OVERVIEW

Given the vibrancy of India’s startup ecosystem, it is interesting to see what sort of competitive advantages businesses of this sort can build. We use five parameters – (1) Barriers to Entry, (2) Product Complexity, (3) Customer Stickiness, (4) Bargaining Power & (5) Network Effects – to assess the strength of online businesses & apply the framework to a couple of well-known platforms – Nykaa and Zomato. Whilst Nykaa emerges as a well-moated business, Zomato’s more modest moats are representative of most ‘platform’ businesses that are being built in India.

Given the vibrancy of India’s startup ecosystem, it is interesting to see what sort of competitive advantages businesses of this sort can build. We use five parameters – (1) Barriers to Entry, (2) Product Complexity, (3) Customer Stickiness, (4) Bargaining Power & (5) Network Effects – to assess the strength of online businesses & apply the framework to a couple of well-known platforms – Nykaa and Zomato. Whilst Nykaa emerges as a well-moated business, Zomato’s more modest moats are representative of most ‘platform’ businesses that are being built in India.

Competitive Advantages (and why they matter)

Over the past couple of years, India has witnessed a startup boom with ~55+ unicorns born between January 2021 to April 2022. A cursory scan of this club shows that a significant proportion of these companies (~30+) call themselves ‘platforms’, utilizing technology to solve some problem(s) in the market. The simple definition of a platform is anything that facilitates relationships between two parties – the buyers & the sellers.

Anything that makes a company’s business harder to disrupt or imitate is a competitive advantage (‘moat’). For a corporation to flourish, the presence of one or more such moats is imperative – otherwise new entrants could keep entering the industry & drive down the incumbents’ share of the profit pie. Consequently, over time, being in the business itself might not make economic sense.

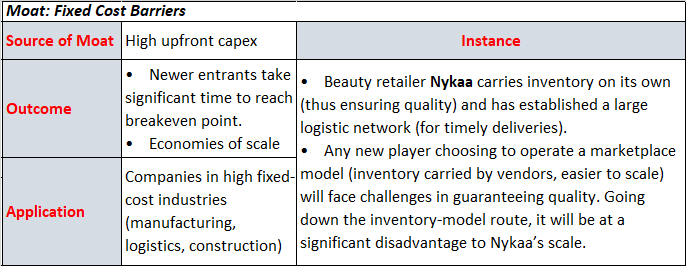

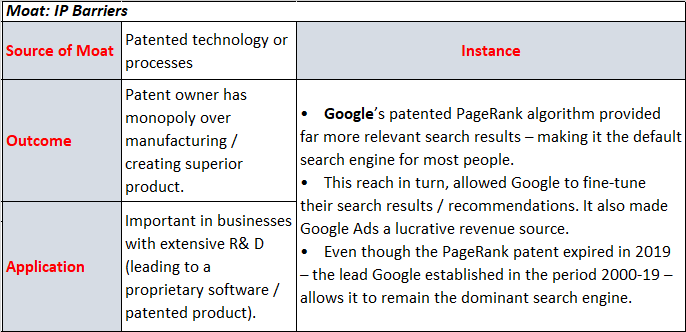

Moats can be classified into two broad categories – ‘Demand-side’ or ‘Supply-side’ moats. Demand-side moats are factors that make it difficult for a new entrant to thrive in the space. These include typical barriers to entry (such as upfront capex, complex regulations, proprietary IP) & economies of scale (fixed costs spread across an ever-increasing base of customers). Supply-side moats include anything that make customers stickier – such as high switching costs or brand loyalty.

Before the Internet, profitable companies thrived using some combination of the above moats. With the advent of the internet, many of these moats vanished – fixed costs were drastically reduced, visibility in the customers’ eyes was easy to establish and there were few switching costs.

At Marcellus, our team scouts for companies with the following characteristics – (1) Clean accounts, (2) Prudent capital allocation, and (3) Sustainable competitive advantages. The first two criteria take equal effort to discern regardless of whether the company is offline or online. However, the third parameter, i.e. presence of sustainable moats is what becomes tricky to figure out in a digital environment.

Using insights from two relevant books on this subject, ‘The Platform Delusion’ (by Jonathan Knee) and ‘7 Powers’ (by Hamilton Helmer), we have tried to construct a framework for evaluating the competitive advantages for an Internet-enabled company.

