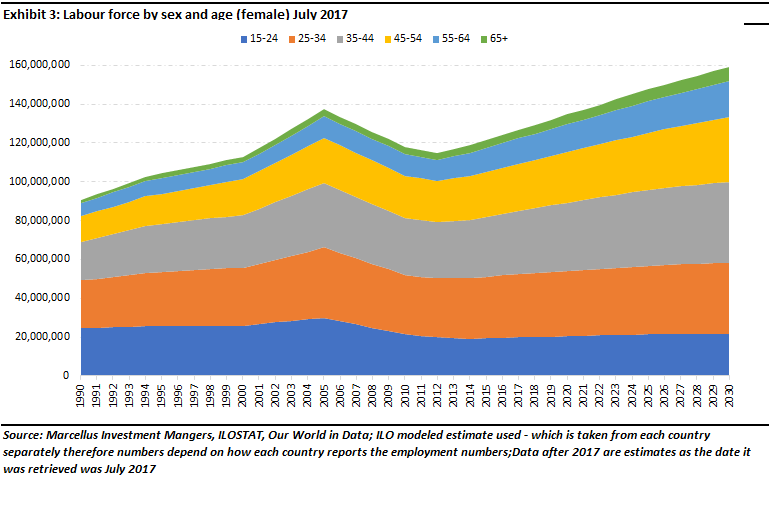

Furthermore, if we look at the LFPR data but with a different lens, namely age-wise stratification, a completely new picture emerges – whilst the LFPR for women in the age bracket 15-24 has gone down substantially since 2010, the LFPR for 25-35 years has remained fairly stable and remarkably, the LFPR for 35+ age bracket has actually gone up (see exhibit below).

What is driving these positive changes for women in India? And secondly, what are the implications of such changes?

Education and Rise of the Service Economy

Not only are more Indian women getting educated, but they are also getting educated more rapidly than their male counterparts. India’s female literacy rate in 2011 was 64.6% as compared to the male literacy rate of 80.6%. However, between 1961 to 2011, female literacy in India has grown 3x as fast as male literacy (~3% p.a. vis-à-vis ~1%).

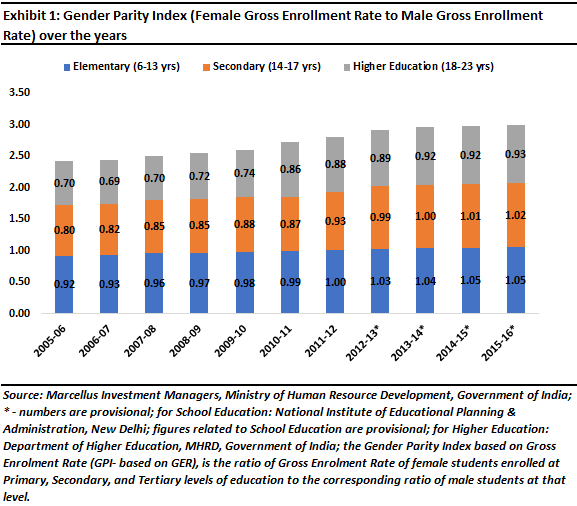

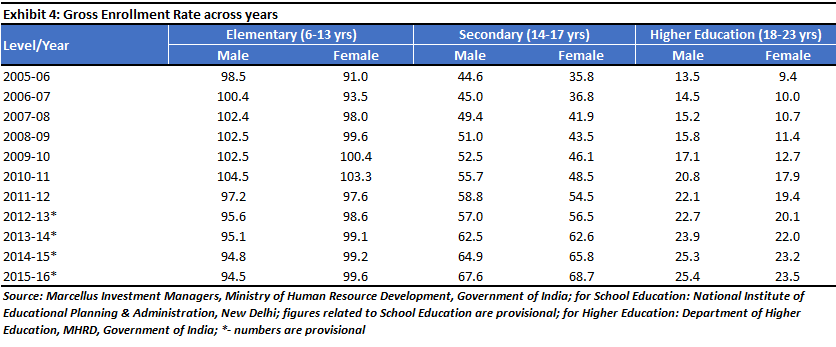

Furthermore, if we look at the number of women per one hundred men enrolled by level of education, the number has risen from being less than 40 to more than 90 across almost all levels of education. This coupled with higher pass percentages for girls, relative to boys, in both 10th and 12th grade exams in the country (i.e., secondary and higher secondary exams) shows that more women are getting educated (see table below) and performing better at exams than boys (source: https://www.education.gov.in/

In fact, this rising trend of more women getting educated well into their twenties is partly the reason for falling LFPR in the 15-24 age group (as seen in exhibit 3) i.e., the entry of women into the workforce is getting delayed.

