OVERVIEW

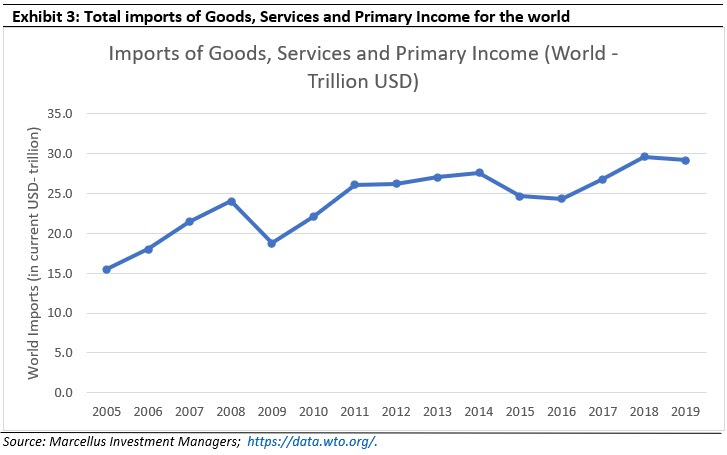

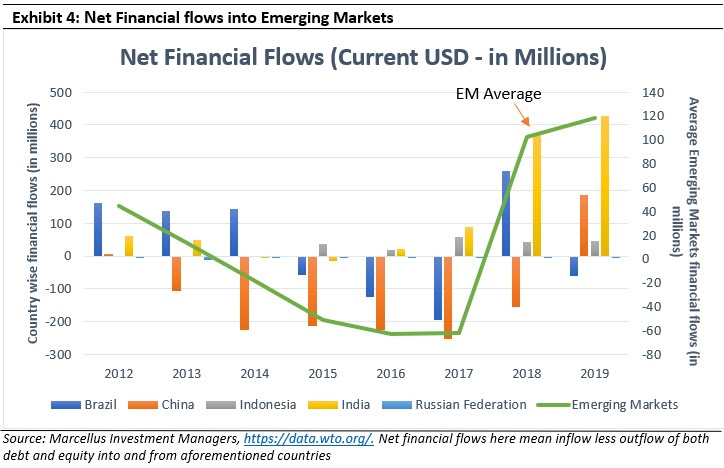

It has become fashionable to say that we are in the age of de-globalization driven by hyper-nationalist politicians. Thankfully, the data simply does not support such an alarmist narrative. Instead the data on trade and on capital flows shows that globalization continues to progress apace.

The creation of a false narrative

2016 was the year in which it became fashionable to propagate the idea that local producers and manufacturers need to be saved from foreign competition. This in turn led to angst-ridden commentary in the mainstream media regarding the rise of deglobalization i.e. restricting trade (especially imports) to raise demand for domestically produced goods and services. The new gloomy mood was captured aptly by The Economist in its March 2017th issue which noted that, “The new nationalists are on the march in Europe and America. They argue that globalization has benefited the elites and penalized the ordinary workers and that governments should put America/Britain/France first. That means favoring domestic producers and restricting global flows of people, goods and (this gets mentioned less often) capital….A previous column suggested that the world may have entered a third phase of the post-1945 economy, after the Bretton Woods phase (fixed exchange rates and recovery) from 1945-early 1970s and the globalization phase from 1982-2007. Each phase ended in a crisis (stagflation in the 1970s, a credit crunch after 2008). The next era could see globalization in retreat for the first time since 1945.” (read more here). Such commentary gathered credence and momentum as the US-China tariff war clicked through the gears. And by the time Covid-19 arrived, most people were utterly convinced that we are living through deglobalization. However, is there any data to support this narrative?

Credible data versus a less-than-credible narrative

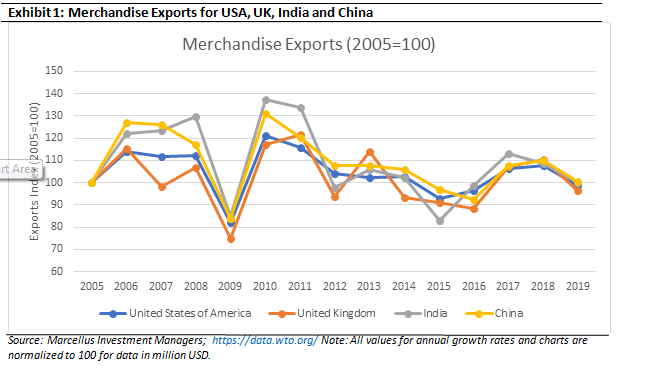

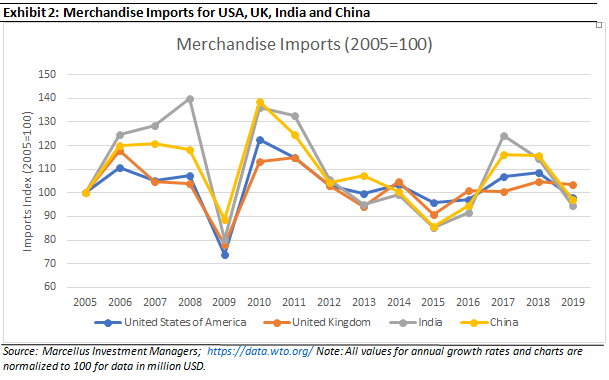

Data for trade (both import and export of merchandise & services) for the US, the UK, India, and China show that trade volumes have been stable between 2016 to 2019 – see Exhibits 1 & 2. Whilst the rate of growth in the imports and exports of services has been slower than what was seen in the first decade of this century, merchandise imports and exports have both risen for the US, the UK, India, and China (compounded annual growth for each of them approximating around 1-2% from 2016-2019).

|

||

|