Assessing the moats for an Internet company

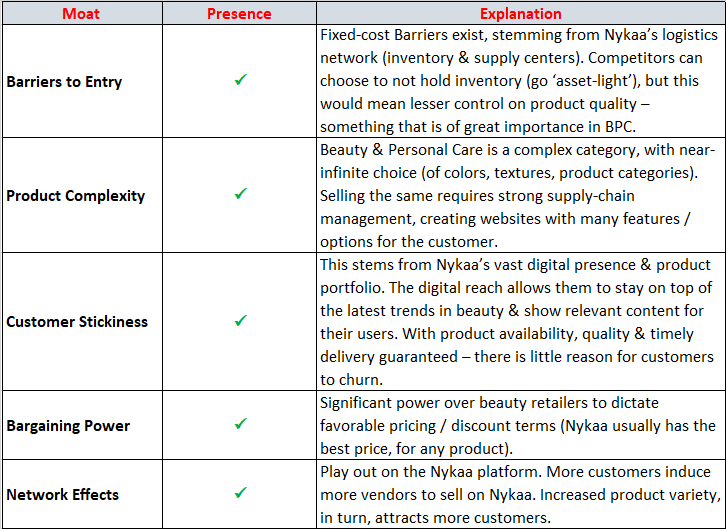

There are five key parameters, which can be used to gauge the strength & sustainability of the competitive advantages an online player has. Some of these are used to assess moats for traditional businesses too, but the context changes materially when looking at new age business models.

1) Barriers to entry – Factors endemic to the industry (in which the company operates) that make the entry of new players difficult. We can classify these into two broad categories, Fixed-cost barriers & IP barriers.

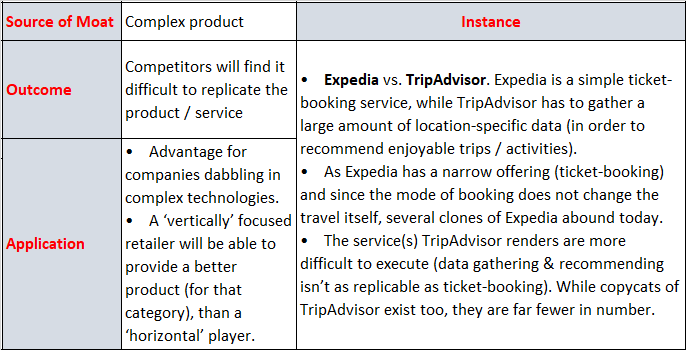

2) Product Complexity – The more complex a product/service is to develop (multiple features, wider range of offerings), the more difficult competitors will find it to mimic.

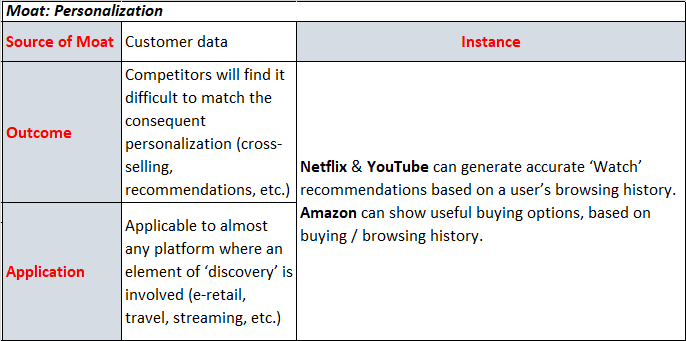

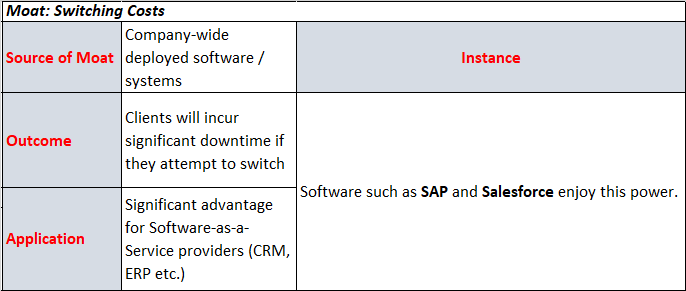

3) Customer Stickiness – In an online world, customer loyalty is almost non-existent (customers will go for the best deal) and retention becomes that much harder. However, here too, customer stickiness can manifest in two different forms, Personalization & Switching Costs.

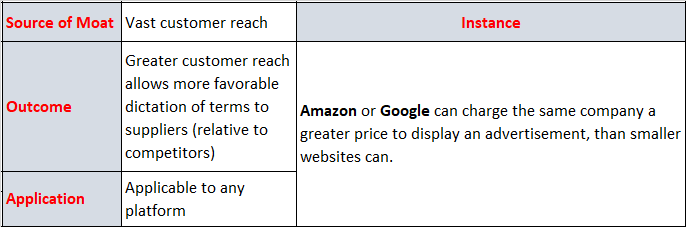

4) Bargaining power over Suppliers –

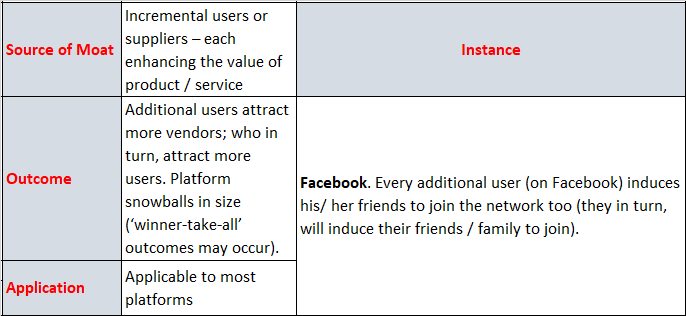

5) Network Effects –

Application to the Indian Startup Ecosystem

We apply the above Framework to a couple of popular platforms in India, the beauty retailer Nykaa & the food delivery giant Zomato.