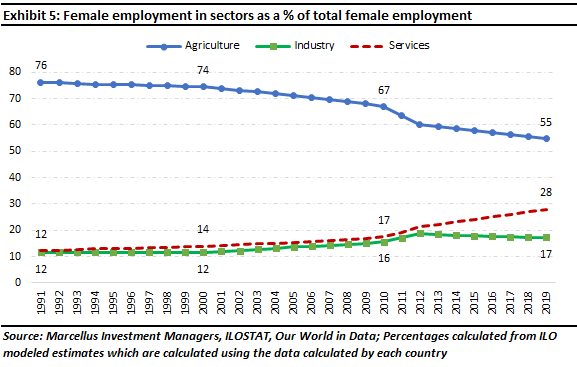

Furthermore, given that the Indian economy is dominated by Services (which accounts for 53% of India’s GDP), the growing educational prowess of women positions them beautifully to thrive in that part of the Indian economy which has consistently done well. Unsurprisingly therefore, if we look at how women’s employment has progressed by different sectors over the years, their share in services has consistently grown (see chart below).

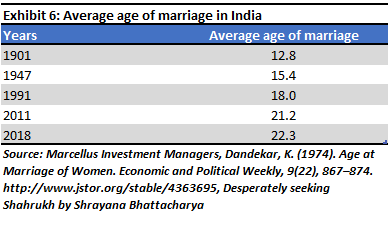

As women are staying in the educational system for longer and then either getting employment or finding self-employment, they are getting married later on in life (see the table below). This too is a big positive for India because later marriage usually translates into a lower fertility rate which in turn brings down the population growth and thus boosts per capita income.

The Impact of Electricity and the Internet

By 2018, every part of India (including every village) had access to electricity. The spread of electricity opens up a world of possibilities for people in general but even more so for women. Thanks to access to washing machines, general kitchen appliances, flowing water from taps, cooking gas and so on, the amount of time, energy, and effort that women typically had to spend on daily chores has gone down significantly, freeing up a lot of their time. This effect, in fact, has been seen around the world. Robert Gordon, in his book ‘The Rise and Fall of American Growth’ (2017), writes “The life-changing implications of the revolution, especially in liberating American women, is a central aspect of the increase in the standard of living between 1870 and 1940… A third cause (for increase in the female participation rate from 1920-1940) was the gradual diffusion of electric appliances, including the iron, vacuum cleaner, range, refrigerator, and washing machine.”

This phenomenon has been observed not only in the US but also in other countries, especially the ones that are emerging market economies. Research by Louise Grogan and Asha Sadanand for the World Bank empirically established that in case of Guatemala, electrification reduces children being born, increases the time spent by women in labour force activities and also reduces the time spent by them in household activities (source: Grogan, L., & Sadanand, A. (2009). Electrification and the Household. University of Guelph, Economics Department, Guelph, Ontario. Processed.)

In India, Dr. Piyul Mukherjee and Ipsita Bandyopadyay, who represent Quipper, a market research firm, note that “Before the pandemic, smartphones were owned by the person in the family who was the most outgoing. But during the pandemic, another one was added due to educational requirements, and as a result, women got access to it via their children’s needs. This has reduced information asymmetry to a large extent, which has opened new avenues for income generation.”

With the growing ease of access to smartphones and thanks to low-cost broadband, Indian women are accessing the financial system not only through bank accounts and traditional instruments like Fixed Deposits (FDs) but also experimenting with new age investment avenues like cryptocurrency. Shaili Chopra writes in her book ‘Sisterhood Economy’ (2017), “This is a story of a woman who wanted to dabble in cryptocurrency in the words of Kavita Gupta of Delta Blockchain Fund… A student from a village in Punjab studying engineering and working as a receptionist had crypto money. She invested Rs. 100 every day in crypto from the salary that she earned as a receptionist. Later she earned so much money through crypto that she was able to pay her education loan. So as far as digitalization of financial services are concerned, options for investments and savings have dimensionally increased and become easier and young girls are willingly experimenting.”

As a result of both increased spare time and access to the world via the internet and smartphones, women and girls today are not only more articulate about their goals and dreams, but they are also more ambitious than their male counterparts. Increased assertiveness by women in what they want and how they wish to live their lives is a result of precisely this effect, as echoed by Dr. Mukherjee and Ms. Bandyopadyay. They say, “In a way, men have become complacent because they’ve always had access to better resources and the best that any family could offer. Women on the other hand are more ambitious and are trying to make the most of this wave of change that is flowing.”

Local Role Models Have National Impact

As more women build their own careers and businesses, they become role models for the generation behind them. Anirudha Dutta speaks from his experience of talking to women across the country, “Women and girls look up to their immediate circle of people of importance – be it their teachers or some girl from their neighbourhood who went to a larger city in search of a better life or their mothers. The girls treat such women – mostly their mothers – as their role models and the impact that this has on them is immense.”

In India, a similar revolution is underway – a revolution that is almost never covered by the media. When one travels to the smaller towns and villages, it is quite evident women are running small businesses e.g., grocery stores, beauty parlours, restaurants, etc. which give them economic freedom that they did not have even until five years ago.

At the other end of the economic spectrum, more women are being hired into leadership roles today than eight years ago. In 2022, almost a quarter of women who were hired, were hired for leadership roles, a sharp increase over the prevalent percentage in 2015 (source: https://www.businessinsider.in/careers/news/linkedin-data-reveals-that-indian-women-are-now-seeking-more-entrepreneurship-opportunities-than-men/articleshow/92866668.cms).

According to Dr. Mukherjee and Ms. Bandyopadyay, “Whilst women are moving out and about and trying to make their presence felt, men aren’t doing the same. This coupled with the advent of social media has helped women aspire beyond the idea of family and caregiving, and helped them express agency, which is a powerful signal.”

Economic and Investment Implications

Shaili Chopra writes in her book ‘Sisterhood Economy’, “women contribute 17% of the GDP in India. And if female labour force participation is increased, women can add up to $700 billion to the country’s GDP by 2025.” Leaving aside the specific GDP boost that women can deliver, it is obvious that if almost the entire other half of the population of the country is currently not employed and were to be included in the workforce (by better measurement techniques when it comes to employment and broader policy changes), the directional implications on GDP would be transformational.

As women are increasingly well educated and gainfully employed, investment opportunities associated with women investing and spending their money are increasingly becoming obvious:

- According to Rajiv Anand, the deputy MD at Axis Bank “According to Axis Mutual Funds, they are seeing a seven-times increase in the number of women visitors on their websites from January 2020 to October 2021. Similarly, the number of women investors have also increased in the same period by 30%” (source: Sisterhood Economy by Shaili Chopra).

- In the listed space, we at Marcellus are significant shareholders in Titan, a $30 bn market cap company whose revenues, profits, and free cashflows have grown over the last 5 years at 17%, 25%, and 58% (since free cashflows were negative for FY22, FY16-FY21 period is used) p.a. respectively. Titan is India’s largest and fastest growing jeweller.

- Last year, Nykaa, India’s largest Beauty & Personal Care platform, went public and now has market cap of $6.5 bn. As of June 2021, Nykaa had over 15 million customers and now generates annualized revenues of $617 mn (source: Statista & Bloomberg).

- In the unlisted space, Mamaearth, a D2C company selling beauty and baby products has signed 5 million customers within its first two years of operation and generated revenue of $130 mn for the fiscal ending in 2022 (revenue for the parent – Honasa Consumer; source: revenue 2022). In its January 2022 funding round, Mamaearth was valued at $1.2 bn (source: moneycontrol).

The rise of India’s women is symptomatic of the rise of a new India – better educated, better informed (thanks to broadband and the internet), and more gainfully employed (thanks to a flourishing economy). As The Economist said in its 13th May 2022 edition, “…a novel confluence of forces stands to transform India’s economy over the next decade, improving the lives of 1.4bn people and changing the balance of power in Asia…As the country emerges from the pandemic, however, a new pattern of growth is visible. It is unlike anything you have seen before…. These changes…help explain why India is forecast to be the world’s fastest-growing big economy in 2022 and why it has a chance of holding on to that title for years.” (Source: https://www.economist.com/leaders/2022/05/13/the-indian-economy-is-being-rewired-the-opportunity-is-immense)

Nandita Rajhansa and Saurabh Mukherjea work for Marcellus Investment Managers (www.marcellus.in). Saurabh and Nandita’s families and Marcellus’ clients are shareholders in Titan.

If you want to read our other published material, please visit https://marcellus.in/blog/

Note: the above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates, the authors of this material (including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.