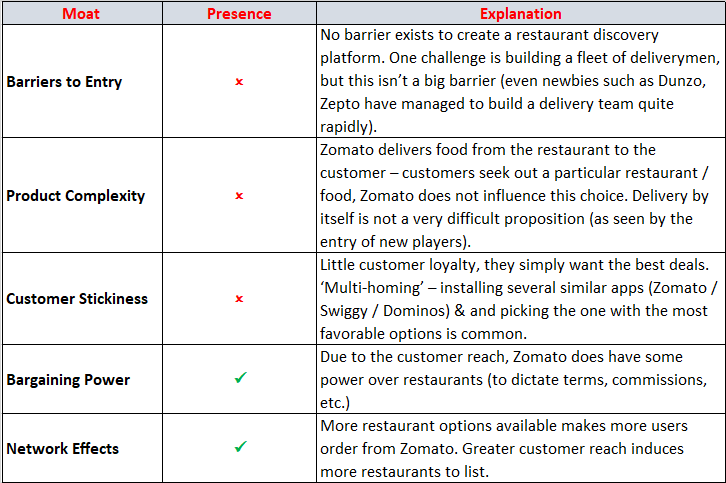

- Zomato

- Nykaa

Nykaa is a rare example of an Internet business that is deeply moated. In stark contrast, the majority of today’s startups have only a couple of moats (at best) working in their favor. As the strength of these moats is not enough to prevent new entrants from prospering as well, the game often reduces to ‘capital as a moat’. This strategy – fueled by the glut of capital readily available – involves capturing market share (i.e. customers) by any means possible & worrying about profitability last. The assumption is that profits will follow post market consolidation.

However, this is a fallacy, due to two factors:

1) Little Complexity – Most platforms simply connect ‘buyers’ to ‘suppliers’ – there is nothing that stops another company from catering to those specific buyers / suppliers. Consequently, newer players keep entering the market – which gets increasingly fragmented. Companies that have some element of complexity involved (usually some offline component, or proprietary technology) are better positioned, because mimicking them would require significant investment.

2) Customer Retention – Little irreplaceability results in many copycats, all providing customer with the same products / Customers have no incentive to stick with a specific platform & consequently exhibit little loyalty. This means that each additional customer does not necessarily translate into a future revenue stream.

In fact, spaces where market consolidation has occurred in India – for instance, food delivery or payments

- it has happened due to a time advantage, as much as anything else (Zomato, PayTM etc. were all ‘first- movers’). Today’s scenario, with abundant capital has just led to several players simultaneously facing off

- to the detriment of their businesses.

Complicating this further, is the entry of giant conglomerates such as Reliance & Tata into several emerging spaces (JioMart, Tata Neu). Backed by their many businesses, these titans have extremely deep pockets and can out-spend almost any startup in the race to acquire customers. Building competitive advantages in this sort of environment is a daunting proposition and it seems unlikely that the majority of India’s unicorns will be able to build durable competitive advantages of the sort discussed in this note.

The above material is neither investment research, nor investment advice. Marcellus does not seek payment for or business from this material/email in any shape or form. Marcellus Investment Managers Private Limited (“Marcellus”) is regulated by the Securities and Exchange Board of India (“SEBI”) as a provider of Portfolio Management Services. Marcellus is also a US Securities & Exchange Commission (“US SEC”) registered Investment Advisor. No content of this publication including the performance related information is verified by SEBI or US SEC. If any recipient or reader of this material is based outside India and USA, please note that Marcellus may not be regulated in such jurisdiction and this material is not a solicitation to use Marcellus’s services. This communication is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. If you are not the intended recipient, please notify the sender by return email and immediately destroy all copies of this message and any attachments and delete it from your computer system, permanently. No liability whatsoever is assumed by Marcellus as a result of the recipient or any other person relying upon the opinion unless otherwise agreed in writing. The recipient acknowledges that Marcellus may be unable to exercise control or ensure or guarantee the integrity of the text of the material/email message and the text is not warranted as to its completeness and accuracy. The material, names and branding of the investment style do not provide any impression or a claim that these products/strategies achieve the respective objectives. Further, past performance is not indicative of future results. Marcellus and/or its associates (re, the authors of this material,including their relatives) may have financial interest by way of investments in the companies covered in this material. Marcellus does not receive compensation from the companies for their coverage in this material. Marcellus does not provide any market making service to any company covered in this material. In the past 12 months, Marcellus and its associates have never i) managed or co-managed any public offering of securities; ii) have not offered investment banking or merchant banking or brokerage services; or iii) have received any compensation or other benefits from the company or third party in connection with this coverage. Authors of this material have never served the companies in a capacity of a director, officer or an employee.

This material may contain confidential or proprietary information and user shall take prior written consent from Marcellus before any reproduction in any form.